TIDMRIO

RNS Number : 0969A

Rio Tinto PLC

17 January 2020

Rio Tinto releases fourth quarter production results

17 January 2020

Rio Tinto chief executive J-S Jacques said "We finished the year

with good momentum, particularly in our Pilbara iron ore operations

and in bauxite, despite having experienced some operational

challenges in 2019. We are increasing our investment, with $2.25

billion of high-return projects in iron ore and copper approved in

the fourth quarter. We also boosted our exploration and evaluation

expenditure to $624 million in 2019, further strengthening our

pipeline of opportunities.

"We have the platform and performance to maintain our delivery

of superior returns to shareholders over the short, medium and

long-term, driven by our strong value over volume approach and

ongoing disciplined allocation of capital."

Q4 2019 vs Q4 vs Q3 2019 vs 2018

2018 2019

---------------------------- ---

Pilbara iron ore shipments

(100% basis) Mt 86.8 -1% +1% 327.4 -3%

Pilbara iron ore production

(100% basis) Mt 83.6 -3% -4% 326.7 -3%

Bauxite Mt 15.1 +28% +10% 55.1 +9%

Aluminium kt 783 -4% -1% 3,171 -2%

Mined copper kt 138.7 -9% -12% 577.4 -5%

Titanium dioxide slag kt 286 -3% -11% 1,206 +8%

IOC iron ore pellets and

concentrate Mt 2.6 -10% -13% 10.5 +18%

--- ------- ----- ----- ----- -------

Operational update

-- Pilbara iron ore shipments of 327 million tonnes (100% basis)

were 3% lower than 2018, primarily impacted by weather and

operational challenges in the first half of 2019 and our active

decision to protect the quality of the Pilbara Blend. In addition

to direct sales from Australia, we commenced trials of portside

trading in October 2019.

-- On 27 November 2019, we announced a $749 million investment

in the Greater Tom Price operations (Western Turner Syncline

Phase 2) in the Pilbara region of Western Australia, to sustain

production capacity.

-- Bauxite production of 55 million tonnes was 9% higher than

2018, underpinned by the successful ramp-up of the Amrun mine

in Queensland, Australia. Third party shipments of 40 million

tonnes were 21% higher than 2018.

-- Aluminium production of 3.2 million tonnes was 2% lower than

2018, primarily reflecting a preventive safety shutdown of

one of the three pot-lines at ISAL in Iceland and earlier

than planned pot relining at Kitimat in British Columbia,

Canada in the second half.

-- On 23 October 2019, we announced a strategic review of our

interest in the Tiwai Point aluminium smelter in New Zealand,

to be completed in the first quarter of 2020.

-- On 3 December 2019, we announced the approval of a $1.5 billion

investment at Kennecott in the US, phase two of the south

wall pushback project, extending operations to 2032.

-- Mined copper production of 577 thousand tonnes was 5% lower

than 2018, reflecting lower copper grades, partially offset

by higher throughput. Lower copper grades at Kennecott impacted

the fourth quarter in particular: this is expected to persist

until we access higher grades from the end of 2020, resulting

from phase one of the south wall pushback project.

-- Following the signing of renewable power agreements in Chile,

Escondida has raised a provision related to the cancellation

of existing coal contracts. We have recognised a charge of

approximately $200 million against 2019 underlying EBITDA.

-- At the Oyu Tolgoi underground project in Mongolia, we completed

the primary production shaft (shaft 2) in October. Work continued

on the mine design and, overall, we remain within the cost

and schedule ranges as announced in July 2019. We continue

to expect to complete the mine design in the first half of

2020 and the Definitive Estimate of cost and schedule in the

second half of 2020.

-- Titanium dioxide slag production of 1.2 million tonnes was

8% higher than 2018, reflecting continued operational improvement

and the restart of furnaces in line with market conditions.

Fourth quarter production was impacted by the curtailment

of operations at Richards Bay Minerals (RBM) in South Africa,

following an escalation in violence in the surrounding communities.

A phased restart commenced at the end of December.

-- Production of pellets and concentrate at the Iron Ore Company

of Canada (IOC) was 18% higher than 2018, when strike action

occurred. Fourth quarter production was 10% lower than the

same quarter of 2018 due to unplanned equipment-related downtime.

-- On 18 November 2019, we announced that we would support Energy

Resources of Australia Limited's (ERA) plans for a renounceable

entitlement offer to raise $324 million for the rehabilitation

of the Ranger Project Area in Australia's Northern Territory.

-- Exploration and evaluation spend in 2019 was $624 million,

28% higher than 2018, primarily reflecting increased activity

at Resolution Copper in the US and on the Winu and Falcon

advanced projects in Australia and Canada. We achieved a major

permitting milestone at Resolution with the release of an

independently prepared Draft Environmental Impact Statement

in August 2019.

-- In 2019, we repurchased approximately $1.6 billion of Rio

Tinto plc shares (28.4 million) on-market.

Average realised prices

2019 vs 2018

Pilbara iron

ore $/wmt, FOB 79.0 +37%

$/t (including VAP, mid-west

Aluminium premium) 2,132 -14%

Copper US cents per lb 274.5 -7%

----------------------------- ----- -------

2020 production guidance (Rio Tinto share, unless otherwise

stated)

2019 actual 2020 guidance

------------ -----------------

Pilbara iron ore (shipments, 327.4 Mt 330 to 343 Mt

100% basis)

Bauxite 55.1Mt 55 to 58 Mt

Alumina 7.7 Mt 7.8 to 8.2 Mt

Aluminium 3.2 Mt 3.1 to 3.3 Mt

Mined copper 577 kt 530 to 570 kt

Refined copper 260 kt 205 to 235 kt

Diamonds 17 M carats 12 to 14 M carats

Titanium dioxide slag 1.2 Mt 1.2 to 1.4 Mt

IOC pellets and concentrate 10.5 Mt 10.5 to 12.0 Mt

Boric oxide equivalent 0.5 Mt 0.5 Mt

------------ -----------------

-- Our guidance is framed by expectations of general stability

in global GDP growth in 2020, tempered by negative risks,

including geopolitical tensions and oil price volatility.

In this environment, we will continue to monitor and adjust

production levels and product mix to meet customer requirements

in 2020, in line with our value over volume strategy.

-- Iron ore shipments and bauxite production guidance are subject

to weather and market conditions.

-- Aluminium guidance reflects a continued focus on capacity

creep, offset by earlier than planned pot relining at Kitimat.

-- Mined copper guidance reflects lower grades at Kennecott as

mining transitions from the east to south wall. We expect

to access higher, more consistent grade ore from late 2020.

-- Diamonds guidance reflects the expected closure of Argyle

in the fourth quarter of 2020 and lower grades at Diavik.

-- Titanium dioxide slag guidance assumes return to normal operations

at RBM in early 2020.

All figures in this report are unaudited. All currency figures

in this report are US dollars, and comments refer to Rio Tinto's

share of production, unless otherwise stated. To allow production

numbers to be compared on a like-for-like basis, production from

asset divestments completed in 2018 is excluded from Rio Tinto

share of production data.

IRON ORE

Million tonnes Q4 2019 vs Q4 2018 vs Q3 2019 2019 vs 2018

------------------------------

Rio Tinto share of production

Pilbara Blend and SP10

Lump(1) 19.9 -8% -5% 80.8 -5%

Pilbara Blend and SP10

Fines(1) 30.3 -4% -4% 119.3 -3%

Robe Valley Lump 1.6 +12% -5% 5.1 -14%

Robe Valley Fines 2.8 +7% -9% 9.2 -16%

Yandicoogina Fines (HIY) 14.2 -4% -3% 56.3 -2%

-------

Total Pilbara production 68.8 -5% -5% 270.7 -4%

-------

Total Pilbara production

(100% basis) 83.6 -3% -4% 326.7 -3%

------- ---------- ---------- ----- -------

Million tonnes Q4 2019 vs Q4 2018 vs Q3 2019 2019 vs 2018

----------------------------------

Rio Tinto share of shipments

Pilbara Blend Lump 16.2 -12% +1% 65.9 -11%

Pilbara Blend Fines 31.2 -6% +4% 120.2 -7%

Robe Valley Lump 1.2 +2% -3% 4.0 -17%

Robe Valley Fines 3.3 +9% -3% 10.5 -13%

Yandicoogina Fines (HIY) 15.3 +3% +7% 57.1 -1%

SP10 Lump(1) 2.1 n/a -23% 5.4 n/a

SP10 Fines(1) 2.1 +12% -49% 9.4 +180%

-------

Total Pilbara shipments 71.3 -2% -1% 272.5 -3%

-------

Total Pilbara shipments

(100% basis) 86.8 -1% +1% 327.4 -3%

---------------------------------- ------- ---------- ---------- ----- -------

Total Pilbara sales (Rio

Tinto share)(2) 70.0 -4% -2% 271.1 -3%

---------------------------------- ------- ---------- ---------- ----- -------

Total Pilbara sales (100%

basis)(2) 85.5 -2% -0% 326.0 -4%

---------------------------------- ------- ---------- ---------- ----- -------

Total Pilbara sales (consolidated

basis)(2, 3) 72.2 -3% -2% 278.6 -3%

------- ---------- ---------- ----- -------

(1) SP10 includes some lower grade products.

