TIDMFUM

RNS Number : 5424E

Futura Medical PLC

19 October 2018

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA,

AUSTRALIA, THE REPUBLIC OF IRELAND, NEW ZEALAND OR ANY OTHER

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN FUTURA MEDICAL PLC OR ANY OTHER

ENTITY IN ANY JURISDICTION. NEITHER THIS ANNOUNCEMENT NOR THE FACT

OF ITS DISTRIBUTION, SHALL FORM THE BASIS OF, OR BE RELIED ON IN

CONNECTION WITH ANY INVESTMENT DECISION IN RESPECT OF FUTURA

MEDICAL PLC.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014.

UNLESS OTHERWISE INDICATED, CAPITALISED TERMS IN THIS

ANNOUNCEMENT HAVE THE MEANING GIVEN TO THEM IN THE DEFINITIONS

SECTION INCLUDED IN THE APPIX TO THE ANNOUNCEMENT MADE BY THE

COMPANY ON 18 OCTOBER 2018.

Futura Medical plc

("Futura" or the "Company")

Further Details on the Fundraising and Participation of

Directors and

Substantial Shareholders in the Fundraising

Futura, a pharmaceutical company developing a portfolio of

innovative products based on its proprietary, transdermal

Dermasys(R) drug delivery technology and focused on sexual health

and pain confirms that, further to the announcement made yesterday,

it has conditionally raised c. GBP5.6 million in aggregate before

fees and expenses through a successful Placing, Subscription and

PrimaryBid Offer with certain existing and new institutional and

other investors at the Placing Price of 7 pence per share. The

Placing Price of 7 pence represents a 27.5 per cent. discount to

the Closing Price of 9.65 pence on 18 October 2018, being the last

practicable trading day prior to the release of this

announcement.

The Company announces that, as part of the PrimaryBid Offer,

existing institutional investor Lombard Odier has subscribed for

PrimaryBid Shares (the "Related Party Transaction") as detailed

further below.

Directors participation in the Fundraising and related party

transaction

Certain of the Directors have agreed to subscribe for

Subscription Shares. The number of Subscription Shares subscribed

for by each of these Directors pursuant to the Subscription, and

their resulting shareholdings on Admission (assuming take-up in

full of the Offer for Subscription by Eligible Shareholders), are

set out below:

Number Number Percentage

Number Percentage of Subscription of Ordinary of Enlarged

of Existing of existing Shares Shares Share

Ordinary issued share subscribed held Capital

Directors Shares capital for on Admission on Admission*

James Barder 1,528,830 1.26% 357,142 1,885,972 0.88%

Angela Hildreth - -% 142,857 142,857 0.07%

Ken James 14,000 0.01% 285,714 299,714 0.14%

* Assuming take-up in full of the Offer for Subscription by Eligible Shareholders

Each of the above Director's participation is conditional upon

certain matters and events including, amongst other things, the

passing of the Resolutions, the Placing Agreement having become

unconditional and Admission of the Placing Shares becoming

effective on or before 8.00 a.m. on 13 November 2018 (but in any

event by no later than 8.00 a.m. on 30 November 2018).

Where a company enters into a related party transaction, under

the AIM Rules the independent directors of the company are

required, after consulting with the company's nominated adviser, to

state whether, in their opinion, the transaction is fair and

reasonable in so far as its shareholders are concerned.

James Barder, Angela Hildreth and Ken James (the "Participating

Directors") by virtue of being directors of the Company are

considered to be "related parties" as defined under the AIM Rules.

The Participating Directors participation in the Subscription

constitutes a related party transaction for the purposes of rule 13

of the AIM Rules.

John Clarke and Jonathan Freeman, the independent directors for

the purposes of the Subscription consider, having consulted with

the Company's nominated adviser, N+1 Singer, that the terms of the

Participating Directors participation in the Subscription is fair

and reasonable insofar as the Shareholders are concerned.

Substantial Shareholder participation in the Fundraising and

related party transaction

The following existing substantial Shareholders will be

participating in the Placing:

Number Percentage Number of Number of Percentage

of Existing of existing PrimaryBid Ordinary of enlarged

Ordinary issued share Shares subscribed Shares held share capital

Shares capital for following following

Admission Admission*

Lombard

Odier 19,354,205** 15.99% 35,714,286 55,068,491 25.58%

* Assuming take-up in full of the Offer for Subscription by Eligible Shareholders

** Based on the last published TR1 announcement by Lombard Odier

on 24 September 2018

Where a company enters into a related party transaction, under

the AIM Rules the independent directors of the company are

required, after consulting with the company's nominated adviser, to

state whether, in their opinion,

the transaction is fair and reasonable in so far as its

shareholders are concerned.

