TIDMOCN

RNS Number : 8507I

Ocean Wilsons Holdings Ltd

10 August 2023

2023 Interim Statement

About Ocean Wilsons Holdings Limited

Ocean Wilsons Holdings Limited ("Ocean Wilsons" or the

"Company") is a Bermuda investment holding company which, through

its subsidiaries, holds a portfolio of international investments

and operates a maritime services company in Brazil. The Company is

listed on both the London Stock Exchange and the Bermuda Stock

Exchange.

Principal Activities

The Company's principal activities are the management of a

diverse global investment portfolio and the provision of maritime

and logistics services in Brazil.

Ocean Wilsons has two operating subsidiaries: Ocean Wilsons

(Investments) Limited ("OWIL") and Wilson Sons S.A. ("Wilson Sons")

(together with the Company and their subsidiaries, the

"Group").

The Company owns 57% of Wilson Sons which is fully consolidated

in the financial statements with a 43% non-controlling interest.

Wilson Sons is one of the largest providers of maritime services in

Brazil with activities including towage, container terminals,

offshore oil and gas support services, small vessel construction,

logistics and ship agency.

Objective

The Company's objective is to focus on long-term value creation

through both the investment portfolio and the investment in Wilson

Sons. This longer-term view directs an OWIL investment strategy of

a balanced thematic portfolio of funds leveraging our long-standing

investment market relationships and through detailed insights and

analysis. The Wilson Sons' strategy focuses on providing best in

class or innovative solutions in a rapidly growing maritime

logistics market.

Data Highlights

KEY OPERATING DATA (in US$ millions)

6 months ended 6 months ended

30 June 2023 30 June 2022 Change

-------------------------------- --------------- --------------- -------

Revenue 229.7 211.0 +18.7

--------------- --------------- -------

Operating profit 54.7 54.7 -

--------------- --------------- -------

Investment portfolio net

return 11.2 (50.5) +61.7

--------------- --------------- -------

Profit/(loss) after tax 47.9 (20.4) +68.3

--------------- --------------- -------

Net cash inflow from operating

activities 44.3 24.7 +19.6

--------------- --------------- -------

KEY FINANCIAL POSITION DATA (in US$ millions)

At 30 June At 31 December

2023 2022 Change

----------------------------- ----------- --------------- -------

Investment portfolio assets 299.6 293.8 +5.8

----------- --------------- -------

Net assets 773.9 754.1 +19.8

----------- --------------- -------

Net debt 525.9 442.3 +83.6

----------- --------------- -------

SHARE DATA

6 months ended 6 months ended

30 June 2023 30 June 2022 Change

------------------------- --------------- --------------- -------------

Proposed/Actual dividend 70 cents 70 cents -

per share (USD)

--------------- --------------- -------------

Earnings per share (USD) 86.2 cents (98.0) cents +184.2 cents

--------------- --------------- -------------

At 30 June At 31 December

2023 2022 Change

----------------------------- ----------- --------------- -------

Share price discount to net

asset value 56.55% 50.5% +6.05%

----------- --------------- -------

Implied net asset value per

share* (GBP) 22.10 18.78 +3.32

----------- --------------- -------

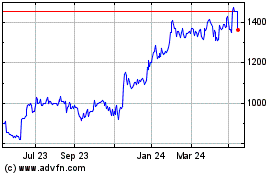

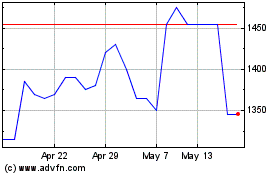

Share price (GBP) 9.60 9.30 +0.30

----------- --------------- -------

*net asset value per share of Ocean Wilsons based on the market

value of each operating subsidiary

Chair's Statement

Our financial result for the first half of 2023 has improved

substantially from the loss for the same period last year. This

result is a clear affirmation of both the robust business model at

Wilson Sons which is continuing to go from strength-to-strength

post Covid, and the longer-term balanced wealth creation strategy

of our investment portfolio.

Our financial assets portfolio delivered a $12.7 million

contribution to profit for the period, representing a gross overall

return of 4.5% and returning to a positive performance after the

challenging prior year comparative period which reported a loss of

$48.9 million. The diversified nature of the portfolio means that

when equity markets sharply rise, as they have done this period, it

is unlikely our performance will keep up but, similarly, when

markets fall our portfolio declines will be less correlated. During

the period our core regional funds have been the main driver of

returns, while in 2022 the portfolio's defensive and private equity

holdings were instrumental in mitigating the decline of global

markets. We strongly believe that this is key to delivering on our

strategy of long-term value creation and leads to the best outcome

for shareholders.

Our operating profit of US$54.7 million for the period is almost

entirely due to the performance of Wilson Sons and is identical to

the same metric in the prior year period. The result, however,

masks some offsetting trends where we saw revenue growth across the

major business lines of towage and container terminals and, most

notably, the offshore support bases which delivered an operating

profit for the first time. The overall 9% growth in revenues was

offset by higher operating costs, due almost entirely to the wage

and raw materials cost inflation continuing to bite across the

world in most sectors. It was very pleasing however to see that,

even with these inflationary costs, key operating margins and

profits were maintained. We believe this demonstrates both the

financial resilience of Wilson Sons, and the success of our

strategy of driving revenue growth, continuing to find operating

efficiencies and maintaining our focus on innovation and

sustainability. As well as our own operating performance, our

results are beginning to reflect the increasing stability in Brazil

demonstrated by both the relatively low level of inflation compared

to the more developed markets in the US and Europe, and the

appreciation of the BRL versus the USD.

The Board continues to recognise that there are divergent views

among our shareholders regarding our non-correlated asset holdings.

We announced on 12 June 2023 that the Board has instigated a

strategic review of the Company's investment in Wilson Sons. This

review is intended to provide a platform for us to optimise our

asset mix, enhance returns, and drive growth in the longer term. We

will communicate the findings of this review once completed and we

appreciate your patience during this period.

Our healthy financial results for this half-year illustrate our

solid business model and our capacity to deliver returns. We remain

focused on delivering strong performance from the whole business in

the belief that the market will eventually recognise the

attractiveness of our investment proposition and the level of

dividends we are able to consistently deliver.

Investment Manager's Report

Portfolio Review

The investment portfolio returned 4.5% over the first six months

of 2023. With equity markets performing strongly so far this year,

many of the portfolio's core regional exposures have performed well

with this investment silo gaining 9.9%. The thematic exposures saw

lower returns of 1.9% and the private equity segment of the

portfolio gained 1.3% over the last six months. Private markets

normally lag behind the public markets and some of our newer

private equity commitments have seen their valuations increase

notably.

Market Backdrop

The first half of 2023 was strong for global stock markets with

the MSCI ACWI + FM Index gaining 13.9%. Most developed markets

performed strongly with the US and Eurozone leading the way as the

biggest technology companies saw increased investor interest in

artificial intelligence boost their share prices in the US and some

large semiconductor companies seeing increases in their share

prices driving performance in the Eurozone. This came against a

backdrop of moderating inflation in the US and signs that the

economy may be more resilient than previously thought. Emerging

markets lagged, mainly due to China's COVID recovery being weaker

than expected. Government bond yields slightly declined since year

end in most markets with the Global Treasury Index up 0.6%. All

major central banks continued to raise interest rates but many

started to slow the pace.

Corporate bonds gained as recession fears eased with high yield

bonds outperforming their investment grade peers. Commodities

declined 7.8% driven by a fall in demand for both crude oil and gas

with industrial metals also performing poorly. Gold, however, was

up 5.2%, driven mainly by uncertainty in the banking sector early

in the year.

Outlook

We continue to execute our strategy of diversification and

balance at both the country, asset class and style level.

