TIDMQRT

RNS Number : 8090K

Quarto Group Inc

30 August 2023

The Quarto Group, Inc.

(the "Company", "Quarto", "Group")

Half-Year Results for the Six Months Ended 30 June 2023

The Quarto Group, Inc. (LSE: QRT), the leading global

illustrated book publisher, announces its unaudited half-year

results for the six months ended 30 June 2023.

Results ($m) H1 2023 H1 2022

------------------------------- -------- --------

Group Revenue 52.0 61.9

Adjusted(1) Group Operating

Profit 3.1 6.7

Group Operating Profit 3.1 7.2

Adjusted(1) Profit before Tax 3.1 6.1

Profit before Tax 2.6 6.6

Profit after Tax 1.8 4.7

Net Cash / (Debt) 9.1 (5.6)

1. Adjusted measures are stated exceptional items.

Headlines

-- Revenue down 16% at $52m against 2022, partly due to Quarto

Distribution Services & Smart Lab being discontinued, with core

revenue $51m, down 10% year on year.

-- Operating profit of $3.1m down from $7.2m in 2022, driven by the reduction in revenue.

-- Strong cash generation has continued to feature, with $14.7

million generated over the last 12 months to June 2023. Net cash

position was $9.1m against a net debt position of $5.6m (June

2022)

Chief Executive, Alison Goff commented on the half year

position:

"Following the economic challenges faced towards the end of 2022

and into 2023, this is a steady set of results following on from

the growth in 2022. Whilst revenue and profits were down year on

year, the results achieved are in line with our expectations for

the seasonally weaker first half of the year.

Quarto UK, whilst sales experienced a decline of 6% year on year

from $27.2m (2022) to $25.5m (2023), this is still 3% ahead of

2021. With the decline in revenue, operating profits reduced from

$3.1m in 2022 to $2. 4m in 2023 , although this is still a

significant improvement on 2021 at $1m. Softness across all areas

of the business contributed to this decline, as consumer demand

reduced and our business to business sales slowed as customers

managed their inventory.

Bestsellers within the period include The King, a new title for

2023 in our very successful Little People Big Dreams series and

London: A Guide for Curious Wanderers also a new title in 2023. We

were also shortlisted for numerous prestigious awards including

Flooded by Mariajo Ilustrajo (Klaus Flugge Prize) and Rescuing

Titanic (Yoto Carnegie award).

Quarto US has also seen a decline in revenue down 23% from

$34.7m to $26.5m. Excluding the discontinued Quarto Distribution

Services and Smart Lab core trading is down 12%, with trade sales

and custom down 7% and 44% respectively. The reduction in custom

sales is purely timing of orders and we expect this to recover

during the second half of 2023. Operating profit reduced by 69% to

$1.3m from $4.1m, with the decline in sales.

We continue to see Beautiful Boards perform strongly, with

Nascar 75 years published in 2023 also performing well.

We are now focused on the second half of the year, which will be

a significant period for Quarto as we expect the trading

environment to continue to be challenging. However, I am confident

with inflation past its recent peak and supply chain issues now

easing, we have the right plans in place to capture all potential

opportunities. We are confident that these plans will enable us to

navigate through these uncertain times.

The Board remains focused on ensuring we keep costs under

control, drive sales, and develop further growth strategies for the

remainder of 2023, 2024 and beyond."

-S -

The Legal Identifier of the Company is 549300BJ2WPX3QUATW58.

For further information, please contact:

The Quarto Group, Inc. +44 (0)20 7700 6700

Daniel Logan, Group Finance Director

Michael Clarke, Company Secretary

About The Quarto Group

The Quarto Group (LSE: QRT) creates a wide variety of books and

intellectual property products, with a mission to inspire life's

experiences. Produced in many formats for adults, children and the

whole family, our products are visually appealing, information rich

and stimulating.

The Group encompasses a diverse portfolio of imprints and

businesses that are creatively independent and expert in developing

long-lasting content across specific niches of interest.

Quarto sells and distributes its products globally in over 50

countries and 40 languages, through a variety of sales channels,

partnerships and routes to market.

Quarto employs c.305 talented people in the US and the UK. The

group was founded in London in 1976. It is domiciled in the US and

listed on the London Stock Exchange.

