TIDMSIHL

RNS Number : 6868G

Symphony International Holdings Ltd

27 November 2020

Symphony International Holdings Limited ("Symphony")

27 November 2020

Symphony International Holdings Limited (LSE: SIHL.L) today

issues the following Shareholder Update.

Highlights

-- Symphony International Holdings Limited's ("Symphony" or the

"Company") unaudited Net Asset Value ("NAV") at 30 September 2020

was US$335,246,851 and NAV per share was US$0.6530. This compares

to NAV and NAV per share at 30 June 2020 of US$319,117,581, and

US$0.6216, respectively.

-- The change in NAV was predominantly due to an increase in the

value of Symphony's unlisted investments by 6.2% (including some

higher valuations and follow-on investments).

-- Symphony's share price continued to trade at a discount to

NAV. At 30 September 2020, Symphony's share price was US$0.27,

representing a discount to NAV per share of 58.65%.

Anil Thadani, Chairman of Symphony Asia Holdings Pte. Ltd. and a

Director of Symphony, said:

" Although stock markets have improved with many reaching highs

last seen in February, there is still a long journey ahead for

countries to rebuild their economies. Economic stimulus is unlikely

to reverse all the damage that has been caused by Covid-19. As we

enter the last quarter of the year, we remain cautiously optimistic

of an improvement in the business environment in the months

ahead".

For further information:

Symphony Asia Holdings Pte. Ltd.:

Anil Thadani +65 6536 6177

Rajgopal Rajkumar

Dealing codes

The ISIN number of the Ordinary Shares is VGG548121059, the

SEDOL code is B231M63 and the TIDM is SIHL.

The LEI number of the Company is 254900MQE84GV5DS6F03.

Note

NAV takes into account the fair value of unrealised investments.

In accordance with the valuation policies of the Company, real

estate related investments are valued by third parties on 30 June

and 31 December each year. In addition and in accordance with the

Company's valuation policies, investments that have been held for

less than 12-months are held at cost unless there is evidence of a

diminution in the value of that investment. Although the investment

manager believes there not to be a diminution in the value of

investments held for less than 12- months, the Covid-19 pandemic

has led to a significant increase in economic uncertainty which is

evidenced by more volatile asset prices and currency exchange rates

and therefore cost may not correspond to an appropriate measure of

fair value in the current environment

About Symphony

Symphony is a London listed strategic investment company that

invests in consumer businesses in the healthcare, hospitality,

lifestyle (including branded real estate developments), education,

and logistics sectors, principally in Asia. It offers a way for

investors to gain exposure to the rising disposable incomes &

consumer spending, resulting from the wealth generation in the fast

growing economies of the region. Symphony's objective is to provide

superior capital growth by investing in high quality companies and

forming long-term business partnerships with talented

entrepreneurs. Symphony is managed by Symphony Asia Holdings Pte.

Ltd., which has a team of investment professionals with a broad

range of expertise - many of them have been working in Asia for

more than 30 years. For more information, please visit our website

at www.symphonyasia.com

MARKET OVERVIEW AND OUTLOOK

In the midst of the coronavirus crisis there seem to be green

shoots appearing in different parts of the world: Wall Street

analysts are raising their estimates going into earnings season for

the first time in more than two years, China's economy has

recovered more quickly than expected and countries like Vietnam, in

Asia, are projected to show a record trade surplus, despite the

sharp decline in global trade in late Q1 and in Q2 2020.

In the United States, the S&P500 companies are projected to

report a 21 percent fall in earnings in the third quarter from the

same period last year, according to data provider FactSet. That is

an improvement from 25.3 percent decline that had been projected at

the beginning of summer. It is also a substantial improvement from

the March to June quarters, when earnings per share plunged nearly

32 percent. Surveys of business owners have improved, retail

spending has increased month on month up to August and consumer

sentiment has reached its highest level in six months.

On the employment front, the United States has recovered half of

the 22 million jobs lost at the height of coronavirus shutdowns in

March and April.

China's economic rebound from the coronavirus pandemic remains

on track. China's GDP fell 6.8 per cent year on year in the first

quarter, the first such contraction in more than 40 years, China's

economy rebounded to grow 3.2 per cent in the second quarter, 4.9

percent in the third quarter and is projected to grow by 5.5

percent in the fourth quarter according to forecasts by Macquarie

Bank (Financial Times on October 16, 2020). China's ability to

contain the coronavirus has been beneficial for the country's

exporters. With factories, logistics companies and ports being able

to operate as normal, the country has been able to grow exports

year on year by 9.9 percent in September. However, a strengthening

renminbi could impact this trend going forward. The currency has

appreciated 7 percent from US$7.2 in late May to $6.70.