(2) Differences between shipments and sales reflect tonnes held

for portside trading and material purchased from IOC and sold.

(3) While Rio Tinto has a 53% net beneficial interest in Robe

River Iron Associates, it recognises 65% of the assets,

liabilities, sales revenues and expenses in its accounts (as 30% is

held through a 60% owned subsidiary and 35% is held through a 100%

owned subsidiary). The consolidated basis sales reported here

include Robe River Iron Associates on a 65% basis to enable

comparison with revenue reported in the financial statements.

Pilbara operations

Pilbara operations produced 326.7 million tonnes (Rio Tinto

share 270.7 million tonnes) in 2019, 3% lower than 2018. Fourth

quarter production of 83.6 million tonnes (Rio Tinto share 68.8

million tonnes) was 3% lower than the same quarter of 2018 and 4%

lower than the previous quarter due to normal maintenance cycles

and mine sequencing. Overall material moved in 2019 was the highest

on record. Our increased focus on waste material movement and pit

development will continue in 2020 to improve mine performance and

pit sequencing.

2019 shipments of 327.4 million tonnes (Rio Tinto share 272.5

million tonnes) were 3% lower than 2018. In the first half of 2019,

shipments were impacted by significant weather disruptions, a fire

at the Cape Lambert A port facility and operational challenges.

Fourth quarter shipments of 86.8 million tonnes (Rio Tinto share

71.3 million tonnes) were 1% below the same quarter of 2018.

Performance in the second half of 2019 was strong, with both

production and shipments exceeding the same period in 2018 despite

the extended rail maintenance shut limiting rail capacity for 12

days. In October 2019 we commenced trials of portside trading. The

operation maintains some inventory at Chinese ports and can also

handle material from third parties and from IOC. Reported Pilbara

sales in the table above therefore reflect the timing differences

that may occur between shipments from the Pilbara and sales to

external customers.

We price the majority of our iron ore sales (76%) by reference

to the average index price for the month of shipment. In 2019, we

priced approximately 16% of sales by reference to the prior

quarter's average index lagged by one month, with the remainder

sold either on current quarter average, current month average or on

the spot market.

In 2019, approximately 22% of sales were made on a cost and

freight (CFR) basis, 46% were made on a cost, freight and insurance

(CIF) basis and 32% were made on a free on board (FOB) basis.

In 2019, we achieved an average iron ore price of $79.0 per wet

metric tonne on an FOB basis (equivalent to $85.9 per dry metric

tonne, based on an average moisture rate of 8%). In 2018, average

pricing was $57.8 per wet metric tonne (equivalent to $62.8 per dry

metric tonne).

Pilbara projects

The Koodaideri iron ore mine is continuing to progress, with key

construction activities on schedule. We commenced work on the major

structural foundations in the fourth quarter and expect first ore

in late 2021, consistent with previous guidance.

First ore from the Robe River Joint Venture sustaining

production projects (West Angelas C&D and Mesa B, C and H at

Robe Valley) is expected in 2021, consistent with previous

guidance. All major environmental approvals have been received with

the exception of the Mesa H approval. Procurement and construction

activities are progressing, with concrete pouring commencing at

West Angelas and Robe Valley civil contractors mobilising to

site.

On 27 November 2019, we announced the approval of a $749 million

(A$1 billion) investment in the Greater Tom Price operations to

help sustain production capacity. This investment in the Western

Turner Syncline Phase 2 mine will facilitate mining of existing and

new deposits and includes construction of a new crusher as well as

a 13-kilometre conveyor. Pending final government approvals,

construction will start in the first quarter of 2020 with first ore

from the crusher expected in 2021.

ALUMINIUM

Rio Tinto share of production ('000 tonnes)

Q4 2019 vs Q4 2018 vs Q3 2019 2019 vs 2018

--------------------

Bauxite 15,137 +28% +10% 55,105 +9%

Bauxite third party

shipments 10,968 +48% +6% 39,648 +21%

Alumina 2,032 +1% +11% 7,744 -3%

Aluminium 783 -4% -1% 3,171 -2%

------- ---------- ---------- ------ -------

Bauxite

Bauxite production of 55.1 million tonnes was 9% higher than

2018. In Australia, production at the Pacific managed mines was 11%

above prior year underpinned by the successful ramp-up of Amrun,

which achieved its design capacity rates in the fourth quarter of

2019, replacing the depleting Weipa mines. Production at the

non-managed JVs (CBG in Guinea and MRN in Brazil) was 1% higher

than 2018, but was constrained by a slower than planned ramp-up of

the expansion project at CBG.

Fourth quarter bauxite production was 28% higher than the same

period of 2018. Production at the Pacific managed mines was 34%

higher than the same period last year, partly offset by lower

production at non-managed JVs (CBG and MRN).

Third party bauxite shipments were 39.6 million tonnes in 2019,

which was 21% higher than 2018 reflecting increased volumes from

Amrun. Fourth quarter shipments were 48% higher than the same

period in 2018.

Alumina

Alumina production of 7.7 million tonnes was 3% lower than 2018,

primarily due to major maintenance activities at the Pacific

refineries including a planned five-year maintenance shutdown to

service the cogeneration plant at Yarwun.

Fourth quarter alumina production was 1% higher than the same

period of 2018. Our share of production from the Pacific refineries

was 17% higher than the third quarter, ramping up after completion

of major maintenance activities. Yarwun achieved a production

record for the fourth quarter.

Aluminium

Aluminium production of 3.2 million tonnes in 2019 was 2% lower

than 2018, primarily due to lower volumes from ISAL from a pot-line

outage in the third quarter and at Kitimat, due to earlier than

planned pot-lining replacement. Excluding the non-managed Becancour

operation where a lock-out constrained operations, the Quebec and

Pacific smelters performed well, with aluminium production for 2019

1% higher than 2018, reflecting continued productivity improvement.

The restart of Becancour is progressing well, with full ramp-up

expected by mid-2020.

Fourth quarter aluminium production of 0.8 million tonnes was 4%

lower than the same period of 2018. Production at the Quebec and

Pacific smelters for the fourth quarter was 1% higher than the same

period last year. Following the preventive pot-line shutdown, the

ISAL smelter was ramped back up and maintained at about 85% of

capacity, optimised for value over volume. Production at the

Kitimat smelter continues to be impacted by earlier than planned

pot-lining replacement, with actions underway to minimise

production impacts. The estimated impact on 2020 production is

reflected in our guidance.

The aluminium industry continues to face challenging conditions

in global markets and policy uncertainty, reflected in low industry

profitability. We continue to actively work on enhancing the

competitiveness of our smelters, including discussions with

stakeholders on energy pricing, to ensure the sustainability and

global competitiveness of our Pacific smelters.

On 23 October 2019, we announced a strategic review of our

interest in the Tiwai Point aluminium smelter in New Zealand, to

determine the operation's ongoing viability and competitive

position. The strategic review will consider all options, including

curtailment and closure and is expected be complete in the first

quarter of 2020.

Average realised aluminium prices were $2,132 per tonne (2018:

$2,470 per tonne). This includes premiums for value-added products

(VAP), which represented 51% of primary metal sold (2018: 54%,

excluding the divested Dunkerque smelter) and generated attractive

product premiums averaging $234 per tonne of VAP sold (2018: $227

per tonne) on top of the physical market premiums. The mid-west

premium decreased from $419 per tonne in 2018 to $320 per tonne in

2019. A 10% tariff on Canadian aluminium imports into the United

States under Section 232 was paid until the tariff was removed on

19 May 2019.

Kemano

At the Kemano hydropower facility at Kitimat, British Columbia,

tunnel boring continues to progress with 2,731 metres excavated at

the end of 2019. Tunnel boring machine productivity has been lower

than expected with completion now expected in 2021 (previously late

2020).

COPPER & DIAMONDS

Rio Tinto share of production ('000 tonnes)

Q4 2019 vs Q4 2018 vs Q3 2019 2019 vs 2018

-----------------------

Mined copper

Rio Tinto Kennecott 35.4 -39% -39% 186.8 -8%

Escondida 92.3 +16% +2% 341.6 -3%

Oyu Tolgoi 11.0 -21% +16% 49.1 -8%

Refined copper

Rio Tinto Kennecott 51.4 -20% +27% 184.6 -5%

Escondida 20.5 -5% +22% 75.0 -6%

Diamonds ('000 carats)

Argyle 3,363 +5% -5% 12,999 -8%

Diavik 840 -22% -15% 4,031 -8%

------- ---------- ---------- ------ -------

Rio Tinto Kennecott

Mined copper production was 8% lower than 2018, primarily due to

increased grade variability, with grades on average 11% lower. This

grade impact was partially offset by a 4% year on year improvement

in ore processed. Copper grades of 0.35% achieved in the final

quarter of 2019 compare to 0.59% in the same quarter of 2018.