For more information, visit quarto.com or follow us on Twitter

at @TheQuartoGroup.

CHIEF EXECUTIVE'S STATEMENT

SUMMARY

Following the growth in sales in the first half of 2022 compared

to 2021, the revenue in first half of 2023 declined by 16% year on

year at $52m, with core revenue, excluding Quarto Distribution

Services and Smart Lab, down 10% at $51m. Revenue increased year on

year in 2022 by 9% (H1 2021: $56.9m, Core revenue $51.5m).

Whilst sales declined due to the disposal of Smart Lab and the

scaling back of Quarto Distribution Services, gross profit margin

was impacted by only 1.2% to 35.2%, with prior year at 36.4%.

The decline in revenue resulted in an adjusted group operating

profit of $3.1m (H1 2022: $6.7m). The adjusted profit before tax

was $2.6m (H1 2022: $6.1m).

With both US and UK reporting segments showing revenue declines

year on year, this resulted in the Group's adjusted operating

results also showing a reduction, as shown in the table below.

June 2023, was a significant moment, as Quarto had net cash of

$9.1m, compared with net debt of $5.6m in H1 2022, with cash

generation of $14.7m over the twelve-month period and $8.5m in the

last 6 months (See note 7). This strong cash generation has been

driven by strong trading in 2022, dynamic inventory management,

tight cost controls and reduced finance costs.

The overall book market in the first six months of 2023 proved,

as expected, to be even more challenging than 2022.

OPERATING REVIEW

Revenue ($m) H1 2023 H1 2022 H1 2021

--------------------------- -------- -------- --------

United States 29.3 39.7 36.3

United Kingdom 7.5 6.6 7.9

Rest of the World 6.8 8.0 6.1

Europe 8.4 7.6 6.6

--------------------------- -------- -------- --------

Total Revenue 52.0 61.9 56.9

--------------------------- -------- -------- --------

Adjusted Operating Profit H1 2023 H1 2022 H1 2021

($m)

--------------------------- -------- -------- --------

US Publishing 1.3 4.1 3.8

UK Publishing 2.4 3.1 1.0

Group overhead (0.6) (0.5) (0.8)

--------------------------- -------- -------- --------

Total adjusted operating

profit 3.1 6.7 4.0

--------------------------- -------- -------- --------

Note: Revenue is shown by destination; adjusted operating profit

is shown by segment.

The Group's decrease in revenue this year to date, is a result

of soft trade sales and reduction of our custom sales, following a

very strong 2022.

UK-based Frances Lincoln Children's Books imprint continues to

drive forward, with the Little People, Big Dreams series continuing

to be a highlight, with over 7 million copies sold in the English

language to date. We continue to expand the list, with King Charles

publishing in 2023, generating $535k in revenue. This series

continues to grow and we add even more foreign language partners to

our sales.

In the US, our Beverly-based Adult imprints, especially

Motorbooks, Rockport and Walter Foster, continue to perform

strongly led by Nascars 75 years and Kawaii Tarot Coloring

Book.

Foreign language sales are ahead year on year, and we expect

this to continue as we move into H2.

The current shortfall in Custom sales is purely timing and we

expect this to recover in H2. English language co-edition sales,

currently down year on year, are expected to remain flat as

customers work through existing inventory and reprint orders are

reduced.

The reduction in our financing costs will continue as we improve

our cash position.

OUTLOOK

As we move into H2 we expect the challenges seen in H1 which

have been impacting trade sales to continue. With the expected fall

in inflation across both the US & UK, we should start to see a

softening of the cost-of-living crisis and more buoyancy in the

market.

Foreign language sales are expected to hold firm, with strong

orders in the pipeline and Custom sales whilst down year on year,

are expected to recover during the second half of the year.

The decision to close our Quarto Distribution Service and Smart

Lab, our toy imprint, has allowed us to focus on our core

publishing business, whilst reducing the overhead in those

areas.

After the recent period of volatility in freight in terms of

lead times and costs, we have seen significant improvement in both

areas. This will allow us a greater number of options when sourcing

our print, enabling us to be nimble whilst ensuring competitive

pricing.

I am confident we have the right plans in place to capture all

potential opportunities. The Board remains focused on keeping costs

under control, driving sales, and developing further growth

strategies for the remainder of 2023, 2024 and beyond.

