TIDMPRSR

RNS Number : 6665F

PRS REIT PLC (The)

23 March 2022

23 March 2022

PRSR.L

The PRS REIT plc

("PRS REIT" or "the REIT" or "the Company" or "the Group")

Interim Results

for the six months ended 31 December 2021

Strong asset performance and portfolio now at over 4,560

completed homes

KEY POINTS

Financial

Six months ended

Six months ended 31 December

31 December 2021 2020 Change

-------------------------- ------------------ ----------------- -------

Revenue GBP19.9m GBP10.7m +86%

Net rental income GBP16.4m GBP8.4m +95%

Operating profit GBP44.0m GBP24.7m +78%

Profit after tax GBP38.6m GBP20.3m +90%

Basic earnings per share 7.4p 4.1p +80%

At At

31 December 2021 30 Jun 2021 Change

------------------------ ------------------ ------------- -------

Net assets* GBP572.9m GBP490.3m +17%

IFRS and EPRA NTA* per

share 104.3p 99.0p +5%

------------------------ ------------------ ------------- -------

*after dividend payments

Operational

Portfolio delivery At At At

31 Dec 2021 30 Jun 2021 31 Dec 2020

--------------------------------- ------------- ------------- -------------

No. of completed homes 4,489 3,984 3,163

Estimated rental value ("ERV") GBP43.5m GBP37.5m GBP29.4m

per annum

--------------------------------- ------------- ------------- -------------

No. of contracted homes 949 1,071 1,963

ERV per annum GBP8.2m GBP10.6m GBP19.4m

Completed and contracted

sites 67 64 65

ERV per annum GBP51.7m GBP48.1m GBP48.8m

--------------------------------- ------------- ------------- -------------

No. of completed and contracted

homes 5,438 5,055 5,126

--------------------------------- ------------- ------------- -------------

Portfolio performance At At

31 Dec 2021 31 Dec 2020

------------------------------------------------ ------------- -------------

Average gross yields on cost of completed

assets 6.4% 6.2%

------------------------------------------------ ------------- -------------

Average capital uplift on cost of completed

assets to investment value 15.1% 9.7%

------------------------------------------------ ------------- -------------

Average capital uplift on cost of completed

assets to vacant possession value 21.8% 17.4%

Cost management of Gross to Net 17.6% 21.3%

Rent collection (rent collected in H1 relative

to rent invoiced in H1) 99% 100%

------------------------------------------------ ------------- -------------

Like-for-like rental growth (based on average

rent per unit for stabilised sites) 3.2% 0.5%

------------------------------------------------ ------------- -------------

Average yield on assets in the portfolio 4.2% 4.3%

------------------------------------------------ ------------- -------------

-- Strong performance from completed assets

- continued high demand for homes, with 99% of homes occupied or reserved

- extremely strong rent collection relative to rent invoiced at

99%, with arrears remaining at c. 1% of annualised ERV despite a

significant increase in rent roll

- net rental income up 95% to GBP16.4m (2020: GBP8.4m)

- like-for-like rental growth for H1 was 2.4%

-- Bloomberg cumulative total return from IPO to 31 December 2021 of 27.7p

-- Portfolio target has increased to c.5,700 homes with an ERV

of c.GBP55m per annum following a c.GBP55.6m equity placing in

September 2021

- proceeds of placing fully committed by December 2021

-- Continued progress in delivery, against challenges of

coronavirus and supply chain disruption

- 505 new homes added in H1, taking portfolio to 4,489 completed

homes, with an ERV of GBP43.5m p.a., and a further 949 homes under

way

- three development sites and one fully-completed and let site acquired in H1

- two additional development sites expected to be acquired in H2

-- Total dividends per share declared in H1, 2.0p (2020: 2.0p)

- minimum dividend target of 4.0p* per share for the financial year

Outlook

-- As at 11 March 2022, an additional 72 homes have been added

to the portfolio, taking it to 4,561 completed homes, with an ERV

of GBP44.8m p.a, and a further 877 were under way

-- Rental demand remains very strong, underpinned by nationwide

undersupply of quality rental housing for families, and will

support prospects for further rental growth

-- As the portfolio approaches stabilisation and the benefits of

scale are realised, the outlook for the PRS REIT remains very

positive as a first mover in an attractive market segment

Steve Smith, Non-Executive Chairman of The PRS REIT plc,

said:

"The PRS REIT's portfolio of built-to-rent family homes is the

largest of its kind in the UK and continues to perform extremely

well. Demand for our high-quality homes has remained strong,

evidenced in our occupancy levels and reservations.

"We are delivering our target gross yield on completed assets

and seeing very good capital appreciation on both completed assets

and newly-constructed vacant assets.

"We remain focused on completing the delivery of our portfolio

of contracted homes. Our target has risen to around 5,700

built-to-rent homes, generating an estimated rental income

approaching GBP55m a year, following a fundraising in

September.

"We are confident that the Company is on track to achieve market

expectations for the year, and continue to see significant

opportunity in this highly attractive market segment. The PRS

REIT's first mover status means it is well-positioned for further

progress."

*These are targets only and not a forecast. There can be no

assurance that these targets will be met and they should not be

taken as an indication of the Company's expected future results

.

For further information, please contact:

The PRS REIT plc Tel: 020 3178 6378

Steve Smith, Non-executive Chairman (c/o KTZ Communications)

Sigma PRS Management Limited Tel: 0333 999 9926

Graham Barnet, Mike McGill

Singer Capital Markets Securities Limited Tel: 020 7496 3000

James Maxwell, Asha Chotai (Investment Banking)

Alan Geeves, James Waterlow, Sam Greatrex

(Markets)

Panmure Gordon (UK) Limited Tel: 020 7886 2500

Chloe Ponsonby (Corporate Broking), Alex Collins

(Corporate Finance)

David Hawkins, Tom Scrivens (Sales)

G10 Capital Limited (part of the IQEQ Group Tel: 020 7397 5450

as AIFM)

Paul Cowland

KTZ Communications Tel: 020 3178 6378

Katie Tzouliadis, Dan Mahoney

NOTES TO EDITORS

About The PRS REIT plc

www.theprsreit.com

The PRS REIT plc is a closed-ended real estate investment trust

established to invest in the Private Rented Sector ("PRS") and to

provide shareholders with an attractive level of income together

with the potential for capital and income growth. The Company is

investing over GBP1bn in a portfolio of high quality homes for

private rental across the regions, having raised a total of

GBP0.56bn (gross) through its Initial Public Offering, on 31 May

2017 and subsequent fundraisings in February 2018 and September

2021. The UK Government's Homes England has supported the Company

with direct investments. In March 2021, the Company transferred its

entire issued share capital to the premium listing segment of the

Official List of the FCA and to the London Stock Exchange's premium

segment of the Main Market. The Company has over 4,500 new rental

homes in its portfolio, which the Company believes is the largest

build-to-rent single family rental portfolio in the UK.

LEI: 21380037Q91HU97WZX58

About Sigma PRS Management Limited

Sigma PRS Management Limited is a wholly-owned subsidiary of

Sigma Capital Group Limited and is Investment Adviser to The PRS

REIT plc. It sources investments and operationally manages the

assets of The PRS REIT plc and advises the Alternative Investment

Fund Manager ("AIFM") and The PRS REIT plc on a day-to-day basis in

accordance with The PRS REIT plc's Investment Policy. The AIFM is

G10 Capital Limited. Sigma PRS Management Ltd is an appointed

representative of G10 Capital Limited, which is authorised and

regulated by the Financial Conduct Authority (FRN:648953).