Specifically, bonds have increasingly returned to being a viable

asset class and the approach whereby "there is no alternative" to

equities is no longer the case. Similarly at the country level,

countries other than the US are increasingly attractive as they are

both cheaper in valuation and have improving investment stories in

many instances. Stylistically, value investing is again becoming

attractive having suffered years of underperformance as a low

duration asset class. Hence whilst this new backdrop might generate

returns that are somewhat lower than those generated by equity

markets over the past ten years, we still view them as being

attractive.

Cumulative Portfolio Returns

3 Years 5 Years

YTD 2022 p.a. p.a.

----------------------------- ----- ------ ------- -------

Gross return 4.5% -13.8% 7.2% 4.9%

----------------------------- ----- ------ ------- -------

Net return* 3.9% -14.7% 5.9% 3.7%

----------------------------- ----- ------ ------- -------

Performance Benchmark** 4.2% 9.5% 8.8% 6.9%

MSCI ACWI + FM NR US$ 13.9% -18.4% 11.0% 8.1%

----------------------------- ----- ------ ------- -------

Bloomberg Global Treasury TR

US$ (Unhedged) 0.6% -17.5% -6.3% -2.1%

----------------------------- ----- ------ ------- -------

MSCI Emerging Markets NR US$ 4.9% -20.1% 2.3% 0.9%

----------------------------- ----- ------ ------- -------

*Net of management fees and performance fees. No performance

fees were earned in 2023 and 2022.

** The OWIL Performance Benchmark is an absolute benchmark of US

CPI Urban Consumers NSA +3% p.a.

Investment Portfolio at 30 June 2023

Market

Value % of

US$000 NAV Primary Focus

------------------------------------------ -------- ------ --------------------------------

Findlay Park American Fund 27,754 9.3 US Equities - Long Only

BlackRock Strategic Equity Hedge

Fund 14,299 4.8 Europe Equities - Hedge

Select Equity Offshore, Ltd 11,270 3.8 US Equities - Long Only

BA Beutel Goodman US Value Fund 9,075 3.0 US Equities - Long Only

Private Assets - Latin

NG Capital Partners II, LP 7,272 2.4 America

iShares Core MSCI Europe UCITS Europe Equities - Long

ETF 6,493 2.2 Only

Global Equities - Long

Schroder ISF Global Recovery 6,204 2.1 Only

Pershing Square Holdings Ltd 6,152 2.0 US Equities - Long Only

Schroder ISF Asian Total Return Asia ex-Japan Equities

Fund 6,106 2.0 - Long Only

Pangaea II, LP 6,085 2.0 Private Assets - GEM

------------------------------------------ -------- ------ --------------------------------

Top 10 Holdings 100,710 33.6

------------------------------------------ -------- ------ --------------------------------

Stepstone Global Partners VI, Private Assets - US Venture

LP 5,709 1.9 Capital

Polar Capital Global Insurance Financials Equities -

Fund 5,394 1.8 Long Only

Hudson Bay International Fund

Ltd 5,385 1.8 Market Neutral - Multi-Strategy

Asia ex-Japan Equities

NTAsian Discovery Fund 5,380 1.8 - Long Only

Europe/US Equities -

Egerton Long - Short Fund Limited 5,331 1.8 Hedge

Armistice Capital Offshore Fund

Ltd 5,250 1.7 US Equities - Hedge

Private Assets - Global

Silver Lake Partners IV, LP 5,059 1.7 Technology

Navegar I, LP 5,046 1.7 Private Assets - Asia

iShares Core S&P 500 UCITS ETF 4,863 1.6 US Equities - Long Only

Japan Equities - Long

Indus Japan Long Only Fund 4,729 1.6 Only

------------------------------------------ -------- ------ --------------------------------

Top 20 Holdings 152,856 51.0

------------------------------------------ -------- ------ --------------------------------

Private Assets - North

KKR Americas XII, LP 4,609 1.5 America

GAM Star Fund PLC - Disruptive Technology Equities -

Growth 4,187 1.4 Long Only

Private Assets - Global

TA Associates XIII-A, LP 4,141 1.4 Growth

Baring Asia Private Equity Fund

VII, LP 4,018 1.3 Private Assets - Asia

Global Event Partners Ltd 3,691 1.2 Market Neutral - Event-Driven

Japan Equities - Long

Goodhart Partners: Hanjo Fund 3,559 1.2 Only

Reverence Capital Partners Opportunities

Fund II 3,502 1.2 Private Assets - Financials

Schroder GAIA BlueTrend 3,477 1.2 Market Neutral - Multi-Strategy

GAM Systematic Core Macro (Cayman)

Fund 3,440 1.2 Market Neutral - Multi-Strategy

Private Assets - Global

Silver Lake Partners V, LP 3,420 1.1 Technology

------------------------------------------ -------- ------ --------------------------------

Top 30 Holdings 190,900 63.7

------------------------------------------ -------- ------ --------------------------------

Remaining Holdings 108,686 36.3

------------------------------------------ -------- ------ --------------------------------

Cash and cash equivalents 61 0.02

------------------------------------------ -------- ------ --------------------------------

TOTAL 299,647 100.0

------------------------------------------ -------- ------ --------------------------------

Wilson Sons' Management Report

Wilson Sons' net revenues of US$229.7 million were 8.9% higher

than the six months of 2022 (US$211.0 million), mainly driven by

excellent towage results, container terminal operational growth and

a strong recovery in offshore energy-linked services.

Towage revenues rose 12.7% year-over-year with higher volume and

an increase in average revenue per manoeuvre and special

operations. In April, we added a new 91-tonne bollard pull tug to

our which fleet to serve large iron ore carriers and tankers. In

July, the company implemented a new tugboat fleet management system

developed in partnership with Argonáutica, a leading provider of

digital solutions for the maritime and port sectors, which will

allow us to continue seeking operational efficiencies, improving

margins and providing better services to customers.

Container terminal revenues increased 5.7% with volumes up 7.1%.

The Rio Grande terminal reported an 11.9% increase in overall

handling mainly due to higher empty, export, inland navigation,

import and transshipment flows. The Salvador terminal registered

flat volumes, as the increase in empty, cabotage and export flows

was offset by lower imports and transshipment. The completion of

the quay reinforcement in August 2023 will support improved service

offering in the Salvador terminal through the second half of the

year.

Demand for our offshore energy-linked services improved markedly

as vessel turnarounds in the offshore support bases increased 68.4%

and operating days in the offshore support vessel joint venture

rose 17.8% year-over-year.

Overall, the first-half performance demonstrates strong organic

growth. We remain positive on the fundamentals of our trade

flow-related businesses of towage and container terminals which,

together with rebounding demand for our offshore energy-linked

services, will provide the basis for a superior performance of our

assets. In addition to this positive market environment we are

confident our continued focus on security, growing utilisation rate

of assets, cost control and disciplined approach to capital

allocation will yield results for clients and other stakeholders of

the business.

Financial Report

Operating Profit

Operating profit remained unchanged from the 2022 comparative

period at US$54.7 million. Overall operating expenses increased

11.8%. Raw material expenses rose 18.2% mainly due to higher fuel

consumption and increased operational activity in the towage

division. Employee benefit expenses rose 9.0% mainly due to annual

inflation-linked adjustments to salary and benefits and payroll tax

provisions. Other operating expenses increased 13.4% principally

due to increased operating activity and inflation with higher

rental costs of tugs from third-party chartering in the towage

business, higher container handling costs and increased utilities

expenses.

The depreciation and amortisation expense at US$35.7 million was

US$4.0 million higher than the comparative period (2022: US$31.7

million) driven by the two new tugs in operation. Foreign currency

exchange gains of US$0.6 million (2022: US$2.0 million) arose from

the Group's foreign currency monetary items and reflect the

movement of the BRL against the USD during the period.