Vietnam, where Symphony has an investment in a major logistics

operator, has also been successful in limiting the spread of

Covid-19, which has allowed businesses to reopen with minimal

disruption. While many countries are suffering large economic

contractions, Vietnam's GDP is projected to grow at 3 percent this

year making it one of the fastest growing economies. In fact, the

country has been so successful that the United States has formally

accused Vietnam of currency manipulation and has initiated an

investigation into this, similar to the investigation that gave

rise to the tariff war with China.

One of the key factors to recovery is going to be the

willingness of governments and development institutions to provide

further economic assistance and stimulus. While the US Treasury

announced aggressive spending programs in spring this year, there

has been no agreement on a new stimulus package at the time of this

shareholder update. Partisan differences have arisen regarding the

size of a package and its contents. The Federal Reserve has risen

to the challenge by reducing the Fed Funds rate from 1.50-1.75% in

March to 0-0.25% now. In addition, the Federal Reserve between

mid-March and July this year bought Treasury Bonds and notes and

other securities of more than US$2.3 trillion. This is nearly 20

times what was purchased during the Global Financial Crisis.

These actions by the Federal Reserve has reassured investors

enabling companies to raise large amounts of debt. For example,

despite the largest quarterly decline in US GDP in recorded

history, US$345.6 billion of US high yield bonds have been issued

so far this year, according to S&P. This is more than the

record of US$ 344.8 billion issued in 2012.

Although the stock market is back near the highs reached in

February, there are certain sectors that have had a limited

recovery, such as hospitality, retail and commercial real estate

for example. As Symphony's portfolio has material exposure to some

of these sectors, NAV and NAV per share remain depressed. However,

we believe our hospitality and retail investee companies are well

placed to benefit from a gradual recovery in travel and reduced

restrictions related to Covid-19. We continue to work closely with

the management teams and are optimistic that our portfolio will do

well over the long-term. The pandemic continues to impact many

companies and individuals. Essential workers across the world, in

sectors like food production and hospitals, have put themselves in

harms way. We at Symphony are extremely grateful for the efforts

made by all these individuals and hope that they and their families

stay safe during these difficult times.

COMPANY UPDATE

Symphony's listed investments accounted for 25.81% of NAV at 30

September 2020 (or US$0.1685 per share), which compares to 26.85%

of NAV (or US$0.1669 per share) at 30 June 2020. The change in NAV

was predominantly due to an increase in the value of Symphony's

unlisted investments by 6.2% (including some higher valuations and

follow-on investments). The value of Symphony's unlisted

investments (including property) comprised a further 82.34% of

Symphony's NAV (or US$0.5377 per share), and (8.15%) of NAV (or

(US$0.0532) per share) were temporary investments.

As of 30 September 2020, the sum of Symphony's temporary

investments and listed investments amounted to US$59.2 million, or

US$0.1153 per share.

Symphony's share price continued to trade at a significant

discount to NAV. At 30 September 2020, Symphony's share price was

US$0.27, representing a discount to NAV per share of 58.65%.

PORTFOLIO DEVELOPMENTS

HOSPITALITY

Minor International Public Company Limited ("MINT"): is one of

the largest hospitality and restaurant companies in the Asia

Pacific region. MINT owns 379 hotels and manages 156 other hotels

and serviced suites with 75,968 rooms. MINT owns and manages hotels

in 55 countries predominantly under its own brand names that

include Anantara, Avani, Oaks, Tivoli, NH Collection, NH Hotels,

nhow, Elewana Collection. MINT also owns and operates 2,356

restaurants (comprising 1,183 equity-owned outlets and 1,173

franchised outlets) under brands that include The Pizza Company,

Benihana, Swensen's, Sizzler, Dairy Queen, Burger King, Beijing

Riverside, Thai Express, The Coffee Club, Veneziano Coffee

Roasters, Bonchon and BreadTalk.

MINT's operations also include contract manufacturing and an

international lifestyle consumer brand distribution business with

468 retail outlets focusing on fashion, cosmetics, wholesale and

direct marketing channels under brands that include Anello,

Bossini, Charles & Keith, Esprit, Etam, OVS and Radley, and

Joseph Joseph, Zwilling J.A. Henckels, and Bodum focusing on home

and kitchenware.

