TIDMRBS

RNS Number : 5059W

Royal Bank of Scotland Group PLC

17 April 2019

Segmental Reporting Restatement

Document

April 2019

The Royal Bank of Scotland Group plc

Overview of business re-segmentation

This announcement sets out changes to RBS's operating segments

and consequent changes in results presentation. The announcement

contains re-presented financial results for the year ended 31

December 2018 and, is presented to aid comparison of RBS's quarter

ended 31 March 2019 results with prior periods. Re-presented

financial information for the quarters ended 31 December 2018 and

31 March 2018 are included.

Segmental reorganisation

RBS continues to deliver on its plan to build a strong, simple

and fair bank for both customers and shareholders. To support this,

the following previously reported operating segments are now

realigned, with comparatives re-presented:

-- Effective from 1 January 2019, Business Banking has been

transferred from UK Personal and Business Banking (UK PBB) to

Commercial Banking as the nature of the business, including

distribution channels, products and customers, are more closely

aligned to the Commercial Banking (CB) business. Concurrent with

the transfer, UK PBB has been renamed to UK Personal Banking (UK

PB) and the previous franchise combining UK PBB (now UK PB) and

Ulster Bank RoI has been renamed Personal & Ulster. The

Commercial & Private Banking franchise has also been renamed to

Commercial & Private.

Quarter ended 31 March 2019 results

RBS's results for the quarter ended 31 March 2019 will be

announced on Friday 26 April 2019. These results will be reported

on the new structure and reporting basis as described above.

In conjunction with this Segmental Reporting Restatement

Document, a financial supplement showing re-presented financial

information for the last nine quarters is available at

www.rbs.com/results.

Forward-looking statements

This document contains forward-looking statements within the

meaning of the United States Private Securities Litigation Reform

Act of 1995, such as statements that include, without limitation,

the words 'expect', 'estimate', 'project', 'anticipate', 'commit',

'believe', 'should', 'intend', 'plan', 'could', 'probability',

'risk', 'Value-at-Risk (VaR)', 'target', 'goal', 'objective',

'may', 'endeavour', 'outlook', 'optimistic', 'prospects' and

similar expressions or variations on these expressions. These

statements concern or may affect future matters, such as RBSG's

future economic results, business plans and current strategies. In

particular, this document includes forward-looking statements

relating to RBSG in respect of, but not limited to: its regulatory

capital position and related requirements, its financial position,

profitability and financial performance (including financial,

capital and operational targets), its access to adequate sources of

liquidity and funding, increasing competition from new incumbents

and disruptive technologies, its impairment losses and credit

exposures under certain specified scenarios, substantial regulation

and oversight, ongoing legal, regulatory and governmental actions

and investigations, LIBOR, EURIBOR and other benchmark reform and

RBSG's exposure to economic and political risks (including with

respect to Brexit and climate change), operational risk, conduct

risk, cyber and IT risk and credit rating risk. Forward-looking

statements are subject to a number of risks and uncertainties that

might cause actual results and performance to differ materially

from any expected future results or performance expressed or

implied by the forward-looking statements. Factors that could cause

or contribute to differences in current expectations include, but

are not limited to, legislative, political, fiscal and regulatory

developments, accounting standards, competitive conditions,

technological developments, interest and exchange rate fluctuations

and general economic conditions. These and other factors, risks and

uncertainties that may impact any forward-looking statement or

RBSG's actual results are discussed in RBSG's UK 2018 Annual Report

and Accounts (ARA) and materials filed with, or furnished to, the

US Securities and Exchange Commission, including, but not limited

to, RBSG's most recent Annual Report on Form 20-F and Reports on

Form 6-K. The forward-looking statements contained in this document

speak only as of the date of this document and RBSG does not assume

or undertake any obligation or responsibility to update any of the

forward-looking statements contained in this document, whether as a

result of new information, future events or otherwise, except to

the extent legally required.

Document roadmap

Pages 2 to 5 of this document show the income statement,

selected balance sheet line items and key metrics for the new

reportable segments for the year and quarter ended 31 December 2018

and for the quarter ended 31 March 2018. The Re-segmentation

reconciliation Appendix - summarises how Business Banking area is

allocated to the reportable operating segment Commercial

Banking.

