Savannah Resources PLC Issue of Shares - Portuguese Acquisition (7686G)

June 01 2017 - 2:00AM

UK Regulatory

TIDMSAV

RNS Number : 7686G

Savannah Resources PLC

01 June 2017

Savannah Resources Plc / Index: AIM / Epic: SAV / Sector:

Mining

1 June 2017

Savannah Resources Plc

Issue of Shares in connection with Portuguese Acquisition

Savannah Resources plc (AIM: SAV) ('Savannah' or 'the Company'),

announces that, pursuant to the terms of the transaction between

the Company and a consortium of vendors led by Slipstream Resources

Investments Pty Ltd (the 'Vendors'), for the acquisition of various

mining and exploration assets within the territory of Portugal (as

announced by the Company on 25 May 2017), the Company will now

issue 20,000,000 ordinary shares of 1p each in the Company

('Ordinary Shares') at an issue price of 6.5p (being the Company's

closing price on 31 May 2017) (the 'Consideration Shares') to the

Vendors.

Details of Consideration Share Issue

Application will be made for the Consideration Shares, which

will rank pari passu with the existing Ordinary Shares in the

Company, to be admitted to trading on AIM ('Admission'). It is

expected that Admission will become effective on or around 6 June

2017. The Consideration Shares shall be held in escrow for six

months from their date of issue.

Following Admission, the Company's total issued share capital

will consist of 534,540,089 Ordinary Shares. As such, the total

number of voting rights in the Company will be 534,540,089 Ordinary

Shares. This number may be used by shareholders as the denominator

for the calculations by which they will determine if they are

required to notify their interest in, or a change to their

interest, in the Company under the FCA's Disclosure and

Transparency Rules.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

**ENDS**

For further information please visit www.savannahresources.com

or contact:

David Archer Savannah Resources Tel: +44 20

plc 7117 2489

David Hignell / Gerry Northland Capital Tel: +44 20

Beaney (Nominated Partners Ltd 3861 6625

Adviser)

Jon Belliss / Elliot Beaufort Securities Tel: +44 20

Hance Ltd 7382 8300

(Corporate Broker)

Charlotte Page / St Brides Partners Tel: +44 20

Lottie Brocklehurst Ltd 7236 1177

(Financial PR)

Notes

Savannah Resources Plc (AIM: SAV) is a growth oriented,

multi-commodity, mineral development company.

Mozambique

Savannah operates the Mutamba heavy mineral sands project in

Mozambique in collaboration with Rio Tinto, and can earn a 51%

interest in the related Consortium, which has an established

initial Indicated and Inferred Mineral Resource Estimate of 4.4

billion tonnes at 3.9% THM over the Jangamo, Dongane and Ravene

deposits. Under the terms of the Consortium Agreement with Rio

Tinto, upon delivery by Savannah of the following will earn the

corresponding interest in the Mutamba Project (which currently is

20% following delivery of scoping study in May 2017):

pre-feasibility study - 35%; feasibility study - 51%. Additionally,

the Consortium Agreement includes an offtake agreement on

commercial terms for the sale of 100% of heavy mineral concentrate

production to Rio Tinto (or an affiliate).

Oman

Savannah has interests in two copper blocks in the highly

prospective Semail Ophiolite Belt in Oman. The projects, which have

an Indicated and Inferred Mineral Resource of 1.7Mt @ 2.2% copper

and high-grade intercepts of up to 56.35m at 6.21% Cu, with gold

credits, provide Savannah with an excellent opportunity to

potentially evolve into a mid-tier copper and gold producer in a

relatively short time frame. Together with its Omani partners,

Savannah aims to outline further mineral resources to provide the

critical mass for a central operating plant to develop the deposits

and in December 2015 outlined exploration targets of between

10,700,000 and 29,250,000 tonnes grading between 1.4% and 2.4%

copper.

Portugal

Savannah holds a 75% interest one mining licence and nine

prospective applications for the exploration and development of

lithium, covering an area in excess of 1,018km2 in northern

Portugal. This includes the highly strategic Mina do Barroso

prospect, which with an approved Mining Plan ('MP'), Environmental

Impact Assessment ('EIA') and a 30-year mining concession/Mining

Licence ('ML'), means that with a defined JORC resource a

development decision could be made as early as Q4 2018.

Finland

Savannah has Reservation Permits over two new lithium projects,

Somero and Erajarvi, covering an area of 159km(2) in Finland.

Savannah holds a 100% interest in these projects through its

Finnish subsidiary Finkallio Oy. Geological mapping has highlighted

the presence of seven pegmatites across the licence areas - two on

Somero and five on Erajarvi - with key lithium minerals petalite,

spodumene and lepidolite all identified in hand specimens. Follow

up work to further expand and define the pegmatites in readiness

for drilling is being planned for the second quarter of 2017 (after

winter).

This information is provided by RNS

The company news service from the London Stock Exchange

END

IOEWGUQWAUPMGQG

(END) Dow Jones Newswires

June 01, 2017 02:00 ET (06:00 GMT)

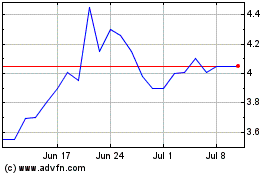

Savannah Resources (LSE:SAV)

Historical Stock Chart

From Mar 2024 to Apr 2024

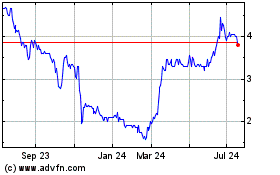

Savannah Resources (LSE:SAV)

Historical Stock Chart

From Apr 2023 to Apr 2024