About Sigma Capital Group Limited (formerly Sigma Capital Group

plc)

www.sigmacapital.co.uk

Sigma Capital Group Limited ("Sigma") is a PRS, residential

development, and urban regeneration specialist, with offices in

Edinburgh, Manchester and London, and is part of PineBridge

Investments, a private, global asset manager with $150bn in assets

under management as at December 2021.

Sigma's principal focus is on the delivery of large scale

housing schemes for the private rented sector. Sigma has a

well-established track record in assisting with property related

regeneration projects in the public sector, acting as a bridge

between the public and private sectors.

Sigma has created an unrivalled property platform, which sources

sites and brings together construction resource to develop them,

enabling Sigma to deliver an integrated solution to partners. As

well as sourcing sites and managing all stages of the planning and

development process, Sigma also manages the rental of completed

homes through its award winning rental brand 'Simple Life'. Sigma's

subsidiary, Sigma PRS Management Limited, is Investment Adviser to

The PRS REIT plc.

Chairman's Statement

Overview

I am pleased to present The PRS REIT plc's (the "Company" or

"PRS REIT") financial results and progress for the six months ended

31 December 2021.

Our portfolio of build-to-rent ("BTR") family homes continued to

increase. We believe that it is the largest of its kind in the UK,

with a delivery and management platform that remains unrivalled.

Our portfolio spans the major regions of England and central

Scotland, and at the period end, stood at 4,489 completed homes

with an additional 949 homes under way at that point. This is an

increase of 42% against the same point last year (31 December 2020:

3,163 completed homes) and a 13% increase since 30 June 2021 (30

June 2021: 3,984 completed homes). The value of our net assets at

31 December 2021 was GBP572.9 million, up by 20% year-on-year and

by 17% since 30 June 2021 (31 December 2020: GBP476.3 million and

30 June 2021: GBP490.3 million). This equates to a net asset value

("NAV") per share of 104.3p. The Bloomberg cumulative total return

from IPO to 31 December 2021 is 27.7p.

The most recent data at 11 March 2022 shows the portfolio at

4,561 completed homes, with a further 877 homes under way, at

varying stages of the construction process.

This is a significant achievement, and progress should be seen

against the background of the ongoing challenges arising out of the

coronavirus pandemic, which has caused labour and supply chain

disruption. Following our fundraising in September 2021, we raised

our target number of homes to 5,700. Once all these homes are

completed, the portfolio will provide an estimated annual rental

income approaching GBP55.0 million, and we expect to reach the

landmark of 5,000 completed homes towards the end of calendar

2022.

Our properties continued to rent very well. Occupancy at 31

December 2021 was at 98% (31 December 2020: 96%), and rent

collection (which is rent collected relative to rent invoiced in

the period) was very strong at 99% (2020: 99%). Total arrears

remained low, at GBP0.5 million at 31 December 2021, which is c.1%

of annualised ERV on completed units (H1 2021: GBP0.2 million on

3,163 completed units).

We also achieved rental growth with new tenant lettings. These

realised average like-for-like rental growth per unit on stabilised

sites of 3.2% over the year to 31 December 2021. Average

like-for-like rental growth per unit on stabilised sites over the

six months to 31 December 2021 was 2.4%. This reflects a period

prior to 31 December 2020 when rental increases were frozen for

existing tenants during the initial months of the pandemic. These

are strong performance figures.

Reflecting the growth of the portfolio, net rental income for

the six months to 31 December 2021 increased by 95% to GBP16.4

million compared with the same period in 2020 (H1 2020: GBP8.4

million). The ERV of the 4,489 homes in our portfolio at the period

end was GBP43.5 million per annum, up 48% (31 December 2020:

GBP29.4 million per annum). As at 11 March 2022 on 4,561 homes, ERV

increased to GBP44.8 million per annum.

The September equity placing raised gross proceeds of

approximately GBP55.6 million, which was used to acquire three

sites with planning permission for 383 new homes, with an ERV of

GBP3.6 million per annum. The aggregate gross development cost

("GDC") is GBP60.3 million. We plan to acquire two further sites by

the end of June 2022 using debt funding. These additional sites

should deliver approximately 160 new homes, with an ERV of c.GBP1.5

million per annum.

The Board continues to target a minimum total dividend of 4.0p

per ordinary share for the current financial year.

The Investment Adviser's report provides further commentary on

housing delivery, asset performance and our ESG activity over the

year.

Financial results

Revenue, which is derived entirely from rental income, increased

by 86% to GBP19.9 million against the same period last year (H1

2021: GBP10.7 million). This reflected growth in completed and let

homes. After non-recoverable property costs, the net rental income

for the period was GBP16.4 million, a 95% rise on the first half of

2020 (H1 2020: GBP8.4 million) ahead of the overall growth in

rental income.

Profit from operations rose by 78% to GBP44.0 million (H1 2021:

GBP24.7 million) after gains of GBP31.1 million from fair value

adjustments on investment property (H1 2021: GBP19.4 million) and

total expenses of GBP3.8 million (H1 2021: GBP3.1 million).

Profit before tax increased by 90% to GBP38.6 million (H1 2021:

GBP20.3 million), and basic earnings per share rose by 80% to 7.4p

(H1 2021: 4.1p). Of this, 1.4p represented recurring earnings per

share in line with the EPRA definition compared to 2.0p of

dividends, reflecting 70% dividend cover in the period.

Net assets stood at GBP572.9 million as at 31 December 2021, a

rise of 20% against the same point in 2020 (31 December 2020:

GBP476.3 million and 30 June 2021: GBP490.3 million). This equates

to a net asset value ("NAV") of 104.3p per share, on an

International Financial Reporting Standards ("IFRS") basis and the

European Public Real Estate Association ("EPRA") Net Tangible Asset

("NTA") basis (30 June 2021: IFRS and EPRA NTA both 99.0p).

Six months Six months Year

ended ended ended

31 December 31 December 30 June

NAV movement: 2021 2020 2021

Opening NAV 99.0p 95.1p 95.1p

------------- ------------- ---------

Valuation and development 5.9p 4.1p 8.8p

------------- ------------- ---------

Earnings 1.4p 0.0p 0.1p

------------- ------------- ---------

Dividends paid (2.0)p (3.0)p (5.0)p

------------- ------------- ---------

Closing NAV 104.3p 96.2p 99.0p

------------- ------------- ---------

The movement in the NAV position, from 99.0p to 104.3p between

30 June 2021 and 31 December 2021, is after total dividend payments

of 2.0p per share (GBP10.3 million). These dividend payments

related to the fourth quarter of the 2021 financial year and the

first quarter of 2022 financial year, and were paid in September

and December 2021, respectively.

Operating cash inflows continued to exceed operating outflows

and covered the Company's cost base.

Six months Six months Year

ended ended ended

31 December 31 December 30 June

2021 (unaudited) 2020 (unaudited) 2021 (audited)

IFRS EPS (pence per share) 7.4 4.1 8.9

------------------ ------------------ ----------------

EPRA EPS (pence per share) 1.4 0.2 1.0

------------------ ------------------ ----------------

As at As at As at

31 December 31 December 30 June

2021 (unaudited) 2020 (unaudited) 2021 (audited)

IFRS NAV (pence per share) 104.3 96.2 99.0

------------------ ------------------ ----------------

EPRA NTA (pence per share) 104.3 96.2 99.0

------------------ ------------------ ----------------

Dividends

Two dividend payments, each of 1.0p per ordinary share, were

made in the period, on 3 September and 3 December 2021. These

payments related to the last quarter of the 2020 financial year

ended 30 June and the first quarter of the current financial year.

