TIDMGMS

RNS Number : 5385U

Gulf Marine Services PLC

30 July 2020

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF

SUCH JURISDICTION

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

FOR IMMEDIATE RELEASE 30 July 2020

Gulf Marine Services PLC

Bank Letter re Seafox International Limited and other

Shareholders' votes

Gulf Marine Services PLC ("GMS" or the "Company") announces that

it yesterday received a letter from the agent on behalf of all six

lenders (the "Bank Letter") in relation to the votes of Seafox

International Limited ("Seafox"), Mazrui Investments LLC

("Mazrui"), and Horizon Energy LLC ("Horizon") at the Company's

recent annual general meeting. The full text of the letter is set

out below.

The Bank Letter rejects the statements made by Seafox on 13 July

2020 with regards to the common terms agreement announced by the

Company on 10 June 2020, and expresses the lenders' concern that

Seafox is "publicly disseminating a view which the lenders and the

Company do not share at this critical juncture."

The common terms agreement was thoroughly discussed, heavily

negotiated and agreed in good faith by all parties. Under the

agreement, GMS's lenders have committed to provide additional

funding to the Company, to assist management in delivering the

agreed business plan and the associated working capital needs, to

the benefit of all stakeholders. Both the Board and the lenders

remain committed to its terms. As set out in the Bank Letter, the

lenders' expectation that the Company will continue to perform its

obligations under the common terms agreement will continue

regardless of the composition of the Company's Board of Directors

or the appointment of new Directors.

Tim Summers, Executive Chairman, said:

"The revised debt structure agreed with our banks in June

provides a platform for GMS to sustain its upward trajectory and

continue to drive growth as oil and gas markets stabilize. GMS's

Board and its banks are fully aligned in ensuring that the

financial foundation of the business remains stable and robust,

which is essential for the future success of the Company. The

Board's commitment to creating value for all stakeholders is

unwavering."

Letter from Agent on behalf of GMS's banks

28 July 2020

Dear Sirs

GMS' Annual General Meeting - Seafox International Limited and

other Shareholders votes

We refer to (i) your letter dated 30 June 2020 in relation to

certain actions taken by Seafox International Limited ( Seafox )

and other shareholders at the Annual General Meeting of the Company

in relation to the removal and appointment of certain directors

(the AGM Communication ) and (ii) the Common Terms Agreement

originally dated 29 November 2015 (as lastly amended and restated

on 16 June 2020, the Common Terms Agreement ).

Terms defined in the Common Terms Agreement shall have the same

meaning when used in this letter. We are writing to you in our

capacity as Intercreditor Agent under the Common Terms Agreement,

on behalf of all the Banks.

In light of the events described in the AGM Communication and

certain statements subsequently made by shareholders of the

Company, the Banks would like to take the opportunity to reconfirm

certain facts and make the following clarifications:

-- the amendments to the Common Terms Agreement were negotiated

in good faith and at arms' length between the Banks and the

Company, with the support of internationally recognised legal and

financial professional advisers;

-- the discussions and negotiations on the terms of the revised

Common Terms Agreement between the Banks and the Company, were

subject to extensive discussions over a prolonged period of over 12

months;

-- under the amended terms of the Common Terms Agreement, the

Banks have committed to provide additional funding to the Company,

to assist management in delivering the agreed business plan and the

associated working capital needs, to the benefit of all

stakeholders;

-- ultimately, the transaction was supported and approved by all

Banks as well as the Board of Directors of the Company;

-- as such, the Banks reject the statements made by Seafox on 13

July 2020 with regards to the Common Terms Agreement describing

some terms as "punitive" and "onerous". The Banks are concerned

that Seafox, the largest shareholder in the Company, is publicly

disseminating a view which the Banks and the Company do not share

at this critical juncture.

With reference to the provisions of Clause 20.27 (Warrants) and

Clause 23.16 (Warrants), we note again that in the absence of a

sufficient number of favourable votes of the shareholders, both the

decision to raise equity (which the Banks understand may be

necessary in order to effect a USD75,000,000 prepayment) as well as

the issuance of the Warrants, may be blocked, therefore causing an

Event of Default under the Common Terms Agreement.

While we recognise that shareholders have an unfettered right to

exercise their rights in their absolute discretion, we expect that

the Company will ensure that the terms of the Common Terms

Agreement, in particular the relevant prepayment and Event of

Default provisions, are clearly understood by all shareholders

since the occurrence of any such Events of Default will give the

Banks a right to accelerate the Facilities and enforce any of their

rights under the Common Terms Agreement, including enforcement of

asset security.

For the avoidance of doubt, the Banks confirm that they are not

willing to renegotiate any of the terms and expect the Company to

perform all of its obligations under the Common Terms Agreement.