Grades will continue to be lower through 2020 before increasing

from the first quarter of 2021, with the transition from east wall

to south wall mining.

Refined copper production was 5% lower than 2018, reflecting

reduced copper concentrate availability, a planned smelter shutdown

in July and additional unplanned maintenance impacting furnace

online time.

We continue to toll and purchase third party concentrate to

optimise smelter utilisation, with 92 thousand tonnes of

concentrate received for processing in 2019, compared with 100

thousand tonnes in 2018. Purchased and tolled copper concentrate

are excluded from reported production figures.

A 45-day maintenance shut is planned at the smelter during the

second quarter of 2020. This is a standard rebuild, which is

undertaken approximately every three years.

Molybdenum production more than doubled in 2019 (from 5.8kt to

11.2kt), as a result of both higher grades and plant capacity and

productivity improvements.

On 3 December 2019, we announced the approval of a $1.5 billion

investment at Rio Tinto Kennecott, extending operations to 2032.

The investment will further extend strip waste rock mining and

support additional infrastructure development in the second phase

of the south wall pushback project, to allow mining to continue

into a new area of the ore body between 2026 and 2032.

Escondida

Copper production at Escondida was 3% lower than 2018, mainly

due to grade declines, which were 8% lower than last year, partly

offset by higher throughput. Fourth quarter production was 16%

higher than the same quarter of 2018 due to higher throughput,

offsetting production losses from stoppages associated with the

social unrest in Chile.

Following the signing of renewable power agreements, Escondida

has raised a provision related to the cancellation of existing coal

contracts. We have recognised a charge of approximately $200

million against 2019 underlying EBITDA.

Oyu Tolgoi

As anticipated, mined copper production from the open pit was 8%

lower than 2018 as mining activity moved to lower grade areas.

Grades were 11% lower for the year and especially reflected in the

21% decline in fourth quarter production, partly offset by

productivity improvements.

Oyu Tolgoi Underground Project

During the fourth quarter, we took the decision to remove two of

the three mid-access drives. We will retain one mid-access drive on

the apex level of the mine design of Panel 0. The removal of these

mid-access drives has an unfavourable impact on schedule, however,

overall, the underground project remains within the range announced

in July 2019 of a 16 to 30 month(1) delay in schedule and an

increase of $1.2 to $1.9 billion(1) in development capital

costs.

We continue the detailed work on mine design, which we still

expect to complete in the first half of the year, with a Definitive

Estimate in the second half of 2020, as previously disclosed. This

will include the estimate of development capital costs and schedule

for the underground project based on the updated design of Panel

0.

Decisions on other key underground design elements such as the

location of the ore handling system and options for panel

sequencing will be taken in the first half of 2020. These will take

into consideration the consequential impacts on cost, schedule and

other key variables such as Ore Reserves, project ramp-up profile

and peak production, together with improvements in

productivity.

These productivity improvements resulted in increased

underground lateral development during the fourth quarter, to an

average monthly rate of 1,607 equivalent metres (eqm) compared to

1,214 eqm in the third quarter.

Completion of shaft 2, a key milestone, occurred in October

2019. Construction is progressing on shafts 3 and 4 to enable

commencement of main sinking operations for both shafts during the

first half of 2020.

Resolution Copper

Deepening of the existing shaft 9 continues, as well as work on

the underground characterisation study to increase ore body

knowledge.

Permitting and studies are progressing well, following the

release of the independently prepared Draft Environmental Impact

Statement for the project in August 2019. A plan is in place with

the US Forest Service to address comments received on the study to

maintain schedule on the Final Environmental Impact Study in

2020.

In April 2019, we approved $302 million ($166 million our share)

of additional expenditure for Resolution, to fund additional

drilling, ore-body studies, infrastructure improvements and

permitting activities, as we progress the project to the final

stage of the permitting phase.

Provisional pricing

At 31 December 2019, the Group had an estimated 220 million

pounds of copper sales that were provisionally priced at 271 cents

per pound. The final price of these sales will be determined during

the first half of 2020. This compares with 240 million pounds of

open shipments at 31 December 2018, provisionally priced at 277

cents per pound.

Diamonds

At Argyle, carat production was 8% lower than 2018 due to lower

recovered grade, partially offset by stronger mining and processing

rates.

At Diavik, carats recovered in 2019 were 8% lower than 2018 due

to lower ore availability and grade from the underground

operations, partly offset by higher tonnes and grade from the A21

open pit.

(1) As described above, the level of accuracy of these estimates

is preliminary in nature and subject to a range of variables, in

line with previous guidance. The confidence level of these

estimates is at a level associated with a Conceptual or Order of

Magnitude Study, and further work is required between now and the

second half of 2020 to refine the mine design options and study

them to a level of confidence and accuracy associated with

Feasibility Study quality estimates.

ENERGY & MINERALS

Rio Tinto share of production

Q4 2019 vs Q4 2018 vs Q3 2019 2019 vs 2018

-----------------------

Iron ore pellets and

concentrate (million

tonnes)

IOC 2.6 -10% -13% 10.5 +18%

Minerals ('000 tonnes)

Borates - B(2) O(3)

content 128 +8% -7% 520 +2%

Titanium dioxide slag 286 -3% -11% 1,206 +8%

Uranium ('000 lbs)

Energy Resources of

Australia 642 -31% +10% 2,640 -12%

Rössing - - - 2,114 -

------- ---------- ---------- ----- -------

Iron Ore Company of Canada (IOC)

Iron ore pellets and concentrate production available for sale

at IOC was 18% higher than 2018 when operations were impacted by a

two-month strike. It was 10% lower than the fourth quarter of 2018,

attributable to unplanned equipment-related downtime.

Borates

Borates production was in line with 2018 and aligned with market

conditions. We will base any decision to increase refinery

utilisation rates to match market demand.

Iron and Titanium

Titanium dioxide feedstock production was 8% higher than 2018,

reflecting improved operational performance and the restart of

furnaces.

Fourth quarter production was impacted by the curtailment of

operations at Richards Bay Minerals (RBM) in South Africa.

Operations were impacted in mid-November, following an escalation

in violence in the communities surrounding the operations, and a

full curtailment commenced at the beginning of December. A phased

restart commenced at the end of December. While RBM continues to

monitor the security situation closely, a return to full operations

and resumption of normalised production is expected in early

2020.

All nine furnaces at Rio Tinto Fer et Titane (RTFT) are

currently in operation, with three of four furnaces in operation at

RBM. This compares with six out of nine furnaces in operation at

RTFT and three out of four at RBM in the fourth quarter of 2018. We

will base our decision to re-start the remaining idled furnace to

match market demand.

Zulti South project

Construction of the $463 million Zulti South project at RBM

remains on hold post a suspension of operations following a number

of security incidents that impacted operations. We will review the

restart of the Zulti South project after normalisation of

operations at RBM.

Uranium

Energy Resources of Australia (ERA) continues to process

existing stockpiles. Production was 12% lower than 2018, reflecting

lower grades.

On 18 November 2019, we announced that we would support ERA's

plans for a renounceable entitlement offer to raise $324 million

for the rehabilitation of the Ranger Project Area in Australia's

Northern Territory.

As announced by the Takeovers Panel on 12 December 2019, we have

applied to the Takeovers Panel for a review of its decision of 11

December 2019, relating to ERA's renounceable entitlement offer. We

remain committed to fully subscribe for our entitlement and to

underwrite the entitlement offer in the absence of any other

commercially viable solution being available to ERA for the

rehabilitation of the Ranger Project Area.

Production from Rössing Uranium is reported up to the date of

completion of divestment on 16 July 2019.

EXPLORATION AND EVALUATION

Pre-tax and pre-divestment expenditure on exploration and

evaluation charged to the profit and loss account in 2019 was $624

million, compared with $488 million in 2018, with increased spend

at Resolution Copper in the US and on the Winu and Falcon Order of

Magnitude studies in Australia and Canada. Approximately 52% of

this expenditure was incurred by central exploration, 33% by Copper

& Diamonds, 9% by Energy & Minerals and the remainder by

Iron Ore and Aluminium.

There were no significant divestments of central exploration

properties in 2019.