Revenue from Maritime Services

Revenue for the period increased by 8.9% compared to the first

half of the prior year to US$229.7 million (2022: US$211.0

million). Revenue growth was generated across all divisions, except

for logistics, with higher volume and a better revenue mix in the

towage division; higher revenues from handling and ancillary

services in the container terminal business; increased operational

activity in the offshore support base unit and increased

conversions and dry-docking for third parties in the shipyard

business. The logistics division saw a decline in revenues of 17.6%

reflecting the decline in volumes and rates at both the logistics

centre and international logistics businesses.

Operating volumes

(to 30 June) 2023 2022 % Change

----------------------- ------ ------ --------

Container Terminals

(container movements

in TEU '000s)* 490.5 458.1 7.1%

----------------------- ------ ------ --------

Towage (number

of harbour manoeuvres

performed) 27,079 26,746 1.2%

----------------------- ------ ------ --------

Offshore Vessels

(days in operation) 3,657 3,104 17.8%

----------------------- ------ ------ --------

*TEUs stands for "twenty-foot equivalent units".

Returns on the Investment Portfolio

The gain for the period on the investment portfolio of US$12.7

million (2022: loss of US$48.9 million) comprises unrealised gains

of US$10.5 million (2022: loss of US$72.1 million), net investment

income of US$0.7 million (2022: US$7.6 million) and realised

profits on disposal of US$1.5 million (2022: US$15.6 million).

Share of results of joint ventures and associates

The share of results of joint ventures and associates is Wilson

Sons' 50% share of the net results for the period from the offshore

support vessel joint ventures and 32.32% share of the net results

for the period from the associate Argonáutica. The net profit

attributable to Wilson Sons for the period was US$6.0 million

(2022: US$0.5million). Average operating days were up 7.2% with the

impact of contracts that were signed in 2022 becoming operational.

At the end of the period, the joint venture had 22 active vessels

(2022: 21 active vessels) of a total fleet of 25 OSVs including two

third-party vessels.

Exchange rates

The Group reports in USD and has revenue, costs, assets and

liabilities in both BRL and USD. In the six months to 30 June 2023

the BRL appreciated 7.7% against the USD from R$5.22 at 1 January

2023 to R$4.82 at the period end. In the comparative period in 2022

the BRL appreciated 5.9% against the USD from R$5.58 to R$5.25.

Profit/(Loss) before tax

Profit before tax was US$58.3 million compared with the prior

period loss of US$9.7 million. This significant increase is driven

by the US$12.7 million positive return of the investment portfolio

when compared to the US$48.9 million loss in the prior period as

well as the improved share of results of joint ventures and

associates from US$0.5 million to US$6.0 million.

Taxation

The corporate tax rate in Brazil is 34%. The Group recorded an

income tax expense for the period of US$10.4 million (2022: US$10.7

million). The principal items not included in determining taxable

profit in Brazil are foreign exchange gains/losses, share of

results of joint ventures and associates, and deferred tax items.

These are mainly deferred tax charges or credits arising on the

retranslation in USD of BRL denominated fixed assets, tax

depreciation, foreign exchange variance on borrowings, prior

periods accumulated tax losses, and profit on construction

contracts.

Profit/(Loss) for the period

After deducting the profit attributable to non-controlling

interests of US$17.4 million (2022: US$14.2 million), the profit

for the period attributable to equity holders of the Company is

US$30.5 million (2022: loss US$34.7 million). The earnings per

share for the period was US 86.2 cents (2022: US 98.0 cents

loss).

Investment portfolio performance

The investment portfolio and cash under management was US$5.9

million higher at US$299.7 million at 30 June 2023 (31 December

2022: US$293.8 million), after paying dividends of US$5.5 million

to the parent company and deducting management and other fees of

US$1.6 million.

Cash flow and debt

At 30 June 2023, the Group had cash and cash equivalents of

US$14.9 million (30 June 2022: US$12.8 million). Net cash inflow

from operating activities for the period was US$44.3 million (2022:

US$24.7 million). Purchase of trading investments, net of

disposals, were US$30.2 million (2022: net disposal of US$ 29.0

million). Dividends of US$24.8 million were paid to equity holders

of the Company in both periods with a further US$12.4 million paid

to non-controlling interests in our subsidiaries (2022: US$18.5

million). Group borrowings including lease liabilities at the

period end were US$540.7 million (31 December 2022: US$518.1

million). New loans of US$29.0 million were raised in the period

(2022: US$20.5 million) while capital repayments on existing loans

in the period of US$36.2 million were made (2022: US$24.3

million).

Balance sheet

Equity attributable to equity holders of the Company at the end

of the period was US$565.2 million compared with US$554.6 million

at 31 December 2022. The main movements in equity for the half year

was the profit for the period attributable to equity holders of the

Company of US$30.5 million, dividends paid of US$24.8 million and a

positive currency translation adjustment of US$5.3 million.

Other matters

Principal risks

The Board reported on the principal risks and uncertainties

faced by the Company in the Annual Report and Financial Statements

for the year ended 31 December 2022. A detailed description can be

found in the Report of Directors of the 2022 Annual Report and

Financial Statements which are available on the Company website at

www.oceanwilsons.bm.

The Board notes that there has been no substantive changes to

the risk assessment during the reporting period.

Related party transactions

Related party transactions during the period are set out in note

17.

Going concern

The Group closely monitors and manages its liquidity risk. The

Group has considerable financial resources including US$14.9

million in cash and cash equivalents and the majority of the

Group's borrowings have a long maturity profile. The Group's

business activities together with the factors likely to affect its

future development and performance are set out in the Chair's

statement together with the Investment Manager's report and the

Wilson Sons report. Details of the Group's borrowings are set out

in note 15 to the accounts. Based on the Group's year to date

results and cash forecasts, the Directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue in operation for the foreseeable future.

The Group manages its liquidity risk and does so in a manner

that reflects its structure and two distinct businesses.

OWIL

OWIL has no debt but has outstanding commitments of US$55.3

million in respect of investment subscriptions, for which details

are provided in note 7. The timing of these investment commitments

may be accelerated or delayed in comparison with those indicated in

note 7.

However, highly liquid investments held are significantly in

excess of the commitments. Neither Ocean Wilsons nor OWIL have made

any commitments or have obligations towards Wilson Sons and its

subsidiaries and their creditors or lenders. Therefore, in the

unlikely circumstance that Wilson Sons was to encounter financial

difficulty, the parent company and its investment subsidiary have

no obligations to provide support and have sufficient cash and

other liquid resources to continue as a going concern on a

standalone basis.

Wilson Sons

Wilson Sons has adequate cash, other liquid resources and

undrawn credit facilities to enable it to meet its obligations as

they fall due in order to continue its operations. All of the debt,

as set out in note 15, and all of the lease liabilities, as set out

in note 11, relate to Wilson Sons, and generally have a long

maturity profile. The debt held by Wilson Sons is subject to

covenant compliance tests as summarised in note 15, which were

satisfied at 30 June 2023.

Based on the Board's review of Wilson Sons' going concern

assessment and the liquidity and cash flow reviews of the Company

and its subsidiary OWIL, the Directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue in operational existence for the foreseeable future.

Accordingly, the Directors continue to adopt the going concern

basis in preparing the Interim report and accounts.

Responsibility statement

The Directors confirm that this interim financial information

has been prepared in accordance with IAS 34 and that the interim

management report includes a fair review of the information

required by DTR 4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the set of interim

financial statements and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

-- material related party transactions in the first six months

and any material changes in the related party transactions

described in the last Annual Report.