This position continues to hold regardless of the composition of

the Company's Board or the appointment of new directors. The Banks'

primary concern remains the financial health of the Company and its

ability to continue its business operations effectively and at the

same time fulfil its contractual obligations to the Banks. The

Banks expect the Company to clearly communicate with its

shareholders to reassure them that the restructuring terms have

been thoroughly discussed, heavily negotiated and agreed in good

faith.

This letter may be communicated by the Company to all

shareholders.

Ends

Enquiries:

GMS

Tim Summers, Executive Chairman

Stephen Kersley, Chief Financial

Officer +44 (0) 207 603

Tony Hunter, Company Secretary 1515

Brunswick (PR Adviser to GMS) +44 (0) 20 7404

Patrick Handley - UK 5959

Will Medvei - UK +971 (0) 50 600

Jade Mamarbachi - UAE 3829

------------------

MAR

The information contained within this announcement is considered

by the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014. Upon the publication

of this announcement via a Regulatory Information Service, this

inside information will be considered to be in the public

domain.

The person responsible for arranging for the release of this

announcement on behalf of GMS is Tony Hunter, Company

Secretary.

DISCLAIMER

The content of the Gulf Marine Services PLC website should not

be considered to form a part of or be incorporated into this

announcement.

CAUTIONARY STATEMENT

This announcement includes statements that are forward-looking

in nature. All statements other than statements of historical fact

are capable of interpretation as forward-looking statements. These

statements may generally, but not always, be identified by the use

of words such as 'will', 'should', 'could', 'estimate', 'goals',

'outlook', 'probably', 'project', 'risks', 'schedule', 'seek',

'target', 'expects', 'is expected to', 'aims', 'may', 'objective',

'is likely to', 'intends', 'believes', 'anticipates', 'plans', 'we

see' or similar expressions. By their nature these forward-looking

statements involve numerous assumptions, risks and uncertainties,

both general and specific, as they relate to events and depend on

circumstances that might occur in the future.

Accordingly, the actual results, operations, performance or

achievements of the Company and its subsidiaries may be materially

different from any future results, operations, performance or

achievements expressed or implied by such forward-looking

statements, due to known and unknown risks, uncertainties and other

factors. Neither Gulf Marine Services PLC nor any of its

subsidiaries undertake any obligation to publicly update or revise

any forward-looking statement as a result of new information,

future events or other information. No part of this announcement

constitutes, or shall be taken to constitute, an invitation or

inducement to invest the Company or any other entity, and must not

be relied upon in any way in connection with any investment

decision. All written and oral forward-looking statements

attributable to the Company or to persons acting on the Company's

behalf are expressly qualified in their entirety by the cautionary

statements referred to above.

ABOUT GMS

GMS, a company listed on the London Stock Exchange, was founded

in Abu Dhabi in 1977 and has become a world-leading provider of

advanced self-propelled self-elevating support vessels (SESVs). The

fleet serves the oil, gas and renewable energy industries from its

offices in the United Arab Emirates and Saudi Arabia. The Group's

assets are capable of serving clients' requirements across the

globe, including those in the Middle East, South East Asia, West

Africa, North America, the Gulf of Mexico and Europe.

The GMS fleet of 13 SESVs is amongst the youngest in the

industry, with an average age of eight years. The vessels support

GMS's clients in a broad range of offshore oil and gas platform

refurbishment and maintenance activities, well intervention work

and offshore wind turbine maintenance work (which are opex-led

activities), as well as offshore oil and gas platform installation

and decommissioning and offshore wind turbine installation (which

are capex-led activities).

The SESVs are categorised by size - K-Class (Small), S-Class

(Mid) and E-Class (Large) - with these capable of operating in

water depths of 45m to 80m depending on leg length. The vessels are

four-legged and are self-propelled, which means they do not require

tugs or similar support vessels for moves between locations in the

field; this makes them significantly more cost-effective and

time-efficient than conventional offshore support vessels without

self-propulsion. They have a large deck space, crane capacity and

accommodation facilities (for up to 300 people) that can be adapted

to the requirements of the Group's clients.

The Company's Legal Entity Identifier is

213800IGS2QE89SAJF77.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCSEWESUESSELW

(END) Dow Jones Newswires

July 30, 2020 02:00 ET (06:00 GMT)

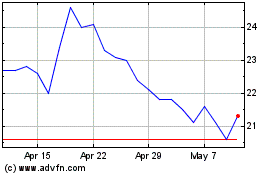

Gulf Marine Services (LSE:GMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

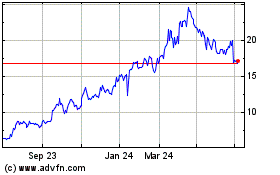

Gulf Marine Services (LSE:GMS)

Historical Stock Chart

From Apr 2023 to Apr 2024