Exploration highlights

We have a strong portfolio of projects with activity in 17

countries across some seven commodities. The bulk of the

exploration expenditure in this quarter was focused on copper in

Australia, Brazil, Canada, Chile, Colombia, Kazakhstan, Mongolia,

Peru, Serbia, United States, Zambia and diamonds projects in

Canada. Mine-lease exploration continued at a number of our managed

businesses including Pilbara Iron in Australia, Oyu Tolgoi in

Mongolia, Diavik in Canada, and Resolution and Boron in the US. A

summary of activity for the quarter is as follows:

Commodities Studies Stage Advanced Greenfield/Brownfield

projects programmes

Bauxite Cape York, Australia Amargosa, Brazil*; Cape York, Australia

Sanxai, Laos*

----------------------- ------------------ ----------------------

Base Metals Copper/molybdenum: La Granja, Peru Copper Greenfield:

Resolution, US; Winu, Nickel: Tamarack, Australia, Brazil,

Australia US (third party Canada, Chile, China,

operated) Colombia, Kazakhstan,

Mongolia, Peru,

Serbia, US, Zambia

Copper Brownfield:

Resolution, US;

Bingham, US; Oyu

Tolgoi, Mongolia

Nickel Greenfield:

Canada, Uganda,

Finland

----------------------- ------------------ ----------------------

Diamonds Falcon, Canada Greenfield: Canada

Brownfield: Diavik,

Canada

----------------------- ------------------ ----------------------

Minerals Lithium borates: Heavy mineral sands:

Jadar, Serbia Tanzania

Heavy mineral sands: Industrial Minerals:

Mutamba, Mozambique Serbia

(third party operated) Industrial minerals

brownfield: Boron

----------------------- ------------------ ----------------------

Iron Ore Pilbara, Australia Pilbara, Australia Brownfield: Pilbara,

Australia

----------------------- ------------------ ----------------------

* Limited activity during the quarter

Forward-looking statements

This announcement may include "forward-looking statements"

within the meaning of the US Private Securities Litigation Reform

Act of 1995. All statements other than statements of historical

facts included in this announcement, including, without limitation,

those regarding Rio Tinto's production forecast or guidance,

financial position, business strategy, plans and objectives of

management for future operations (including development plans and

objectives relating to Rio Tinto's products and reserve and

resource positions), are forward-looking statements. The words

"intend", "aim", "project", "anticipate", "estimate", "plan",

"believes", "expects", "may", "should", "will", "target", "set to",

"assumes" or similar expressions, commonly identify such forward

looking statements.

Such forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual

production, performance or results of Rio Tinto to be materially

different from any future production, performance or results

expressed or implied by such forward-looking statements. Such

forward-looking statements could be influenced by such risk factors

as identified in Rio Tinto's most recent Annual Report and Accounts

in Australia and the United Kingdom and the most recent Annual

Report on Form 20-F filed with the United States Securities and

Exchange Commission (the "SEC") or Form 6-Ks furnished to, or filed

with, the SEC. Forward-looking statements should, therefore, be

construed in light of such risk factors and undue reliance should

not be placed on forward-looking statements. These forward-looking

statements speak only as of the date of this announcement. Rio

Tinto expressly disclaims any obligation or undertaking (except as

required by applicable law, the UK Listing Rules, the Disclosure

and Transparency Rules of the Financial Conduct Authority and the

Listing Rules of the Australian Securities Exchange) to release

publicly any updates or revisions to any forward-looking statement

contained herein to reflect any change in Rio Tinto's expectations

with regard thereto or any change in events, conditions or

circumstances on which any such statement is based.

Nothing in this announcement should be interpreted to mean that

future earnings per share of Rio Tinto plc or Rio Tinto Limited

will necessarily match or exceed its historical published earnings

per share.

Contacts

media.enquiries@riotinto.com

riotinto.com

Follow @RioTinto on Twitter

Media Relations, United Kingdom Media Relations, Australia

Illtud Harri Jonathan Rose

M +44 7920 503 600 T +61 3 9283 3088

M +61 447 028 913

David Outhwaite

T +44 20 7781 1623 Matt Chambers

M +44 7787 597 493 T +61 3 9283 3087

M +61 433 525 739

Media Relations, Americas

Matthew Klar Jesse Riseborough

T +1 514 608 4429 T +61 8 6211 6013

M +61 436 653 412

Media Relations, Asia

Grant Donald

T +65 6679 9290

M +65 9722 6028

===================================== ================================

Investor Relations, United Kingdom Investor Relations, Australia

Menno Sanderse Natalie Worley

T +44 20 7781 1517 T +61 3 9283 3063

M +44 7825 195 178 M +61 409 210 462

David Ovington Amar Jambaa

T +44 20 7781 2051 T +61 3 9283 3627

M +44 7920 010 978 M +61 472 865 948

===================================== ================================

Group Company Secretary Joint Company Secretary

Steve Allen Tim Paine

Rio Tinto plc Rio Tinto Limited

6 St James's Square Level 7, 360 Collins Street

London SW1Y 4AD Melbourne 3000

United Kingdom Australia

T +44 20 7781 2000 T +61 3 9283 3333

Registered in England Registered in Australia

No. 719885 ABN 96 004 458 404

--------------------------------

This announcement is authorised for release to the market by Rio

Tinto's Group Company Secretary.

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1 Additional regulated information required to

be disclosed under the laws of a Member State

Rio Tinto production summary

Rio Tinto share of production

Quarter Full Year % Change

2018 2019 2019 2018 2019 Q4 Q4 2019

Q4 Q3 Q4 19 19 vs

vs vs 2018

Q4 Q3

18 19

------- -------------- ------ ------------ ------- -------- ---- ---------

Principal Commodities

------------

('000

Alumina t) 2,020 1,826 2,032 7,980 7,744 1% 11% -3%

('000

Aluminium t) 817 789 783 3,231 3,171 -4% -1% -2%

('000

Bauxite t) 11,790 13,796 15,137 50,421 55,105 28% 10% 9%

('000

Borates t) 118 138 128 512 520 8% -7% 2%

('000

Copper - mined t) 151.9 157.9 138.7 607.6 577.4 -9% -12% -5%

('000

Copper - refined t) 86.1 57.1 71.9 274.8 259.6 -17% 26% -6%

('000

Diamonds cts) 4,290 4,551 4,203 18,427 17,030 -2% -8% -8%

('000

Iron Ore t) 75,018 75,117 71,352 290,800 281,192 -5% -5% -3%

Titanium dioxide ('000

slag t) 294 321 286 1,116 1,206 -3% -11% 8%

('000

Uranium lbs) 1,904 755 642 6,764 4,754 -66% -15% -30%

------- -------------- ------ ------------ ------- -------- ---- ---------

Other Metals & Minerals

('000

Gold - mined oz) 118.4 87.8 75.0 372.1 389.7 -37% -15% 5%

('000

Gold - refined oz) 58.6 60.8 63.3 198.0 218.7 8% 4% 10%

('000

Molybdenum t) 2.2 2.1 4.7 5.8 11.2 110% 119% 95%

('000

Salt t) 1,496 1,392 1,450 6,153 5,422 -3% 4% -12%

('000

Silver - mined oz) 1,586 1,320 1,209 5,656 5,412 -24% -8% -4%

('000

Silver - refined oz) 807 664 839 2,865 2,853 4% 26% 0%

------- -------------- ------ ------------ ------- -------- ---- ---------

Throughout this report, figures in italics indicate adjustments

made since the figure was previously quoted on the equivalent page

or reported for the first time. Production figures are sometimes

more precise than the rounded numbers shown, hence small differences

may result between the total of the quarter figures and the year

to date figures.

Rio Tinto share of production

Rio Tinto Q4 Q1 Q2 Q3 Q4 Full Full Year

Year

interest 2018 2019 2019 2019 2019 2018 2019

---------------------------------------------- ---------- ------ -------- ------ ------- -------- -------- ---------

ALUMINA

Production ('000 tonnes)

Jonquière (Vaudreuil) 100% 354 373 336 360 345 1,444 1,413

Jonquière (Vaudreuil) specialty Alumina

plant 100% 29 25 31 28 24 124 109

Queensland Alumina 80% 742 711 668 669 716 2,958 2,763

São Luis (Alumar) 10% 92 86 86 99 97 351 368

Yarwun 100% 803 813 757 671 850 3,103 3,091

------ -------- ------ ------- -------- -------- ---------

Rio Tinto total alumina production 2,020 2,008 1,878 1,826 2,032 7,980 7,744

---------------------------------------------- ---------- ------ -------- ------ ------- -------- -------- ---------

ALUMINIUM

Production ('000 tonnes)

Australia - Bell Bay 100% 48 45 47 48 48 189 189

Australia - Boyne Island 59% 74 73 75 75 74 295 296

Australia - Tomago 52% 77 74 76 77 76 305 303

Canada - six wholly owned 100% 408 400 400 399 383 1,616 1,582

Canada - Alouette (Sept-Îles) 40% 58 58 60 61 62 234 241

Canada - Bécancour 25% 8 4 4 4 7 34 19

Iceland - ISAL (Reykjavik) 100% 54 52 52 36 43 212 184

New Zealand - Tiwai Point 79% 70 71 69 70 69 270 279

Oman - Sohar 20% 20 19 19 20 20 76 78

------ -------- ------ ------- -------- -------- ---------

Rio Tinto total aluminium production 817 796 803 789 783 3,231 3,171

BAUXITE

Production ('000 tonnes) (a)

Gove 100% 3,250 3,004 2,957 2,968 3,273 12,540 12,201

Porto Trombetas 12% 489 285 287 385 371 1,576 1,327

Sangaredi (b) 1,204 1,558 1,630 1,749 1,227 5,868 6,165

Weipa 100% 6,847 7,917 8,533 8,695 10,267 30,437 35,411

------ -------- ------ ------- -------- -------- ---------

Rio Tinto total bauxite production 11,790 12,763 13,407 13,796 15,137 50,421 55,105

(a) Mine production figures for metals refer to the total quantity

of metal produced in concentrates, leach liquor or doré bullion

irrespective of whether these products are then refined onsite,

except for the data for bauxite and iron ore which represent production

of marketable quantities of ore plus concentrates and pellets.