Lombard Odier Asset Management (Europe) Limited ("Lombard

Odier") by virtue of being a substantial shareholder is considered

to be "related party" as defined under the AIM Rules. Lombard

Odier's participation in the PrimaryBid Offer constitutes a related

party transaction for the purposes of rule 13 of the AIM Rules.

The Directors consider, having consulted with the Company's

nominated adviser, N+1 Singer, that the terms of Lombard Odier's

participation in the PrimaryBid Offer is fair and reasonable

insofar as the Shareholders are concerned.

Open Offer

The Board recognises and is grateful for the continued support

received from Shareholders and the importance of shareholder

pre-emption rights and therefore wishes to provide an opportunity

for all existing Eligible Shareholders to participate in a further

issue of new Ordinary Shares by way of the Open Offer. The Open

Offer is being made so as to enable all Eligible Shareholders to

subscribe for new Ordinary Shares at the Issue Price on a pro rata

basis to their current holdings.

Eligible Shareholders may subscribe for Open Offer Shares on the

basis of 10 Open Offer Shares for every 85 Existing Ordinary Shares

held at 6.00 p.m. on 18 October 2018 (the "Record Date"). The

proposed price of 7 pence per Open Offer Share (the "Issue Price")

is the same as the Placing Price for the Placing, Subscription and

PrimaryBid Offer.

The Open Offer will be for up to 14,236,000 new Ordinary Shares

in aggregate.

Assuming a full take-up by Eligible Shareholders under the Open

Offer, the issue of the Open Offer Shares will raise further gross

proceeds of up to approximately GBP1.0 million for the Company.

Further information on the Open Offer will be set out in a

circular to be sent to Shareholders (the "Circular").

Completion of the Fundraising is conditional upon, amongst other

things, approval by existing Shareholders at a General Meeting of

the Company, expected to be held at the offices of Futura Medical

plc at Surrey Technology Centre, 40 Occam Road, Guildford, Surrey

GU2 7YG at 1.00 p.m. on 12 November 2018. The Circular, containing

background information to the Fundraising, together with a notice

of the General Meeting, will be posted to Shareholders shortly.

James Barder, Chief Executive Officer of Futura, said:

Today's Fundraising provides us with a new foundation to deliver

additional value by progressing the development of MED2002, a

breakthrough topical erectile dysfunction ("ED") gel through Phase

3 studies.

We are grateful for the long-term support from our shareholders

and new investors which have participated in the Placing, and we

are pleased to be able to offer participation in this Fundraising

to all other shareholders through the Open Offer."

For further information please contact:

+44 (0) 1483 685

Futura Medical plc 670

James Barder, Chief Executive Officer www.Futuramedical.com

Angela Hildreth, Finance Director & Chief

Operating Officer

N+1 Singer +44 (0) 207 496 3000

Aubrey Powell / Jen Boorer (Corporate Finance)

Tom Salvesen (Corporate Broking)

For media enquiries please contact

Optimum Strategic Communications +44 (0) 20 3950 9144

Mary Clark / Hollie Vile /Ellie Blackwell

Capitalised terms used in this announcement shall, unless

defined in this announcement or unless the context provides

otherwise, bear the same meaning ascribed to such terms in the

announcement made by the Company on 18 October 2018 to announce the

launch of the Fundraising.

Important Notice

N+1 Singer is acting as nominated adviser and broker and as

agent for and on behalf of the Company for the Placing. N+1 Singer

is authorised and regulated by the Financial Conduct Authority (the

"FCA") in the United Kingdom. N+1 Singer is not acting for the

Company in relation to the PrimaryBid Offer. N+1 Singer is acting

exclusively for the Company and no one else in connection with the

Placing and N+1 Singer will not be responsible to anyone (including

any Placees) other than the Company for providing the protections

afforded to its clients or for providing advice in relation to the

Placing or any other matters referred to in this announcement.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by N+1 Singer or by any of its affiliates or

agents as to, or in relation to, the accuracy or completeness of

this announcement or any other written or oral information made

available to or publicly available to any interested party or its

advisers, and any liability therefore is expressly disclaimed.

No statement in this announcement is intended to be a profit

forecast or estimate, and no statement in this announcement should

be interpreted to mean that earnings per share of the Company for

the current or future financial years would necessarily match or

exceed the historical published earnings per share of the

Company.

