Mercia Asset Management PLC Soccer Manager receives GBP3.0million investment

February 23 2021 - 2:00AM

RNS Non-Regulatory

TIDMMERC

Mercia Asset Management PLC

23 February 2021

RNS REACH 23 F ebruary 2021

Mercia Asset Management PLC

("Mercia" the "Company" or the "Group")

Soccer Manager receives GBP3.0million investment

Mercia Asset Management PLC (AIM: MERC), the proactive

regionally focused specialist asset manager with c.GBP872million of

assets under management, is pleased to announce completion of a

GBP3.0million investment round into Soccer Manager Limited ("Soccer

Manager"), one of the Group's direct investments.

The funding round comprised GBP0.75million from Mercia's

proprietary capital, GBP0.75million from the Northern Powerhouse

Investment Fund and GBP1.5million in matched funding from the

Government's Future Fund. This investment will support Soccer

Manager's continuing growth.

Soccer Manager is a prime example of Mercia's Complete Connected

Capital. It was first backed in December 2013 with a loan from one

of Mercia's managed debt funds. Subsequently in December 2014, it

received equity investment from two of Mercia's EIS funds and in

March 2015 received its first direct investment from Mercia's

proprietary capital. Mercia now holds a fully diluted direct

investment stake of 39.0% with a further 7.6% held by Mercia's

managed EIS funds.

The Soccer Manager team is led by founders Andy and Chris Gore,

alongside executive chairman Nick Wheelwright, the former CEO of

Codemasters and Monumental Games. Soccer Manager's games are played

in 234 countries around the world, having been downloaded by more

than 50 million players, with more than one million active monthly

users. Revenue has grown over 80% since the launch of Soccer

Manager 2021' in September 2020.

Andy Gore, CEO of Soccer Manager, said: "We founded Soccer

Manager with a vision to create high-quality football games that

the whole world could play. We have always had the view that

football, mobile technology and the internet is a powerful

combination with which to achieve this vision. After years of

building out our IP, technology and games to millions of people

worldwide, this investment will help us further accelerate our

current growth and deliver on our strategic ambitions.

We are delighted to have Mercia as a partner that continues to

share our vision and we look forward to the next stage of our

journey together."

Julian Viggars, CIO of Mercia Asset Management, said: "The video

gaming market was estimated to be worth $159.3billion in 20201,

which is a considerable increase of c.9% from 2019, in part due to

the changes in the leisure time spend we have seen following the

start of the COVID-19 pandemic. Soccer Manager is a great example

of an innovative regional business which, with the determination of

its founders, has scaled its recurring customer base and revenues

by offering high-quality games to a very loyal community. The

business was already on a strong growth trajectory before the

pandemic but with the increasing numbers of 'at home gamers' not

expected to slow down, we believe that there is significant further

potential in this asset."

1 https://www.wepc.com/news/video-game-statistics//

-Ends-

For further information, please contact:

Mercia Asset Management PLC

Mark Payton, Chief Executive Officer

Martin Glanfield, Chief Financial Officer +44 (0)330 223

www.mercia.co.uk 1430

Canaccord Genuity Limited (NOMAD and Joint +44 (0)20 7523

Broker) 8000

Simon Bridges, Emma Gabriel, Richard Andrews

N+1 Singer (Joint Broker)

+44 (0)20 7496

Harry Gooden, James Moat 3000

+44 (0)20 3727

FTI Consulting 1051

Tom Blackwell, Louisa Feltes, Shiv Talwar

mercia@fticonsulting.com

About Mercia Asset Management PLC:

Mercia is a proactive, specialist asset manager focused on

supporting regional SMEs to achieve their growth aspirations.

Mercia provides capital across its four asset classes of balance

sheet, venture, private equity and debt capital: the Group's

'Complete Connected Capital'. The Group initially nurtures

businesses via its third-party funds under management, then over

time Mercia can provide further funding to the most promising

companies, by deploying direct investment follow-on capital from

its own balance sheet.

The Group has a strong UK footprint through its regional

offices, 19 university partnerships and extensive personal

networks, providing it with access to high-quality deal flow.

Mercia currently has c.GBP872million of assets under management

and, since its IPO in December 2014, has invested c.GBP106million

gross into its direct investment portfolio.

Mercia Asset Management PLC is quoted on AIM with the EPIC

"MERC".

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

Reach is a non-regulatory news service. By using this service an

issuer is confirming that the information contained within this

announcement is of a non-regulatory nature. Reach announcements are

identified with an orange label and the word "Reach" in the source

column of the News Explorer pages of London Stock Exchange's

website so that they are distinguished from the RNS UK regulatory

service. Other vendors subscribing for Reach press releases may use

a different method to distinguish Reach announcements from UK

regulatory news.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAFZGZZVZFGMZM

(END) Dow Jones Newswires

February 23, 2021 02:00 ET (07:00 GMT)

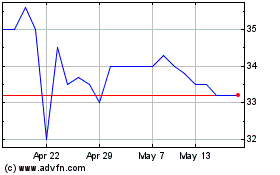

Mercia Asset Management (LSE:MERC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mercia Asset Management (LSE:MERC)

Historical Stock Chart

From Apr 2023 to Apr 2024