TIDMAXM

RNS Number : 3793C

Alexander Mining PLC

28 September 2018

28 September 2018

ALEXANDER MINING PLC

INTERIM REPORT FOR SIX MONTHSED 30 JUNE 2018

Alexander Mining plc ("Alexander" or "the Company"), an AIM

listed mining and mineral processing technologies company,

announces its unaudited results for the six months ended 30 June

2018.

The Company's business objective is to become a successful

company focused on the mining and processing of base metals which

are integral to the delivery of technologies and products of the

future. This will be achieved from the commercialisation of its

proprietary mineral processing technologies and potential strategic

partnerships in producing mines and through equity and/ or royalty

positions in advanced projects.

Highlights

* Potential technology licensing and consulting

agreement for the Kapili Tepe copper project at Sivas

in Republic of Turkey

* Working closely with Proses Mühendislik

investigating the commercial use of Alexander's base

metals leaching technology in Turkey

* Progressing research and development initiatives for

HyperLeach(R) , lithium and vanadium

* Aggressively investigating a range of potentially

complementary corporate investment opportunities in

the mining sector

* Adequate financial position and working capital to

end of June 2019

Chairman's Statement & Review of the Half-Year

Dear Shareholders and Investors.

Herewith I take pleasure on behalf of your Board of Directors in

presenting the Company's unaudited interim results for the

half-year ended 30 June 2018, along with commentary on the

operating environment and related outlook.

Once again, the period under review was filled with sentiment

and fundamental driven sectoral performance in the global mining

sector, whilst resource nationalism continues but has been tempered

in some countries by government changes. In general, although the

mining and natural resources investment sector remained positive,

even within some commodities exhibiting flattening demand curves,

we are clearly seeing, for the first time, that sentiment is

dominant and even driving fundamentals. However, in the continuing

volatile economic and political environment, precious metals

prices, including gold and silver, continued to support the demand

for risk hedging against rising government and public debt levels,

US dollar uncertainty and fear of Fiat currency failure.

The world's leading economy, the USA, is also reasserting itself

as a primary producer of much of what it needs to support the 'Buy

USA' and industrial development policy driven by the Trump

government. This is being reflected notably on the changed

economics of the metals production value chain in the Americas and

within a long dormant now massively resurgent brownfield

re-establishment of old mines, even from the 1800s, in some cases.

New district size plays, primarily in precious metals but also in

base metals, are being established with modern exploration

techniques and step out drilling. Significantly, many of the base

metal deposits are oxide in nature and so potentially amenable to

Alexander's AmmLeach technology and we shall be monitoring these

opportunities actively moving forward, while Mexico remains highly

prospective for the Company.

Markedly, another realisation that is impacting seriously is

that the days of drill, find, dig and produce within 3 to 5 years

are long gone. Increased regulation and ESIA (Environmental &

Social Impact Assessment) processes for exploring for, proving-up,

exploitation permitting, then financing & constructing a

producing mine can take well in excess of ten years and on average

in many of the common mining jurisdictions at least 15 years.

During that period some or all of the following will probably have

occurred, government changes that alter the rules of engagement,

demand for the metals/minerals change, and/or operating currency

changes markedly against the US dollar market price.

This is significantly and inherently positive for Alexander as

both existing and past closed operations look to 'squeeze the

stone' for more via innovative processing of residues and waste

(historically low grade sub-economic) materials. The Company's

technologies are ideally situated to make the squeezing possible

with relatively low capital expenditure, low operating expenditure

and environmentally neutral impacts. We are aggressively pursuing

such opportunities.

The price of base metals, Alexander's main area of activity, and

related base metals equities continued to experience corrections

and expected volatility but they remained range bound and in a

rising general trend. LME stock depletion was sustained, even with

observed flattening economic demand and global trade threats. There

was continued significant capital inflow for exploration. The

crypto-currencies investment bubble has deflated for now and we see

a switch back to providing significant funding for the usual junior

resource investment market.

