Lancashire Hld Ltd Notice of Q4 2018 Results and Conference Call

January 15 2019 - 9:25AM

UK Regulatory

TIDMLRE

LANCASHIRE HOLDINGS LIMITED

15 January 2019

London, UK

Notice of Q4 2018 Results and Conference Call

Lancashire Holdings Limited ("Lancashire" or "the Company") will be announcing

its 2018 fourth quarter results at 7:00am UK time on Thursday 14 February 2019

and hosting an analyst and investor conference call at 1:00pm UK time / 8:00am

EST on Thursday 14 February 2019. The conference call will be hosted by

Lancashire management.

Participant Access:

Dial in 5-10 minutes prior to the start time using the number / confirmation

code below:

United Kingdom - Toll free / Freephone: 0800 279 6619

United Kingdom - Local: 0844 481 9752

United States - Toll free / Freephone: 1 877 870 9135

United States - Local: +1 646 741 3167

Canada - Toll free / Freephone: +1 866 925 0818

Canada - Local: +1 646 741 3167

Confirmation Code: 2799373

The call can also be accessed via webcast, please go to our website at:

https://www.lancashiregroup.com/en/investors.html or https://

edge.media-server.com/m6/p/e4gvgp5d

to register and access.

A webcast replay facility will be available for 12 months and accessible at:

https://www.lancashiregroup.com/en/investors/

results-reports-and-presentations.html

For further information, please contact:

Lancashire Holdings Limited

Christopher Head +44 20 7264 4145

chris.head@lancashiregroup.com

Jelena Bjelanovic +44 20 7264 4066

jelena.bjelanovic@lancashiregroup.com

Haggie Partners +44 20 7562 4444

David Haggie david@haggie.co.uk

About Lancashire

Lancashire, through its UK and Bermuda-based operating subsidiaries, is a

provider of global specialty insurance and reinsurance products. The Group

companies carry the following ratings:

Financial Financial Long Term

Strength Strength Issuer

Rating (1) Outlook (1) Rating (2)

A.M. Best A (Excellent) Stable bbb+

S&P Global Ratings A- Stable BBB

Moody's A3 Stable Baa2

(1) Financial Strength Rating and Financial Strength Outlook apply to

Lancashire Insurance Company Limited and Lancashire Insurance Company (UK)

Limited.

(2) Long Term Issuer Rating applies to Lancashire Holdings Limited.

Cathedral benefits from Lloyd's ratings: A.M. Best: A (Excellent); S&P Global

Ratings: A+ (Strong); and Fitch: AA- (Very Strong).

Lancashire has capital of approximately $1.4 billion and its common shares

trade on the premium segment of the Main Market of the London Stock Exchange

under the ticker symbol LRE. Lancashire has its head office and registered

office at Power House, 7 Par-la-Ville Road, Hamilton HM 11, Bermuda.

For more information, please visit Lancashire's website at

www.lancashiregroup.com .

The Bermuda Monetary Authority ("BMA") is the Group Supervisor of the

Lancashire Group.

Lancashire Insurance Company Limited is regulated by the BMA, with its

registered office at Power House, 7 Par-la-Ville Road, Hamilton HM 11, Bermuda.

Lancashire Insurance Company (UK) Limited is authorised by the Prudential

Regulation Authority ("PRA") and regulated by the Financial Conduct Authority

("FCA") and the PRA, with its registered office at Level 29, 20 Fenchurch

Street, London EC3M 3BY, United Kingdom.

Cathedral Underwriting Limited is authorised by the PRA and regulated by the

FCA and the PRA. It is also authorised and regulated by Lloyd's, with its

registered office at Level 29, 20 Fenchurch Street, London EC3M 3BY, United

Kingdom.

Kinesis Capital Management Limited is regulated by the BMA, with its registered

office at Power House, 7 Par-la-Ville Road, Hamilton HM 11, Bermuda.

This release contains information which may be of a price sensitive nature that

Lancashire is making public in a manner consistent with the EU Market Abuse

Regulation and other regulatory obligations. The information was submitted for

publication, through the agency of the contact persons set out above, at 14:30

GMT on 15 January 2019.

NOTE REGARDING FORWARD-LOOKING STATEMENTS:

CERTAIN STATEMENTS AND INDICATIVE PROJECTIONS (WHICH MAY INCLUDE MODELED LOSS

SCENARIOS) MADE IN THIS RELEASE OR OTHERWISE THAT ARE NOT BASED ON CURRENT OR

HISTORICAL FACTS ARE FORWARD-LOOKING IN NATURE INCLUDING, WITHOUT LIMITATION,

STATEMENTS CONTAINING THE WORDS "BELIEVES", "ANTICIPATES", "PLANS", "PROJECTS",

"FORECASTS", "GUIDANCE", "INTS", "EXPECTS", "ESTIMATES", "PREDICTS", "MAY",

"CAN", "LIKELY", "WILL", "SEEKS", "SHOULD", OR, IN EACH CASE, THEIR NEGATIVE

OR COMPARABLE TERMINOLOGY. ALL SUCH STATEMENTS OTHER THAN STATEMENTS OF

HISTORICAL FACTS INCLUDING, WITHOUT LIMITATION, THE GROUP'S FINANCIAL

POSITION, LIQUIDITY, RESULTS OF OPERATIONS, PROSPECTS, GROWTH, CAPITAL

MANAGEMENT PLANS AND EFFICIENCIES, ABILITY TO CREATE VALUE, DIVID POLICY,

OPERATIONAL FLEXIBILITY, COMPOSITION OF MANAGEMENT, BUSINESS STRATEGY, PLANS

AND OBJECTIVES OF MANAGEMENT FOR FUTURE OPERATIONS (INCLUDING DEVELOPMENT PLANS

AND OBJECTIVES RELATING TO THE GROUP'S INSURANCE BUSINESS) ARE FORWARD-LOOKING

STATEMENTS. SUCH FORWARD-LOOKING STATEMENTS INVOLVE KNOWN AND UNKNOWN RISKS,

UNCERTAINTIES AND OTHER IMPORTANT FACTORS THAT COULD CAUSE THE ACTUAL RESULTS,

PERFORMANCE OR ACHIEVEMENTS OF THE GROUP TO BE MATERIALLY DIFFERENT FROM FUTURE

RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY SUCH

FORWARD-LOOKING STATEMENTS.

THESE FACTORS INCLUDE, BUT ARE NOT LIMITED TO: THE ACTUAL DEVELOPMENT OF LOSSES

AND EXPENSES IMPACTING ESTIMATES FOR HURRICANE FLORENCE, THE TYPHOONS AND

MARINE LOSSES THAT OCCURRED IN THE THIRD QUARTER OF 2018, HURRICANE MICHAEL

WHICH OCCURRED IN THE FOURTH QUARTER OF 2018, HURRICANES HARVEY, IRMA AND MARIA

AND THE EARTHQUAKES IN MEXICO THAT OCCURRED IN THE THIRD QUARTER OF 2017 AND

THE WILDFIRES WHICH IMPACTED PARTS OF CALIFORNIA DURING THE FOURTH QUARTER OF

2017; THE IMPACT OF COMPLEX AND UNIQUE CAUSATION AND COVERAGE ISSUES ASSOCIATED

WITH ATTRIBUTION OF LOSSES TO WIND OR FLOOD DAMAGE OR OTHER PERILS SUCH AS FIRE

OR BUSINESS INTERRUPTION RELATING TO SUCH EVENTS; POTENTIAL UNCERTAINTIES

RELATING TO REINSURANCE RECOVERIES, REINSTATEMENT PREMIUMS AND OTHER FACTORS

INHERENT IN LOSS ESTIMATION; THE GROUP'S ABILITY TO INTEGRATE ITS BUSINESSES

AND PERSONNEL; THE SUCCESSFUL RETENTION AND MOTIVATION OF THE GROUP'S KEY

MANAGEMENT; THE INCREASED REGULATORY BURDEN FACING THE GROUP; THE NUMBER AND

TYPE OF INSURANCE AND REINSURANCE CONTRACTS THAT THE GROUP WRITES OR MAY WRITE;

THE GROUP'S ABILITY TO IMPLEMENT SUCCESSFULLY ITS BUSINESS STRATEGY DURING

'SOFT' AS WELL AS 'HARD' MARKETS; THE PREMIUM RATES WHICH MAY BE AVAILABLE AT

THE TIME OF SUCH RENEWALS WITHIN THE GROUP'S TARGETED BUSINESS LINES; THE

POSSIBLE LOW FREQUENCY OF LARGE EVENTS; POTENTIALLY UNUSUAL LOSS FREQUENCY; THE

IMPACT THAT THE GROUP'S FUTURE OPERATING RESULTS, CAPITAL POSITION AND RATING

AGENCY AND OTHER CONSIDERATIONS MAY HAVE ON THE EXECUTION OF ANY CAPITAL

MANAGEMENT INITIATIVES OR DIVIDS; THE POSSIBILITY OF GREATER FREQUENCY OR

SEVERITY OF CLAIMS AND LOSS ACTIVITY THAN THE GROUP'S UNDERWRITING, RESERVING

OR INVESTMENT PRACTICES HAVE ANTICIPATED; THE RELIABILITY OF, AND CHANGES IN

ASSUMPTIONS TO, CATASTROPHE PRICING, ACCUMULATION AND ESTIMATED LOSS MODELS;