The price of shares and any income expected from them may go

down as well as up and investors may not get back the full amount

invested upon disposal of the shares. Past performance is no guide

to future performance, and persons needing advice should consult an

independent financial adviser.

The Placing Shares and the Open Offer Shares will not be

admitted to trading on any stock exchange other than on the AIM

market of the London Stock Exchange.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this announcement.

This Announcement may contain and the Company may make verbal

statements containing "forward-looking statements" with respect to

certain of the Company's plans and its current goals and

expectations relating to its future financial condition,

performance, strategic initiatives, objectives and results.

Forward-looking statements sometimes use words such as "aim",

"anticipate", "target", "expect", "estimate", "intend", "plan",

"goal", "believe", "seek", "may", "could", "outlook" or other words

of similar meaning. By their nature, all forward-looking statements

involve risk and uncertainty because they relate to future events

and circumstances which are beyond the control of the Company,

including amongst other things, United Kingdom domestic and global

economic business conditions, market-related risks such as

fluctuations in interest rates and exchange rates, the policies and

actions of governmental and regulatory authorities, the effect of

competition, inflation, deflation, the timing effect and other

uncertainties of future acquisitions or combinations within

relevant industries, the effect of tax and other legislation and

other regulations in the jurisdictions in which the Company and its

respective affiliates operate, the effect of volatility in the

equity, capital and credit markets on the Company's profitability

and ability to access capital and credit, a decline in the

Company's credit ratings; the effect of operational risks; and the

loss of key personnel. As a result, the actual future financial

condition, performance and results of the Company may differ

materially from the plans, goals and expectations set forth in any

forward-looking statements. Any forward-looking statements made in

this Announcement by or on behalf of the Company speak only as of

the date they are made. Except as required by applicable law or

regulation, the Company expressly disclaims any obligation or

undertaking to publish any updates or revisions to any

forward-looking statements contained in this Announcement to

reflect any changes in the Company's expectations with regard

thereto or any changes in events, conditions or circumstances on

which any such statement is based.

Terms of the Placing, the Subscription and the PrimaryBid

Offer

The Company has conditionally raised approximately GBP5.6

million before expenses pursuant to the Placing, Subscription and

PrimaryBid Offer. The Issue Price represents a discount of

approximately 27.5 per cent. to the Closing Price on 18 October

2018, being the latest practicable date prior to the announcement

of the Placing, the Subscription and the PrimaryBid Offer.

The PrimaryBid Offer, was partially underwritten for GBP0.5

million by PrimaryBid, and took place between 5.04 p.m. on 18

October 2018 and 9.00 p.m. on 18 October 2018 and was made in

accordance with an available exemption against the requirement to

produce an FCA approved prospectus.

Subject to the satisfaction of the conditions under the Placing,

Subscription and PrimaryBid Offer including, inter alia, the

passing of the Resolutions, the Company will issue 80,000,000 new

Ordinary Shares in aggregate at the Issue Price, thereby raising

approximately GBP5.6 million, before expenses, and GBP5.2 million,

after the expenses of the Placing and PrimaryBid Offer. The Placing

Shares have been conditionally placed by N+1 Singer, as agent for

the Company, with institutional and other investors. The Company

has conditional commitments with certain other investors including

the Directors named above for the issue of the Subscription Shares.

The Placing Shares, Subscription Shares and PrimaryBid Shares

issued pursuant to the Fundraising will represent approximately

37.2 per cent. of the Enlarged Share Capital on Admission.

No element of the Fundraising has been underwritten by N+1

Singer. The Company has agreed to pay certain fees and commissions

to N+1 Singer in connection with the Fundraising and to PrimaryBid

in connection with the PrimaryBid Offer.

The Placing, the Subscription and the PrimaryBid Offer are

conditional, inter alia, upon:

-- the Resolutions being passed (without amendment) at the

General Meeting or any adjournment thereof;

-- each of the warranties contained in the Placing Agreement

being and remaining accurate and not misleading until

Admission;

-- the Company having complied in all material respects with its

obligations and having satisfied the conditions under the Placing

Agreement which are to be performed or satisfied prior to

Admission;

-- the Placing Agreement having become unconditional in all

respects (save for the condition relating to Admission) and not

having been terminated by N+1 Singer in accordance with its

terms;

-- Admission of the Placing Shares, the Subscription Shares and

the PrimaryBid Shares taking place by no later than 8.00 a.m. on or

around 13 November 2018 (or such later date as the Company may

agree with N+1 Singer).