(b) Rio Tinto has a 22.95% shareholding in the Sangaredi mine but

benefits from 45.0% of production.

----------------------------------------------------------------------------------------------------------------------------

Rio Tinto share of production

Rio Tinto Q4 Q1 Q2 Q3 Q4 Full Year Full Year

interest 2018 2019 2019 2019 2019 2018 2019

-------------------------------------------- ---------- ------ ------ ------ ------ ------ --------- ---------

BORATES

Production ('000 tonnes B(2) O(3) content)

Rio Tinto Borates - borates 100% 118 115 138 138 128 512 520

-------------------------------------------- ---------- ------ ------ ------ ------ ------ --------- ---------

COPPER

Mine production ('000 tonnes) (a)

Bingham Canyon 100% 58.3 52.5 41.1 57.8 35.4 203.9 186.8

Escondida 30% 79.7 76.0 82.7 90.5 92.3 350.4 341.6

Oyu Tolgoi (b) 34% 13.9 15.4 13.1 9.5 11.0 53.3 49.1

------ ------ ------ ------ ------ --------- ---------

Rio Tinto total mine production 151.9 143.9 136.9 157.9 138.7 607.6 577.4

------ ------ ------ ------ ------ --------- ---------

Refined production ('000 tonnes)

Escondida 30% 21.6 18.7 19.0 16.8 20.5 80.0 75.0

Rio Tinto Kennecott 100% 64.6 29.6 63.3 40.3 51.4 194.7 184.6

------ ------ ------ ------ ------ --------- ---------

Rio Tinto total refined production 86.1 48.3 82.3 57.1 71.9 274.8 259.6

(a) Mine production figures for metals refer to the total quantity of metal produced in concentrates,

leach liquor or doré bullion irrespective of whether these products are then refined

onsite, except for the data for bauxite and iron ore which represent production of marketable

quantities of ore plus concentrates and pellets.

(b) Rio Tinto owns a 33.52% indirect interest in Oyu Tolgoi through its 50.79% interest in

Turquoise Hill Resources Ltd.

----------------------------------------------------------------------------------------------------------------------

DIAMONDS

Production ('000 carats)

Argyle 100% 3,211 2,786 3,292 3,558 3,363 14,069 12,999

Diavik 60% 1,078 1,010 1,188 994 840 4,358 4,031

------ ------ ------ ------ ------ --------- ---------

Rio Tinto total diamond production 4,290 3,796 4,481 4,551 4,203 18,427 17,030

-------------------------------------------- ---------- ------ ------ ------ ------ ------ --------- ---------

GOLD

Mine production ('000 ounces) (a)

Bingham Canyon 100% 57.1 53.0 65.1 64.6 52.0 196.7 234.7

Escondida 30% 22.1 22.2 22.4 14.6 14.8 79.7 74.0

Oyu Tolgoi (b) 34% 39.1 40.2 24.1 8.6 8.2 95.7 81.1

------ ------ ------ ------ ------ --------- ---------

Rio Tinto total mine production 118.4 115.4 111.6 87.8 75.0 372.1 389.7

------ ------ ------ ------ ------ --------- ---------

Refined production ('000 ounces)

Rio Tinto Kennecott 100% 58.6 41.7 52.9 60.8 63.3 198.0 218.7

(a) Mine production figures for metals refer to the total quantity of metal produced in concentrates,

leach liquor or doré bullion irrespective of whether these products are then refined

onsite, except for the data for bauxite and iron ore which represent production of marketable

quantities of ore plus concentrates and pellets.

(b) Rio Tinto owns a 33.52% indirect interest in Oyu Tolgoi through its 50.79% interest in

Turquoise Hill Resources Ltd.

----------------------------------------------------------------------------------------------------------------------

Rio Tinto share of production

Rio Tinto Q4 Q1 Q2 Q3 Q4 Full Year Full

Year

interest 2018 2019 2019 2019 2019 2018 2019

-------------------------------------------- ------------ ------ ------ ------ ------ ------ --------- -------

IRON ORE

Production ('000 tonnes) (a)

Hamersley mines (b) 56,364 51,218 50,087 55,567 52,521 220,612 209,392

Hamersley - Channar 60% 1,337 931 1,451 947 1,452 4,304 4,782

Hope Downs 50% 5,845 5,957 6,051 6,077 6,047 22,684 24,132

Iron Ore Company of Canada 59% 2,836 2,481 2,532 2,960 2,564 8,952 10,536

Robe River - Pannawonica (Mesas J and A) 53% 4,004 1,870 3,329 4,725 4,360 16,932 14,284

Robe River - West Angelas 53% 4,631 4,125 4,692 4,840 4,409 17,316 18,066

------ ------ ------ ------ ------ --------- -------

Rio Tinto iron ore production ('000 tonnes) 75,018 66,581 68,141 75,117 71,352 290,800 281,192

------ ------ ------ ------ ------ --------- -------

Breakdown of Production:

Pilbara Blend and SP10 Lump (c) 21,674 19,978 19,842 21,015 19,930 84,843 80,766

Pilbara Blend and SP10 Fines (c) 31,652 28,779 28,463 31,713 30,304 122,582 119,260

Robe Valley Lump 1,409 635 1,201 1,650 1,574 5,897 5,060

Robe Valley Fines 2,595 1,235 2,128 3,075 2,786 11,035 9,224

Yandicoogina Fines (HIY) 14,852 13,473 13,975 14,704 14,194 57,491 56,346

------ ------ ------ ------ ------ --------- -------

Pilbara iron ore production ('000 tonnes) 72,182 64,101 65,610 72,156 68,788 281,848 270,655

IOC Concentrate 1,433 890 1,193 1,400 1,146 3,934 4,629

IOC Pellets 1,403 1,590 1,339 1,560 1,418 5,018 5,908

------ ------ ------ ------ ------ --------- -------

IOC iron ore production ('000 tonnes) 2,836 2,481 2,532 2,960 2,564 8,952 10,536

------ ------ ------ ------ ------ --------- -------

Breakdown of Shipments:

Pilbara Blend Lump (d) 18,439 15,772 18,009 15,948 16,176 73,892 65,906

Pilbara Blend Fines (d) 33,342 26,864 32,165 30,032 31,182 129,177 120,243

Robe Valley Lump 1,219 457 1,037 1,290 1,246 4,881 4,030

Robe Valley Fines 2,996 1,308 2,577 3,349 3,259 12,085 10,493

Yandicoogina Fines (HIY) 14,831 12,294 15,212 14,286 15,260 57,380 57,052

SP10 Lump (c) 0 0 635 2,685 2,072 0 5,391

SP10 Fines (c) 1,863 1,542 1,747 4,057 2,081 3,364 9,427

------ ------ ------ ------ ------ --------- -------

Pilbara iron ore shipments ('000 tonnes) 72,690 58,236 71,382 71,646 71,277 280,778 272,540

IOC Iron ore shipments ('000 tonnes) 3,073 2,092 2,738 2,654 2,636 8,837 10,120

------ ------ ------ ------ ------ --------- -------

Rio Tinto iron ore shipments ('000 tonnes) 75,763 60,328 74,119 74,300 73,913 289,614 282,660

------ ------ ------ ------ ------ --------- -------

Breakdown of Sales:

Pilbara Blend Lump (d) 18,439 15,772 18,009 15,948 16,176 73,892 65,906

Pilbara Blend Fines (d) 33,342 26,864 32,165 30,032 31,182 129,177 120,243

Robe Valley Lump 1,219 457 1,037 1,290 1,246 4,881 4,030

Robe Valley Fines 2,996 1,308 2,577 3,349 3,259 12,085 10,493

Yandicoogina Fines (HIY) 14,831 12,294 15,212 14,286 15,260 57,380 57,052

SP10 Lump (c) 0 0 635 2,611 1,733 0 4,979

SP10 Fines (c) 1,863 1,542 1,747 3,962 1,185 3,364 8,437

------ ------ ------ ------ ------ --------- -------

Pilbara iron ore sales ('000 tonnes) (e) 72,690 58,236 71,382 71,478 70,043 280,778 271,139

Pilbara iron ore sales - consolidated basis ('000 tonnes)

(e) (f) 74,711 59,541 73,230 73,619 72,166 288,610 278,557

IOC Concentrate 1,558 516 1,315 1,425 1,223 3,887 4,479

IOC Pellets 1,516 1,576 1,423 1,229 1,413 4,950 5,641

------ ------ ------ ------ ------ --------- -------

IOC Iron ore sales ('000 tonnes) 3,073 2,092 2,738 2,654 2,636 8,837 10,120

(a) Mine production figures for metals refer to the total quantity

of metal produced in concentrates, leach liquor or doré bullion

irrespective of whether these products are then refined onsite,

except for the data for bauxite and iron ore which represent production

of marketable quantities of ore plus concentrates and pellets.