For further information contact:

Alexander Holcroft

Investor Relations

+44 (0) 207 672 1982

Group Media Centre

+44 (0)131 523 4205

Re-presented customer segments

Year ended 31 December 2018

===============================================================================

Personal & Commercial &

Ulster Private

================ ===================

UK Ulster Central

Personal Bank Commercial Private RBS NatWest items Total

Banking & other

(1) RoI Banking Banking International Markets (2) RBS

Income statement GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

============================ ======== ====== ========== ======= ============= ======= ======= =======

Net interest income 4,283 444 2,855 518 466 112 (22) 8,656

Non-interest income 771 166 1,747 257 128 1,238 347 4,654

Own credit adjustments - - - - - 92 - 92

============================ ======== ====== ========== ======= ============= ======= ======= =======

Total income 5,054 610 4,602 775 594 1,442 325 13,402

============================ ======== ====== ========== ======= ============= ======= ======= =======

Direct expenses

- staff (698) (202) (739) (161) (102) (557) (1,190) (3,649)

- other (266) (103) (255) (66) (67) (241) (2,712) (3,710)

Indirect expenses (1,464) (185) (1,294) (229) (91) (415) 3,678 -

Strategic costs

- direct (41) (2) (33) - (3) (195) (730) (1,004)

- indirect (185) (20) (122) (21) (6) (43) 397 -

Litigation and conduct costs (213) (71) (44) (1) 9 (153) (809) (1,282)

============================ ======== ====== ========== ======= ============= ======= ======= =======

Operating expenses (2,867) (583) (2,487) (478) (260) (1,604) (1,366) (9,645)

============================ ======== ====== ========== ======= ============= ======= ======= =======

Operating profit/(loss)

before impairment

(losses)/releases 2,187 27 2,115 297 334 (162) (1,041) 3,757

Impairment (losses)/releases (339) (15) (147) 6 2 92 3 (398)

============================ ======== ====== ========== ======= ============= ======= ======= =======

Operating profit/(loss) 1,848 12 1,968 303 336 (70) (1,038) 3,359

============================ ======== ====== ========== ======= ============= ======= ======= =======

Key metrics

============================ ======== ====== ========== ======= ============= ======= ======= =========

Return on equity (3) 24.7% 0.5% 12.1% 15.4% 24.4% (2.0%) nm 4.8%

Net interest margin 2.67% 1.79% 1.96% 2.52% 1.71% 0.40% nm 1.98%

Cost:income ratio (4) 56.7% 95.6% 52.8% 61.7% 43.8% 111.2% nm 71.7%

Loan impairment rate 0.23% 0.08% 0.14% nm nm nm nm 0.13%

============================ ======== ====== ========== ======= ============= ======= ======= =========

As at 31 December 2018

=================================================================================

Capital and balance sheet GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

============================ ======== ====== ========== ======= ============= ======= ======= =========

Total assets 171.0 25.2 166.4 22.0 28.4 244.5 36.7 694.2

Funded assets (5) 171.0 25.2 166.4 22.0 28.4 111.4 36.5 560.9

Net loans to customers -

amortised cost 148.9 18.8 101.4 14.3 13.3 8.4 - 305.1

Impairment provisions (1.1) (0.8) (1.3) - - (0.1) - (3.3)

Customer deposits 145.3 18.0 134.4 28.4 27.5 2.6 4.7 360.9

Risk-weighted assets (RWAs) 34.3 14.7 78.4 9.4 6.9 44.9 0.1 188.7

RWA equivalent (RWAes) 35.5 14.7 79.7 9.5 6.9 50.0 0.2 196.5

Employee numbers (FTEs -

thousands) (6) 21.7 3.1 10.3 1.9 1.7 4.8 23.6 67.1

============================ ======== ====== ========== ======= ============= ======= ======= =========

For notes to this table

refer to page 5.