Update: MINT reported improving business trends across all three

business units in 3Q20 compared to the previous quarter, driven by

continuous easing of COVID-19 restrictions in most of the regions,

together with MINT's stringent cost cutting measures.

MINT's 3Q20 reported Revenue, EBITDA and Net Profit post-TFRS16

fell by 57%, 92% and 223% respectively year-over-year. In 3Q20,

total core revenue of hotel & mixed use business declined by

62% year-over-year, adversely impacted by COVID-19 pandemic across

the portfolio including owned, leased and managed hotels, as well

as Anantara Vacation Club ("AVC") and plaza and entertainment. Core

EBITDA of hotel and mixed-use business excluding impact of TFRS16

in 3Q20 turned into net loss of THB 2,479 million from positive

EBITDA of THB 4,417 million in 3Q19, given lower overall

flow-through from revenue shortfall.

In 3Q20 total core restaurant revenue fell by 9% year-over-year.

The year-over-year top-line growth of China hub in the quarter

helped ease the softer sales performance of Thailand and Australian

hubs, as well as, the loss contribution from joint ventures.

Meanwhile, franchise income declined by 20% year-over-year in

3Q20.

In 3Q20, total retail trading & contract manufacturing

revenue decreased by 17% year-over-year, dragged by fashion

business from weak consumer sentiment and domestic economic

slowdown amidst the COVID-19 pandemic. However, the stronger

performance of home & kitchenware and manufacturing businesses

partially compensated the revenue shortfall of fashion brands.

Overall sales improved from previous quarter as most of the retail

outlets resumed their operations in the quarter

MINT continues to focus on preserving its liquidity and managing

its balance sheet, with approximately THB 30 billion of cash on

hand and THB 25 billion of unutilized credit facilities as at end

of October. Additionally, there is another THB 5 billion from

potential warrant conversion into equity over the next three years.

MINT has stated that it expects to post positive cash flow and

profit in 2021 as a group, following the likelihood of travel

resuming and planned asset rotation strategy.

The fair value of Symphony's investment in MINT increased from

US$85.7 million at 30 June 2020 to US$86.5 million at 30 September

2020. The change in value is due to (i) the participation in MINT's

rights issue that resulted in the receipt of 15.9 million shares at

a cost of US$8.8 million and (ii) the receipt of bonus warrants at

no cost, which were partially offset by a decline in MINT's share

price by 1.5% and a depreciation in the onshore Thai baht rate by

2.5% during Q3 2020.

LIFESTYLE/ REAL ESTATE

Minuet Limited ("Minuet"): is a joint venture between Symphony

and an established Thai partner. Symphony has a direct 49% interest

in the venture and is considering several development and/or sale

options for the land owned by Minuet, which is located in close

proximity to central Bangkok, Thailand. As at 30 September 2020,

Minuet held approximately 211 rai (34 hectares) of land in

Bangkok.

Update: The value of Symphony's interest at 30 September 2020

was US$63.5 million based on an independent valuation at 30 June

2020 and adjusted for land sales during Q3 2020. The change in

value from US$77.1 million at 30 June 2020 is predominantly due to

the repayment of US$12.9 million of shareholder loans by Minuet

from proceeds related to completed land sales in September 2020 and

to a lesser extent, a depreciation of the Thai baht by 2.2% and

other minor movements in assets and liabilities.

SG Land Co. Ltd ("SG Land") : is a joint venture company that

owns the leasehold rights for two office buildings in downtown

Bangkok - SG Tower and Millenia Tower. The two buildings in SG

Land's portfolio have high occupancy rates and offer attractive

rental yields. Symphony holds 49.9% of the venture.

Update: The value of SG Land as at 30 September 2020 was US$8.1

million based on an independent third-party valuation at 30 June

2020. The change from US$8.0 million at 30 June 2020 is due to an

increase in cash on the balance sheet from rental income that has

not yet been offset by a reduced lease term used to derive the

value for this property. The increase in cash was partially offset

by a depreciation in the Thai baht by 2.2% during the quarter.