Caroline Foulger

Chair

9 August 2023

Interim Consolidated Financial Statements

Interim Consolidated Statement of Profit or Loss and Other

Comprehensive Income

(Unaudited) for the 6 months ended 30 June 2023

(Expressed in thousands of US Dollars)

Unaudited Unaudited

Note 30 June 2023 30 June 2022

------------------------------------------------------- ---- ------------------ -------------------

Sales of services 4 229,663 210,980

Raw materials and consumables used (17,749) (15,014)

Employee charges and benefits expense (67,592) (62,012)

Other operating expenses (56,380) (49,717)

Depreciation of owned assets 10 (27,665) (23,706)

Depreciation of right-of-use assets 11 (6,943) (6,805)

Amortisation of intangible assets 12 (1,047) (1,175)

Gain on disposal of property, plant and equipment

and intangible assets 1,716 88

Foreign exchange gains on monetary items 678 2,018

------------------------------------------------------- ---- ------------------ -------------------

Operating profit 54,681 54,657

Share of results of joint ventures and associates 9 6,045 529

Return on investment portfolio at fair value

through profit or loss 4 12,694 (48,899)

Investment portfolio management fees (1,477) (1,626)

Other investment income 4 4,423 3,693

Finance costs 5 (18,059) (18,070)

------------------------------------------------------- ---- -------------------

Profit/(loss) before tax 58,307 (9,716)

Tax expense 6 (10,442) (10,723)

------------------------------------------------------- ---- ------------------ -------------------

Profit/(loss) for the period 47,865 (20,439)

------------------------------------------------------- ---- ------------------ -------------------

Other comprehensive income:

Items that will be or may be reclassified subsequently

to profit or loss

Exchange differences arising on translation

of foreign operations 9,426 7,272

Effective portion of changes in fair value of

derivatives - 9

------------------------------------------------------- ---- ------------------ -------------------

Other comprehensive income for the period 9,426 7,281

------------------------------------------------------- ---- ------------------ -------------------

Total comprehensive income/(loss) for the period 57,291 (13,158)

------------------------------------------------------- ---- ------------------ -------------------

Profit/(loss) for the period attributable to:

Equity holders of the Company 30,492 (34,673)

Non-controlling interests 17,373 14,234

------------------------------------------------------- ---- ------------------ -------------------

47,865 (20,439)

------------------------------------------------------- ---- ------------------ -------------------

Total comprehensive income/(loss) for the period

attributable to:

Equity holders of the Company 35,813 (30,558)

Non-controlling interests 21,478 17,400

------------------------------------------------------- ---- ------------------ -------------------

57,291 (13,158)

------------------------------------------------------- ---- ------------------ -------------------

Earnings per share:

Basic and diluted 19 86.2c (98.0)c

------------------------------------------------------- ---- ------------------ -------------------

Interim Consolidated Statement of Financial Position

(Unaudited) at 30 June 2023

(Expressed in thousands of US Dollars)

Audited

Unaudited 31 December

Note 30 June 2023 2022

---------------------------------------------- ---- ------------------- -----------------

Current assets

Cash and cash equivalents 14,862 75,724

Financial assets at fair value through profit

and loss 7 317,181 275,080

Recoverable taxes 26,399 34,515

Trade and other receivables 8 81,042 67,136

Inventories 16,532 17,579

---------------------------------------------- ---- -----------------

456,016 470,034

---------------------------------------------- ---- ------------------- -----------------

Non-current assets

Other trade receivables 8 1,630 1,456

Related party loans receivable 17 13,789 11,176

Other non-current assets 16 3,499 3,506

Recoverable taxes 24,309 15,143

Investment in joint ventures and associates 9 92,805 81,863

Deferred tax assets 22,500 21,969

Property, plant and equipment 10 609,503 589,629

Right-of-use assets 11 193,587 178,699

Other intangible assets 12 13,986 14,392

Goodwill 13 13,608 13,420

---------------------------------------------- ---- -----------------

989,216 931,253

---------------------------------------------- ---- ------------------- -----------------

Total assets 1,445,232 1,401,287

---------------------------------------------- ---- ------------------- -----------------

Current liabilities

Trade and other payables 14 (64,196) (58,337)

Tax liabilities (9,619) (10,290)

Lease liabilities 11 (26,859) (24,728)

Bank loans 15 (51,625) (59,881)

---------------------------------------------- ---- -----------------

(152,299) (153,236)

---------------------------------------------- ---- ------------------- -----------------

Net current assets 303,717 316,798

---------------------------------------------- ---- ------------------- -----------------

Non-current liabilities

Bank loans 15 (272,666) (262,010)

Post-employment benefits (1,973) (1,737)

Deferred tax liabilities (46,446) (49,733)

Provisions for legal claims 16 (8,381) (8,997)

Lease liabilities 11 (189,597) (171,448)

---------------------------------------------- ---- -----------------

(519,063) (493,925)

---------------------------------------------- ---- ------------------- -----------------

Total liabilities (671,362) (647,161)

---------------------------------------------- ---- ------------------- -----------------

Capital and reserves

Share capital 11,390 11,390

Retained earnings 640,181 634,910

Translation and hedging reserve (86,372) (91,692)

---------------------------------------------- ---- ------------------- -----------------

Equity attributable to equity holders of

the Company 565,199 554,608

---------------------------------------------- ---- ------------------- -----------------

Non-controlling interests 208,671 199,518

---------------------------------------------- ---- ------------------- -----------------

Total equity 773,870 754,126

---------------------------------------------- ---- ------------------- -----------------

Signed on behalf of the Board

F. Beck A. Berzins

Director Director

Interim Consolidated Statement of Changes in Equity

(Unaudited) for the 6 months ended 30 June 2023

(Expressed in thousands of US Dollars)

Hedging and Attributable to

Retained Translation equity holders Non-controlling

Share capital earnings reserve of the Company interests Total equity

----------------- ------------- ---------------- ---------------- ---------------- ---------------- ------------

Balance at 1

January 2022 11,390 678,006 (95,739) 593,657 190,015 783,672

----------------- ------------- ---------------- ---------------- ---------------- ---------------- ------------

Currency

translation

adjustment - - 4,111 4,111 3,161 7,272

Effective portion

of changes in

fair value of

derivatives - - 5 5 4 9

(Loss)/profit for

the period - (34,673) - (34,673) 14,234 (20,439)

----------------- ------------- ---------------- ---------------- ---------------- ---------------- ------------

Total

comprehensive

(loss)/income

for the period - (34,673) 4,116 (30,557) 17,399 (13,158)

Dividends (note

18) - (24,754) - (24,754) (18,473) (43,227)

Equity

transactions in

subsidiary - 692 - 692 1,302 1,994

----------------- ------------- ---------------- ---------------- ---------------- ---------------- ------------

Balance at 30

June 2022 11,390 619,271 (91,623) 539,038 190,243 729,281

----------------- ------------- ---------------- ---------------- ---------------- ---------------- ------------

Balance at 1

January 2023 11,390 634,910 (91,692) 554,608 199,518 754,128

----------------- ------------- ---------------- ---------------- ---------------- ---------------- ------------

Currency

translation

adjustment - - 5,320 5,320 4,106 9,426

Profit for the

period - 30,492 - 30,492 17,373 47,865

----------------- ------------- ---------------- ---------------- ---------------- ---------------- ------------

Total

comprehensive

income for the

period - 30,492 5,320 35,812 21,479 57,291

Dividends (note

18) - (24,754) - (24,754) (12,394) (37,148)

Equity

transactions in

subsidiary - (467) - (467) 68 (399)

----------------- ------------- ---------------- ---------------- ---------------- ---------------- ------------

Balance at 30

June 2023 11,390 640,181 (86,372) 565,199 208,671 773,870

----------------- ------------- ---------------- ---------------- ---------------- ---------------- ------------

Hedging and translation reserve

The hedging and translation reserve arises from exchange

differences on the translation of operations with a functional

currency other than US Dollars and effective movements on

designated hedging relationships.