(b) Includes 100% of production from Paraburdoo, Mt Tom Price,

Marandoo, Yandicoogina, Brockman, Nammuldi, Silvergrass and the

Eastern Range mines. Whilst Rio Tinto owns 54% of the Eastern

Range mine, under the terms of the joint venture agreement, Hamersley

Iron manages the operation and is obliged to purchase all mine

production from the joint venture and therefore all of the production

is included in Rio Tinto's share of production.

(c) SP10 includes some lower grade products. SP10 fines sales

also include IOC product that is further blended and sold at port

in China.

(d) Restatement due to separately reporting SP10 lump and SP10

fines products that include other lower grade products.

(e) Differences between shipments and sales reflect tonnes held

for portside trading and material purchased from IOC and sold.

(f) While Rio Tinto has a 53% net beneficial interest in Robe

River Iron Associates, it recognises 65% of the assets, liabilities,

sales revenues and expenses in its accounts (as 30% is held through

a 60% owned subsidiary and 35% is held through a 100% owned subsidiary).

The consolidated basis sales reported here include Robe River

Iron Associates on a 65% basis to enable comparison with revenue

reported in the financial statements.

----------------------------------------------------------------------------------------------------------------------

Rio Tinto share of production

Rio Tinto Q4 Q1 Q2 Q3 Q4 Full Year Full Year

interest 2018 2019 2019 2019 2019 2018 2019

------------------------------------ ----------- ------- ------- ------- ------- --------- --------- ---------

MOLYBDENUM

Mine production ('000 tonnes) (a)

Bingham Canyon 100% 2.2 1.9 2.6 2.1 4.7 5.8 11.2

(a) Mine production figures for metals refer to the total quantity of metal produced in concentrates,

leach liquor or doré bullion irrespective of whether these products are then refined

onsite, except for the data for bauxite and iron ore which represent production of marketable

quantities of ore plus concentrates and pellets.

----------------------------------------------------------------------------------------------------------------------

SALT

Production ('000 tonnes)

Dampier Salt 68% 1,496 1,310 1,269 1,392 1,450 6,153 5,422

------------------------------------ ----------- ------- ------- ------- ------- --------- --------- ---------

SILVER

Mine production ('000 ounces) (a)

Bingham Canyon 100% 736 741 700 768 605 2,520 2,815

Escondida 30% 771 657 622 488 539 2,830 2,306

Oyu Tolgoi (b) 34% 80 83 80 64 64 306 290

------- ------- ------- ------- --------- --------- ---------

Rio Tinto total mine production 1,586 1,481 1,403 1,320 1,209 5,656 5,412

------- ------- ------- ------- --------- --------- ---------

Refined production ('000 ounces)

Rio Tinto Kennecott 100% 807 617 734 664 839 2,865 2,853

(a) Mine production figures for metals refer to the total quantity of metal produced in concentrates,

leach liquor or doré bullion irrespective of whether these products are then refined

onsite, except for the data for bauxite and iron ore which represent production of marketable

quantities of ore plus concentrates and pellets.

(b) Rio Tinto owns a 33.52% indirect interest in Oyu Tolgoi through its 50.79% interest in

Turquoise Hill Resources Ltd.

----------------------------------------------------------------------------------------------------------------------

TITANIUM DIOXIDE SLAG

Production ('000 tonnes)

Rio Tinto Iron & Titanium (a) 100% 294 296 303 321 286 1,116 1,206

(a) Quantities comprise 100% of Rio Tinto Fer et Titane and Rio Tinto's 74% interest in Richards

Bay Minerals (RBM).

----------------------------------------------------------------------------------------------------------------------

URANIUM

Production ('000 lbs U(3) O(8) ) (a)

Energy Resources of Australia 68% 924 793 620 585 642 3,014 2,640

Rössing (b) 0% 979 802 1,142 170 - 3,750 2,114

------- ------- ------- ------- --------- --------- ---------

Rio Tinto total uranium production 1,904 1,595 1,762 755 642 6,764 4,754

------------------------------------------------- ------- ------- ------- ------- --------- --------- ---------

(a) ERA and Rössing production reported are drummed U(3) O(8) .

(b) On 16 July 2019, Rio Tinto completed the sale of its entire 68.62% interest in the Rössing

mine in Namibia to China National Uranium Corporation Limited. Production is reported up to

the date of completion.

Production figures are sometimes more precise than the rounded numbers shown, hence small

differences may result between the total of the quarter figures and the year to date figures.

The Rio Tinto percentage shown above is at 31 December 2019.

Rio Tinto's interest in the Kestrel, Hail Creek, Dunkerque and Grasberg operations were sold

in 2018. No data for these operations are included in the Share of production table.

Rio Tinto operational data

Rio Q4 Q1 Q2 Q3 Q4 Full Full

Tinto Year Year

interest 2018 2019 2019 2019 2019 2018 2019

ALUMINA

Smelter Grade Alumina - Aluminium

Group

Alumina production ('000

tonnes)

Australia

Queensland Alumina Refinery

- Queensland 80.0% 927 888 834 836 895 3,697 3,454

Yarwun refinery - Queensland 100.0% 803 813 757 671 850 3,103 3,091

Brazil

São Luis (Alumar)

refinery 10.0% 918 859 864 989 966 3,509 3,679

Canada

Jonquière (Vaudreuil)

refinery - Quebec (a) 100.0% 354 373 336 360 345 1,444 1,413

------ ------ ------ ------ ------ ------ ------

(a) Jonquière's (Vaudreuil's) production shows smelter grade

alumina only and excludes hydrate produced and used for specialty

alumina.

Specialty Alumina - Aluminium

Group

Specialty alumina production

('000 tonnes)

Canada

Jonquière (Vaudreuil)

plant - Quebec 100.0% 29 25 31 28 24 124 109

Rio Tinto percentage interest shown above is at 31 December 2019.

The data represent full production and sales on a 100% basis unless

otherwise stated.

Rio Tinto operational data

Rio Q4 Q1 Q2 Q3 Q4 Full Full

Tinto Year Year

interest 2018 2019 2019 2019 2019 2018 2019

------------------------------- ---------- ------ ------ ------ ------ ------ ------ ------

ALUMINIUM

Primary Aluminium

Primary aluminium production

('000 tonnes)

Australia

Bell Bay smelter - Tasmania 100.0% 48 45 47 48 48 189 189

Boyne Island smelter -

Queensland 59.4% 125 122 126 125 125 497 499

Tomago smelter - New South

Wales 51.6% 149 144 147 149 148 592 588

Canada

Alma smelter - Quebec 100.0% 118 115 118 119 119 465 472

Alouette (Sept-Îles)

smelter - Quebec 40.0% 146 144 150 153 155 584 602

Arvida smelter - Quebec 100.0% 44 43 44 45 44 173 175

Arvida AP60 smelter - Quebec 100.0% 13 14 15 15 15 52 60

Bécancour smelter

- Quebec 25.1% 30 17 16 16 28 136 77

Grande-Baie smelter - Quebec 100.0% 59 58 58 59 59 233 233

Kitimat smelter - British

Columbia 100.0% 109 106 102 96 81 436 385

Laterrière smelter

- Quebec 100.0% 65 64 64 65 65 257 257

France

Dunkerque smelter (a) 0.0% 57 - - - - 227 -

Iceland

ISAL (Reykjavik) smelter 100.0% 54 52 52 36 43 212 184

New Zealand

Tiwai Point smelter 79.4% 88 89 87 88 87 341 351

Oman

Sohar smelter 20.0% 99 97 97 98 98 380 391

(a) On 14 December 2018, Rio Tinto completed the sale of its 100%

interest in the Dunkerque smelter. Production is reported up to

the date of completion.

Rio Tinto percentage interest shown above is at 31 December 2019.