INCREASED COMPETITION FROM EXISTING ALTERNATIVE CAPITAL PROVIDERS, INSURANCE

LINKED FUNDS AND COLLATERALISED SPECIAL PURPOSE INSURERS AND THE RELATED DEMAND

AND SUPPLY DYNAMICS AS CONTRACTS COME UP FOR RENEWAL; THE EFFECTIVENESS OF THE

GROUP'S LOSS LIMITATION METHODS; THE POTENTIAL LOSS OF KEY PERSONNEL; A DECLINE

IN THE GROUP'S OPERATING SUBSIDIARIES' RATING WITH A.M. BEST, S&P GLOBAL

RATINGS, MOODY'S OR OTHER RATING AGENCIES; INCREASED COMPETITION ON THE BASIS

OF PRICING, CAPACITY, COVERAGE TERMS OR OTHER FACTORS; CYCLICAL DOWNTURNS OF

THE INDUSTRY; THE IMPACT OF A DETERIORATING CREDIT ENVIRONMENT FOR ISSUERS OF

FIXED MATURITY INVESTMENTS; THE IMPACT OF SWINGS IN MARKET INTEREST RATES,

CURRENCY EXCHANGE RATES AND SECURITIES PRICES; CHANGES BY CENTRAL BANKS

REGARDING THE LEVEL OF INTEREST RATES; THE IMPACT OF INFLATION OR DEFLATION IN

RELEVANT ECONOMIES IN WHICH THE GROUP OPERATES; THE EFFECT, TIMING AND OTHER

UNCERTAINTIES SURROUNDING FUTURE BUSINESS COMBINATIONS WITHIN THE INSURANCE AND

REINSURANCE INDUSTRIES; THE IMPACT OF TERRORIST ACTIVITY IN THE COUNTRIES IN

WHICH THE GROUP WRITES RISKS; A RATING DOWNGRADE OF, OR A MARKET DECLINE IN,

SECURITIES IN THE GROUP'S INVESTMENT PORTFOLIO; CHANGES IN GOVERNMENTAL

REGULATIONS OR TAX LAWS IN JURISDICTIONS WHERE THE GROUP CONDUCTS BUSINESS;

LANCASHIRE OR ANY OF THE GROUP'S BERMUDIAN SUBSIDIARIES BECOMING SUBJECT TO

INCOME TAXES IN THE UNITED STATES OR IN THE UNITED KINGDOM; THE INAPPLICABILITY

TO THE GROUP OF SUITABLE EXCLUSIONS FROM THE UK CFC REGIME; ANY CHANGE IN UK

GOVERNMENT POLICY WHICH IMPACTS THE CFC REGIME OR OTHER TAX CHANGES; AND THE

IMPACT OF "BREXIT" (FOLLOWING THE UK'S NOTIFICATION TO THE EUROPEAN COUNCIL

UNDER ARTICLE 50 OF THE TREATY ON EUROPEAN UNION ON 29 MARCH 2017) AND FUTURE

NEGOTIATIONS REGARDING THE UK'S RELATIONSHIP WITH THE EU ON THE GROUP'S

BUSINESS, REGULATORY RELATIONSHIPS, UNDERWRITING PLATFORMS OR THE INDUSTRY

GENERALLY.

ALL FORWARD-LOOKING STATEMENTS IN THIS RELEASE SPEAK ONLY AS AT THE DATE OF

PUBLICATION. LANCASHIRE EXPRESSLY DISCLAIMS ANY OBLIGATION OR UNDERTAKING (SAVE

AS REQUIRED TO COMPLY WITH ANY LEGAL OR REGULATORY OBLIGATIONS INCLUDING THE

RULES OF THE LONDON STOCK EXCHANGE) TO DISSEMINATE ANY UPDATES OR REVISIONS TO

ANY FORWARD-LOOKING STATEMENT TO REFLECT ANY CHANGES IN THE GROUP'S

EXPECTATIONS OR CIRCUMSTANCES ON WHICH ANY SUCH STATEMENT IS BASED. ALL

SUBSEQUENT WRITTEN AND ORAL FORWARD-LOOKING STATEMENTS ATTRIBUTABLE TO THE

GROUP OR INDIVIDUALS ACTING ON BEHALF OF THE GROUP ARE EXPRESSLY QUALIFIED IN

THEIR ENTIRETY BY THIS NOTE. PROSPECTIVE INVESTORS SHOULD SPECIFICALLY CONSIDER

THE FACTORS IDENTIFIED IN THIS RELEASE WHICH COULD CAUSE ACTUAL RESULTS TO

DIFFER BEFORE MAKING AN INVESTMENT DECISION.

END

(END) Dow Jones Newswires

January 15, 2019 09:25 ET (14:25 GMT)

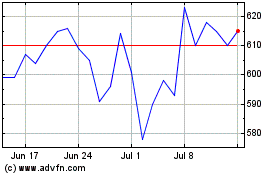

Lancashire (LSE:LRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

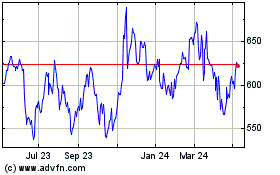

Lancashire (LSE:LRE)

Historical Stock Chart

From Apr 2023 to Apr 2024