Equity transactions in subsidiary

Wilson Sons S.A. ("Wilson Sons"), a controlled subsidiary listed

on the Novo Mercado exchange, has in place a share option plan and

a share buyback plan. During the period ended 30 June 2023,

1,680,600 share options of Wilson Sons were exercised (2022:

2,808,840) and 1,150,500 shares of Wilson Sons were repurchased

(2022: 601,400), resulting in a net increase in non-controlling

interest of 0.06% (2022: increase of 0.28%).

Amounts in the statement of changes of equity are stated net of

tax where applicable.

Interim Consolidated Statement of Cash Flow

(Unaudited) for the 6 months ended 30 June 2023

(Expressed in thousands of US Dollars)

Unaudited Unaudited

Note 30 June 2023 30 June 2022

------------------------------------------------------------------------ -------- ------------- ----------------

Operating activities

Profit/(loss) for the period 47,865 (20,439)

Adjustment for:

Depreciation & amortisation 10,11,12 35,655 31,686

Gain on disposal of property, plant and equipment and intangible assets (1,716) (88)

Share of results of joint ventures and associates 9 (6,045) (529)

Returns on investment portfolio at fair value through profit or loss 7 (12,694) 48,899

Other investment income 4 (4,423) (3,693)

Finance costs 5 18,059 18,070

Foreign exchange gains on monetary items (678) (2,018)

Share based payment expense 152 173

Tax expense 6 10,442 10,723

Changes in:

Inventories 1,047 (3,547)

Trade and other receivables 8,17 (16,693) (14,004)

Other current and non-current assets (1,043) (4,629)

Trade and other payables 14 5,188 (10,678)

Provisions for legal claims 16 (616) 499

Taxes paid (13,681) (10,848)

Interest paid (16,495) (14,872)

Net cash inflow from operating activities 44,324 24,705

------------------------------------------------------------------------ -------- ------------- ----------------

Investing activities

Income received from trading investments 3,239 9,563

Purchase of trading investments (42,402) (59,418)

Proceeds on disposal of trading investments 12,249 88,448

Purchase of property, plant and equipment 10 (31,714) (27,513)

Proceeds on disposal of property, plant and equipment 1,852 270

Purchase of intangible assets 12 (290) (575)

Investment in joint ventures and associates 9 (4,986) (4,937)

Net cash (outflow)/inflow from investing activities (62,052) 5,838

------------------------------------------------------------------------ -------- ------------- ----------------

Financing activities

Dividends paid to equity holders of the Company 18 (24,754) (24,754)

Dividends paid to non-controlling interests in subsidiary (12,394) (18,473)

Repayments of borrowings 15 (36,218) (24,312)

Payments of lease liabilities 11 (4,927) (4,399)

New bank loans drawn down 15 29,024 20,476

Shares repurchased in subsidiary (2,338) (1,005)

Issue of new shares in subsidiary under employee share option plan 1,787 2,826

------------------------------------------------------------------------ -------- ------------- ----------------

Net cash used in financing activities (49,820) (49,641)

------------------------------------------------------------------------ -------- ------------- ----------------

Net decrease in cash and cash equivalents (67,548) (19,098)

------------------------------------------------------------------------ -------- ------------- ----------------

Cash and cash equivalents at the beginning of the period 75,724 28,565

------------------------------------------------------------------------ -------- ------------- ----------------

Effect of foreign exchange rate changes 6,686 3,294

------------------------------------------------------------------------ -------- ------------- ----------------

Cash and cash equivalents at the end of the period 14,862 12,761

------------------------------------------------------------------------ -------- ------------- ----------------

Notes to the Interim Consolidated Financial Statements

(Unaudited) for the 6 months ended 30 June 2023

(Expressed in thousands of US Dollars)

1 General Information

Ocean Wilsons Holdings Limited ("Ocean Wilsons" or the

"Company") is a Bermuda investment holding company which, through

its subsidiaries, operates a maritime services company in Brazil

and holds a portfolio of international investments. The Company is

incorporated in Bermuda under the Companies Act 1981 and the Ocean

Wilsons Holdings Limited Act, 1991. The Company's registered office

is Clarendon House, 2 Church Street, Hamilton, Bermuda. These

interim consolidated financial statements comprise the Company and

its subsidiaries (the "Group").

These interim consolidated financial statements were approved by

the Board on 9 August 2023.

2 Significant accounting policies

These interim consolidated financial statements have been

prepared in accordance with IAS 34 - Interim Financial Reporting

and follow the same accounting policies disclosed in the 31

December 2022 annual report. These interim consolidated financial

statements do not include all the information required in the

annual report and should be read in conjunction with the 31

December 2022 annual report.

3 Business and geographical segments

The Group has two reportable segments: maritime services and

investments. These segments report their financial and operational

data separately to the Board. The Board considers these segments

separately when making business and investment decisions. The

maritime services segment provides towage and ship agency, port

terminals, offshore, logistics and shipyard services in Brazil. The

investment segment holds a diverse global portfolio of

international investments with an investment strategy of a balanced

thematic portfolio of funds and is a Bermuda based company.

Brazil -

Maritime Services Bermuda - Investments Unallocated Consolidated

------------------------- ---------------------- ---------------------- ---------------------- -------------------

Result for the period

ended 30 June 2023

(unaudited)

Sale of services 229,663 - - 229,663

Net return on investment

portfolio at fair value

through profit or loss - 11,217 - 11,217

------------------------- ---------------------- ---------------------- ---------------------- -------------------

Profit/(loss) before tax 49,402 11,060 (2,155) 58,307

Tax expense (10,442) - - (10,442)

------------------------- ---------------------- ---------------------- ---------------------- -------------------

Profit/(loss) after tax 38,960 11,060 (2,155) 47,865

------------------------- ---------------------- ---------------------- ---------------------- -------------------

Financial position at 30

June 2023 (unaudited)

Segment assets 1,142,811 299,530 2,891 1,445,232

Segment liabilities (669,942) (762) (658) (671,362)

------------------------- ---------------------- ---------------------- ---------------------- -------------------

Brazil -

Maritime Services Bermuda - Investments Unallocated Consolidated

------------------------- ---------------------- ---------------------- ---------------------- -------------------

Result for the period

ended 30 June 2022

(unaudited)

Sale of services 210,980 - - 210,980

Net return on investment

portfolio at fair value

through profit or loss - (50,525) - (50,525)

------------------------- ---------------------- ---------------------- ---------------------- -------------------

Profit/(loss) before tax 43,047 (50,740) (2,023) (9,716)

Tax expense (10,723) - - (10,723)

------------------------- ---------------------- ---------------------- ---------------------- -------------------

Profit/(loss) after tax 32,324 (50,740) (2,023) (20,439)

------------------------- ---------------------- ---------------------- ---------------------- -------------------

Financial position at 31

December 2022 (audited)

Segment assets 1,098,393 293,717 9,177 1,401,287

Segment liabilities (646,339) (509) (313) (647,161)

------------------------- ---------------------- ---------------------- ---------------------- -------------------

4 Revenue

An analysis of the Group's revenue is as follows:

Unaudited Unaudited

30 June 2023 30 June 2022

----------------------------------------------------------------------------------- ------------- -------------

Sale of services 229,663 210,980

----------------------------------------------------------------------------------- ------------- -------------

Net income from underlying investment vehicles 746 7,596

Profit on disposal of financial assets at fair value through profit or loss 1,495 15,618

Unrealised gains/(losses) on financial assets at fair value through profit or loss 10,453 (68,036)

Write down of Russia-focused investments (note 7) - (4,077)

----------------------------------------------------------------------------------- ------------- -------------

Returns on investment portfolio at fair value through profit or loss 12,694 (48,899)

----------------------------------------------------------------------------------- ------------- -------------

Interest on bank deposits 2,058 1,720

Other interest 2,365 1,973

----------------------------------------------------------------------------------- ------------- -------------

Other investment income 4,423 3,693

----------------------------------------------------------------------------------- ------------- -------------

Total Revenue 246,780 165,774

----------------------------------------------------------------------------------- ------------- -------------