On behalf of the Board, I would like to thank all our staff,

readers, customers, suppliers and shareholders around the world,

for their continued support and commitment.

Alison Goff

Chief Executive Officer

THE QUARTO GROUP, INC.

Condensed Consolidated Income Statement

For the six months ended 30 June 2023

Six months

Six months to Year ended

to 30 June 31 December

30 June 2023 2022 2022

Unaudited Unaudited Audited

Note $'000 $'000 $'000

Continuing operations

Revenue 3 52,041 61,908 141,017

Cost of sales (33,699) (39,391) (87,319)

------------------------------------ ---- ------------- ---------- ------------

Gross profit 18,342 22,517 53,698

Distribution costs (2,965) (3,699) (7,582)

Impairment of financial assets (264) (301) (69)

Administrative expenses (12,041) (11,836) (24,723)

------------------------------------ ----

Operating profit before exceptional

items 3,072 6,681 21,324

------------------------------------ ---- ------------- ---------- ------------

Exceptional items 4 - 491 774

------------------------------------ ---- ------------- ---------- ------------

Operating profit 3 3,072 7,172 22,098

Finance costs (493) (545) (1,213)

------------------------------------ ---- ------------- ---------- ------------

Profit before tax 2,579 6,627 20,885

Taxation 5 (797) (1,904) (4,279)

Profit for the period 1,782 4,723 16,606

==================================== ==== ============= ========== ============

Attributable to:

Owners of the parent 1,782 4,723 16,606

==================================== ==== ============= ========== ============

Earnings per share (cents)

From continuing operations

Basic 6 4.4 11.5 40.6

Diluted 6 4.4 11.5 40.6

THE QUARTO GROUP, INC.

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2023

Six months Six months Year ended

to to 31 December

30 June 2023 30 June 2022 2022

Unaudited Unaudited Audited

$'000 $'000 $'000

Profit for the period 1,782 4,723 16,606

Other comprehensive income which

may be reclassified to profit

or loss

Foreign exchange translation

differences 625 (2,833) (2,475)

Total comprehensive income for

the period 2,407 1,890 14,131

================================= ============= ============= ============

Attributable to:

Owners of the parent 2,407 1,890 14,131

================================= ============= ============= ============

THE QUARTO GROUP, INC.

Condensed Consolidated Balance Sheet

31 December

30 June 2023 30 June 2022 2022

As at 30 June 2023 Note Unaudited Unaudited Audited

$'000 $'000 $'000

Non-current assets

Goodwill 18,860 18,622 18,622

Other intangible assets 1 2 1

Property, plant and equipment 7,264 4,419 7,677

Intangible assets: pre-publication

costs 26,147 27,040 25,473

Deferred tax assets 1,834 2,437 1,835

----------------------------------- ---- ------------ ------------ -----------

Total non-current assets 54,106 52,520 53,608

----------------------------------- ---- ------------ ------------ -----------

Current assets

Inventories 20,522 22,552 21,826

Trade and other receivables 32,323 38,293 40,122

Cash and cash equivalents 7 13,464 8,106 13,290

Assets held for sales 8 - 2,360 -

----------------------------------- ---- ------------ ------------ -----------

Total current assets 66,309 71,311 75,238

----------------------------------- ---- ------------ ------------ -----------

Total assets 120,415 123,831 128,846

----------------------------------- ---- ------------ ------------ -----------

Current liabilities

Short term borrowings 7 (4,362) (3,116) (4,636)

Trade and other payables (33,254) (42,083) (33,869)

Lease liabilities (1,231) (1,111) (944)

Tax payable (2,866) (5,420) (3,295)

------------ ------------ -----------

Total current liabilities (41,713) (51,730) (42,744)

----------------------------------- ---- ------------ ------------ -----------

Non-current liabilities

Medium and long-term borrowings 7 - (10,596) (9,301)

Deferred tax liabilities (2,928) (2,933) (2,798)

Tax payable (386) (386) (386)

Lease liabilities (5,641) (3,087) (6,277)

------------ ------------ -----------

Total non-current liabilities (8,955) (17,002) (18,762)

----------------------------------- ---- ------------ ------------ -----------

Total liabilities (50,668) (68,732) (61,506)

----------------------------------- ---- ------------ ------------ -----------

Net assets 69,747 55,099 67,340

=================================== ==== ============ ============ ===========

Equity

Share capital 4,089 4,089 4,089

Paid in surplus 48,701 48,701 48,701

Retained earnings and other

reserves 16,957 2,309 14,550

----------------------------------- ---- ------------ ------------ -----------

Total equity 69,747 55,099 67,340

=================================== ==== ============ ============ ===========

THE QUARTO GROUP, INC.

Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 June 2023

Equity

attributable

to owners

Paid in Translation Retained of the

Share capital surplus reserve earnings parent

$000 $000 $000 $000 $000

Balance at 1 January

2022 4,089 48,701 (6,047) 6,466 53,209

Profit for the period - - - 4,723 4,723

Foreign exchange translation

differences - - (2,833) - (2,833)

Total comprehensive (expense)

/ income for the period - - (2,833) 4,723 1,890

------------------------------ ------------- -------- ----------------------- ---------- -------------

Balance at 30 June 2022 4,089 48,701 (8,880) 11,189 55,099

============================== ============= ======== ======================= ========== =============

Balance at 1 January

2023 4,089 48,701 (8,522) 23,072 67,340

Profit for the period - - - 1,782 1,782

Foreign exchange translation

differences - - 625 - 625

Total comprehensive (expense)

/ income for the period - - 625 1,782 2,407

------------------------------ ------------- -------- ----------------------- ---------- -------------

Balance at 30 June 2023 4,089 48,701 (7,897) 24,854 69,747

============================== ============= ======== ======================= ========== =============

THE QUARTO GROUP, INC.

Condensed Consolidated Statement of Changes in Equity

For the year ended 31 December 2022

Equity

attributable

Paid in Translation Retained to owners

Share capital surplus reserve earnings of the parent

$000 $000 $000 $000 $000

Balance at 1 January

2022 4,089 48,701 (6,047) 6,466 53,209

Profit for the year - - - 16,606 16,606

Foreign exchange translation

differences - - (2,475) - (2,475)

Total comprehensive

(expense) / income

for the period - - (2,475) 16,606 14,131

----------------------------- ------------- -------- ----------------------- ---------- --------------

Balance at 31 December

2022 4,089 48,701 (8,522) 23,072 67,340

============================= ============= ======== ======================= ========== ==============

THE QUARTO GROUP, INC.

Condensed Consolidated Cash Flow Statement

For the six months ended 30 June 2023

Six months

to Six months Year ended

30 June to 31 December

2023 30 June 2022 2022

Unaudited Unaudited Audited

$'000 $'000 $'000

Profit for the period 1,782 4,723 16,606

Adjustments for:

Net finance costs 493 545 1,213

Depreciation of property, plant

and equipment 813 696 2,029

Software amortization - 50 50

Tax charge 797 1,904 4,279

Impairment of right-of-use assets - - 228

Amortization and amounts written

off pre-publication costs 8,558 10,176 19,935

Impairment of pre-publication costs (121) - (729)

Forgiveness of the Cares Act Loan - (2,272) (2,272)

(Gain) / loss on disposal of property,

plant & equipment (1) 58 3

Loss on disposal of SmartLab - - 1,498

Operating cash flows before movements

in working capital 12,321 15,880 42,840

Decrease/ (increase) in inventories 1,597 (5,253) (3,299)

Decrease / (increase) in receivables 8,523 10,664 8,594

(Decrease) / increase in payables (1,437) (10,279) (17,119)

--------------------------------------------- ---------- ------------- --------------------------

Cash generated by operations 21,004 11,012 31,016

Income taxes paid (1,315) (3,614) (7,561)

--------------------------------------------- ---------- ------------- --------------------------

Net cash from operating activities 19,689 7,398 23,455

Investing activities

Net proceeds from disposal of SmartLab

& property, plant & equipment - - 1,437

Net proceeds from disposal of property,

plant & equipment 1 - -

Investment in pre-publication costs (8,597) (8,997) (18,067)

Purchases of property, plant and

equipment (190) (35) (1,238)

Net cash used in investing activities (8,786) (9,032) (17,868)

Financing activities

Interest payments (281) (182) (397)

Lease payments (696) (837) (1,708)

External loans repaid (9,658) (17,629) (19,693)

External loans drawn - - 1,500

Net cash used in financing activities (10,635) (18,648) (20,298)

Net increase / (decrease) in cash

and cash equivalents 268 (20,282) (14,711)

Cash and cash equivalents at beginning

of period 13,290 28,432 28,432

Foreign currency exchange differences

on cash and cash equivalents (94) (44) (431)

--------------------------------------------- ---------- ------------- --------------------------

Cash and cash equivalents at end

of period 13,464 8,106 13,290

============================================= ========== ============= ==========================

THE QUARTO GROUP, INC.

