TIDMGMAA

RNS Number : 7821L

Gama Aviation PLC

15 January 2021

Date: 15(th) January 2021

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) No 596/2014

Gama Aviation Plc (AIM:GMAA) ("Gama Aviation", the "Group")

Strategically Significant Expansion of the Group's US

Maintenance Operations

Gama Aviation Plc, the global business aviation service

provider, today announces the strategic acquisition of Jet East

Aviation Corporation, LLC ("Jet East") from East Coast Aviation,

LLC which will significantly expand its existing US aircraft

maintenance operations.

Jet East is a full-service business aviation aircraft

maintenance provider with approximately 200 employees. It supplies

a range of maintenance services at high traffic business aviation

gateway airports that include, amongst others, the cities of New

York, Boston, Philadelphia, Cleveland and Cincinnati. Jet East's

maintenance network is highly complementary to the Group's existing

US operations with little service or geographic overlap.

The acquisition of Jet East has been transacted by the Group's

wholly owned US subsidiary Gama Aviation Engineering Inc ("GAEI")

for $7.7m in cash, with a further $1m in deferred cash payable over

two years and the assumption of $3.2m of Jet East debt. The

transaction has been entirely funded from the Group's existing

resources.

In 2020, Jet East's performance was negatively impacted by

COVID-19. In 2019, it reported revenues of $29.5m and an underlying

EBIT of $1.2m inclusive of a depreciation charge of $0.3m. The net

assets of Jet East as at 31(st) December 2019 were $6.7m.

The acquisition will substantially enhance the Group's already

extensive maintenance capability within the US, capturing further

market share in the world's most valuable business aviation market

with circa 15,000 active business aviation aircraft. The enlarged

business will provide unparalleled coast-to-coast coverage and

capability that will enhance its service offering to the market and

significantly strengthen its trading relationships with key

customers.

The addition of three highly experienced executives will

strengthen the Group's US business operations. A tailored long-term

executive incentive plan, which includes potential awards of GAEI

stock linked to value accretion, will ensure alignment of

managements' interests with that of the Group's shareholders.

The increased scale and competencies of the enlarged US

maintenance business and the anticipated revenue synergies and

operational efficiencies are expected to be enhancing to Group

earnings following the first full year of acquisition.

Commenting on the transaction, Marwan Khalek, Chief Executive of

Gama Aviation said:

"This strategically important acquisition enlarges and

strengthens our presence in the US, the world's largest business

aviation market. We are taking two entirely complementary

businesses and combining them to provide a highly capable,

coast-to-coast maintenance operation that supports our customers

evident need to rationalise their supply base. The combination will

provide our customers the advantages of operational efficiencies

that only a single-source strategic supplier relationship can

deliver. The combined business will also be well positioned to

benefit from the inevitable recovery in US business aviation

activity once the pandemic impact subsides.

This is a deal that enhances our service offering to our

clients, is anticipated to be value accretive to our shareholders

and will provide opportunity for our people."

ENDS

For further information please visit www.gamaaviation.com or

contact:

Gama Aviation Plc +44 (0) 1252 553000

Marwan Khalek, Chief Executive Officer

Daniel Ruback, Chief Financial Officer

Camarco +44 (0) 20 3757 4992

Ginny Pulbrook

Geoffrey Pelham-Lane

Gama Aviation - notes to editors

Founded in 1983 on the simple purpose of providing aviation

services that equip its customers with decisive advantage , Gama

Aviation Plc (LSE AIM: GMAA) is a highly valued global partner to

blue chip corporations, government agencies, healthcare trusts and

private individuals.

The Group has three global divisions: Business Aviation

(Aircraft Management, Charter, FBO & Maintenance), Special

Mission (Air Ambulance & Rescue, National Security &

Policing, Infrastructure & Survey, Energy & Offshore); and

Technology & Outsourcing (Flight Operations, FBO, CAM software,

Flight Planning, CAM & ARC services)

More details can be found at: https://www.gamaaviation.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQFZGMMZDDGMZZ

(END) Dow Jones Newswires

January 15, 2021 02:00 ET (07:00 GMT)

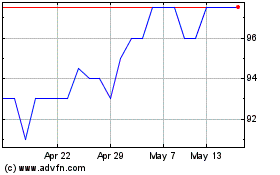

Gama Aviation (LSE:GMAA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gama Aviation (LSE:GMAA)

Historical Stock Chart

From Apr 2023 to Apr 2024