Increased investment in exploration and development activity in

the infrastructure commodities and energy storage, or battery

metals, continued during the period and still underpins further

potential price rises. More importantly, the consumer automobile

industries are beginning to quickly realise that the much-stated

ambitious adoption rates of electric vehicle ("EV"), primarily

driven by political environmental agendas with no cognisance of the

quantities of metals' production growth required to meet these

rates, simply cannot be met. With some industry analysts

forecasting an additional 30% to 40% increase in copper production

(1.5Mtpa), 100% increase for Class 1 nickel production (1Mtpa) and

an additional 2x to 3x current cobalt production (200ktpa to

300ktpa) for the passenger EV market alone, a gross under estimate

of the supporting infrastructure and ignorance of the impact of

commercial EVs, the prices of these metals in real terms are likely

set to record levels.

One of the key metrics that demonstrates the current low

potential for additional capacity being added, and therefore upward

pressure on prices, is the 'Incentive Price' for development,

assuming the resource is discovered and quantified. Studies show

that establishment of new integrated copper, nickel and cobalt

production operations needs incentive prices of US$9,000/t,

US$22,000/t and US$50,000/t respectively. This is just to consider

investing further. With the average capital cost for these same

metals using current processing methods, of US$30k to US$45k/tpa,

US$80k/tpa to US$120k/tpa, respectively, with cobalt usually a

by-product of the others. Considering the commodity cycle

positioning and project jurisdiction, metals prices need

sustainability at even higher levels for resource companies to

actually deploy capital and build the mines.

All of the above, assuming the capital could be raised, even at

the low end of the scale, to produce the copper, Class 1 nickel,

and cobalt requirement for EVs would need, US$45bn, US$80bn, and

US$5bn respectively. That's US$130bn funding requirement from

where? Car companies? Governments (AKA tax payer)? This is the

exciting opportunity for Alexander's processing technologies as the

significant potential reduction in capital and operating cost,

along with significant environmental benefits could massively

impact in lowering the incentive price and shorten time to

production.

Therefore, considering all of the above, and with the key

operating environment for the Company substantially unchanged from

that which I reported in the 2017 Annual report, the outlook

remains very positive for the Company's commercialisation efforts.

Regardless of market sentiment, Alexanders' management and Board

have remained focused on developing or acquiring commercialisation

opportunities for our technologies to release the embedded value in

the Company's intellectual property.

In the reporting period, the Company continued to add granted

patents in key mining jurisdictions to its portfolio of

intellectual property and, where appropriate, make additional

applications. In addition, the Company progressed with its R&D

activities.

Financial

The Company has continued to be assiduous in keeping its

overheads to the minimum necessary, whilst maintaining required

expenditure on business development and intellectual property

protection. Expenses overall continue to be managed appropriately

consistent with early value creation. The Company's cash position

at 30 June was GBP662,043.

Based on the current budget, the Company should have adequate

working capital through until the end of June 2019.

Commercialisation activities

Turkey

Our optimism in the last annual report that we may benefit from

a change in the ownership of the Sivas copper mineral property

("Sivas") in the Republic of Turkey, where we had maintained

interest and involvement in developing the optimum processing

method potentially using Alexander technology, should be

rewarded.

The Kapili Tepe copper project at Sivas in Republic of Turkey is

on course to be acquired by Canadian company Deep South Resources

Inc. ("DSR") subject to completion. This opportunity affords

Alexander, under a technology licensing and consulting agreement

announced in June 2018, to investigate the potential use of its

technology in a full commercial scale processing plant. In

addition, subject to Toronto Stock Exchange approval, Alexander

will also receive 500,000 shares in DSR.

An exciting separate opportunity being discussed is to test the

potential amenability of Alexander's suite of technologies for

DSR's other project, the HIAB copper project in Namibia.

Per the announcement on 21 February 2018 regarding a commercial

and technical partnership agreement with Proses Mühendislik, Danı

manlık, İn aat ve Tasarım AS. ("Proses") in Turkey, Iran and the

rest of the Middle-East, we have been working closely together.

Particular effort has gone into investigating the commercial use of

Alexander's base metals leaching technology in Turkey. The concept

is that, subject to securing the necessary funding, Proses will

design and construct a semi industrial scale processing plant using

Alexander's technology. We look forward to reporting on progress in

due course.

Research and Development

With regards to the Company's R&D projects, overall progress

has been somewhat slower than expected due to an ongoing shortage

of skilled staff. This is anticipated to accelerate with the

appointment of a new project metallurgist in Perth, Western

Australia where most of our R&D is being conducted.