Notes to the condensed financial statements

1. Interim Statement

These interim consolidated financial statements are for the half

year to 30 June 2023. They were approved by the board on 30 August

2023. These results are unaudited and have not been reviewed by the

Group's auditor. The comparative figures for the six months to 30

June 2022 were unaudited and derived from the interim financial

statements for that period.

The information for the year ended 31 December 2022 does not

constitute statutory accounts as defined in section 434 of the

Companies Act 2006. A copy of the statutory accounts for that year

has been delivered to the Registrar of Companies. The auditor's

report on those accounts was not qualified, did not include a

reference to any matters to which the auditor drew attention by way

of emphasis without qualifying the report and did not contain

statements under section 498 (2) or (3) of the Companies Act

2006.

Basis of preparation

These interim financial statements have been prepared in

accordance with the Disclosure and Transparency Rules of the

Financial Conduct Authority and with IAS 34, "Interim Financial

Reporting".

The Group's forecast and projections, taking account of

reasonably possible changes in trading performance, show that the

Group will be able to operate well within the level of its current

banking facilities. The Directors have therefore adopted a going

concern basis in preparing the Interim Information.

2. Accounting policies

The accounting policies, significant judgements and key sources

of estimation adopted in the preparation of this Interim Report are

consistent with those applied by the Group in its consolidated

financial statements for the year ended 31 December 2022.

THE QUARTO GROUP, INC.

Notes to the condensed financial statement

3. Segmental analysis

Six months to 30 June 2023 US Publishing UK Publishing Total

$000 $000 $000

Revenue 26,545 25,496 52,041

================ ================ ========

Segment result 1,264 2,427 3,691

Unallocated corporate expenses (619)

Exceptional items -

--------

Operating profit 3,072

Finance costs (493)

--------

Profit before tax 2,579

Taxation (797)

--------

Profit after tax 1,782

========

Six months to 30 June 2022 US Publishing UK Publishing Total

$000 $000 $000

Revenue 34,650 27,258 61,908

============== ============== ========

Segment result 4,096 3,115 7,211

Unallocated corporate expenses (530)

Exceptional items 491

Operating profit 7,172

Finance costs (545)

--------

Profit before tax 6,627

Taxation (1,904)

--------

Profit after tax 4,723

========

Year ended 31 December 2022 US Publishing UK Publishing Total

$000 $000 $000

Revenue 75,329 65,688 141,017

============== ============== ========

Segment result 10,608 11,875 22,483

Unallocated corporate expenses (1,159)

Corporate exceptional items 774

--------

Operating profit 22,098

Finance costs (1,213)

--------

Profit before tax 20,885

Taxation (4,279)

--------

Profit after tax 16,606

========

THE QUARTO GROUP, INC.

Notes to the condensed financial statements

3. Segmental analysis (continued)

Geographical revenue

The Group generates its revenue in the

following geographical areas:

Six months Six months Year ended

to to 31 December

30 June 2023 30 June 2022

Unaudited 2022 Audited

$'000 Unaudited $'000

$'000

United States 29,336 39,712 85,397

United Kingdom 7,512 6,556 17,052

Europe 8,352 7,616 23,099

Rest of the World 6,841 8,024 15,469

Total 52,041 61,908 141,017

========================= =============== =========== =============

4. Exceptional Items

Six months Six months

to to Year ended

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

$'000 $'000 $'000

Exceptional items comprised:

Impairment costs on remeasurement of

Disposal Group (see note 8) - (1,781) -

Smartlab Disposal - - (1,498)

Forgiveness of Cares Act Loan - 2,272 2,272

Total - 491 774

====================================== ============ =========== =============

5. Taxation

Taxation for the six months to 30 June 2023 is based on the

Group estimated underlying tax rate for the year.