A dividend of 1.0p per ordinary share relating to the second

quarter of the current financial year was paid on 11 February 2022

to shareholders on the register as at 28 January 2022. This brought

the total of dividends paid to date since the Company's inception

in May 2017 to 20.0p per share.

The Board expects to announce the payment of an interim dividend

for the third quarter of the current financial year in April.

The Board continues to target a minimum total dividend of 4.0p

per ordinary share for the current financial year. This minimum

target is expected to be almost fully covered by earnings on an

annualised run-rate basis by the end of the financial year, with

coverage continuing to grow during the financial year ending 30

June 2023 as construction, completions and lettings advance.

Debt Facilities

As at 31 December 2021, the Company had GBP450 million of

committed debt facilities available for utilisation. This comprises

GBP400 million of investment debt facilities and GBP50 million of

development debt facilities although a portion of the investment

debt facilities can also be utilised as development debt

facilities. Our lending partners are: Scottish Widows (GBP250

million); The Royal Bank of Scotland plc (GBP100 million); Lloyds

Banking Group plc (GBP50 million); and Barclays Bank PLC (GBP50

million). GBP25 million of the Lloyds Banking Group/ RBS facility

and the GBP50 million Barclays Bank PLC debt facility are available

to be drawn as development debt facilities, which enables a number

of sites to be developed simultaneously.

The debt facilities are subject to the maximum gearing ratio of

45% of gross asset value. Approximately GBP330 million of these

facilities have been drawn to date, with the remainder presently

forecast to be utilised over the next 12 months as we finish the

current phase of construction, completion and letting activity. The

long-term investment debt facilities of GBP400 million have an

average term of 11.7 years and an average weighted cost of 2.8%

once fully drawn.

Environmental, Social and Governance ( "ESG") Practices

The PRS REIT is a member of the UK Association of Investment

Companies and applies its Code of Corporate Governance to ensure

best practice in governance.

The Board is responsible for determining the Company's

investment objectives and policy, and has overall responsibility

for the Company's activities including the review of investment

activity and performance. The Board consists of five independent

non-executive directors, who together bring significant and

complementary experience in the management of listed funds, equity

capital markets, public policy, operations and finance in the

property and investment funds sectors.

The Board delegates the day-to-day management of the business,

including the management of ESG matters, to the Investment Adviser,

Sigma PRS Management Ltd ("Sigma PRS"), which is a subsidiary of

Sigma Capital Group Limited ("Sigma"), and a signatory and

participant of the United Nations Global Compact. Sigma Capital

Group Limited is part of PineBridge Investments, a private, global

asset manager with $150bn in assets under management as at December

2021.

Details of ESG policies and activities are contained separately

in the Investment Adviser's Report.

Outlook

The need for high-quality rental homes for families in the UK

remains acute while the supply of new homes continues to fall short

of both Government aspirations and aggregate and increasing demand.

The buy-to-let sector, which traditionally provided the bulk of the

rental stock in the UK is continuing to see private landlords leave

the market, and there have been 180,000 buy-to-let redemptions

since 2017. These factors are continuing to create upward pressure

on rental demand.

While we are mindful of the current inflationary environment,

which is creating a rise in the cost of living for the population,

demand for the Company's high-quality family rental homes remains

strong and we expect our assets continue to perform well. This is

in part a reflection of the affordable nature of our properties and

the fact that rising interest rates typically drive an expansion in

renting versus home ownership. It also reflects the rental

management model, created by Sigma PRS, which aims both to set a

higher standard of customer care in the private rented sector than

hitherto and to create communities that are attractive to renters

generally and families in particular.

These factors are driving performance, and the combination of

growing income, rental appreciation and asset value growth are

beginning to enhance returns to shareholders. As the Built-to-Rent

sector becomes more established and institutionally attractive, we

expect to make significant progress.

We continue to see significant opportunity in the market, and as

a first mover in an attractive market segment we believe that the

PRS REIT is well-positioned for further progress.

The Board is confident that the Company is on track to meet

market expectations for the financial year and to progress towards

covering the current annual dividend of 4.0p per share on an

annualised basis by the end of the 2022 financial year.

Finally, I would like to thank our investors, who have supported

us through our formative period, our customers, Sigma, our

housebuilder partners and all of our stakeholders who have helped

to create what is fast becoming an exciting investment opportunity

and the preeminent PRS investment vehicle for family homes.

Steve Smith

Chairman

22 March 2022

Investment adviser's report

Sigma PRS Management Ltd ("Sigma PRS"), the Investment Adviser

to the PRS REIT is pleased to report on the Company's progress for

the six months to 31 December 2021. Sigma PRS is a wholly-owned

subsidiary of Sigma Capital Group Limited ("Sigma"), which is part

of PineBridge Investments, a private global asset manager with over

$150bn in assets under management.

Investment objective and strategy

The Company is taking advantage of the substantial opportunity

in the private rented sector, and aims to provide investors with an

attractive level of income, together with the prospect of income

and capital growth. It is doing so by creating a large portfolio of

newly-constructed rental stock that meets existing demand in the UK

for well-located, high-quality, professionally -managed rental

homes.

The PRS REIT has delivered a large number of private rented

sector housing schemes, which are let under the 'Simple Life'

brand. It has created a geographically diverse portfolio of

properties that have easy access to the main road and rail

infrastructure and are close to large employment centres and local

amenities. Proximity to good quality primary education is of

particular importance, being a major attraction for families with

children. While the Company is focused on family houses, it has

also invested in some low-rise flats in appropriate locations where

a greater diversity of rental levels is required.

The PRS REIT has built and continues to build its portfolios in

two ways:

-- by acquiring undeveloped sites sourced by Sigma PRS. The

delivery is managed by Sigma PRS (or another member of the Sigma

Group as development manager), and the completed units are let

under the 'Simple Life' brand.

The PRS REIT aims to fund a minimum of two-thirds of the new

properties in this way. Pre-development risks are identified and

underwritten by Sigma and its partners, and sites will have an

appropriate certificate of title, detailed planning consent and a

fixed-price design and build contract with one of Sigma's

housebuilding partners prior to acquisition by the Company. During

the construction phase, many of the properties are pre-let and

subsequently occupied as they complete.

-- by acquiring completed PRS sites from the Sigma Group, or

from third parties. A pre-requisite is that these completed and

stabilised developments must accord with the PRS REIT's investment

objectives and satisfy both return and occupancy hurdles. The

Company may fund up to a maximum of one third of new properties in

this manner. To date, this route represents 17% of the Company's

portfolio.

Sigma has a well-established PRS delivery platform, which

sources and develops investment opportunities. The PRS REIT has

first right of refusal over sites within Sigma's platform assuming

they meet its investment criteria and it has available capital to

fund the opportunities.

The platform benefits from well-established relationships with

construction partners, including Countryside Partnerships PLC,

previously known as Countryside Properties PLC ("Countryside"),

Engie Regeneration Limited, Seddon Construction Limited,

Springfield Properties plc and Vistry Partnerships Limited, as well

as with local authorities and letting agencies. These relationships

enable Sigma to identify and source land, and deliver and manage

properties on behalf of the Company in the target geographies.

Homes England, an executive non-departmental public body sponsored

by the Ministry of Housing, Communities & Local Government, has

been extremely supportive of Sigma, with both parties sharing the

common goal of accelerating new housing delivery in England.

Delivery and pipeline

A total of 505 new homes were added to the PRS REIT's portfolio

in the first half of the current financial year. This took the

total number of completed homes in the Company's portfolio at 31

December 2021 to 4,489, a 42% increase year-on-year (31 December

2020: 3,163 homes). The homes have an estimated rental value

("ERV") of GBP43.5 million per annum (31 December 2020: GBP29.4

million per annum), a rise of 48%.