Re-presented customer segments

Quarter ended 31 December 2018

=======================================================================================

Personal & Ulster Commercial & Private

===================== ======================

Ulster Central

UK Personal Bank Commercial Private RBS NatWest items Total

Banking & other

(1) RoI Banking Banking International Markets (2) RBS

Income statement GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

========================= ============ ======= ============ ======== ============= ======= ======= =======

Net interest income 1,061 110 724 133 123 30 (5) 2,176

Non-interest income 185 37 392 65 32 89 49 849

Own credit adjustments - - - - - 33 - 33

========================= ============ ======= ============ ======== ============= ======= ======= =======

Total income 1,246 147 1,116 198 155 152 44 3,058

========================= ============ ======= ============ ======== ============= ======= ======= =======

Direct expenses

- staff (166) (53) (185) (39) (25) (128) (263) (859)

- other (80) (27) (77) (22) (22) (65) (870) (1,163)

Indirect expenses (414) (52) (403) (72) (35) (123) 1,099 -

Strategic costs

- direct (27) (3) (5) - (1) (89) (230) (355)

- indirect (63) (12) (57) (10) (2) (22) 166 -

Litigation and conduct

costs (7) (17) (37) - (1) (28) (2) (92)

========================= ============ ======= ============ ======== ============= ======= ======= =======

Operating expenses (757) (164) (764) (143) (86) (455) (100) (2,469)

========================= ============ ======= ============ ======== ============= ======= ======= =======

Operating profit/(loss)

before impairment

(losses)/releases 489 (17) 352 55 69 (303) (56) 589

Impairment

(losses)/releases (142) 19 (5) 8 2 100 1 (17)

========================= ============ ======= ============ ======== ============= ======= ======= =======

Operating profit/(loss) 347 2 347 63 71 (203) (55) 572

========================= ============ ======= ============ ======== ============= ======= ======= =======

Key metrics

========================= ============ ======= ============ ======== ============= ======= ======= =======

Return on equity (3) 17.2% 0.4% 8.3% 12.3% 20.0% (9.2%) nm 3.5%

Net interest margin 2.60% 1.73% 1.96% 2.49% 1.81% 0.39% nm 1.95%

Cost:income ratio (4) 60.8% 111.6% 67.5% 72.2% 55.5% 299.3% nm 80.5%

Loan impairment rate 0.38% (0.39%) 0.02% nm nm nm nm 0.02%

------------------------- ------------ ------- ------------ -------- ------------- ------- ------- -------

For the notes to this

table refer to page 5.

Re-presented customer segments

Quarter ended 31 March 2018

=====================================================================================

Personal & Ulster Commercial & Private

=================== ======================

Ulster Central

UK Personal Bank Commercial Private RBS NatWest items Total

Banking & other

(1) RoI Banking Banking International Markets (2) RBS

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

=========================== =========== ====== ============ ======== ============= ======= ======= =======

Net interest income 1,068 106 683 123 104 36 26 2,146

Non-interest income 230 40 475 61 33 380 (84) 1,135

Own credit adjustments - - - - - 21 - 21

=========================== =========== ====== ============ ======== ============= ======= ======= =======

Total income 1,298 146 1,158 184 137 437 (58) 3,302

=========================== =========== ====== ============ ======== ============= ======= ======= =======

Direct expenses

- staff (178) (49) (188) (43) (24) (165) (317) (964)

- other (65) (19) (47) (14) (15) (53) (606) (819)

Indirect expenses (374) (47) (311) (55) (20) (102) 909 -

Strategic costs

- direct (7) (1) (6) (1) - (17) (177) (209)

- indirect (61) (3) (42) (8) (1) (6) 121 -

Litigation and conduct

costs (1) (9) (1) - 1 (6) (3) (19)

=========================== =========== ====== ============ ======== ============= ======= ======= =======

Operating expenses (686) (128) (595) (121) (59) (349) (73) (2,011)

=========================== =========== ====== ============ ======== ============= ======= ======= =======

Operating profit/(loss)

before impairment

(losses)/releases 612 18 563 63 78 88 (131) 1,291

Impairment

(losses)/releases (68) (8) (12) (1) - 9 2 (78)

=========================== =========== ====== ============ ======== ============= ======= ======= =======

Operating profit/(loss) 544 10 551 62 78 97 (129) 1,213

=========================== =========== ====== ============ ======== ============= ======= ======= =======

For the notes to this table refer to page 5.