The project examining nickeliferous flotation tailings has

completed initial characterisation of the tailings. The primary aim

of this work is to demonstrate an economically viable route to

produce battery quality nickel and cobalt sulphates directly from

existing tailings. The secondary target is to demonstrate the

potential for heap leaching nickel sulphide ores which would reduce

the cut-off grade for most mines which currently use crushing,

grinding and flotation to produce a concentrate. The capacity to

process the concentrate on-site will also prove attractive to

smaller producers of concentrate as it allows them to produce

higher value products.

A new project has been started to examine the use of

HyperLeach(R) as a method for recovery of copper from the low-grade

porphyry halos which surround higher grade sulphide deposits. This

work follows on from earlier successful work on flotation

concentrates conducted in both Mongolia and Australia. There has

been increasing interest in the in-situ leaching of metals. The

HyperLeach(R) process has a number of attributes which match well

with those required of an in-situ leaching system. The reagent is

low cost, recyclable at reasonably low cost, operates at low pH and

has a high capacity for metal solubility.

The increasing installation and use of renewable energy at

remote mine sites make HyperLeach(R) increasingly attractive as an

option for on-site value adding. The easy regeneration of the

primary leachant using renewable energy should significantly reduce

the operating costs compared to using conventional energy sources

in remote locations. The potential to produce metal, or other

value-added products at a remote mine site will also be beneficial

by significantly reducing transport costs compared to ore or

concentrates.

The significant R&D JV project to investigate the potential

recovery of vanadium from amenable ores has progressed. John

Webster Innovations Proprietary Limited ("JWI") has undertaken

initial test work focused on Multicom Resources' Saint Elmo

vanadium project in North Queensland, Australia, and we are

awaiting the results.

Australia

Unfortunately, as reported on 29 August 2018, Accudo's plan to

proceed with a DFS on the potential use of our leaching technology

under the existing licence agreement at a copper project in

Australia and which was dependent upon it obtaining financing, has

not happened.

Zambia

Our past reported introducer's agreement with Duard Capital Ltd.

("Duard") for the potential introduction of commercial

opportunities for Alexanders' leaching technologies in Zambia

continues to be active on highly prospective junior projects for

the potential recovery of copper and cobalt using mobile or

semi-mobile containerised plants.

New opportunities

As well as actively working on the commercialisation of our

leaching technologies, given the mining industry background of the

Company's directors and senior employees, we continue to

aggressively investigate and develop a range of potentially

complementary corporate investment opportunities in the mining

sector.

Outlook

All of the above continues to offer shareholders and potential

investors strong fundamentals in the Alexander business and in the

progressive project developments we are engaged in.

The Board remains firmly focused in executing its clearly

defined business plan at all levels and levering the background and

networks of the Company's directors and senior employees. We are

also actively reviewing and submitting commercial proposals on

several complementary opportunities of interest in the mining

sector. However, we continue to remain prudent with regards to the

deployment of the Company's cash.

As usual, I would like to thank you, Alexander's valued

shareholders, for your continuing support and our employees,

directors, consultants and advisers for their continued commitment

for the value filled future we are targeting ahead.

Alan M. Clegg

Non-Executive Chairman

28 September 2018

For further information, please contact:

Martin Rosser

Chief Executive

Mobile: +44 (0) 7770 865 341

Alexander Mining plc

Tel: +44 (0) 20 7078 9566

Email: mail@alexandermining.com

Website: www.alexandermining.com

Northland Capital Partners Limited

Matthew Johnson / Dugald J Carlean

(Corporate Finance)

Isabella Pierre (Corporate Broking)

Tel: +44 (0) 20 3861 6625

Turner Pope Investments (TPI)

Ltd

Andy Thacker

+44 (0) 20 3621 4120

Consolidated income statement

Six months Six months Year ended

ended 30 ended 30 31 December

June 2018 June 2017 2017

GBP'000 GBP'000 GBP'000

--------------------------------------- ----------- ----------- -------------

Continuing operations

Revenue - - -

Cost of sales - - -

--------------------------------------- ----------- ----------- -------------

Gross profit - - -

Administrative expenses (174) (196) (329)

