TIDMJAN

RNS Number : 9597G

Jangada Mines PLC

12 November 2018

Jangada Mines plc / EPIC: JAN.L / Market: AIM / Sector:

Mining

12 November 2018

Jangada Mines plc

('Jangada' or the 'Company')

32% Reduction in Total Capital Expenditure

and Updated Process Flowsheet

Jangada Mines plc, a natural resources company developing South

America's largest and most advanced platinum group metals ('PGM')

project, is pleased to announce a substantial reduction in the

preliminary capital expenditure, as a result of the creation of an

updated process flowsheet in partnership with Consulmet Metals

(Pty) Ltd ("Consulmet"), for its Pedra Branca PGM project ("Pedra

Branca" or "the Project"), in the north-east of Brazil.

Pedra Branca currently has a JORC (2012) compliant resource of

approximately 1.45 million ounces of PGM+Au at a grade of 1.3g/t

PGM+Au (2.5 g/t Pd Eq), 140 million pounds of nickel, 26 million

pounds of copper and 6.7 million pounds of cobalt.

To view the full announcement, complete with illustrative

diagrams, please use the following link:

http://www.rns-pdf.londonstockexchange.com/rns/9597G_1-2018-11-9.pdf

Highlights:

-- Optimised and updated process flowsheet, delivered in

partnership with Consulmet, for Pedra Branca has resulted in a

significant reduction in projected plant capex costs and overall

upfront capex costs:

o 38% reduction in plant capex to US$33.8 million (previously

estimated at US$54.2 million)

o 32% reduction in overall capex figure to US$43.9 million

(previously estimated at US$64.9 million)

-- The updated flowsheet further enhances the already robust

economics of Pedra Branca and underpins Management's confidence in

the Project's potential to be a competitive and profitable mining

operation

Brian McMaster, Chairman of Jangada, said: "Pedra Branca is the

largest and most advanced PGM project in South America and the

Jangada team has already demonstrated its potential to generate

material returns to investors once in production. Today's

refinement and optimisation of the process flowsheet has delivered

an impressive 32% and 38% reduction in plant capex and overall

capex, respectively, further enhancing the Project's potential to

provide lucrative returns. As such, we are delighted with today's

result, which is primarily a result of Consulmet's highly

specialist experience in building PGM plants. The team from

Consulmet have hit the ground running and their experience and

understanding of projects such as Pedra Branca is coming to the

fore.

"As we extrapolate the revised capex number into the already

robust economic model, the financial merits of Pedra Branca will

simply get stronger. Importantly, the revised process flow sheet

has demonstrated a simpler and more efficient process route. We

anticipate that this will reflect in reduced operating cost metrics

that will feed into the ongoing BFS."

Further Information

Jangada and Consulmet entered into an agreement for the

flowsheet development and plant design of the Project as per the

Company's announcement on 27 September 2018.

As part of the initial work programme, Consulmet reviewed all

available metallurgical test work results from the Project and

produced a preliminary flowsheet for the production of a PGM-rich

nickel copper sulphide concentrate and a chrome concentrate. This

flowsheet, which demonstrates a notably simpler and more efficient

process than previously envisaged, will form the basis of all

subsequent test and design work relating to advancing the project

toward FEL3 level (commonly known as BFS level) feasibility.

Consulmet's review coupled with their institutional knowledge

and experience in developing PGM and base metal processing plants,

has resulted in important changes to the flowsheet which have

simplified and improved the efficiency of the overall process.

As part of the Consulmet's process flowsheet review, an updated

capital expenditure estimate has also been calculated by Consulmet.

The updated plant capex figure, that has been prepared to a

preliminary economic assessment level of accuracy, amounts to

US$33.8 million with an overall upfront capex of US$43.9 million.

These revised numbers compare favourably with the recently

completed Preliminary Economic Assessment for Pedra Branca prepared

by GE21 in Brazil (as announced on 18 June 2018) which estimated a

plant capex of US$54.2 million and total upfront capex of

US$64.9million.

The updated plant capex estimate amounts to a 38% reduction

whilst the impact on total upfront capex is a reduction of 32%.

Figure 1. Conceptual Block Flow Diagram for Pedra Branca

produced by Consulmet

About Pedra Branca

Pedra Branca is the largest and most advanced PGM project in

South America and currently has a JORC (2012) compliant resource of

approximately 1.45 million ounces of PGM+Au at a grade of 1.3g/t

PGM+Au (2.5 g/t Pd Eq), 140 million pounds of nickel, 26 million

pounds of copper and 6.7 million pounds of cobalt.

The Project is located 280km from the port city of Fortaleza in

the northeast of Brazil and holds three mining licences and 42

exploration licences over an area of 48,000 hectares. Previous

operators have spent more than US$35 million on exploration and

development activities, which include 30,000 metres of diamond core

drilling, geophysical surveys and metallurgical tests. The current

resources are at surface and Jangada is currently preparing a

pre-feasibility study assuming shallow open pit mining and

conventional processing methods.

About Consulmet Metals

Consulmet Metals are a specialist engineering group focussed on

fast-tracked design and construction of minerals processing plants

on a fixed price basis (EPC/LSTK). They excel in delivering

projects in remote locations and developing countries. They have

delivered greenfield and brownfield projects in Africa, Australia,

Asia, Europe and South America for BHP Billiton, Rio Tinto, Anglo

American, mid-tier and junior mining companies.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

*ENDS*

For further information please visit www.jangadamines.com or

contact:

Jangada Mines plc Brian McMaster (Chairman) Tel: +44 (0) 20 7317

6629

Strand Hanson Limited James Spinney Tel: +44 (0)20 7409

(Nominated & Financial Ritchie Balmer 3494

Adviser) Jack Botros

Brandon Hill Capital Jonathan Evans Tel: +44 (0)20 3463

(Broker) Oliver Stansfield 5000

St Brides Partners Isabel de Salis Tel: +44 (0)20 7236

Ltd Gaby Jenner 1177

(Financial PR)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDBLBFTMBMMBBP

(END) Dow Jones Newswires

November 12, 2018 02:00 ET (07:00 GMT)

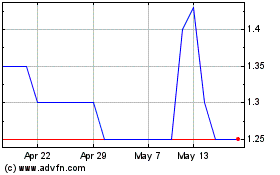

Jangada Mines (LSE:JAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jangada Mines (LSE:JAN)

Historical Stock Chart

From Apr 2023 to Apr 2024