Re-presented customer segments

Quarter ended 31 March 2018

====================================================================================

Personal & Ulster Commercial & Private

=================== ======================

Ulster Central

UK Personal Bank Commercial Private RBS NatWest items Total

Banking & other

Key metrics (1) RoI Banking Banking International Markets (2) RBS

============================ =========== ====== ============= ======= ============= ======= ======= ======

Return on equity (3) 29.9% 1.6% 13.6% 12.5% 23.2% 2.0% nm 9.3%

Net interest margin 2.73% 1.80% 1.91% 2.51% 1.57% 0.54% nm 2.04%

Cost:income ratio (4) 52.9% 87.7% 50.0% 65.8% 43.1% 79.9% nm 60.5%

Loan impairment rate 0.18% 0.16% 0.05% nm nm nm nm nm

============================ =========== ====== ============= ======= ============= ======= ======= ======

As at 31 March 2018

Capital and balance sheet GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

============================ =========== ====== ============= ======= ============= ======= ======= ======

Total assets 166.3 23.4 165.6 20.4 28.0 283.8 51.0 738.5

Funded assets (5) 166.3 23.3 165.5 20.4 28.0 135.2 50.0 588.7

Net loans to customers -

amortised cost (GBPbn) 145.9 19.0 102.9 13.7 13.1 9.4 (0.2) 303.8

Impairment provisions (1.3) (1.2) (1.5) (0.1) - (0.2) 0.1 (4.2)

Customer deposits 142.9 16.4 131.1 25.3 26.9 3.8 8.1 354.5

Risk-weighted assets (RWAs) 31.5 16.9 84.3 9.4 7.0 53.1 0.5 202.7

RWA equivalent (RWAes) 32.2 17.4 88.9 9.4 7.0 56.5 0.9 212.3

Employee numbers (FTEs -

thousands) (6) 24.5 3.0 10.7 1.9 1.7 5.7 23.4 70.9

============================ =========== ====== ============= ======= ============= ======= ======= ======

nm = not meaningful

Notes:

(1) Reportable operating segment UK Personal and Business Banking renamed to UK Personal Banking

to reflect re-segmentation.

(2) Central items include unallocated transactions which principally comprise volatile items under

IFRS and RMBS related charges.

(3) RBS's CET 1 target is approximately 14% but for the purposes of computing segmental return

on equity (ROE), to better reflect the differential drivers of capital usage, segmental operating

profit after tax and adjusted for preference share dividends is divided by average notional

equity allocated at different rates of 14% (Ulster Bank RoI), 12% (Commercial Banking), 13.5%

(Private Banking), 16% (RBS International) and 15% for all other segments, of the monthly

average of segmental risk-weighted assets equivalents (RWAes) incorporating the effect of

capital deductions. RBS return on equity is calculated using profit for the period attributable

to ordinary shareholders over tangible net asset value.

(4) Operating lease depreciation included in income for the year ended 31 December 2018 - GBP121

million; Q4 2018 - GBP32 million; Q1 2018 - GBP31 million.

(5) Funded assets exclude derivative assets.

(6) On 1 January 2018, 7,600 employees on a FTE basis were transferred from Central items to UK

Personal Banking, 200 to Ulster Bank RoI, 3,700 to Commercial Banking and 400 to Private Banking.