Research and development expenses (103) (65) (101)

Operating loss (277) (261) (430)

Finance income 1 - -

Finance cost - - -

--------------------------------------- ----------- ----------- -------------

Loss before taxation (276) (261) (430)

Income tax expense - - -

--------------------------------------- ----------- ----------- -------------

Loss for the period from continuing

operations (276) (261) (430)

Loss for the period from discontinued

operations - - -

--------------------------------------- ----------- ----------- -------------

Loss for the period (276) (261) (430)

--------------------------------------- ----------- ----------- -------------

Basic and diluted (loss) per share

(pence)

from continuing operations: (0.01) p (0.02) p (0.03) p

All components of profit or loss are attributable to equity

holders of the parent.

Consolidated statement of comprehensive income

Six months Six months Year ended

ended 30 ended 30 31 December

June 2018 June 2017 2017

GBP'000 GBP'000 GBP'000

---------------------------------------- ----------- ----------- -------------

Loss for the period (276) (261) (430)

Other comprehensive income: - - -

Total comprehensive loss for the

period attributable to equity holders

of the parent (276) (261) (430)

---------------------------------------- ----------- ----------- -------------

Consolidated balance sheet

As at 30 As at 30 As at

June 2018 June 2017 31 December

2017

GBP'000 GBP'000 GBP'000

------------------------------- ----------- ----------- -------------

Assets

Property, plant & equipment - - -

Total non-current assets - - -

------------------------------- ----------- ----------- -------------

Trade and other receivables 33 36 37

Cash and cash equivalents 662 672 995

------------------------------- ----------- ----------- -------------

Total current assets 695 708 1,032

------------------------------- ----------- ----------- -------------

Total assets 695 708 1,032

------------------------------- ----------- ----------- -------------

Equity attributable to owners

of the parent

Issued share capital 15,352 14,951 15,352

Share premium 14,044 13,932 14,044

Translation reserve - - -

Accumulated losses (29,125) (28,749) (28,866)

------------------------------- ----------- ----------- -------------

Total equity 271 (134) (530)

------------------------------- ----------- ----------- -------------

Liabilities

Current liabilities

Trade and other payables 424 574 502

Provisions - - -

------------------------------- ----------- ----------- -------------

Total current liabilities 424 574 502

Total liabilities 424 574 502

------------------------------- ----------- ----------- -------------

Total equity and liabilities 695 708 1,032

------------------------------- ----------- ----------- -------------

Consolidated statement of cash flows

Six months Six months Year ended

ended 30 ended 30 31 December

June 2018 June 2017 2017

GBP'000 GBP'000 GBP'000

---------------------------------------- ----------- ----------- -------------

Cash flows from operating activities

Operating loss - continuing operations (277) (261) (430)

(Increase) / decrease in trade

and other receivables 4 2 2

Increase / (decrease) in trade

and other payables (78) (50) (121)

Share option & Warrant charge 17 12 21

Net cash outflow from operating

activities (334) (297) (528)

---------------------------------------- ----------- ----------- -------------

Cash flows from investing activities

Interest received 1 - -

Net cash inflow from investing 1 -

activities -

---------------------------------------- ----------- ----------- -------------

Cash flows from financing activities

Proceeds from the issue of share

capital - 710 1,264

Proceeds from issue of share options - - -

---------------------------------------- ----------- ----------- -------------

Net cash inflow from financing

activities - 710 1,264

---------------------------------------- ----------- ----------- -------------

Net increase / (decrease) in cash

and cash equivalents (333) 413 736

Cash and cash equivalents at beginning

of period 995 259 259

Exchange differences - - -

---------------------------------------- ----------- ----------- -------------

Cash and cash equivalents at end

of period 662 672 995

---------------------------------------- ----------- ----------- -------------

Consolidated statement of changes in equity

Share Share premium Shares Translation Accumulated Total

capital to be reserve losses equity

issued

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January

2017 14,404 13,772 - - (28,501) (325)

------------------------ ---------------- -------------- -------- ------------ ------------ --------

Accumulated loss

for period - - - - (261) (261)

Total comprehensive

loss for the

period attributable

to equity holders

of the parent - - - - (261) (261)

