FSA Fines RBS, NatWest GBP2.8m For Poor Complaint Handling

January 11 2011 - 5:47AM

Dow Jones News

The Financial Services Authority or FSA, a U.K. Regulator of all

providers of financial services announced Tuesday it has fined

Royal Bank of Scotland (RBS.LN) and National Westminster Bank or

NatWest GBP2.8 million for multiple failings in the way they

handled customers' complaints, responding inadequately to more than

half the complaints reviewed by the FSA.

MAIN FACTS:

-The FSA's investigation found that there was an unacceptably

high risk that customers may not have been treated fairly due to a

number of failings within the banks' approach to routine complaint

handling, including:

*delays in responding to customers;

*poor quality investigations into complaints, with complaint

handlers failing to obtain and consider all the appropriate

information when making their decision;

*issuing correspondence that failed to fully address all of the

concerns raised by customers and failed to explain why complaints

had been upheld or rejected; and

*customers not receiving their Financial Ombudsman Service

(Ombudsman) referral rights within the appropriate time period.

-Of the complaint files reviewed by the FSA, 53% showed

deficient complaint handling; 62% showed a failure to comply with

FSA requirements on timeliness and disclosure of Ombudsman referral

rights; and 31% failed to demonstrate fair outcomes for

consumers.

-The FSA's investigation also found that:

*the banks did not give complaint handling staff adequate

training and guidance on how to properly investigate a

complaint;

*the monitoring of complaint handling in branches and the

management information produced was ineffective in assessing

whether customers were being treated fairly; and

*the banks failed to ensure that complaint handlers properly

reviewed complaints taking account of all relevant factors.

-The failings in the complaints handling processes of RBS and

NatWest were uncovered during the FSA's review of complaints

handling in the U.K.'s major retail banks.

-As a result of the thematic review, five banks have undertaken

significant action to improve their complaint handling.

-RBS and NatWest have co-operated fully with the investigation,

accepting the findings at an early stage and have agreed to make

significant changes to their complaints handling arrangements.

-The firms agreed to settle at an early stage in the

investigation and therefore qualify for a 30% reduction in

penalty.

-Were it not for this discount the FSA would have sought to

impose a financial penalty of GBP4 million on the firms.

-By Zechariah Hemans, Dow Jones Newswires; 44-20-7842-9411;

zechariah.hemans@dowjones.com

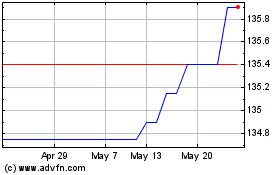

Nat.west 9%pf (LSE:NWBD)

Historical Stock Chart

From Apr 2024 to May 2024

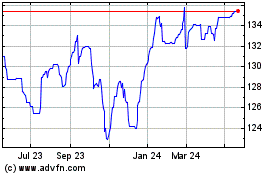

Nat.west 9%pf (LSE:NWBD)

Historical Stock Chart

From May 2023 to May 2024