The data represent full production and sales on a 100% basis unless

otherwise stated.

Rio Tinto operational data

Rio Q4 Q1 Q2 Q3 Q4 Full Full

Tinto Year Year

interest 2018 2019 2019 2019 2019 2018 2019

--------------------------------- ---------- ------ ------ ------ ------ ------ ------ ------

BAUXITE

Bauxite production ('000

tonnes)

Australia

Gove mine - Northern Territory 100.0% 3,250 3,004 2,957 2,968 3,273 12,540 12,201

Weipa mine - Queensland 100.0% 6,847 7,917 8,533 8,695 10,267 30,437 35,411

Brazil

Porto Trombetas (MRN) mine 12.0% 4,073 2,372 2,393 3,205 3,090 13,134 11,060

Guinea

Sangaredi mine (a) 23.0% 2,675 3,463 3,623 3,887 2,727 13,039 13,701

Rio Tinto share of bauxite shipments

Share of total bauxite shipments

('000 tonnes) 11,622 12,725 13,122 13,912 14,849 49,536 54,607

Share of third party bauxite

shipments ('000 tonnes) 7,387 8,842 9,477 10,361 10,968 32,813 39,648

------ ------ ------ ------ ------ ------ ------

(a) Rio Tinto has a 22.95% shareholding in the Sangaredi mine

but benefits from 45.0% of production.

BORATES

Rio Tinto Borates - borates 100.0%

US

Borates ('000 tonnes) (a) 118 115 138 138 128 512 520

(a) Production is expressed as B(2) O(3) content.

Rio Tinto percentage interest shown above is at 31 December 2019.

The data represent full production and sales on a 100% basis unless

otherwise stated.

Rio Tinto operational data

Rio Tinto Q4 Q1 Q2 Q3 Q4 Full Full

Year Year

interest 2018 2019 2019 2019 2019 2018 2019

--------------------------------- ---------- ------ ------ ------ ------ ------ ------- -------

COPPER & GOLD

Escondida 30.0%

Chile

Sulphide ore to concentrator ('000

tonnes) 30,507 32,027 32,519 33,956 33,659 124,956 132,161

Average copper grade (%) 0.87 0.82 0.86 0.86 0.87 0.93 0.85

Mill production (metals

in concentrates):

Contained copper ('000 tonnes) 219.9 216.9 230.9 245.0 246.1 968.0 938.9

Contained gold ('000 ounces) 74 74 75 49 49 266 247

Contained silver ('000 ounces) 2,570 2,189 2,074 1,626 1,798 9,433 7,687

Recoverable copper in ore stacked

for leaching ('000 tonnes) (a) 45.7 36.5 44.7 56.8 61.7 199.9 199.7

Refined production from

leach plants:

Copper cathode production

('000 tonnes) 71.9 62.4 63.5 55.9 68.4 266.8 250.2

(a) The calculation of copper in material mined for leaching is

based on ore stacked at the leach pad.

Freeport-McMoRan

0.0%

Grasberg mine (a) (b)

Papua, Indonesia

Ore treated ('000 tonnes) 14,049 - - - - 64,310 -

Average mill head grades:

Copper (%) 0.73 - - - - 0.99 -

Gold (g/t) 1.08 - - - - 1.59 -

Silver (g/t) 2.09 - - - - 4.17 -

Production of metals in

concentrates:

Copper in concentrates ('000

tonnes) 85.4 - - - - 569.7 -

Gold in concentrates ('000

ounces) 402 - - - - 2,779 -

Silver in concentrates ('000

ounces) 545 - - - - 5,045 -

Sales of payable metals in concentrates:

(c)

Copper in concentrates ('000

tonnes) 82.7 - - - - 556.0 -

Gold in concentrates ('000

ounces) 399 - - - - 2,719 -

Silver in concentrates ('000

ounces) 426 - - - - 3,928 -

(a) Through a joint venture agreement with Freeport-McMoRan (FCX),

Rio Tinto is entitled to 40% of additional material mined as a

consequence of expansions and developments of the Grasberg facilities

since 1998. The Q4 2018 results show the forecast from FCX's most

recent five-year plan. On 21 December 2018, Rio Tinto completed

the sale of its entire interest in the Grasberg mine in Indonesia

to PT Indonesia Asahan Aluminium (Persero) (Inalum). Production

is reported up to the date of completion.

(b) Rio Tinto share of Grasberg production is 40% of the expansion.

(c) Net of smelter deduction

Rio Tinto percentage interest shown above is at 31 December 2019.

The data represent full production and sales on a 100% basis unless

otherwise stated.

Rio Tinto operational data

Rio Q4 Q1 Q2 Q3 Q4 Full Full

Tinto Year Year

interest 2018 2019 2019 2019 2019 2018 2019

----------------------------- ---------- ------ ------ ------ ------ ------ ------ ------

COPPER & GOLD (continued)

Rio Tinto Kennecott

Bingham Canyon mine 100.0%

Utah, US

Ore treated ('000 tonnes) 10,853 10,685 10,123 10,084 11,141 40,260 42,033

Average ore grade:

Copper (%) 0.59 0.55 0.46 0.64 0.36 0.56 0.50

Gold (g/t) 0.26 0.25 0.33 0.30 0.23 0.25 0.28

Silver (g/t) 2.76 2.76 2.84 2.74 2.09 2.60 2.60

Molybdenum (%) 0.032 0.032 0.039 0.039 0.061 0.028 0.043

Copper concentrates produced

('000 tonnes) 222 207 161 207 156 820 731

Average concentrate grade

(% Cu) 26.0 25.3 25.5 27.8 22.6 24.8 25.5

Production of metals in copper

concentrates:

Copper ('000 tonnes) (a) 58.3 52.5 41.1 57.8 35.4 203.9 186.8

Gold ('000 ounces) 57 53 65 65 52 197 235

Silver ('000 ounces) 736 741 700 768 605 2,520 2,815

Molybdenum concentrates produced

('000 tonnes): 4.5 3.8 5.0 4.3 9.4 11.6 22.4

Molybdenum in concentrates

('000 tonnes) 2.2 1.9 2.6 2.1 4.7 5.8 11.2

Kennecott smelter & refinery 100.0%

Copper concentrates smelted

('000 tonnes) 262 204 207 160 216 932 787

Copper anodes produced ('000

tonnes) (b) 62.4 33.3 60.3 39.3 53.7 207.3 186.6

Production of refined metal:

Copper ('000 tonnes) 64.6 29.6 63.3 40.3 51.4 194.7 184.6

Gold ('000 ounces) (c) 58.6 41.7 52.9 60.8 63.3 198.0 218.7

Silver ('000 ounces) (c) 807 617 734 664 839 2,865 2,853

(a) Includes a small amount of copper in precipitates.

(b) New metal excluding recycled material.

(c) Includes gold and silver in intermediate products.

Rio Tinto percentage interest shown above is at 31 December 2019.

The data represent full production and sales on a 100% basis unless

otherwise stated.

Rio Tinto operational data

Rio Q4 Q1 Q2 Q3 Q4 Full Full

Tinto Year Year

interest 2018 2019 2019 2019 2019 2018 2019

--------------------------------- ---------- ------ ------ ------ ------ ------ ------ ------

COPPER & GOLD (continued)

Turquoise Hill Resources

Oyu Tolgoi mine (a) 33.5%

Mongolia

Ore Treated ('000 tonnes) 9,361 9,255 10,394 10,040 11,088 38,738 40,777

Average mill head grades:

Copper (%) 0.55 0.57 0.46 0.37 0.42 0.51 0.45

Gold (g/t) 0.56 0.58 0.31 0.14 0.15 0.36 0.29

Silver (g/t) 1.22 1.25 1.20 1.03 1.06 1.22 1.13

Copper concentrates produced

('000 tonnes) 189.0 210.1 180.6 131.3 152.6 724.9 674.6

Average concentrate grade

(% Cu) 21.9 21.8 21.7 21.7 21.6 21.9 21.7

Production of metals in

concentrates:

Copper in concentrates

('000 tonnes) 41.5 45.8 39.2 28.4 32.9 159.1 146.3

Gold in concentrates ('000

ounces) 116.7 120.1 71.8 25.6 24.3 285.4 241.8

Silver in concentrates

('000 ounces) 238 247 239 191 190 914 867

Sales of metals in concentrates:

Copper in concentrates

('000 tonnes) 40.2 38.5 46.6 32.5 32.3 156.7 149.9

Gold in concentrates ('000

ounces) 111 98 116 35 25 248 274

Silver in concentrates

('000 ounces) 216 200 245 207 244 873 896

(a) Rio Tinto owns a 33.52% indirect interest in Oyu Tolgoi through

its 50.79% interest in Turquoise Hill Resources.