---------------- -------------- -------- ------------ ------------

Share option

costs - - - - 13 13

Shares issued 547 214 - - - 761

Share issue costs (54) (54)

At 30 June 2017 14,951 13,932 - - (28,749) 134

------------------------ ---------------- -------------- -------- ------------ ------------ --------

Accumulated loss

for period - - - - (169) (169)

Total comprehensive

loss for the

period attributable

to equity holders

of the parent - - - - (169) (169)

------------------------ ---------------- -------------- -------- ------------ ------------ --------

Share option

and Warrant costs - - - - 8 8

Shares issued 401 158 - - 44 603

Share issue costs (46) (46)

At 31 December

2017 15,352 14,044 - - (28,866) 530

------------------------ ---------------- -------------- -------- ------------ ------------ --------

Accumulated loss

for period - - - - (276) (276)

Translation Difference - -

---------------- -------------- -------- ------------ ------------

Total comprehensive

loss for the

period attributable

to equity holders

of the parent - - - - (276) (276)

------------------------ ---------------- -------------- -------- ------------ ------------ --------

Share option

and Warrant costs - - - - 17 17

Shares issued - - - - - -

Share issue costs - - - - - -

At 30 June 2018 15,352 14,044 - - 29,125 271

------------------------ ---------------- -------------- -------- ------------ ------------ --------

Notes to the interim financial information

1. Basis of preparation

The interim financial information has been prepared in

accordance with International Financial Reporting Standards

("IFRSs") in force at the reporting date and their interpretations

issued by the International Accounting Standards Board ("IASB") as

adopted for use within the European Union. The accounting policies,

methods of computation and presentation used in the preparation of

the interim financial information are the same as those used in the

Group's audited financial statements for the year ended 31 December

2017.

The financial information in this statement does not constitute

full statutory accounts within the meaning of Section 434 of the

Companies Act 2006. The financial information for the six months

ended 30 June 2018 and 30 June 2017 is unaudited. The comparative

information for the year ended 31 December 2017 was derived from

the Group's audited financial statements for that period as filed

with the Registrar of Companies. It does not constitute the

financial statements for that period. Those financial statements

received an unqualified audit report, but contained a material

uncertainty related to going concern.

Going Concern

In common with many mining, exploration and intellectual

property development companies, the Company has raised finance for

its activities in discrete tranches to finance its activities for

limited periods. At 30 June 2018 the Company had a cash position of

GBP662,043. The cash flow forecasts prepared by the directors

indicate that the Company should be able to cover its operating

costs for a twelve months period, however the minimal headroom in

the forecast together with the uncertainty surrounding the Group's

ability to generate positive operating cash flows indicates a

significant risk relating to going concern. It is currently

anticipated that further funding will be required in the next

twelve months.

On this basis, the directors have concluded that it is

appropriate to draw up the interim financial information on the

going concern basis. However, there can be no certainty that the

Group will generate positive operating cash flows or further

funding. This indicates the existence of a material uncertainty

that may cast significant doubt on the ability of the Company and

the Group to continue as a going concern and therefore, that it may

be unable to realise its assets and discharge its liabilities in

the normal course of business. The interim financial information do

not include the adjustments that would result if the Company and

Group were unable to continue as a going concern.

2. Loss per share

The calculation of loss per share is based on the weighted

average number of shares in issue in the six months to 30 June 2018

of 1,888,730,149 (six months to 30 June 2017: 1,161,843,581 and

year to 31 December 2017: 1,615,533,388) and computed on the

respective loss figures as follows:

6 months 2018 6 Months 2017 Full year 2017

GBP'000 Per share GBP'000 Per share GBP'000 Per share

(Loss) - continuing operations (276) (0.01)p (261) (0.02)p (430) (0.03)p

There is no difference between the diluted loss per share and

the basic loss per share presented. Share options granted to

employees, consultants and directors could potentially dilute basic

earnings per share in the future, but were not included in the

calculation of diluted earnings per share as they were

anti-dilutive for the period presented.

At 30 June 2018, there were 150,200,000 (at 30 June 2017:

56,200,000; at 31 December 2017: 56,200,000) share options in issue

that could have a potentially dilutive effect on the basic earnings

per share in the future.