Purchases of investment property over the first half to 31

December 2021 totalled GBP48.0 million (H1 2020: GBP104.1 million).

The year-on-year reduction reflects the maturity of the portfolio

and the normal cycle of property development expenditure, where

expenditure is typically higher during the earlier months of

acquiring and developing a site, and reduces as homes complete

across a site.

The Company completed an equity placing in September 2021,

raising GBP55.6 million, which took its Company's gross funding to

GBP956 million (including debt), the major part of which has been

fully allocated.

During October 2021, part of the placing proceeds were used to

acquire a completed and let 16-unit site in Bury St Edmunds,

Suffolk and three development sites, in Derbyshire, Lancashire and

Perthshire. When completed, these sites will add 383 homes to the

portfolio.

The table below provides a summary of development activity, and

shows the cumulative number of PRS units that have been completed

since the launch of the Company on 31 May 2017 and the ERV of homes

under construction or completed.

At 30

At 31 December June At 31 December

2021 2021 2020

No. of completed PRS units 4,489 3,984 3,163

--------------- --------- ---------------

Rental income per annum GBP43.5m GBP37.5m GBP29.4m

--------------- --------- ---------------

No. of contracted homes 949 1,071 1,963

--------------- --------- ---------------

ERV per annum GBP8.2m GBP10.6m GBP19.4m

--------------- --------- ---------------

Total number of sites (completed

and contracted) 67 64 65

--------------- --------- ---------------

No. of completed and contracted

units 5,438 5,055 5,126

--------------- --------- ---------------

ERV per annum GBP51.7m GBP48.1m GBP48.8m

--------------- --------- ---------------

Geographic diversification

The number of sites in the Company's portfolio increased to 67

sites at 31 December 2021 (31 December 2020: 65). They span the

major regions of England and central Scotland.

Approximately 58% of homes in the portfolio, both completed and

under development, are located in the North West of England, with

the Midlands accounting for approximately 19%, and Yorkshire and

the North East together representing around 14%. Homes in the South

of England account for 7% of the portfolio, and the remaining 2% of

homes are situated in central Scotland, the Company having acquired

its first development site here in the period. The wide

geographical spread of homes has created a diverse customer base,

which helps to balance risk - particularly important given current

geopolitical and economic uncertainties.

As at 31 December 2021, 52 sites were completed and income

producing, with the remaining 15 sites still part-way through

development. Many of the partially-completed sites are already

producing rental income. This is because sites are developed in

such a way that tranches of completed homes can be released for

letting while construction continues, subject to health and safety

reviews. The approach enables development sites to become

income-generating relatively quickly.

Rental performance and key performance measures

The PRS REIT's homes remain in demand, and the portfolio

continues to perform very strongly as it grows.

Increased rental income and rental growth

Reflecting the increasing number of assets in the portfolio and

buoyant demand, annualised gross rental income as at 31 December

2021 was 48% higher at GBP43.5 million than a year ago, and 16%

higher than at 30 June 2021 (31 December 2020: GBP29.4 million and

30 June 2021: GBP37.5 million). Acquisitions of completed assets

during the period accelerated this rental income growth.

It is worth noting that rental growth was to some extent

restrained by our decision in March 2020, during the first national

lockdown, to freeze increases on existing tenancy renewals.

Like-for-like growth in the 12 month period was 3.2% on stabilised

sites, with just over 2% of this increase arising in the first half

of the current financial year.

High occupancy levels

Occupancy levels were at 98% in December 2021, and including

those prospective tenants who had passed referencing and paid their

deposits, this figure increases to 99%. An average of 45 new

applications were received each week over the period.

Strong rent collection

Rent collection remained strong at 99%; this ratio is measured

as rent invoiced in the period relative to rent received in the

same period (2021: 99%). Rent arrears continued to be low, at

GBP0.5m, which is approximately 1% of annualised ERV (2021: less

than 1%).

Cost base covered

The Company's cost base is covered, and operating cash inflows

have increased in the period as rental income from completed and

let homes has grown.

As previously advised, legislative change in the form of the

Tenant Fees Act 2020, which came into force on 1 June 2020, added

almost 1.5% of additional cost to the lettings process, and

contributed to an increase in overall running costs in the prior

year. However, this cost has reduced with the growth in the

portfolio triggering a revised letting agent fee structure that has

lowered total lettings costs by over 1.0%. Currently,

non-recoverable property costs are 17.6% of gross rent, reflecting

the lower lettings costs. All other costs are in line with

management's targets.

Bloomberg total return

The Bloomberg cumulative total return from IPO to 31 December

2021 is 27.7p.

Key performance measures and investment valuation of completed

assets

The table below summarises key performance measures on completed

assets:

31 Dec 31 Dec

2021 2020

Average gross yields on cost of completed assets 6.4% 6.2%

------- -------

Average capital uplift on cost of completed assets

to Investment Value 15.1% 9.7%

------- -------

Average capital uplift on cost of completed assets

to Vacant Possession Value 21.8% 17.4%

------- -------

Average yield on assets in the portfolio 4.2% 4.3%

------- -------

Cost management of Gross to Net 17.6% 21.3%

------- -------

Like-for-like rental growth 3.2% 0.5%

------- -------

Significant uplift in value of completed assets

The Investment Valuation completed in December 2021 showed an

average uplift in the value of completed assets over the costs of

delivery of 15.1%.

The average uplift in the value of completed assets on a vacant

possession basis against the cost of delivery was 21.8%.

Both of these uplifts provide significant headroom between cost

and value, underlining the benefits of the Investment Adviser's PRS

model.

Latest data on delivery and asset performance

Between 1 January and 11 March 2022, we delivered a further 72

rental homes with an ERV of approximately GBP0.83 million per

annum. This has taken the Company's portfolio of completed homes at

11 March 2022 to 4,561 homes, with an ERV of around GBP44.8 million

per annum. A further 877 homes were under way at that point.

Out of 4,561 completed homes, 4,477 homes were let as at 11

March 2022, which provides an annualised rental income of GBP43.9

million, and a further 42 homes were reserved to qualified

applicants with rent deposits paid at that date.

ESG Approach

The PRS REIT recognises that it is a long-term stakeholder in

the communities and neighbourhoods it creates, and takes this role

very seriously. It has delegated the day-to-day management of ESG

strategy to the Investment Adviser, Sigma PRS. Sigma PRS has also

assumed responsibility for how the Company's ESG priorities are

managed at both Company and asset level, and funds the PRS REIT's

social and charitable activities. Sigma PRS reports to the PRS

REIT's Board on ESG on a quarterly basis.

The Investment Adviser is a signatory of the United Nations

Global Compact ("UN Global Compact"), which is a voluntary

initiative designed to encourage business leaders to implement

universal sustainability principles and in particular the UN Global

Compact's Ten Principles. These are derived from the Universal

Declaration of Human Rights, the International Labour

Organisation's Declaration on Fundamental Principles and Rights at

Work, the Rio Declaration on Environment and Development, and the

United Nationals Convention Against Corruption.

The Company's 2021 ESG Report can be found on the Company's

website at, www.prsreit.com.

Processes and strategies

As an industry leader in the provision of private rental homes,

the PRS REIT is aware of its increased ESG responsibilities. Sigma

PRS therefore aims to work alongside forward-looking partners who

share the Company's goals and aspirations for reduced carbon

emissions. The Investment Adviser also recognises the need for

action in priority areas such as energy and water consumption,

non-fossil fuel heating provision, and biodiversity.

As Sigma PRS continues to develop the Company's ESG agenda and

strategy, the focus is on embedding best practice, monitoring

supply chain activity, and ensuring policies and activities comply

with the PRS REIT's commitment to the UN Global Compact.