If any of the conditions are not satisfied, the Placing Shares,

the Subscription Shares and the PrimaryBid Shares will not be

issued and any monies received from the placees and subscribers

will be returned to them (at the placees' and subscribers' risk and

without interest) as soon as possible thereafter. In relation to

the PrimaryBid Offer only in the event of any conflict between the

incorporated contractual conditions which apply to the Placing and

the further conditions of PrimaryBid, the contractual conditions

which apply to the Placing will prevail.

The Placing Agreement contains customary warranties given by the

Company to N+1 Singer as to matters relating to the Company and its

business and as to matters relevant to the Company and an indemnity

to N+1 Singer in respect of liabilities arising out of or in

connection with the Placing. The Placing Agreement also contains

customary rights of termination which could enable N+1 Singer to

terminate the Placing in certain limited circumstances.

Application will be made to the London Stock Exchange for the

Placing Shares, the Subscription Shares and the PrimaryBid Shares

to be admitted to trading on AIM. Subject to passing of the

Resolutions, it is expected that Admission will become effective

and that dealings in the Placing Shares, the Subscription Shares

and the PrimaryBid Shares will commence on or around 13 November

2018. The Placing Shares, the Subscription Shares and the

PrimaryBid Shares will, when issued, be credited as fully paid and

will rank equally in all respects with the Existing Ordinary Shares

already in issue, including the right to receive all dividends and

other distributions declared, made or paid in respect of such

shares after the date of issue of the Placing Shares, the

Subscription Shares and the PrimaryBid Shares.

The Open Offer

Introduction

The Board recognises and is grateful for the continued support

received from Shareholders and the importance of shareholder

pre-emption rights and therefore wishes to provide an opportunity

for all existing Eligible Shareholders to participate in a further

issue of new Ordinary Shares also at the Issue Price by way of the

Open Offer.

The Open Offer is being made so as to enable all Eligible

Shareholders to subscribe for new Ordinary Shares at the Issue

Price on a pro rata basis to their current holdings.

The Open Offer has been structured so that it is not available

to Non-Eligible Shareholders, being Shareholders resident or

located in any Restricted Jurisdiction. The Open Offer is

conditional on the Placing, Subscription and PrimaryBid Offer being

approved.

Details of the Open Offer

(a) Structure

The Directors have considered the best way to structure the Open

Offer, having regard to, inter alia, the importance of pre-emption

rights to all Shareholders, the extent to which there are Overseas

Shareholders, the regulatory requirements applicable to companies

listed on AIM, cost implications and market risks. After

considering these factors, the Directors have concluded that the

most suitable structure for the Open Offer, for both the Company

and its Shareholders as a whole, is that the Open Offer be made

only to Eligible Shareholders who are not resident or located in

any Restricted Jurisdiction.

The Open Offer provides an opportunity for all Eligible

Shareholders to acquire Open Offer Shares pro rata to their current

holdings of Existing Ordinary Shares as at the Record Date. The

Issue Price for the Open Offer is the same as the Issue Price in

the Placing. Eligible Shareholders shall not be able to apply for

subscriptions in excess of their respective Basic Entitlements.

Principal Terms of the Open Offer

The Open Offer is conditional on:

-- the passing of the Resolutions to be proposed at the General Meeting; and

-- Admission of the Open Offer Shares having occurred not later

than 8.00 a.m. on 13 November 2018 (or such later time and/or date

as N+1 Singer and the Company may agree, being not later than 8.00

a.m. on 30 November 2018).

Accordingly, if any of such conditions are not satisfied, the

Open Offer will not proceed. It is a condition of the Open Offer

that the Placing also proceeds. Further terms and conditions of the

Open Offer are set out in the Circular to be sent to Shareholders.

Subject to the fulfilment of the conditions referred to above and

set out below and also set out in the Circular, Eligible

Shareholders are being given the opportunity to subscribe for the

Open Offer Shares at the Issue Price per Open Offer Share, pro rata

to their holdings of Existing Ordinary Shares on the Record Date on

the basis of:

10 Open Offer Shares for every 85 Existing Ordinary Shares

Eligible Shareholders are not being given the opportunity to

apply for subscription of any New Ordinary Shares in excess of

their Basic Entitlement. Assuming full take-up under the Open Offer

the issue of the Open Offer Shares will raise gross proceeds of

approximately GBP1.0 million for the Company. The Open Offer is not

underwritten. The Fundraising is not conditional upon the level of

applications made to subscribe under the Open Offer. Accordingly,

if no applications to subscribe under the Open Offer are received,

the total amount that the Company would raise via the Fundraising

would be GBP5.6 million (before expenses).