Niseko Property Joint Venture ("Niseko JV") : Symphony invested

in a property development venture that acquired land in Niseko,

Hokkaido, Japan. Symphony has a 37.5% interest in this venture,

which it acquired for a total investment of US$10.2 million and has

to date received distributions of US$16.7 million from the partial

sale of land held by the venture. The Niseko JV sold 31% of the

development site to Hanwha Hotels & Resorts with a further 39%

to a new joint venture company that is equally held and being

co-developed by the Niseko JV and Hanwha Hotels & Resorts. The

Niseko JV continues to effectively hold approximately 50% of the

development site, of which one third of the total site is held for

future development and/or sale.

Update: The development team for the JV with Hanwha Hotels and

Resorts continue to work on permits/ permissions related to the

design for the development in Niseko. As reported previously, there

continues some delays due to Covid-19 and foreign visitors to the

region are expected to be limited during the upcoming ski

season.

Desaru Property Joint Venture in Malaysia : Symphony has a 49%

interest in a property joint venture in Malaysia with an affiliate

of Themed Attractions Resorts & Hotels Sdn Bhd, a subsidiary of

Khazanah Nasional Berhad, the investment arm of the Government of

Malaysia. The joint venture has developed a beachfront resort and

will offer private villas for sale on the south-eastern coast of

Malaysia, branded and managed by One&Only Resorts

("O&O").

Update: The fair value of Symphony's interest in the joint

venture was US$38.9 million at 30 September 2020 based on an

independent third-party valuation at 30 June 2020. There was a

negligible change in value from 30 June 2020.

Earlier in the summer, Symphony announced the launch of the

luxury One & Only Desaru Coast Resort in September 2020.

Despite global travel restrictions due to COVID, the opening was

well received within the local Malaysian travel market.

The management team of the resort reported that in September,

the first month of operations, the average occupancy and average

daily rates were in excess of budget. However, the resumption of a

movement control order in response to a wave of Covid-19 (in Kuala

Lumpur from mid-October and Malaysia-wide from November) has

impacted operations.

For the past few months, the property has started to selectively

market luxury villas for sale within the resort complex and has

received interest from both local and international buyers.

Infrastructure works to support the new villas are ongoing.

Phuket Luxury Villa: Symphony holds a one third interest in a

luxury villa in Phuket, Thailand. Together with an effective cash

payment, the Phuket Villa formed part of the settlement in June

2020 for a structured loan transaction made by Symphony in 2014.

The Phuket Villa was valued by a third-party independent valuer and

was transferred to Symphony with a contractual minimum guaranteed

value and profit share upon realisation of any excess above the

minimum guaranty .

HEALTHCARE

ASG Hospitals Pvt Ltd ("ASG") : is a full-service eye-healthcare

provider with operations in India, Africa, and Nepal. ASG was

co-founded in Rajasthan, India in 2005 by Dr. Arun Singhvi and Dr.

Shashank Gang. ASG's operations have since grown to 33 clinics,

which offer a full range of eye-healthcare services, including

outpatient consultation and a full suite of inpatient procedures

(cataract, retina surgeries, Lasik, glaucoma, cornea and other

complicated eye surgeries). ASG also operates an optical and

pharmacy business, which is located within clinics. Symphony

invested in ASG in tranches and following the completion of the

final tranche in July 2020, Symphony has a 19.24% interest in

ASG.

Update: ASG's revenue has fully recovered from pre-Covid levels

towards the end of Q3 2020 and in September 2020, revenue grew

year-over-year. Management expect to achieve double digit revenue

growth in October from the same month a year earlier. ASG continues

to keep a reduced cost structure in place given the ongoing

uncertainty while actively pursuing several new initiatives to

further grow the business, including acquisitions (one opportunity

completed in September 2020), partnerships and a new telemedicine

platform.

Soothe Healthcare Private Limited ("Soothe") : was founded in

2012 and operates within the fast-growing feminine hygiene market

segment in India. Together with government initiatives to promote

usage, growing disposable income in India is expected to drive the

market size for feminine hygiene products over the coming decades.

Symphony completed its investment in Soothe in August 2019, which

provided a significant minority position.

Update: Sales continued to improve month-on-month to reach

approximately INR100 million in September 2020, which is almost

double the level of monthly sales pre-Covid. Soothe's brands

continue to gain recognition, which has increased demand from

distributers and retailers. At the end of September, distribution

had increased to over 110,000 outlets. In September, Soothe also

launched a diaper brand that has been received favourably by the

market .