At 30 June 2018, there were 282,359,373 (at 30 June 2017:

42,359,373; at 31 December 2017: 282,359,373) share warrants in

issue that could have a potentially dilutive effect on the basic

earnings per share in the future.

3. Share Capital

Changes in issued share capital and share premium during the

reporting period occurred as follows:

Ordinary shares Number of shares Share Share

capital premium

Balance at 1 January 2018 1,888,730,149 1,888,730,149 14,044,441

Balance at 30 June 2018 1,888,730,149 1,888,730 14,044,441

========================== ================ ============== ==========

Deferred shares Deferred share

Number of shares capital

Balance at 1 January 2018 135,986,542 13,462,667

-------------------------- ---------------- --------------

Balance at 30 June 2018 135,986,542 13,462,667

========================== ================ ==============

4. Share options and Warrants

All Share Option costs incurred are allocated to Accumulated

Losses.

The Company had a total of 150,200,000 Share Options in issue

during the period (12,900,000 with exercise prices of 4.92p per

share, 43,300,000 with and exercise price of 0.22p per share and

94,000,000 with an exercise price of 0.15p per share), representing

6.47 per cent of the issued share capital of the Company on a fully

diluted basis. Share option charges for the six months to 30 June

2017 amounted to GBP10,005 (2017: GBP8,265).

The Company had a total of 47,359,375 warrants in issue during

the period for the provision of Broker services (7,359,375 with an

exercise price of 0.4p per share, 40,000,000 with an exercise price

of 0.15p per share. Warrant charges for the six months to 30 June

2018 amounted to GBP6,834 (2017: GBP3,546).

The Company had a total of 34,999,998 warrants in issue during

the period granted to subscribers of the 2 October 2015 placing

with an exercise price of 0.45 pence per share. No charge was made

to equity for the six months ending 30 June 2018 (2017:

GBP1,677).

The Company had a total of 200,000,000 warrants in issue during

the period granted to subscribers of the 22 November 2017 placing

with an exercise price of 0.225 pence per share.

5. Post balance sheet events:

On 31 July 2018, Alexander announced that it had approved the

grant of 4,000,000 new share options ("New Share Options") at an

exercise price of 0.15 pence ("Exercise Price") to an important

consultant to the Company.

Copies of these announcements are available to view on the

Company's website at www.alexandermining.com.

Disclaimers

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

This news release contains forward looking or future-oriented

financial information, being information, which is not historical

fact, including, without limitation, statements regarding potential

results of metallurgical testwork, anticipated applications for the

Company's intellectual property and discussions of future plans and

objectives. Although the Company believes that the expectations

reflected by such information are reasonable, these statements are

based on assumptions and factors concerning future events that may

prove to be inaccurate. Such statements are necessarily based upon

a number of estimates and assumptions based on information

available to the Company about itself and the business in which it

operates. Information used in developing forward-looking

information has been acquired from various sources including third

party consultants, suppliers, regulators and other sources and is

subject to numerous risks and uncertainties that could cause actual

results and future events to differ materially from those

anticipated or projected. Important factors that could cause actual

results to differ materially from the Company's expectations are

the continuing availability of capital resources to fund the

commercialisation of Alexander's technologies; continued positive

results from trials and applications of Alexander's AmmLeach(R) and

HyperLeach(R) technologies and other factors as disclosed in

Company documents filed from time to time. Management uses

forward-looking statements because it believes they provide useful

information to the shareholders with respect to proposed

transactions involving Alexander, and cautions readers that the

information may not be appropriate for other purposes and should

not be read as guarantees of future performance or results. The

Company disclaims any intention or obligation to revise or update

such statements unless required by law.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BDGDCIUDBGII

(END) Dow Jones Newswires

September 28, 2018 09:02 ET (13:02 GMT)

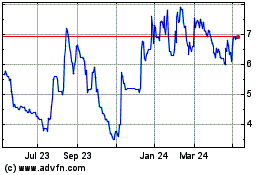

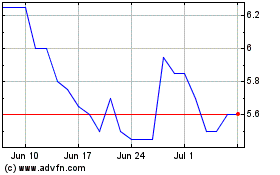

Eenergy (LSE:EAAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eenergy (LSE:EAAS)

Historical Stock Chart

From Apr 2023 to Apr 2024