THE QUARTO GROUP, INC.

Notes to the condensed financial statements

6. Earnings per share

Six months

to Six months Year ended

30 June to 31 December

2023 30 June 2022 2022

Unaudited Unaudited Audited

$'000 $'000 $'000

From continuing operations

Profit for the purposes of basic and

diluted earnings per share, being net

profit attributable to owners of the

parent 1,782 4,723 16,606

Exceptional items (net of tax) - (369) (1,160)

-------------------------------------------- ---------- ------------- ------------

Earnings for the purposes of adjusted

earnings per share 1,782 4,354 15,446

============================================ ========== ============= ============

Number Number Number

Weighted average number of shares 40,889,000 40,889,000 40,889,100

Dilutive outstanding options awards - - -

-------------------------------------------- ---------- ------------- ------------

Diluted weighted average number of shares 40,889,000 40,889,000 40,899,100

============================================ ========== ============= ============

Earnings per share (cents) Cents Cents Cents

From continuing operations

Basic 4.4 11.5 40.6

Diluted 4.4 11.5 40.6

Adjusted basic 4.4 10.6 37.8

Adjusted diluted 4.4 10.6 37.8

7. Net cash

30 June 31 December

30 June 2023 2022 2022

Unaudited Unaudited Audited

$'000 $'000 $'000

Net cash / (debt) comprised:

Cash and cash equivalents 13,464 8,106 13,290

Short term borrowings (4,362) (3,116) (4,636)

Medium and long-term borrowings - (10,596) (9,301)

--------------------------------- -------------

Net cash / (debt) 9,102 (5,606) (647)

================================= ============= =========== ============

At 30 June 2023, the Group has a $12.7m club facility,

comprising a term loan, revolving credit facility and overdraft.

These facilities expire on 16 July 2024 and are subject to

covenants, which were all met in the current period.

THE QUARTO GROUP, INC.

Notes to the condensed financial statements

8. Disposal group held for sale

Assets and liabilities of disposal group held for sale

30 June 31 December

30 June 2023 2022 2022

Unaudited Unaudited Audited

$'000 $'000 $'000

Non-current assets - 16 -

Current assets - 2,344 -

--------------------- -------------

Assets held for Sale - 2,360 -

===================== ============= =========== ============

Non-current assets held for sale are Pre-publication costs.

9. Principal risks and uncertainties facing the Group

There have been no changes to the principal risks and

uncertainties facing the Group since the year-end. These are

disclosed on pages 17 to 19 of the 2022 Annual Report.

10. Financial instruments

There are no material differences between the fair value of

financial instruments and their carrying value.

11. Management Statement

This Interim Management Report (IMR) has been prepared solely to

provide additional information to shareholders to assess the

Group's strategies and the potential for those strategies to

succeed. The IMR should not be relied on by any other party or for

any other purpose.

The IMR contains certain forward-looking statements. These

statements are made by the directors in good faith based on the

information available to them up to the time of their approval of

this report but such statements should be treated with caution due

to the inherent uncertainties, including both economic and business

risk factors, underlying any such forward-looking information.

12. Responsibility statement

We confirm that to the best of our knowledge:

a) the condensed set of financial statements, which has been

prepared in accordance with IAS 34 "Interim Financial Reporting",

gives a true and fair view of the assets, liabilities, financial

position and profit or loss of the issuer, or the undertakings

included in the consolidation as a whole as required by DTR

4.2.4R;

b) the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

c) the interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related party

transactions and changes therein).

By the order of the board

Alison Goff Andrew Cumming

Chief Executive Officer Chairman

30 August 2023 30 August 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SDWSASEDSEIA

(END) Dow Jones Newswires

August 30, 2023 05:00 ET (09:00 GMT)

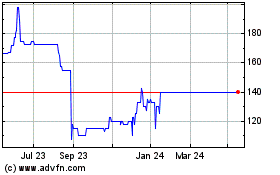

Quarto (LSE:QRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

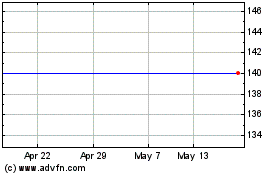

Quarto (LSE:QRT)

Historical Stock Chart

From Apr 2023 to Apr 2024