LIFESTYLE

Liaigre Group ("Liaigre") : In May 2016 Symphony acquired, as

part of a consortium, Financier CL SAS, the holding company of the

Liaigre Group ("Liaigre"). The Liaigre brand is synonymous with

discreet luxury, and has become one of the most sought-after luxury

furniture brands. Liaigre has a strong intellectual property

portfolio and offers a range of bespoke furniture, lighting, fabric

& leather, and accessories through a network of 25 showrooms

across Europe, the US and Asia. In addition, Liaigre also

undertakes exclusive interior architecture projects for select

yachts, hotels, restaurants and private residences.

Update: New orders from Europe and US showrooms remained subdued

in Q3 2020, which is representative of overall luxury furniture

market. However, the pipeline for interior architecture and design

projects remain strong with a number of new mandates. Showrooms in

Asia have performed relatively well, with particular strength in

Shanghai. New orders in September in Asia grew by 46%

year-over-year. A number of digital initiatives continue to be

employed by the management team to facilitate the sales process

offsite. There continues to be some delay with deliveries due to

factory closures earlier in the year as a result of Covid-19

related restrictions. Management are working on initiatives to

improve Liaigre's supply chain .

CHANINTR ("Chanintr") : is a luxury lifestyle company which

primarily sells several high-end U.S. and European furniture and

household accessory brands and is based in Thailand. The current

portfolio of furniture brands includes Christian Liaigre, Barbara

Barry, Baker, Thomasville, Herman Miller & Minotti. In addition

Chanintr also sells Bulthaup kitchens, Puiforcat flatware, and St.

Louis crystal. It also provides Furniture, Fixtures & Equipment

solutions for various real estate and hotel projects. Chanintr also

has the franchise to operate the Clinton Street Baking Company

("CSB") F&B outlets in selected Asian markets. In 2019,

Chanintr launched a new program called Chanintr Residences which

will showcase custom-designed luxury residences as turnkey

projects.

Update: Business sentiment in Thailand is at an all-time low

because of COVID related restrictions and political demonstrations.

CHANINTR, however, has managed to limit decline in business by

offsetting the drop in the B2B projects segment by driving growth

in the B2C residential business.

In the third quarter, CHANINTR launched several projects:

CHANINTR WORK was launched at a converted warehouse featuring

Herman Miller and other modern design products for working from

home or office; CHANINTR CRAFT was launched featuring a showroom

for the in-house brand, alongside Café Craft, and a new Waterworks

showroom; and one of two planned luxury CHANINTR RESIDENCES at

Windshell was completed for sale and use as a design service

showroom. All projects have received positive press and social

media response with a growing stream of visitors at all locations,

especially, at the new cafe. Overall, CHANINTR's business prospects

remain positive despite headwinds.

Wine Connection Group ("WCG") : At the end of April 2014,

Symphony invested in the Wine Connection Group ("WCG"), Southeast

Asia's leading wine themed Food and Beverage chain with

approximately 80 outlets in Singapore, Thailand, Malaysia and South

Korea.

Update: Despite the difficult operating environment, the

management team have been able to turnaround the business in

Thailand while Singapore continues to see strong growth.

Same-store-sales growth ("SSSG") in Thailand in September 2020 for

F&B and wine retail increased to 4.6% and 23.7%, respectively.

During the same month, SSSG for Singapore F&B and wine retail

was 5.6% and 25.5%, respectively. Online month-on-month sales

growth have been strong. EBITDA for the three quarters ended 30

September is 7% higher than EBITDA for full year 2019. The

management team continue to focus on strategic openings and

closures while further improving the overall food and wine offering

to customers.

EDUCATION

WCIB International Co. Ltd. ("WCIB") : In January 2017, Symphony

entered into a joint venture, WCIB International Co. Ltd. ("WCIB"),

that developed and operates Wellington College International

Bangkok, the fifth international addition to the Wellington College

family of schools. WCIB operates a co-educational school that will

ultimately cater to over 1,500 students aged 2-18 years of age when

all phases are fully complete. WCIB commenced operations for the

Primary school in August 2018 with inaugural students attending

Nursery to Year 6.

Update: As mentioned in the previous update, WCIB returned to

normal operations in September following the implementation of

distance learning initiatives / requirements in response to the

Covid-19 pandemic during part of the previous academic year.

Student enrolments have been promising and tuition fees for the

2020/2021 academic year are above expectations. Construction of the

senior school buildings have begun .