Appendix

Re-segmentation reconciliations

UK Personal Banking (operating segment within the Personal &

Ulster franchise)

Year ended Quarter ended Quarter ended

31 December 2018 31 December 2018 31 March 2018

============================= ============================= =============================

Previously Previously Previously

reported To Total reported To Total reported To Total

UK PBB CB UK PB(1) UK PBB CB UK PB(1) UK PBB CB UK PB(1)

Income statement GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

===================== ========== ======= ======== ========== ======= ======== ========== ======= ========

Net interest income 5,098 (815) 4,283 1,267 (206) 1,061 1,259 (191) 1,068

Non-interest income 1,184 (413) 771 290 (105) 185 332 (102) 230

Total income 6,282 (1,228) 5,054 1,557 (311) 1,246 1,591 (293) 1,298

===================== ========== ======= ======== ========== ======= ======== ========== ======= ========

Direct expenses

- staff (890) 192 (698) (208) 42 (166) (229) 51 (178)

- other (300) 34 (266) (93) 13 (80) (70) 5 (65)

Indirect expenses (1,801) 337 (1,464) (522) 108 (414) (456) 82 (374)

Strategic costs

- direct (54) 13 (41) (28) 1 (27) (12) 5 (7)

- indirect (221) 36 (185) (84) 21 (63) (68) 7 (61)

Litigation and

conduct

costs (216) 3 (213) (6) (1) (7) (1) - (1)

Operating expenses (3,482) 615 (2,867) (941) 184 (757) (836) 150 (686)

===================== ========== ======= ======== ========== ======= ======== ========== ======= ========

Operating profit

before

impairment

losses 2,800 (613) 2,187 616 (127) 489 755 (143) 612

Impairment losses (342) 3 (339) (125) (17) (142) (57) (11) (68)

===================== ========== ======= ======== ========== ======= ======== ========== ======= ========

Operating profit 2,458 (610) 1,848 491 (144) 347 698 (154) 544

===================== ========== ======= ======== ========== ======= ======== ========== ======= ========

Key metrics

===================== ========== ======= ======== ========== ======= ======== ========== ======= ========

Return on equity (2) 24.3% 0.4% 24.7% 18.6% (1.4%) 17.2% 27.9% 2.0% 29.9%

Net interest margin 2.78% (0.11%) 2.67% 2.73% (0.13%) 2.60% 2.81% (0.08%) 2.73%

Cost:income ratio 55.4% 1.3% 56.7% 60.4% 0.4% 60.8% 52.5% 0.4% 52.9%

Loan impairment rate 0.21% 0.02% 0.23% 0.31% 0.07% 0.38% 0.14% 0.04% 0.18%

===================== ========== ======= ======== ========== ======= ======== ========== ======= ========

31 December 2018 31 March 2018

============================ ============================

Previously Previously

reported To Total reported To Total

UK PBB CB UK PB(1) UK PBB CB UK PB(1)

Capital and balance sheet GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

======================================== ========== ====== ======== ========== ====== ========

Loans to customers - amortised cost 163.7 (13.7) 150.0 162.1 (14.9) 147.2

Impairment provisions (1.4) 0.3 (1.1) (1.6) 0.3 (1.3)

======================================== ========== ====== ======== ========== ====== ========

Net loans to customers - amortised cost 162.3 (13.4) 148.9 160.5 (14.6) 145.9

Funded assets 194.2 (23.2) 171.0 190.3 (24.0) 166.3

Customer deposits 184.1 (38.8) 145.3 180.3 (37.4) 142.9

Loan:deposit ratio 88% 14% 102% 89% 13% 102%

Risk-weighted assets 45.1 (10.8) 34.3 43.4 (11.9) 31.5

======================================== ========== ====== ======== ========== ====== ========

Notes:

(1) Reportable operating segment UK Personal and Business Banking renamed

to UK Personal Banking to reflect re-segmentation.

(2) Return on equity is based on segmental operating profit after tax

adjusted for preference dividends divided by average notional equity

based on 15% of the monthly average of segmental Risk-weighted

assets equivalents (RWAes), incorporating the effect of capital

deductions, assuming 28% tax rate. Return on equity is calculated

using profit for the period attributable to ordinary shareholders.