DIAMONDS

Argyle Diamonds 100.0%

Western Australia

AK1 ore processed ('000

tonnes) 1,292 1,248 1,427 1,716 1,977 5,444 6,367

AK1 diamonds produced ('000

carats) 3,211 2,786 3,292 3,558 3,363 14,069 12,999

Diavik Diamonds 60.0%

Northwest Territories,

Canada

Ore processed ('000 tonnes) 651 620 671 628 516 2,530 2,435

Diamonds recovered ('000

carats) 1,797 1,683 1,980 1,656 1,400 7,264 6,719

Rio Tinto percentage interest shown above is at 31 December 2019.

The data represent full production and sales on a 100% basis unless

otherwise stated.

Rio Tinto operational data

Rio Q4 Q1 Q2 Q3 Q4 Full Full

Tinto Year Year

interest 2018 2019 2019 2019 2019 2018 2019

------------------------------- ---------- ------ ------ ------ ------ ------ ------- -------

IRON ORE

Rio Tinto Iron Ore

Western Australia

Pilbara Operations

Saleable iron ore production

('000 tonnes)

Hamersley mines (a) 56,364 51,218 50,087 55,567 52,521 220,612 209,392

Hamersley - Channar 60.0% 2,228 1,552 2,419 1,579 2,420 7,173 7,970

Hope Downs 50.0% 11,691 11,913 12,101 12,155 12,095 45,368 48,264

Robe River - Pannawonica

(Mesas J and A) 53.0% 7,555 3,529 6,282 8,914 8,225 31,947 26,951

Robe River - West Angelas 53.0% 8,738 7,783 8,853 9,133 8,318 32,672 34,086

------ ------ ------ ------ ------ ------- -------

Total production ('000

tonnes) 86,576 75,995 79,741 87,347 83,579 337,772 326,663

------------------------------- ---------- ------ ------ ------ ------ ------ ------- -------

Breakdown of total production:

Pilbara Blend and SP10

Lump (b) 26,084 24,068 24,291 25,434 24,326 101,629 98,119

Pilbara Blend and SP10

Fines (b) 38,085 34,924 35,194 38,296 36,833 146,705 145,247

Robe Valley Lump 2,659 1,198 2,266 3,113 2,969 11,126 9,547

Robe Valley Fines 4,896 2,331 4,015 5,802 5,256 20,821 17,404

Yandicoogina Fines (HIY) 14,852 13,473 13,975 14,704 14,194 57,491 56,346

Breakdown of total shipments:

Pilbara Blend Lump (c) 22,161 18,968 21,653 19,329 19,680 88,215 79,630

Pilbara Blend Fines (c) 40,633 33,016 39,358 36,947 39,186 157,191 148,508

Robe Valley Lump 2,301 863 1,957 2,433 2,350 9,209 7,603

Robe Valley Fines 5,652 2,468 4,862 6,318 6,149 22,801 19,797

Yandicoogina Fines (HIY) 14,831 12,294 15,212 14,286 15,260 57,380 57,052

SP10 Lump (b) 0 0 635 2,685 2,072 0 5,391

SP10 Fines (b) 1,863 1,542 1,747 4,057 2,081 3,364 9,427

------ ------ ------ ------ ------ ------- -------

Total shipments ('000 tonnes)

(d) 87,442 69,150 85,423 86,055 86,779 338,160 327,408

------------------------------- ---------- ------ ------ ------ ------ ------ ------- -------

Breakdown of total sales:

Pilbara Blend Lump (c) 22,161 18,968 21,653 19,329 19,680 88,215 79,630

Pilbara Blend Fines (c) 40,633 33,016 39,358 36,947 39,186 157,191 148,508

Robe Valley Lump 2,301 863 1,957 2,433 2,350 9,209 7,603

Robe Valley Fines 5,652 2,468 4,862 6,318 6,149 22,801 19,797

Yandicoogina Fines (HIY) 14,831 12,294 15,212 14,286 15,260 57,380 57,052

SP10 Lump (b) 0 0 635 2,611 1,733 0 4,979

SP10 Fines (b) 1,863 1,542 1,747 3,962 1,185 3,364 8,437

------ ------ ------ ------ ------ ------- -------

Total sales ('000 tonnes) 87,442 69,150 85,423 85,888 85,545 338,160 326,006

------------------------------- ---------- ------ ------ ------ ------ ------ ------- -------

(a) Includes 100% of production from Paraburdoo, Mt Tom Price,

Marandoo, Yandicoogina, Brockman, Nammuldi, Silvergrass and the

Eastern Range mines. Whilst Rio Tinto owns 54% of the Eastern

Range mine, under the terms of the joint venture agreement, Hamersley

Iron manages the operation and is obliged to purchase all mine

production from the joint venture and therefore all of the production

is included in Rio Tinto's share of production.

(b) SP10 includes some lower grade products. SP10 fines sales

also include IOC product that is further blended and sold at port

in China.

(c) Restatement due to separately reporting SP10 lump and SP10

fines products that include other lower grade products.

(d) Shipments represent iron ore exported from Western Australian

ports: a portion of this material is shipped for portside trading

to be further blended and subsequently sold.

Rio Tinto percentage interest shown above is at 31 December 2019.

The data represent full production and sales on a 100% basis unless

otherwise stated.

Rio Tinto operational data

Rio Q4 Q1 Q2 Q3 Q4 Full Full

Tinto Year Year

interest 2018 2019 2019 2019 2019 2018 2019

IRON ORE (continued)

Iron Ore Company of Canada 58.7%

Newfoundland & Labrador and

Quebec in Canada

Saleable iron ore production:

Concentrates ('000 tonnes) 2,441 1,516 2,031 2,384 1,951 6,700 7,883

Pellets ('000 tonnes) 2,389 2,709 2,280 2,657 2,415 8,545 10,061

------ ------ ------ ------ ------ ------- -------

IOC Total production ('000

tonnes) 4,830 4,225 4,311 5,041 4,366 15,245 17,943

Shipments:

Concentrates ('000 tonnes) 2,653 878 2,239 2,427 2,083 6,619 7,628

Pellets ('000 tonnes) 2,581 2,684 2,424 2,093 2,406 8,430 9,607

------ ------ ------ ------ ------ ------- -------

IOC Total Shipments ('000

tonnes) 5,234 3,562 4,663 4,520 4,490 15,049 17,235

IOC Total Sales ('000 tonnes) 5,234 3,562 4,663 4,520 4,490 15,049 17,235

Global Iron Ore Totals

Iron Ore Production ('000

tonnes) 91,406 80,219 84,052 92,389 87,945 353,017 344,606

Iron Ore Shipments ('000

tonnes) 92,676 72,712 90,085 90,576 91,269 353,209 344,642

SALT

Dampier Salt 68.4%

Western Australia

Salt production ('000 tonnes) 2,188 1,917 1,856 2,036 2,121 9,001 7,931

-------------------------------- ---------- ------ ------ ------ ------ ------ ------- -------

TITANIUM DIOXIDE SLAG

Rio Tinto Iron & Titanium 100.0%

Canada and South Africa

(Rio Tinto share) (a)

Titanium dioxide slag ('000

tonnes) 294 296 303 321 286 1,116 1,206

------ ------ ------ ------ ------ ------- -------

(a) Quantities comprise 100% of Rio Tinto Fer et Titane and Rio

Tinto's 74% interest in Richards Bay Minerals' production. Ilmenite

mined in Madagascar is being processed in Canada.

------------------------------------------------------------------------------------------------------

URANIUM

Energy Resources of Australia

Ltd

Ranger mine (a) 68.4%

Northern Territory, Australia

U(3) O(8) Production ('000

lbs) 1,351 1,160 906 855 939 4,407 3,860

(a) ERA production data are drummed U(3) O(8) .

Rössing Uranium Ltd

(a) (b) 0.0%

Namibia

U(3) O(8) Production ('000

lbs) 1,427 1,168 1,665 247 - 5,465 3,080

------ ------ ------ ------ ------ ------- -------

(a) Rössing production data are drummed U(3) O(8) .

(b) On 16 July 2019, Rio Tinto completed the sale of its entire

68.62% interest in the Rössing mine in Namibia to China National

Uranium Corporation Limited. Production is reported up to the

date of completion.

------------------------------------------------------------------------------------------------------

Rio Tinto percentage interest shown above is at 31 December 2019.

The data represent full production and sales on a 100% basis unless

otherwise stated.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DRLSFEEEMESSESF

(END) Dow Jones Newswires

January 17, 2020 02:00 ET (07:00 GMT)

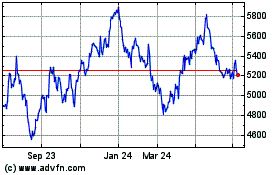

Rio Tinto (LSE:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

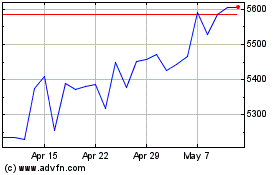

Rio Tinto (LSE:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024