The Group derives its revenue from contracts with customers from

the sale of services in its Brazil - Maritime services segment. The

revenue from contracts with customers can be disaggregated as

follows:

Unaudited Unaudited

30 June 2023 30 June 2022

-------------------------------------------- ---------------- -------------

Harbour manoeuvres 102,935 94,462

Special operations 11,730 7,258

Ship agency 5,230 4,542

-------------------------------------------- ---------------- -------------

Towage and ship agency services 119,895 106,262

-------------------------------------------- ---------------- -------------

Container handling 39,852 36,250

Warehousing 19,194 21,107

Ancillary services 10,263 9,868

Offshore support bases 8,324 4,504

Other port terminal services 7,898 5,814

-------------------------------------------- ---------------- -------------

Port terminals 85,531 77,543

-------------------------------------------- ---------------- -------------

Logistics 19,946 24,210

-------------------------------------------- ---------------- -------------

Shipyard 3,803 2,965

-------------------------------------------- ---------------- -------------

Other services 488 -

-------------------------------------------- ---------------- -------------

Total Revenue from contracts with customers 229,663 210,980

-------------------------------------------- ---------------- -------------

Contract balance

Trade receivables are generally received within 30 days. The net

carrying amount of operational trade receivables at the end of the

reporting period was US$60.4 million (31 December 2022: US$54.5

million). These amounts include US$17.3 million (31 December 2022:

US$12.0 million) of contract assets (unbilled accounts

receivables). There were no contract liabilities as of 30 June 2023

(31 December 2022: none).

Performance obligations

Revenue is measured based on the consideration specified in a

contract with a customer. The Group recognises revenue when it

transfers control over a good or service to a customer, and the

payment is generally due within 30 days. The disaggregation of

revenue from contracts with customers based on the timing of

performance obligations is as follows:

Unaudited Unaudited

30 June 2023 30 June 2022

-------------------------------------------- ------------- -------------

At a point of time 225,860 208,015

Over time 3,803 2,965

Total Revenue from contracts with customers 229,663 210,980

-------------------------------------------- ------------- -------------

5 Finance costs

Finance costs are classified as follows:

Unaudited Unaudited

30 June 2023 30 June 2022

--------------------------------------------- ------------- -------------

Interest on lease liabilities (8,211) (7,843)

Interest on bank loans (9,079) (9,771)

Exchange loss on foreign currency borrowings (367) -

Other interest costs (402) (456)

--------------------------------------------- ------------- -------------

Finance costs (18,059) (18,070)

--------------------------------------------- ------------- -------------

6 Taxation

At the present time, no income, profit, capital or capital gains

taxes are levied in Bermuda and accordingly, no expenses or

provisions for such taxes has been recorded by the Group for its

Bermuda operations.

Tax expense

The reconciliation of the amounts recognised in profit or loss

is as follows:

Unaudited Unaudited

30 June 2023 30 June 2022

--------------------------------------------------------------- ------------- -------------

Current tax expense

Brazilian corporation tax (9,962) (7,999)

Brazilian social contribution (3,824) (3,859)

--------------------------------------------------------------- ------------- -------------

Total current tax expense (13,786) (11,858)

--------------------------------------------------------------- ------------- -------------

Deferred tax - origination and reversal of timing differences

Charge for the period in respect of deferred tax liabilities (7,961) (7,987)

Credit for the period in respect of deferred tax assets 11,305 9,122

--------------------------------------------------------------- ------------- -------------

Total deferred tax credit 3,344 1,135

--------------------------------------------------------------- ------------- -------------

Total tax expense (10,442) (10,723)

--------------------------------------------------------------- ------------- -------------

Brazilian corporation tax is calculated at 25% (2022: 25%) of

the taxable profit for the year. Brazilian social contribution tax

is calculated at 9% (2022: 9%) of the taxable profit for the

year.

7 Financial assets at fair value through profit or loss

The movement in financial assets at fair value through profit or

loss is as follows:

Unaudited Audited

30 June 2023 31 December 2022

------------------------------------------------------------------------------------ ------------- -----------------

Opening balance - 1 January 275,080 392,931

Additions, at cost 42,402 70,864

Disposals, at market value (12,249) (128,959)

Increase/(decrease) in fair value of financial assets at fair value through profit

or loss 10,453 (79,995)

Write down of Russia-focused investments(1) - (4,077)

Profit on disposal of financial assets at fair value through profit or loss 1,495 24,316

------------------------------------------------------------------------------------ ------------- -----------------

Closing balance 317,181 275,080

------------------------------------------------------------------------------------ ------------- -----------------

Bermuda - Investments segment 299,585 272,931

Brazil - Maritime services segment 17,596 2,149

------------------------------------------------------------------------------------ ------------- -----------------

(1) During the period ended 30 June 2022, the Company wrote down

the full value of its investment in Prosperity Quest Fund, a

Russia-focused equity fund held within the investments segment

portfolio, following the issue of an investor notice announcing the

suspension of its net asset valuation, subscriptions and

redemptions. At 30 June 2023, the suspension is still in effect and

the book value of the investment is nil.

Bermuda - Investments segment

The financial assets at fair value through profit or loss held

in this segment represent investments in listed equity securities,

funds and unquoted equities that present the Group with opportunity

for return through dividend income and capital appreciation.

At the end of the reporting period, the Group had entered into

commitment agreements with respect to the investment portfolio for

capital subscriptions. The classification of those commitments

based on their expiry date is as follows:

Unaudited Audited

30 June 2023 31 December 2022

-------------------------------------- -------------- -----------------

Within one year 9,295 5,951

In the second to fifth year inclusive 4,417 2,346

After five years 41,552 42,129

-------------------------------------- -------------- -----------------

Total 55,264 50,426

-------------------------------------- -------------- -----------------

Brazil - Maritime Services segment

The financial assets at fair value through profit or loss held

in this segment are held and managed separately from the Bermuda -

Investments segment portfolio and consist of depository notes, an

investment fund and an exchange fund both privately managed.

8 Trade and other receivables

Trade and other receivables are classified as follows:

Unaudited Audited

30 June 2023 31 December 2022

---------------------------------------------------------- ------------- -----------------

Non-current

Other trade receivables 1,630 1,456

---------------------------------------------------------- ------------- -----------------

Total other trade receivables 1,630 1,456

---------------------------------------------------------- ------------- -----------------

Current

Trade receivable for the sale of services 44,931 43,293

Unbilled trade receivables 17,265 12,036

---------------------------------------------------------- ------------- -----------------

Total gross current trade receivables 62,196 55,329

Allowance for expected credit loss (1,788) (792)

---------------------------------------------------------- ------------- -----------------

Total current trade receivables 60,408 54,537

---------------------------------------------------------- ------------- -----------------

Prepayments 11,580 4,887

Insurance claim receivable 2,940 981

Employee advances 3,232 1,449

Proceed receivable from disposal of financial instruments 61 2,181

Other receivables 2,821 3,101

---------------------------------------------------------- ------------- -----------------

Total other current receivables 20,634 12,599

---------------------------------------------------------- ------------- -----------------

Total trade and other receivables 81,042 67,136

---------------------------------------------------------- ------------- -----------------

The aging of the trade receivables is as follows:

Unaudited Audited

30 June 2023 31 December 2022

------------------------------ ------------- -----------------

Current 50,235 44,699

From 0 - 30 days 5,259 5,997

From 31 - 90 days 4,218 2,461

From 91 - 180 days 592 1,236

More than 180 days 1,892 936

------------------------------ ------------- -----------------

Total gross trade receivables 62,196 55,329

------------------------------ ------------- -----------------

The movement in allowance for expected credit loss is as

follows:

Unaudited Audited

30 June 2023 31 December 2022

--------------------------------------------------- ----------------- ------------------