Partnerships

Sigma PRS engages closely with all partners to deliver the PRS

REIT's ESG commitments. Shared priorities include, reducing carbon

emissions, measuring impact and gathering data, 'future-proofing'

assets, and supporting biodiversity. Sigma PRS is pleased to report

good progress in construction data gathering with Countryside and

its Sustainability Team, and carbon reduction planning with Vistry

Group and its Sustainability Team. Initiatives to reduce traffic

flow and site waste, and to recycle and to divert waste from

landfill remain areas of focus for all partners.

Maintenance Support

The Investment Adviser's repair and management app, FixFlo,

continues to provide both a highly convenient way for Simple Life

customers to report repair and maintenance problems and for

maintenance services to be provided efficiently, with the minimum

of physical contractor visits, which typically incur carbon

emissions.

Over the first half of the financial year:

-- Of 11,000 issues raised:

- 48% were resolved through system advice and self-fix, and

- 52% continued to maintenance to fix/ contractor instructed

Energy Performance data

The energy performance of the homes in the portfolio is well

above the Government's targeted levels for rental properties, with

84% of homes achieving an EPC rating in band B, 1% in band A and

15% rated in band C. The minimum rating band is E for rentals.

Charities

Sigma PRS continued to support chosen partner charities, and in

addition has broadened the number of charities with which it has

links. In particular, Sigma PRS has increased its focus on local

charities, consulting with residents and colleagues over where to

direct support.

An example of resident collaboration during the first half was

the '12 Days of Christmas' campaign. The campaign received over 70

charity nominations from residents, and 12 charities each received

GBP1,000.

Projects

In the first half, Sigma PRS organised a Wellbeing Roadshow in

conjunction with Clever Cogz Learning, which took mobile Escape

Rooms to eight schools and 26 communities across the country. The

idea was to promote wellness and well-being to children, as well as

teamwork, at a time when children's mental health has been the

subject of considerable debate arising out of pandemic-related

restrictions.

In December 2021, Sigma PRS launched an outward-bound course,

'Building for my Future', in partnership with The Outward Bound

Trust, an educational charity that aims to help young people to

defy limitations through learning and outdoor adventures. Sigma PRS

will be providing places for 12 young people, aged between 16 and

18, to develop life and leadership skills, confidence and

resilience.

Residents social events

As lockdown restrictions lifted, Sigma PRS was able to resume

'resident events' for the PRS REIT's communities. Over the summer,

these events include ice-cream vans visits to 47 sites, with over

3,000 ice creams consumed. In the autumn, evening pizza events were

organised for a number of locations and an extended entertainment

evening held at our Empyrean development, providing over 1,300

pizzas in total. At Christmas, Sigma PRS arranged for Father

Christmas, his elves and accompanying band, to visit 54 sites. The

Investment Adviser continues to place great importance on the value

of these events and other opportunities for residents to come

together and socialise.

In August 2021, Sigma PRS launched the 'My Simple Life' mobile

app. While the app provides an easily accessible hub for home

documents, manuals, statements, it is also designed to provide

residents with social and neighbourhood news as well as information

on special offers. Over 1,600 residents have currently registered

to use the app.

The activities of the Company in all aspects of Environment,

Social and Governance are set out in the ESG Report 2021, which can

be obtained from the Company's website at, www.prsreit.com.

Human Rights

The obligations under the Modern Slavery Act 2015 (the 'Act')

are not applicable to the Company given its size. However, to the

best of the Investment Adviser's and Company's knowledge, principal

suppliers and advisors comply with the provisions of the Act. The

Company operates a zero-tolerance approach to bribery, corruption

and fraud.

Health and Safety

In order to maintain high standards of health and safety for

those working on sites, monthly checks by independent project

monitoring surveyors are commissioned to ensure that all potential

risks have been identified and mitigated. These checks supplement

those undertaken by development partners. The data is reported to

the Board on a quarterly basis in the event of a nil return, and

immediately in the event of an incident. There were no reportable

incidents over the year.

Gender diversity

The PRS REIT plc has five Board Directors. The male-to-female

ratio of Directors in 2021 was 80: 20 (2020: 100: 0).

Governance

Appropriate and proportionate governance is essential to ensure

that risks are identified and managed, and that accountability,

responsibility, fairness and transparency are maintained at all

times.

The Group is subject to statutory reporting requirements and to

rules and responsibilities prescribed by the London Stock Exchange

and the Financial Conduct Authority. The Board has a balanced range

of complementary skills and experience, with independent

Non-executive Directors who provide oversight, and challenge

decisions and policies as appropriate. The Board believe in robust

and effective corporate governance and is committed to maintaining

high standards and applying the principles of best practice.

Summary

With the balance of the PRS REIT's gross funding effectively

fully committed, Sigma PRS remains wholly focused on the delivery

of homes currently under development. Based on current schedules,

we expect to deliver the portfolio's 5,000th home towards the end

of calendar 2022. Fixed price design and build contracts provide

protection against raw material price inflation on current

contracted development, and therefore we expect the portfolio to

lag current inflation impacts.

Since January 2022, the start of the third financial quarter, a

further 72 new homes have been completed, taking the portfolio to

4,561 completed homes as at 11 March 2022, with a further 877 homes

under way. The ERV of the portfolio at that date is expected to be

GBP44.8m per annum.

Demand remains strong, and occupancy and reservation levels are

high. Between 1 January and 11 March 2022, the percentage of

occupied homes stood at 98%. Including applicants who have paid

deposits and passed our qualification process, the let portfolio

increases to 99%. Rent collection in the period was very strong at

99%, with arrears low. These figures continue to demonstrate not

only the attraction of our homes and our high standards of customer

care but the ongoing structural undersupply of quality family

rental homes. We expect rising interest rates to boost demand for

rental homes as mortgage affordability pressures increase,

especially for first-time buyers.

Looking ahead to the remainder of the financial year and beyond,

we remain confident that the PRS REIT is in a strong position to

achieve market expectations.

The Board will consider the payment of an interim dividend in

respect of the three months to 31 March 2022 in the fourth quarter

of the current financial year. It continues to target* a minimum

total dividend for the current financial year of 4p per ordinary

share.

The 4p dividend is expected to be almost fully covered by

earnings on an annualised basis by the end of the 2022 financial

year, with coverage continuing to grow thereafter as construction,

completions, lettings and asset management advance.

The global backdrop since the inception of PRS REIT has been

extraordinarily turbulent, so let us hope that the remainder of

2022 and beyond will bring greater stability.

Sigma PRS Management Ltd

22 March 2022

*These are targets only and not forecasts. There can be no

assurance that these targets will be met and they should not be

taken as an indication of the Company's expected future results

.

DEFINITIONS

The following terms shall have the meanings specified below:

"Average capital uplift on completed assets to investment value"

means the difference between investment value and gross development

cost divided by gross development cost.

"Average capital uplift on completed assets to vacant possession

value" means the difference between vacant possession value and

gross development cost divided by gross development cost.

"Average gross yields on cost of completed assets" means current

expected rental value divided by gross development cost.

"Committed" means development sites that have been approved or

are under formal appraisal by the Investment Adviser, and where

planning consent is being sought, and/or are in the process of

being acquired.

"Contracted" means sites under construction (under a design and

build contract), which have been purchased by the PRS REIT or the

PRS REIT's Investment Adviser (forward sold to the PRS REIT).

"EPRA NTA" means net asset value adjusted to include properties

and other investment interests at fair value and to exclude certain

items not expected to crystallise in a long term property business

model.

"EPS" means unadjusted earnings per share.