Creative Technology Solutions DMCC ("CTS") : is a UAE-based

company that provides technology solutions to K12 schools in the

UAE and the Kingdom of Saudi Arabia ("KSA"). The company was

founded in 2013 to provide customized IT solutions to the education

sector, including hardware, software and training. Symphony made

its investment in CTS in June 2019.

Update: Lower enrolment and the impact of Covid-19 has subdued

demand from K12 schools to enter into new long-term contracts for

IT solutions and training. CTS believe this business segment will

take some time to fully recover. As mentioned in the 30 June 2020,

CTS won a large contract from the Abu Dhabi Education Counsel

("ADEK") to train 100 schools for distance learning using a

Microsoft platform. CTS is scaling to provide services to 17

schools with 20,000 users under this mandate. ADEK continues to

build-out its school portfolio, which is expected to contribute to

further growth. CTS has been successful in developing its service

offering for tertiary education institutions and is currently

providing solutions to eight universities. Management expect that

the university segment will become more material and be an

important source of growth in the future .

LOGISTICS AND OTHER INVESTMENTS

Indo Trans Logistics Corporation ("ITL") : was founded in 2000

as a freight-forwarding company and has since grown to become

Vietnam's largest independent integrated logistics company with a

network that is spread across Vietnam, Cambodia, Laos, Myanmar, and

Thailand. ITL has grown to national champion status in Vietnam with

over 2,000 employees across its business units and joint ventures.

ITL's strategic plans include supporting small and medium

enterprises in Vietnam and across the Indochina region. Symphony's

investment cost in ITL is $42.6 million.

Update: Through the third quarter of 2020, ITL has reported

encouraging results compared to its pre-COVID budget. While

revenues have declined due to reduced package volume, gross margins

have increased from higher yield due to index cargo rates and cargo

scarcity in the aviation sector. Also, due to cost-reduction

efforts, pretax profit is largely at pre-COVID budget levels and

impressively has increased on a year-over-year basis. The

performance, primarily due to the aviation cargo and freight

management businesses, is however partially offset by weakness at

contract logistics, regional trucking and the visa business. The

outlook for 2021 is that the first half will be volatile due to

current dislocations but stability will return to the logistics

industry in the second half.

As mentioned previously, Symphony worked closely with ITL to

secure financing in August from an IFC-led consortium to acquire a

55% interest in SoTrans, a Vietnamese inland port & container

depot operator and sea freight-forwarder with extensive real estate

assets. The acquisition, which completed in September, increases

ITL's interest in SoTrans to 97% and will result in a much larger

and more diversified logistics business.

Smarten Spaces Pte. Ltd. ("Smarten") : In November 2019,

Symphony invested in Smarten Spaces Pte. Ltd ("Smarten"), a

Singapore based SaaS (Software-as-a-Service) company that provides

software solutions for space management in commercial and

industrial properties. Smarten was founded in 2017 by Dinesh

Malkani and offers over thirty micro services to manage functions

in work-space management that include building access control,

reservation of conference rooms and individual workstations, room

temperature and lighting, co-working and co-living spaces, F&B

services, and community bulletin boards.

Update: The ongoing COVID-19 pandemic has posed challenges in

terms of delays in deal closures and low workforce utilisation

affecting revenue recognition. Smarten has responded to the

COVID-19 induced workplace restrictions by developing the Jumpree

WorkSafe/WorkFlex products which provide new functions such as

visitor management, automatic social distancing workplace planning,

and work-from home/back to work resource planning. This development

has led to a significant increase in sales pipeline.

Management has noted signs of early movements in deal activity

during Q3 2020 with contracts signed with corporate clients in

Singapore, Scandinavia, Australia, India, and the UK. Smarten's

products are currently deployed in over 40 cities across 13

countries and has further expanded its presence in the global

markets with the opening of an operational US office. The Company

saw third quarter single digit percentage increases QoQ in Exit ARR

(run-rate annualised Annual Recurring Revenue) and TCV (total

contract value).

August Jewellery Pvt. Ltd. ("Melorra") : Symphony, through its

Singapore subsidiary, Shadows Holdings Pte Ltd ("Shadows"),

invested in Melorra, an online fast fashion Indian jewellery

company that produces over 300 new designs per month. Melorra was

founded in January 2015 by Saroja Yeramilli and adopts a minimal

inventory model that uses 3-D printing technology to achieve

just-in-time manufacturing to bring products to market

efficiently.