Opening balance - 1 January (792) (338)

Increase in allowance recognised in profit or loss (879) (419)

Exchange differences (117) (35)

--------------------------------------------------- ----------------- ------------------

Closing balance (1,788) (792)

--------------------------------------------------- ----------------- ------------------

9 Joint ventures and associates

The Group holds the following significant interests in joint

ventures and associates at the end of the reporting period:

Proportion of ownership

----------------------------

Unaudited Unaudited

Place of incorporation and operation 30 June 2023 30 June 2022

------------------------------------------------- ------------------------------------- ------------- -------------

Joint ventures

Logistics

Porto Campinas, Logística e Intermodal

Ltda Brazil 50% 50%

Offshore

Wilson, Sons Ultratug Participações

S.A. Brazil 50% 50%

Atlantic Offshore S.A. Panamá 50% 50%

Associates

Argonáutica Engenharia e Pesquisas S.A. Brazil 32.32% -

------------------------------------------------- ------------------------------------- ------------- -------------

The aggregated Group's interests in joint ventures and

associates are equity accounted. The financial information of the

joint ventures and associates and reconciliations to the share of

result of joint ventures and associates and the investment in joint

ventures and associates recognised for the period are as

follows:

Unaudited Unaudited

30 June 2023 30 June 2022

-------------------------------------------------- -------------- -------------

Sales of services 106,209 77,097

Operating expenses (64,981) (39,143)

Depreciation and amortisation (25,363) (31,499)

Foreign exchange gains on monetary items 6,245 6,274

-------------------------------------------------- -------------- -------------

Results from operating activities 22,110 12,729

-------------------------------------------------- -------------- -------------

Finance income 725 2,409

Finance costs (5,533) (9,245)

Profit before tax 17,302 5,893

-------------------------------------------------- -------------- -------------

Tax expense (5,165) (4,835)

-------------------------------------------------- -------------- -------------

Profit for the period 12,137 1,058

-------------------------------------------------- -------------- -------------

Total profit for the period - joint ventures 12,004 1,058

Participation 50% 50%

Share of profit for the period for joint ventures 6,002 529

-------------------------------------------------- -------------- -------------

Total profit for the period - associates 133 -

Participation 32.32% -

Share of profit for the period for associates 43 -

-------------------------------------------------- -------------- -------------

Share of result of joint ventures and associates 6,045 529

-------------------------------------------------- -------------- -------------

Unaudited Audited

30 June 2023 31 December 2022

----------------------------------------------------------- ------------- -----------------

Cash and cash equivalents 17,439 5,747

Other current assets 56,171 51,260

Non-current assets 536,503 551,921

----------------------------------------------------------- ------------- -----------------

Total assets 610,113 608,928

----------------------------------------------------------- ------------- -----------------

Trade and other payables (25,283) (46,506)

Other current liabilities (54,304) (56,833)

Non-current liabilities (328,656) (324,012)

Total liabilities (408,243) (427,351)

----------------------------------------------------------- ------------- -----------------

Total net assets 201,870 181,577

----------------------------------------------------------- ------------- -----------------

Total net assets - joint ventures 200,738 180,079

Participation 50% 50%

Group's share of net assets - joint ventures 100,369 90,040

----------------------------------------------------------- ------------- -----------------

Total net assets - associates 1,132 1,498

Participation 32.32% 32.32%

Group's share of net assets - associates 366 484

----------------------------------------------------------- ------------- -----------------

Goodwill and surplus generated on associate purchase 1,607 1,711

Cumulative elimination of profit on construction contracts (9,537) (10,372)

----------------------------------------------------------- ------------- -----------------

Investment in joint ventures and associates 92,805 81,863

----------------------------------------------------------- ------------- -----------------

The movement in investment in joint ventures and associates is

as follows:

Unaudited Audited

30 June 2023 31 December 2022

------------------------------------------------------------------------- ------------- -----------------

Opening balance - 1 January 81,863 61,553

Share of result of joint ventures and associates 6,045 3,165

Capital increase 4,986 17,016

Elimination of profit on construction contracts (167) (158)

Purchase price adjustment and surplus amortisation on associate purchase (195) 159

Translation reserve 273 128

Closing balance 92,805 81,863

------------------------------------------------------------------------- ------------- -----------------

Change in capital

Guarantees

Wilson, Sons Ultratug Participações S.A. has loans with the

Brazilian Development Bank guaranteed by a lien on the financed

supply vessel and by a corporate guarantee from its participants,

proportionate to their ownership. The Group's subsidiary Wilson

Sons Holdings Brasil Ltda. is guaranteeing US$159.3 million (31

December 2022: US$163.7 million).

Wilson, Sons Ultratug Participações S.A. has a loan with Banco

do Brasil guaranteed by a pledge on the financed offshore support

vessels, a letter of credit issued by Banco de Crédito e

Inversiones and its long-term contracts with Petrobras. The joint

venture has to maintain a cash reserve account until full repayment

of the loan agreement amounting to US$1.7 million (31 December

2022: US$1.7 million) presented as long-term investment.

Covenants

On 30 June 2023 and 31 December 2022, Wilson Sons Ultratug

Participações S.A. was not in compliance with one of its covenants'

ratios with Banco do Brasil, resulting in a required increase in

capital within a year of US$5.0 million (31 December 2022: US$1.8

million). As the capital will be increased to that amount within a

year, management will not negotiate a waiver letter from Banco do

Brasil. There are no other capital commitments for the joint

ventures and associates as of 30 June 2023 (31 December 2022:

none).

10 Property, plant and equipment

Property, plant and equipment are classified as follows:

Land and Vehicles, plant Assets under

buildings Floating Craft and equipment construction Total

---------------------------------------- ---------- -------------- --------------- ------------- ----------

Cost

At 1 January 2022 274,683 541,252 198,464 9,581 1,023,980

Additions 10,835 15,493 9,936 27,004 63,268

Transfers (112) 24,623 (2,317) (22,194) -

Transfers to intangible assets - - (60) - (60)

Disposals (1,955) (4,477) (4,892) - (11,324)

Exchange differences 11,084 - 10,854 - 21,938

At 1 January 2023 294,535 576,891 211,985 14,391 1,097,802

Additions 6,060 5,879 7,030 12,745 31,714

Transfers (123) 11,823 (1,323) (10,377) -

Transfers from intangible assets 25 - 8 - 33

Disposals (506) (44) (939) - (1,489)

Exchange differences 15,085 - 14,445 - 29,530

---------------------------------------- ---------- -------------- --------------- ------------- ----------

At 30 June 2023 315,076 594,549 231,206 16,759 1,157,590

---------------------------------------- ---------- -------------- --------------- ------------- ----------

Accumulated depreciation

At 1 January 2022 82,651 264,836 113,438 - 460,925

Charge for the period 8,518 27,831 12,124 - 48,473

Elimination on construction contracts - 87 - - 87

Disposals (1,645) (4,426) (4,609) - (10,680)

Exchange differences 3,644 - 5,724 - 9,368

---------------------------------------- ---------- -------------- --------------- ------------- ----------

At 1 January 2023 93,168 288,328 126,677 - 508,173

Charge for the period 4,578 16,638 6,449 - 27,665

Disposals (403) (40) (908) - (1,351)

Exchange differences 5,280 - 8,320 - 13,600

At 30 June 2023 102,623 304,926 140,538 - 548,087

---------------------------------------- ---------- -------------- --------------- ------------- ----------

Carrying Amount

At 31 December 2022 (audited) 201,367 288,563 85,308 14,391 589,629

---------------------------------------- ---------- -------------- --------------- ------------- ----------

At 30 June 2023 (unaudited) 212,453 289,623 90,668 16,759 609,503

---------------------------------------- ---------- -------------- --------------- ------------- ----------

Land and buildings with a net book value of US$0.2 million (31

December 2022: US$0.2 million) and plant and equipment with a

carrying value of US$0.1 million (31 December 2022: US$0.1 million)

have been given in guarantee for various legal processes.