"EPRA EPS" means earnings per share excluding investment

property revaluations, gains and losses on disposals, changes in

the fair value of financial instruments and associated close out

costs and their related taxation.

"IFRS NAV" means unadjusted net asset value.

CONDENSED CONSOLIDATED Statement of COMPREHENSIVE INCOME

For the six months ended 31 December 2021

Six months Six months Year ended

ended ended 30 June

31 December 31 December

2021 2020 2021

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Rental income 19,865 10,676 26,636

Non-recoverable property costs (3,493) (2,278) (5,186)

------------- ------------- -----------

Net rental income 16,372 8,398 21,450

Other income 295 - 353

Administrative expenses

Directors' remuneration (83) (70) (148)

Investment advisory fee (2,485) (2,143) (4,362)

Other administrative expenses (1,235) (891) (2,028)

Migration to Main Market expenses - - (543)

------------- ------------- -----------

Total expenses (3,803) (3,104) (7,081)

Gain from fair value adjustment

on investment property 4 31,100 19,371 38,983

------------- ------------- -----------

Operating profit 43,964 24,665 53,705

Finance costs (5,414) (4,411) (9,592)

------------- ------------- -----------

Profit before taxation 38,550 20,254 44,113

Taxation - - -

------------- ------------- -----------

Total comprehensive income for the

period / year attributable to the

equity holders of the Company 38,550 20,254 44,113

============= ============= ===========

Earnings per share attributable

to the equity holders of the Company:

Basic earnings per share 7 7.4P 4.1p 8.9p

EPRA earnings per share 7 1.4P 0.2p 1.0p

All of the Group activities are classed as continuing and there

were no comprehensive gains or losses in the period other than

those included in the statement of comprehensive income.

CONDENSED CONSOLIDATED Statement of financial position

As at 31 December 2021

Notes As at

As at 30 June

As at 31

December 31 December

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Investment property 4 859,485 700,591 780,366

------------- ------------- -----------

859,485 700,591 780,366

------------- ------------- -----------

Current assets

Trade receivables 513 189 457

Other receivables 8,592 5,095 6,132

Cash and cash equivalents 48,633 128,897 86,414

------------- ------------- -----------

57,738 134,181 93,003

------------- ------------- -----------

Total assets 917,223 834,772 873,369

------------- ------------- -----------

LIABILITIES

Non-current liabilities

Accruals and deferred income 3,501 7,291 4,732

Interest bearing loans and borrowings 278,214 331,197 245,860

------------- -------------

281,715 338,488 250,592

Current liabilities

Trade and other payables 18,741 19,967 22,477

Interest bearing loans and borrowings 43,884 - 110,030

------------- ------------- -----------

62,625 19,967 132,507

Total liabilities 344,340 358,455 383,099

------------- ------------- -----------

Net assets 572,883 476,317 490,270

============= ============= ===========

EQUITY

Called up share capital 5 5,493 4,953 4,953

Share premium reserve 6 298,974 245,005 245,005

Capital reduction reserve 151,539 171,890 161,984

Retained earnings 116,877 54,469 78,328

------------- ------------- -----------

Total equity attributable to

the equity holders of the Company 572,883 476,317 490,270

============= ============= ===========

Net asset value per share 8 104.3p 96.2p 99.0p

As at 31 December 2021, there was no difference between NAV per

share and EPRA NTA per share.

condensed Consolidated statement of changes in equity

For the six months ended 31 December 2021

Share Capital

Share premium reduction Retained Total

capital reserve reserve earnings equity

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2020 4,953 245,005 186,748 34,215 470,921

Transactions with owners

Dividends paid 11 - - (14,858) - (14,858)

Comprehensive income

Profit for the period - - - 20,254 20,254

At 31 December 2020 4,953 245,005 171,890 54,469 476,317

--------- --------- ----------- ---------- ---------

Transactions with owners

Dividends paid - - (9,906) - (9,906)

Comprehensive income

Profit for the period - - - 23,859 23,859

At 30 June 2021 4,953 245,005 161,984 78,328 490,270

--------- --------- ----------- ---------- ---------

Transactions with owners

Issue of ordinary shares 540 53,969 - - 54,509

Dividends paid 11 - - (10,446) - (10,446)

Comprehensive income

Profit for the period - - - 38,550 38,550

--------- --------- ----------- ---------- ---------

At 31 December 2021 5,493 298,974 151,539 116,877 572,883

========= ========= =========== ========== =========

condensed CONSOLIDATED STATEMENT OF Cash Flows

For the six months ended 31 December 2021

Year

ended

Six months Six months

ended ended 30 June

31 December 31 December

2021 2020 2021

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit before tax 38,550 20,254 44,113

Finance costs 5,414 4,411 9,592

Fair value adjustment on investment

property 4 (31,100) (19,371) (38,983)

-----------

Cash generated from operations 12,864 5,294 14,722

Increase in trade and other

receivables (1,884) (1,630) (1,805)

(Decrease) / Increase in trade

and other payables (4,966) 3,259 3,295

Net cash generated from operating

activities 6,014 6,923 16,212

------------- ------------- -----------

Cash flows from investing activities

Purchase of investment property 4 (48,020) (104,101) (164,264)

Net cash used in investing activities (48,020) (104,101) (164,264)

------------- ------------- -----------

Cash flows from financing activities

Proceeds from issue of Ordinary - -

Shares 55,593

Cost of share issue (1,084) - -

Bank and other loans advanced 48,271 187,107 233,119

Bank and other loans repaid (82,789) - (22,134)

Finance costs (5,321) (5,478) (11,059)

Dividends paid (10,445) (14,858) (24,764)

------------- ------------- -----------

Net cash generated from financing

activities 4,225 166,771 175,162

------------- ------------- -----------

Net (decrease) / increase in

cash and cash equivalents (37,780) 69,593 27,110

Cash and cash equivalents at

beginning of period 86,414 59,304 59,304

------------- ------------- -----------

Cash and cash equivalents at

end of period 48,633 128,897 86,414

============= ============= ===========

Notes to the Financial Statements

1. General Information

The PRS REIT plc (the "Company") is a public limited company

incorporated on 24 February 2017 in England and having its

registered office at Floor 3, 1 St. Ann Street, Manchester, M2 7LR

with company number 10638461.

The Company is quoted on the Premium Segment of the Main Market

of the London Stock Exchange.

This interim condensed consolidated financial information was

approved and authorised for issue by the Board of Directors on 22

March 2022 .

2. Basis of Preparation and changes to the Group's accounting policies

Basis of preparation

The financial information for the period ended 31 December 2021,

does not constitute statutory accounts as defined in section 434 of

the Companies Act 2006. A copy of the statutory accounts for the

year ended 30 June 2021, has been delivered to the Registrar of

Companies. The auditors' report on those accounts was not

qualified, did not include a reference to matters to which the

auditor drew attention by way of emphasis without qualifying the

report, and did not contain statements under section 498(2) or (3)

of the Companies Act 2006.

The condensed consolidated interim financial report for the

half-year reporting period ended 31 December 2021, has been

prepared on a going concern basis using accounting policies

consistent with UK-adopted International Accounting Standards, in

accordance with IAS 34 Interim Financial Reporting. On 31 December

2020, EU-adopted IFRS was brought into UK law and became UK-adopted

international accounting standards, with future changes to IFRS

being subject to endorsement by the UK Endorsement Board. The Group

transitioned to UK-adopted International Accounting Standards in

its consolidated financial statements on 1 July 2021. This change

constitutes a change in accounting framework however, there is no

impact on recognition, measurement or disclosure. The current

period financial information presented in this document has not

been reviewed or audited.