Update: With the lifting of lockdown restrictions, in a phased

manner, across the country Melorra is slowly returning to normalcy

on the business front. The business teams across divisions have

acted with agility and rolled out several initiatives to realign

with the new normal and serve customers in new ways. Melorra

launched their Autumn/ Winter 20/21 campaign with a record 500 new

designs released in September (vs. 481 in October). Melorra also

worked on their first television campaign with a Bollywood star,

which is meant for release in the build-up to the Diwali festival.

With a focus on building an omni-channel brand Melorra has

finalized retail store designs for a roll-out of 4-6 stores in the

coming months. Melorra reported net revenues up 140 percent over

the June quarter.

On the fundraising side, Melorra successfully closed a round of

US$10.5 million of capital from Symphony, Lightbox Funds and Family

offices and US$2.0 million from Alteria Capital in the form of

venture debt in the month of September. The new funds will be used

primarily for marketing and new hires and general corporate

purposes.

Good Capital Partners and Good Capital Fund I ("Good Capital") :

Good Capital is majority owned by brothers Rohan and Arjun Malhotra

who founded Investopad in 2014 by investing their own capital into

building substantial infrastructure across India (Delhi, Bangalore

and Gurgaon) and creating a thriving ecosystem of technology

startups. Symphony announced its investment in July 2019, and has a

stake in the General Partner, Good Capital Partners ("GCP") and its

first fund, Good Capital Fund I ("GCF").

Update: Good Capital made three investments in this quarter, one

was a follow-on round and two were new seed investment rounds. In

total the investments this quarter was US$ 1.1 million. Good

Capital is currently evaluating three new investments .

IMPORTANT INFORMATION

A more detailed Shareholder Update is available on request from

the Company and can be accessed via www.symphonyasia.com .

THIS DOCUMENT IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION,

IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES OR ANY OTHER JURISDICTION INTO WHICH THE PUBLICATION OR

DISTRIBUTION WOULD BE UNLAWFUL. THESE MATERIALS DO NOT CONSTITUTE

AN OFFER TO SELL OR ISSUE OR THE SOLICITATION OF AN OFFER TO BUY OR

ACQUIRE SECURITIES IN THE UNITED STATES OR ANY OTHER JURISDICTION

IN WHICH SUCH OFFER OR SOLICITATION WOULD BE UNLAWFUL. THE

SECURITIES REFERRED TO IN THIS DOCUMENT HAVE NOT BEEN AND WILL NOT

BE REGISTERED UNDER THE SECURITIES LAWS OF SUCH JURISDICTIONS AND

MAY NOT BE SOLD, RESOLD, TAKEN UP, TRANSFERRED, DELIVERED OR

DISTRIBUTED, DIRECTLY OR INDIRECTLY, WITHIN SUCH JURISDICTIONS.

NO REPRESENTATION OR WARRANTY IS MADE BY THE COMPANY OR ITS

INVESTMENT MANAGER AS TO THE ACCURACY OR COMPLETENESS OF THE

INFORMATION CONTAINED IN THIS DOCUMENT AND NO LIABILITY WILL BE

ACCEPTED FOR ANY LOSS WHATSOEVER ARISING IN CONNECTION WITH SUCH

INFORMATION.