The Group has pledged assets with a carrying value of US$252.9

million (31 December 2022: US$230.2 million) to secure loans

granted to the Group.

The amount of borrowing costs capitalised in the period ending

30 June 2023 was US$0.1 million at an average interest rate of

5.4%. No borrowing costs were capitalised for the period ended 30

June 2022.

The Group has contractual commitments to suppliers for the

acquisition and construction of property, plant and equipment

amounting to US$19.6 million (31 December 2022: US$19.9

million).

11 Lease arrangements

Right-of-use assets

Right-of-use assets are classified as follows:

Operational Floating Vehicles, plant

facilities craft Buildings and equipment Total

------------------- ------------------ ----------------- ------------------ ------------------ ------------------

Cost

At 1 January 2022 167,118 13,077 5,388 8,846 194,429

Additions - 3,018 1,305 899 5,222

Contractual

amendments 17,901 5,793 63 117 23,874

Terminated

contracts - (2,796) (3,771) (58) (6,625)

Exchange

differences 10,313 510 96 328 11,247

------------------- ------------------ ----------------- ------------------ ------------------ ------------------

At 1 January 2023 195,332 19,602 3,081 10,132 228,147

Additions 8,648 - 82 (113) 8,617

Contractual

amendments 83 - 61 43 187

Terminated

contracts - - (326) (4) (330)

Exchange

differences 15,793 753 232 440 17,218

------------------ ----------------- ------------------ ------------------ ------------------

At 30 June 2023 219,856 20,355 3,130 10,498 253,839

------------------- ------------------ ----------------- ------------------ ------------------ ------------------

Accumulated

depreciation

At 1 January 2022 18,298 8,194 2,960 7,108 36,560

Charge for the

period 8,244 4,825 912 916 14,897

Terminated

contracts - (1,226) (2,424) (44) (3,694)

Exchange

differences 1,104 242 63 276 1,685

------------------- ------------------ ----------------- ------------------ ------------------ ------------------

At 1 January 2023 27,646 12,035 1,511 8,256 49,448

Charge for the

period 4,371 2,487 271 501 7,630

Terminated

contracts - - (290) (3) (293)

Exchange

differences 2,379 508 202 378 3467

At 30 June 2023 34,396 15,030 1,694 9,132 60,252

------------------- ------------------ ----------------- ------------------ ------------------ ------------------

Carrying Amount

At 31 December 2022

(audited) 167,686 7,567 1,570 1,876 178,699

------------------- ------------------ ----------------- ------------------ ------------------ ------------------

At 30 June 2023

(unaudited) 185,460 5,325 1,436 1,366 193,587

------------------- ------------------ ----------------- ------------------ ------------------ ------------------

Lease liabilities

Lease liabilities are classified as follows:

Average Unaudited Average Audited

discount rate 30 June 2023 discount rate 31 December 2022

------------------------------------ -------------- ------------- -------------- -----------------

Operational facilities 8.52% (207,004) 8.55% (184,591)

Floating craft 9.60% (5,723) 9.60% (7,605)

Buildings 11.10% (2,221) 9.75% (2,121)

Vehicles, plant and equipment 15.27% (1,509) 12.12% (1,859)

------------------------------------ -------------- ------------- -------------- -----------------

Total lease liabilities (216,457) (196,176)

------------------------------------ -------------- ------------- -------------- -----------------

Total current lease liabilities (26,859) (24,728)

Total non-current lease liabilities (189,597) (171,448)

------------------------------------ -------------- ------------- -------------- -----------------

The contractual undiscounted cash flows related to leases

liabilities are as follows:

Unaudited Audited

30 June 2023 31 December 2022

-------------------------------------- ------------- -----------------

Within one year (28,159) (25,958)

In the second year (24,043) (23,101)

In the third to fifth years inclusive (61,913) (56,682)

After five years (393,235) (355,360)

-------------------------------------- ------------- -----------------

Total cash flows (507,350) (461,101)

-------------------------------------- ------------- -----------------

Adjustment to present value 290,894 264,925

-------------------------------------- ------------- -----------------

Total lease liabilities (216,456) (196,176)

-------------------------------------- ------------- -----------------

12 Other intangible assets

Other intangible assets are classified as follows:

Concession-

Computer Software rights Total

----------------------------------------------- ----------------- --------------- --------------------

Cost

At 1 January 2022 40,968 15,501 56,469

Additions 1,386 - 1,386

Transfers from right-of-use 60 - 60

Disposals (1,105) - (1,105)

Exchange differences 560 277 837

----------------------------------------------- ----------------- --------------- --------------------

At 1 January 2023 41,869 15,778 57,647

Additions 290 - 290

Transfers from property, plant and equipment (33) - (33)

Disposals (28) - (28)

Exchange differences 775 381 1,156

At 30 June 2023 42,873 16,159 59,032

----------------------------------------------- ----------------- --------------- --------------------

Accumulated amortisation

At 1 January 2022 35,540 5,948 41,488

Charge for the period 1,965 424 2,389

Disposals (1,105) - (1,105)

Exchange differences 381 102 483

----------------------------------------------- ----------------- --------------- --------------------

At 1 January 2023 36,781 6,474 43,255

Charge for the period 834 213 1,047

Disposals (28) - (28)

Exchange differences 603 169 772

----------------------------------------------- ----------------- --------------- --------------------

At 30 June 2023 38,190 6,856 45,046

----------------------------------------------- ----------------- --------------- --------------------

Carrying amount

At 31 December 2022 (audited) 5,088 9,304 14,392

----------------------------------------------- ----------------- --------------- --------------------

At 30 June 2023 (unaudited) 4,683 9,303 13,986

----------------------------------------------- ----------------- --------------- --------------------

13 Goodwill

Goodwill is classified as follows:

Tecon Rio Grande Tecon Salvador Total

----------------------- ---------------- -------------- ------------

Carrying amount

At 1 January 2022 10,792 2,480 13,272

Exchange differences 148 - 148

----------------------- ---------------- -------------- ------------

At 1 January 2023 10,940 2,480 13,420

Exchange differences 188 - 188

----------------------- ---------------- -------------- ------------

At 30 June 2023 11,128 2,480 13,608

----------------------- ---------------- -------------- ------------

The goodwill associated with each cash-generating unit "CGU"

(Tecon Rio Grande and Tecon Salvador) is attributed to the Brazil -

Maritime Services segment.

14 Trade and other payables

Trade and other payables are classified as follows:

Unaudited Audited

30 June 2023 31 December 2022

--------------------------------- ------------- -----------------

Trade payables (28,779) (25,583)

Accruals (10,753) (8,550)

Other payables (193) (479)

Provisions for employee benefits (20,347) (21,365)

Deferred income (4,124) (2,360)

Total trade and other payables (64,196) (58,337)

--------------------------------- ------------- -----------------

15 Bank loans

The movement in bank loans is as follows:

Unaudited Audited

30 June 2023 31 December 2022

---------------------------- ------------- -----------------

Opening balance - 1 January (321,891) (301,599)

Additions (29,024) (59,793)

Principal amortisation 36,218 49,349

Interest amortisation 7,112 13,333

Accrued interest (9,229) (17,437)

Exchange difference (7,477) (5,744)

---------------------------- ------------- -----------------

Closing balance (324,291) (321,891)

---------------------------- ------------- -----------------

The breakdown of bank loans by maturity is as follows:

Unaudited Audited

30 June 2023 31 December 2022

---------------------------------------- ------------- -----------------------

Within one year (51,625) (59,881)

In the second year (70,822) (56,022)

In the third to fifth years (inclusive) (89,335) (91,037)

After five years (112,509) (114,951)

---------------------------------------- ------------- -----------------------