GSTechnologies Ltd US$1.6 million Convertible Loan Facility (9686K)

December 28 2022 - 2:00AM

UK Regulatory

TIDMGST

RNS Number : 9686K

GSTechnologies Ltd

28 December 2022

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 which forms part of UK

law by virtue of the European Union (Withdrawal) Act 2018

("MAR").

28 December 2022

GSTechnologies Limited

("GST" or the "Company" or the "Group")

US$1.6 million Convertible Loan Facility

GSTechnologies Limited (LSE: GST), the fintech company, is

pleased to announce that the Company has entered into an unsecured

convertible loan facility to receive funding of up to US$1.6

million (the "Loan Facility") with an institutional investor

introduced by OvalX, the Company's broker, as further detailed

below.

The proceeds from the Loan Facility will further strengthen the

Company's cash position, providing funding visibility through to Q4

2023, and will be utilised to assist the development and rollout of

the Group's GS Money and associated services as well as for general

working capital purposes.

Further information on the Convertible Loan

The US$1.6 million Loan Facility is unsecured and can be drawn

down in two instalments. The first instalment of US$800,000 has

been drawn down and up to a further US$800,000 is available to be

drawn down from 26 June 2023, subject to certain conditions being

met. The Loan Facility has a redemption date of 28 December 2023

(the "Redemption Date"). Interest equating to ten per cent. of the

principal amount per annum shall accrue until repayment or

conversion of the Loan Facility and be payable in cash quarterly in

arrears.

The amounts drawn down under the Loan Facility and the

associated accrued interest is convertible into new ordinary shares

of no-par value in the capital of the Company ("Ordinary Shares")

at any time up until the Redemption Date at the election of the

Loan Facility provider via service of a conversion notice.

Alternatively, the Company may repay the Loan Facility in cash at

105% of the principal amount drawn down together with applicable

interest, before the Redemption Date, at the election of the

Company by way of the Company giving ten business days' notice in

writing.

The conversion price per new Ordinary Share shall be determined

as the lower of: (i) 140 per cent. of the closing bid price of the

Company's shares on the London Stock Exchange one business day

prior to the relevant draw down date; and (ii) 85% of the

arithmetic average of the daily volume-weighted average price of an

Ordinary Share during any five of the fifteen business days prior

to service or deemed service of a conversion notice, as selected by

the Loan Facility provider.

If the Loan Facility is not repaid or converted prior to the

Redemption Date, the Company shall pay the principal amount of the

Loan Facility together with the associated accrued interest on the

Redemption Date.

The Loan Facility is subject to certain customary events of

default. If the Loan Facility becomes due and payable following an

event of default, it will be repayable immediately at 120% of the

outstanding principal amount.

Tone Goh, Chairman of GST, commented : "2022 has been a

transformational year for the Group and our GS Money ambitions,

including the completion of the acquisitions of Angra and USB

Glindala, the exit from EMS Wiring Systems, the soft launch of our

GS20 Exchange, and the progression of our application for the

Company's stablecoins to be admitted to the FCA Regulatory Sandbox.

With the proceeds of the Loan Facility we will be able to further

accelerate our plans to build a blockchain enabled neobanking

business."

Enquiries:

The Company

Tone Goh, Executive Chairman +65 6444 2988

Financial Adviser

VSA Capital Limited +44 (0)20 3005 5000

Simon Barton / Pascal Wiese

Broker

OvalX +44 (0)20 7392 1400

Tom Curran / Thomas Smith

Financial PR & Investor Relations

IFC Advisory Limited +44 20 (0) 3934 6630

Tim Metcalfe / Graham Herring / Florence gst@investor-focus.co.uk

Chandler

For more information please see:

https://gstechnologies.co.uk/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCPPGGWPUPPGUM

(END) Dow Jones Newswires

December 28, 2022 02:00 ET (07:00 GMT)

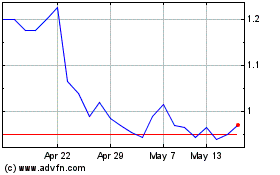

Gstechnologies (LSE:GST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gstechnologies (LSE:GST)

Historical Stock Chart

From Apr 2023 to Apr 2024