Commercial Banking (operating segment within the Commercial

& Private franchise)

Year ended Quarter ended Quarter ended

31 December 2018 31 December 2018 31 March 2018

=========================== ========================= ========================

Previously From Total Previously From Total Previously From Total

reported reported reported

CB UK PB CB CB UK PB CB CB UK PB CB

Income statement GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

============================= ========== ====== ======= ========== ====== ===== ========== ===== =====

Net interest income 2,040 815 2,855 518 206 724 492 191 683

Non-interest income 1,334 413 1,747 287 105 392 373 102 475

Total income 3,374 1,228 4,602 805 311 1,116 865 293 1,158

============================= ========== ====== ======= ========== ====== ===== ========== ===== =====

Direct expenses

- staff (547) (192) (739) (143) (42) (185) (137) (51) (188)

- other (221) (34) (255) (64) (13) (77) (42) (5) (47)

Indirect expenses (957) (337) (1,294) (295) (108) (403) (229) (82) (311)

Strategic costs

- direct (20) (13) (33) (4) (1) (5) (1) (5) (6)

- indirect (86) (36) (122) (36) (21) (57) (35) (7) (42)

Litigation and conduct

costs (41) (3) (44) (38) 1 (37) (1) - (1)

Operating expenses (1,872) (615) (2,487) (580) (184) (764) (445) (150) (595)

============================= ========== ====== ======= ========== ====== ===== ========== ===== =====

Operating profit before

impairment

(losses)/releases 1,502 613 2,115 225 127 352 420 143 563

Impairment (losses)/releases (144) (3) (147) (22) 17 (5) (23) 11 (12)

============================= ========== ====== ======= ========== ====== ===== ========== ===== =====

Operating profit 1,358 610 1,968 203 144 347 397 154 551

============================= ========== ====== ======= ========== ====== ===== ========== ===== =====

Key metrics

============================= ========== ====== ======= ========== ====== ===== ========== ===== =====

Return on equity (1) 10.2% 1.9% 12.1% 5.5% 2.8% 8.3% 12.2% 1.4% 13.6%

Net interest margin 1.67% 0.29% 1.96% 1.66% 0.30% 1.96% 1.64% 0.27% 1.91%

Cost:income ratio 53.8% (1.0%) 52.8% 70.9% (3.4%) 67.5% 49.6% 0.4% 50.0%

Loan impairment rate 0.16% 0.02% 0.14% 0.10% 0.08% 0.02% 0.10% 0.05% 0.05%

============================= ========== ====== ======= ========== ====== ===== ========== ===== =====

31 December 2018 31 March 2018

======================== ========================

Previously From Total Previously From Total

reported reported

CB UK PB CB CB UK PB CB

Capital and balance sheet GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

======================================== ========== ===== ===== ========== ===== =====

Loans to customers - amortised cost 89.0 13.7 102.7 89.5 14.9 104.4

Impairment provisions (1.0) (0.3) (1.3) (1.2) (0.3) (1.5)

======================================== ========== ===== ===== ========== ===== =====

Net loans to customers - amortised cost 88.0 13.4 101.4 88.3 14.6 102.9

Funded assets 143.2 23.2 166.4 141.5 24.0 165.5

Customer deposits 95.6 38.8 134.4 93.7 37.4 131.1

Loan:deposit ratio 92% (16%) 76% 94% (14%) 80%

Risk-weighted assets 67.6 10.8 78.4 72.4 11.9 84.3

======================================== ========== ===== ===== ========== ===== =====

Note:

(1) Return on equity is based on segmental operating profit after

tax adjusted for preference dividends divided by average notional

equity based on 11% of the monthly average of segmental Risk-weighted

assets equivalents (RWAes), incorporating the effect of capital

deductions, assuming 28% tax rate. Return on equity is calculated

using profit for the period attributable to ordinary shareholders.

Legal Entity Identifier: 2138005O9XJIJN4JPN90

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCGGUUGCUPBGUM

(END) Dow Jones Newswires

April 17, 2019 06:20 ET (10:20 GMT)

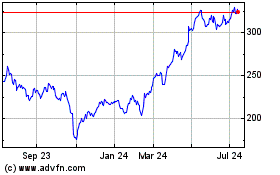

Natwest (LSE:NWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Natwest (LSE:NWG)

Historical Stock Chart

From Apr 2023 to Apr 2024