The Open Offer Shares will, upon issue, rank pari passu with the

Existing Ordinary Shares.

Fractions of Open Offer Shares will not be allotted. The terms

of the Open Offer provide that each Eligible Shareholder's

entitlement under the Open Offer will be rounded down to the

nearest whole number. Eligible Shareholders with holdings of

Existing Ordinary Shares in both certificated and uncertificated

form will be treated as having separate holdings for the purpose of

calculating the Basic Entitlements.

It should be noted that the Open Offer is not a rights issue.

Accordingly, the Application Form is not a document of title and

cannot be traded.

Further information on the Open Offer and the terms and

conditions on which it is made will be set out in the Circular to

be sent to Shareholders.

Admission and dealings

Application will be made to the London Stock Exchange for the

Placing Shares, the Subscription Shares, the PrimaryBid Shares and

the Open Offer Shares to be admitted to trading on AIM. It is

expected that, subject to the passing of the Resolutions at the

General Meeting, Admission will occur and dealings will commence in

such shares on 13 November 2018 at 8.00 a.m. (or such later date as

N+1 Singer and the Company may agree, being not later than 8.00

a.m. on 30 November 2018).

General Meeting

The Circular and a form of proxy in relation to the General

Meeting to be convened in connection with the Fundraising will be

posted to shareholders shortly. The Circular contains notice of the

General Meeting which is to be held at the offices of Futura

Medical plc, at Surrey Technology Centre, 40 Occam Road, Guildford,

Surrey GU2 7YG at 1.00 p.m. on 12 November 2018.

Expected Timetable of Principal Events

Record Date for entitlement under 6.00 p.m. on 18 October2018

the Open Offer

Launch of the Fundraising 5.04 p.m. on 18 October2018

PrimaryBid Offer open from 5.04 p.m. on 18 October

2018

PrimaryBid Offer closed at 9.00 p.m. on 18 October

2018

Announcement of the result of the 19 October 2018

Fundraising

Ex-entitlement date of the Open Offer 8.00 a.m. on 22 October

2018

Publication and posting of the Circular 24 October 2018

and Notice of General Meeting, Form

of Proxy and Application Form (where

applicable)

Basic Entitlements credited to stock 25 October 2018

accounts in CREST for Eligible Shareholders

Latest recommended time and date for 4.30 p.m. on 5 November

requested withdrawal of Basic Entitlements 2018

from CREST

Latest time and date for depositing 3.00 p.m. on 6 November

Basic Entitlements in CREST 2018

Latest time and date for splitting 3.00 p.m. on 7 November

of Application Forms (to satisfy bona 2018

fide market claims only)

Latest time and date for receipt of 11.00 a.m. on 9 November

Application Forms and payment in full 2018

under the Open Offer and settlement

of relevant CREST instructions

Latest time and date for receipt of 1.00 p.m. on 10 November

Forms of Proxy 2018

General Meeting 1.00p.m. on 12 November

2018

Results of the General Meeting and 12 November 2018

the Open Offer announced

Admission of Placing Shares, Subscription 8.00 a.m. on 13 November

Shares, PrimaryBid Shares and Open 2018

Offer Shares to trading on AIM and

commencement of dealings

CREST accounts to be credited for 8.00 a.m. on 13 November

Placing Shares and Open Offer Shares 2018

to be held in uncertificated form

Dispatch of definitive share certificates by 20 November 2018

for Placing Shares, Subscription Shares,

PrimaryBid Shares and Open Offer Shares

to be held in certificated form

The Company reserves the right to alter the dates and times

referred to above and to accept applications under the

Open Offer at any time prior to 5.00 p.m. on 10 November

2018. If any of the dates and times referred to above are

altered by the Company, the revised dates and times will

be announced through a Regulatory Information Service without

delay.

All references to time are to London time, unless otherwise

stated.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFFEEFAFASELS

(END) Dow Jones Newswires

October 19, 2018 02:00 ET (06:00 GMT)

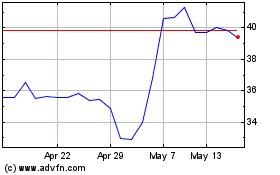

Futura Medical (LSE:FUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Futura Medical (LSE:FUM)

Historical Stock Chart

From Apr 2023 to Apr 2024