The interim report does not include all of the notes of the type

normally included in an annual financial report. Accordingly, this

report is to be read in conjunction with the annual report for the

year ended 30 June 2021, which has been prepared in accordance with

both International Accounting Standards, in conformity with the

requirements of the Companies Act 2006, and IFRSs adopted pursuant

to Regulation (EC) No 1606/2002 as it applies in the European

Union, and any public announcements made by the Group during the

interim reporting period. The Group's annual consolidated financial

statements are available on the Company's' website,

www.theprsreit.com.

Adoption of new and revised standards

The accounting policies adopted in the preparation of the

interim condensed consolidated financial statements are consistent

with those followed in the preparation of the Group's annual

consolidated financial statements for the year ended 30 June 2021,

except for the adoption of new standards effective as of 1 July

2021.

The Group has considered amendments to standards endorsed by the

UK Endorsement Board effective for the current accounting period

and determined that these do not have a material impact on the

consolidated financial statements of the Group in the period ended

31 December 2021. These amendments are as follows: References to

Conceptual Framework in IFRSs (amended); IFRS 16 (amended) -

Covid-19 related Rent Concessions; IFRS 9, IAS 39, IFRS 7, IFRS 4

and IFRS 16 (amended) - Interest Rate Benchmark Reform - Phase

2.

A number of new standards and amendments to standards and

interpretations have been issued but are not yet effective for the

current accounting period. None of these are expected to have a

material impact on the consolidated financial statements of the

Group.

The new standards and amendments are as follows:

IFRS 17 - Insurance Contracts; IAS 1 (amended) - Classification

of liabilities as current or non-current; IAS 1 and IFRS Practice

Statement 2 (amended) - Disclosure of Accounting Policy; IAS 8

(amended) - Definition of Accounting Estimate; and

IAS 12 (amended) - exception to the Initial Recognition

Exemption.

Critical judgements in applying the Group's accounting

policies

In the process of applying the Group's accounting policies, the

Directors have made the following judgements which have the most

significant effect on the amounts recognised in the consolidated

financial statements.

i. Fair value of investment property

The fair value of any property, including investment property

under construction is determined by an independent property

valuation expert to be the estimated amount for which a property

should exchange on the date of the valuation in an arm's length

transaction. The valuation experts use recognised valuation

techniques applying principles of both IAS40 and IFRS13.

The key assumptions that are used in the fair value assessment

of completed assets are estimated rental value, net investment

yield and gross to net deductions. The key assumptions that are

used in the fair value assessment of assets under construction are

investment value on completion and, gross development costs, taking

into account construction costs spent and forecast costs to

completion.

The valuations are prepared in accordance with the Royal

Institution of Chartered Surveyors ("RICS") Valuation - Global

Standards (incorporating the IVSC International Valuation

Standards) effective from 31 January 2020 together, where

applicable, with the UK National Supplement effective 14 January

2019, together the "Red Book".

ii. Acquisition of subsidiaries - as a group of assets and liabilities

During the period, the Group acquired three property-owning

special purpose vehicles. The Directors considered whether these

acquisitions meet the definition of the acquisition of a business

or the acquisition of a group of assets and liabilities. Applying

the Concentration test, it was concluded that the acquisitions did

not meet the criteria for the acquisition of a business as outlined

in IFRS 3 as substantially all of the fair value of the gross asset

acquired was concentrated in a single identifiable asset.

The Directors have reviewed the fair value of the assets and

liabilities as at the date of the acquisitions which were as

follows:

Sigma PRS

Investments Sigma PRS Sigma PRS

(Bury St Investments Northern

Edmunds D) (Drakelow) (Bertha

Limited Limited Park) Limited

GBP'000 GBP'000 GBP'000

Investment properties acquired 4,565 6,751 4,775

Other receivables 12 1,276 -

Other payables (35) - -

Total consideration paid 4,542 8,027 4,775

============= ============= ===============

-- Investment property is measured at fair value as at the date

of the acquisition of the subsidiary by an independent valuation

expert.

-- Other receivables are taken as being the value recorded in

the accounts of the Company acquired, being the best estimate of

the amounts actually recoverable.

-- Other payable balances are measured at the amounts actually payable.

3. Going concern

The interim condensed consolidated financial statements have

been prepared on a going concern basis. The Group's cash balances

at 31 December 2021, were GBP49 million of which GBP37 million was

readily available. The Group had debt borrowing as at 31 December

2021, of GBP326 million (gross of unamortised arrangement fees),

and has secured further facilities of GBP124 million. Capital

commitments outstanding as at 31 December 2021, were GBP63 million.

The Group's ERV as at 31 December 2021, was GBP43.5 million from

4,489 homes and has increased to GBP44.8 million from 4,561 homes

as at 11 March 2022. This has increased the Company's recurring

income and at this level is more than sufficient to cover monthly

cash costs and to support dividend payments, thereby maintaining

the Company's REIT status. The Company has monitored and performed

stress tests throughout the period since the Government imposed the

first national lockdown almost two years ago, and these have shown

the Group to be in a strong position throughout.

Therefore, the Directors believe the Group is well placed to

manage its business risks successfully. After making enquiries, the

Directors have a reasonable expectation that the Group will have

adequate resources to continue in operational existence for the

foreseeable future and for a period of at least 12 months from the

date of the approval of the Group's interim condensed consolidated

financial statements for the six months ended 31 December 2021. The

Board is therefore of the opinion that the going concern basis

adopted in the preparation of the interim condensed consolidated

financial statements for the six months ended 31 December 2021, is

appropriate.

4. Investment property

In accordance with International Accounting Standard, IAS 40

Investment Property, investment property has been independently

valued at fair value by Savills (UK) Limited, an accredited

external valuer with a recognised relevant professional

qualification and with recent experience in the locations and

categories of the investment properties being valued. The valuation

basis conforms to International Valuation Standards and is based on

market evidence of investment yields, expected gross to net income

rates and actual and expected rental values.

The valuations are the ultimate responsibility of the Directors.

Accordingly, the critical assumption used in establishing the

independent valuations are reviewed by the Board.

Completed Assets under

assets construction Total

GBP'000 GBP'000 GBP'000

As at 1 July 2020 231,302 345,817 577,119

Completed properties acquired

on acquisition of subsidiaries 31,606 - 31,606

Property additions - subsequent

expenditure - 72,495 72,495

Change in fair value 6,761 12,610 19,371

Transfers to completed assets 102,850 (102,850) -

---------- -------------- --------

As at 31 December 2020 372,519 328,072 700,591

Completed properties acquired

on acquisition of subsidiaries 10,669 - 10,669

Property additions - subsequent

expenditure - 49,494 49,494

Change in fair value 6,647 12,965 19,612

Transfers to completed assets 143,939 (143,939) -

---------- -------------- --------

As at 30 June 2021 533,774 246,592 780,366

Completed properties acquired

on acquisition of subsidiaries 4,565 - 4,565

Property additions - subsequent

expenditure - 43,454 43,454

Change in fair value 17,349 13,751 31,100

Transfers to completed assets 111,935 (111,935) -

---------- -------------- --------

As at 31 December 2021 667,623 191,862 859,485

========== ============== ========

The historic cost of completed assets and assets under

construction as at 31 December 2021 was GBP751.2 million (30 June

2021: GBP704.2 million).

Fair values

IFRS 13 sets out a three-tier hierarchy for financial assets and

liabilities valued at fair value. These are as follows:

Level 1 quoted prices (unadjusted) in active markets for identical assets and liabilities;

Level 2 inputs other than quoted prices included in Level 1 that

are observable for the asset or liability, either directly or

indirectly; and

Level 3 unobservable inputs for the asset or liability.