THIS DOCUMENT CONTAINS (OR MAY CONTAIN) CERTAIN FORWARD-LOOKING

STATEMENTS WITH RESPECT TO CERTAIN OF THE COMPANY'S CURRENT

EXPECTATIONS AND PROJECTIONS ABOUT FUTURE EVENTS. THESE STATEMENTS,

WHICH SOMETIMES USE WORDS SUCH AS "ANTICIPATE", "BELIEVE", "COULD",

"ESTIMATE", "EXPECT", "INTEND", "MAY", "PLAN", "POTENTIAL",

"SHOULD", "WILL" AND "WOULD" OR THE NEGATIVE OF THOSE TERMS OR

OTHER COMPARABLE TERMINOLOGY, ARE BASED ON THE COMPANY'S BELIEFS,

ASSUMPTIONS AND EXPECTATIONS OF ITS FUTURE PERFORMANCE, TAKING INTO

ACCOUNT ALL INFORMATION CURRENTLY AVAILABLE TO IT AT THE DATE OF

THIS DOCUMENT. THESE BELIEFS, ASSUMPTIONS AND EXPECTATIONS CAN

CHANGE AS A RESULT OF MANY POSSIBLE EVENTS OR FACTORS, NOT ALL OF

WHICH ARE KNOWN TO THE COMPANY AT THE DATE OF THIS ANNOUNCEMENT OR

ARE WITHIN ITS CONTROL. IF A CHANGE OCCURS, THE COMPANY'S BUSINESS,

FINANCIAL CONDITION AND RESULTS OF OPERATIONS MAY VARY MATERIALLY

FROM THOSE EXPRESSED IN ITS FORWARD-LOOKING STATEMENTS. NEITHER THE

COMPANY NOR ITS INVESTMENT MANAGER UNDERTAKE TO UPDATE ANY SUCH

FORWARD LOOKING STATEMENTS

STATEMENTS CONTAINED IN THIS DOCUMENT REGARDING PAST TRENDS OR

ACTIVITIES SHOULD NOT BE TAKEN AS A REPRESENTATION THAT SUCH TRENDS

OR ACTIVITIES WILL CONTINUE IN THE FUTURE. THE INFORMATION

CONTAINED IN THIS DOCUMENT IS SUBJECT TO CHANGE WITHOUT NOTICE AND,

EXCEPT AS REQUIRED BY APPLICABLE LAW, NEITHER THE COMPANY NOR THE

INVESTMENT MANAGER ASSUMES ANY RESPONSIBILITY OR OBLIGATION TO

UPDATE PUBLICLY OR REVIEW ANY OF THE FORWARD-LOOKING STATEMENTS

CONTAINED HEREIN. YOU SHOULD NOT PLACE UNDUE RELIANCE ON

FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE OF THIS

ANNOUNCEMENT.

THIS DOCUMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE AN INVITATION OR OFFER TO UNDERWRITE, SUBSCRIBE FOR OR

OTHERWISE ACQUIRE OR DISPOSE OF ANY SECURITIES OF THE COMPANY IN

ANY JURISDICTION. ALL INVESTMENTS ARE SUBJECT TO RISK. PAST

PERFORMANCE IS NO GUARANTEE OF FUTURE RETURNS. SHAREHOLDERS AND

PROSPECTIVE INVESTORS ARE ADVISED TO SEEK EXPERT LEGAL, FINANCIAL,

TAX AND OTHER PROFESSIONAL ADVICE BEFORE MAKING ANY INVESTMENT

DECISIONS.

THIS DOCUMENT IS NOT AN OFFER OF SECURITIES FOR SALE INTO THE

UNITED STATES. THE COMPANY'S SECURITIES HAVE NOT BEEN, AND WILL NOT

BE, REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933 AND

MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES ABSENT REGISTRATION

OR AN EXEMPTION FROM REGISTRATION. THERE WILL BE NO PUBLIC OFFER OF

SECURITIES IN THE UNITED STATES .

NEITHER THE CONTENT OF THE COMPANY'S WEBSITE (OR ANY OTHER

WEBSITE) NOR THE CONTENT OF ANY WEBSITE ACCESSIBLE FROM HYPERLINKS

ON THE COMPANY'S WEBSITE (OR ANY OTHER WEBSITE) IS INCORPORATED

INTO, OR FORMS PART OF, THIS DOCUMENT.

TO ENSURE THE COMPANY'S COMPLIANCE WITH SUB-SECTION 8(3)(A)(I)

OF THE PRIVATE INVESTMENT FUNDS REGULATIONS, 2019, THE DIRECTORS

WILL KEEP THE FINANCIAL SERVICES COMMISSION OF THE BRITISH VIRGIN

ISLANDS INFORMED OF THE NUMBER OF SHAREHOLDERS ON THE COMPANY'S

REGISTER OF SHAREHOLDERS.

THE COMPANY AND THE INVESTMENT MANAGER ARE NOT ASSOCIATED OR

AFFILIATED WITH ANY OTHER FUND MANAGERS WHOSE NAMES INCLUDE

"SYMPHONY", INCLUDING, WITHOUT LIMITATION, SYMPHONY FINANCIAL

PARTNERS CO., LTD.

End of Announcement

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDDQLFLBFLBFBV

(END) Dow Jones Newswires

November 27, 2020 02:00 ET (07:00 GMT)

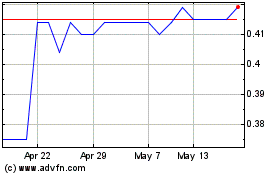

Symphony International H... (LSE:SIHL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Symphony International H... (LSE:SIHL)

Historical Stock Chart

From Apr 2023 to Apr 2024