Investment property falls within Level 3. The investment

valuations provided by the external valuation expert are based on

RICS Professional Valuation Standards, but include a number of

unobservable inputs and other valuation assumptions. The

significant unobservable inputs and the range of values used

are:

Completed assets:

Type Range

Investment yield 4.00% - 4.50%

(net)

Gross to net assumption 22.50% - 25.00%

5. Share capital

No. of Shares Share Capital

GBP'000

Balance as at 31 December 2020 495,277,294 4,953

============== ==============

Balance as at 30 June 2021 495,277,294 4,953

============== ==============

Issue of shares 53,974,164 540

Balance as at 31 December 2021 549,251,458 5,493

============== ==============

In September 2021 the Company undertook an equity raise. On 4

October 2021,a total of 53,974,164 shares were issued at an issue

price of 103.0p.

6. Share premium reserve

The share premium relates to amounts subscribed for share

capital in excess of nominal value.

2020

GBP'000

Balance as at 31 December 2020 245,005

========

Balance as at 30 June 2021 245,005

========

Share premium on the issue of Ordinary

Shares 55,053

Share issue costs (1,084)

Balance as at 31 December 2021 298,974

========

7. Earnings per share

Earnings per share ("EPS") amounts are calculated by dividing

profit for the period attributable to ordinary equity holders of

the Company by the weighted average number of Ordinary Shares in

issue during the period. As there are no dilutive instruments, only

basic earnings per share is quoted below.

The calculation of basic and diluted earnings per share is based

on the following:

31 December 31 December 30 June

2021 2020 2021

GBP'000 GBP'000 GBP'000

Earnings per IFRS income statement 38,550 20,254 44,113

Adjustments to calculate EPRA

Earnings:

Changes in value of investment

properties (31,100) (19,371) (38,983)

------------ ------------- ------------

EPRA Earnings: 7,450 883 5,130

============ ============= ============

Company specific adjustments:

Non-recurring costs incurred

by the Company as part of the

Migration to the Premium Segment

of the Main Market - - 543

------------ ------------- ------------

Company Adjusted Earnings 7,450 883 5,673

============ ============= ============

Weighted average number of ordinary

shares 521,374,692 495,277,294 495,277,294

IFRS EPS (pence) 7.4 4.1 8.9

EPRA EPS (pence) 1.4 0.2 1.0

Company specific Adjusted EPS

(pence) - - 1.2

8. Net Asset Value per share

The Group adopted the EPRA issued new best practice guidelines

in the year ending 30 June 2021. EPRA Net Tangible Assets ("NTA"),

is considered to be the most relevant measure for the Group and

replaces the previously reported EPRA NAV. The underlying

assumption behind the EPRA NTA calculation assumes entities buy and

sell assets, thereby crystallising certain levels of deferred tax

liability. Due to the PRS REIT's tax status, deferred tax is not

applicable and therefore there is no difference between IFRS NAV

and EPRA NTA.

Basic IFRS NAV per share is calculated by dividing net assets in

the Statement of Financial Position attributable to ordinary equity

holders of the parent by the number of Ordinary Shares outstanding

at the end of the period. As there are no dilutive instruments,

only basic NAV per share is quoted below.

Net asset values have been calculated as follows:

As at As at As at

31 December 31 December 30 June

2021 2020 2021

IFRS Net assets (GBP'000) 572,883 476,317 490,270

EPRA adjustments to NTA (GBP'000) - - -

------------- ------------- ------------

EPRA NTA (GBP'000) 572,883 476,317 490,270

------------- ------------- ------------

Shares in issue at end of period 549,251,458 495,277,294 495,277,294

Basic IFRS NAV per share (pence) 104.3 96.2 99.0

============= ============= ============

EPRA NTA per share (pence) 104.3 96.2 99.0

============= ============= ============

The NTA per share calculated on an EPRA basis is the same as the

IFRS NAV per share all periods shown.

9. Capital commitments

The Group has entered into contracts with unrelated parties for

the construction of residential housing with a total value of

GBP671.4 million (30 June 2021: GBP663.8 million). As at 31

December 2021, GBP54.8 million (30 June 2021: GBP89.2 million) of

such commitments remained outstanding. The PRS REIT is also

committed to acquiring one completed and fully let development from

Sigma within the next 12 months for c.GBP9 million.

10. Transactions with Investment Adviser

On 31 March 2017, Sigma PRS Management Ltd ("Sigma PRS") was

appointed as the Investment Adviser ("IA") of the Company.

For the period from 1 July 2021 to 31 December 2021, fees of

GBP2.5 million (1 July 2020 to 31 December 2020: GBP2.1 million)

were incurred and payable to Sigma PRS in respect of investment

advisory services. At 31 December 2021, GBP0.5 million remained

unpaid (30 June 2021: GBP1.5 million).

For the period from 1 July 2021 to 31 December 2021, development

fees of GBP1.6 million (1 July 2020 to 31 December 2020: GBP2.8

million) were incurred and payable to Sigma PRS. At 31 December

2021, GBP0.2 million (30 June 2021: GBP0.3 million) remained

unpaid.

During the period from 1 July 2021 to 31 December 2021, the

Group acquired the following subsidiaries from Sigma Capital Group

Limited, the ultimate holding company of the IA:

Name of Entity Consideration

Sigma PRS Investments (Bury St Edmunds GBP4.5 million

D) Limited

--------------------------

Sigma PRS Northern (Bertha Park) Limited GBP4.8 million

--------------------------

Sigma PRS Northern (Drakelow) Limited GBP8.0 million

--------------------------

11. Dividends paid and proposed

Six months Six months Year

ended ended ended

31 December 31 December 30 June

2021 (unaudited) 2020 (unaudited) 2021 (audited)

GBP'000 GBP'000 GBP'000

Dividends on

ordinary shares

declared

and paid:

3 months to 31

March 2020: 1.0p

per share - 4,952 4,952

3 months to 30

June 2020: 1.0p

per share - 4,953 4,953

3 months to 30

September 2020:

1.0p per share - 4,953 4,953

3 months to 31

December 2020:

1.0p

per share - - 4,953

3 months to 31

March 2021: 1.0p

per share - 4,953

3 months to 30 4,953 - -

June 2021: 1.0p

per share

3 months to 30 5,493 - -

September 2021:

1.0p per share

10,446 14,858 24,764

============================ ============================ ===========================

Proposed

dividends on

ordinary

shares:

3 months to 31 - 4,953 -

December 2020:

1.0p

per share

3 months to 30

June 2021: 2.0p

per share - - 4,953

3 months to 31 5,493 - -

December 2021:

1.0p

per share

5,493 4,953 4,953

============================ ============================ ===========================

The proposed dividend was paid on 11 February 2022, to

shareholders on the register at 28 January 2022.

12. Post balance sheet events

Dividends

On 18 January 2022, the Company declared a dividend of 1.0p per

ordinary share in respect of the second quarter of the current

financial year. The dividend was paid on 11 February 2022, to

shareholders on the register as at 28 January 2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SELFWEEESEDD

(END) Dow Jones Newswires

March 23, 2022 03:00 ET (07:00 GMT)

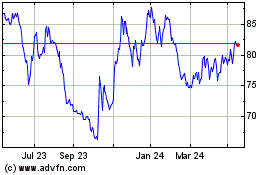

Prs Reit (LSE:PRSR)

Historical Stock Chart

From Mar 2024 to Apr 2024

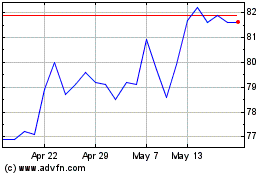

Prs Reit (LSE:PRSR)

Historical Stock Chart

From Apr 2023 to Apr 2024