TIDMCRS

RNS Number : 6601M

Crystal Amber Fund Limited

25 January 2021

25 January 2021

CRYSTAL AMBER FUND LIMITED

("Crystal Amber Fund" or the "Fund")

Monthly Net Asset Value

Crystal Amber Fund announces that its unaudited net asset value

("NAV") per share at 31 December 2020 was 128.99 pence (30 Nov

2020: 133.96 pence per share).

The proportion of the Fund's NAV at 31 December 2020 represented

by the ten largest shareholdings, other investments and cash

(including accruals), was as follows:

Ten largest shareholdings Pence per share Percentage of investee equity

held

------------------------------------ ---------------- ------------------------------

**De La Rue plc 58.6 15.1%

**Allied Minds plc 19.1 20.5%

Equals Group plc 15.2 25.7%

*GI Dynamics Inc. 14.0 *

Hurricane Energy plc 6.6 11.2%

*Board Intelligence Ltd 4.6 *

Sutton Harbour Group plc 3.0 10.8%

**Camellia plc 2.5 1.1%

**Kenmare Resources plc 2.0 0.5%

*Leaf Clean Energy Co 1.6 *

Total of ten largest shareholdings 127.2

Other investments 5.4

Loan Facility -3.8

Cash and accruals 0.2

------------------------------------ ----------------

Total NAV 129.0

------------------------------------ ----------------

*Board Intelligence Ltd, GI Dynamics Inc. and Leaf Clean Energy

Co are private companies and their shares are not listed on a stock

exchange. Therefore, the percentage held is not disclosed.

**Within the percentage of investee company held in Allied Minds

plc and De La Rue plc, contracts for difference were held amounting

to 3.0% and 2.1%, respectively, of such holdings. The holdings in

Camellia plc and Kenmare Resources plc are held on contracts for

difference.

Investment Adviser's commentary on the portfolio

Over the quarter to 31 December 2020, NAV per share grew by

20.0%.

The top three positive contributors to NAV over the quarter to

31 December 2020 were De La Rue plc (11.8%), GI Dynamics Inc (4.8%)

and Equals Group plc (2.1%). Top detractors were Hurricane Energy

plc (-2.5%) and Allied Minds plc (-1.8%).

De La Rue plc ("De la Rue")

During the quarter, De La Rue released interim results for the

six months to 30 September 2020. The company's turnaround plan is

proceeding well. The Fund continues to believe that De La Rue

enjoys a combination of strong competitive positions in high return

businesses and attractive growth opportunities. It holds a 30%

market share of global commercial banknote printing, which enables

the Currency division to accelerate and fully capitalise on the

structural shift towards polymer notes. The higher margin

Authentication division is forecasted to generate revenues for the

year to March 2022 of GBP100 million as against GBP68.5 million for

the year to March 2020.

The Fund believes that De La Rue's current equity valuation of

11 times calendar 2021 forecast earnings does not reflect either

its growth prospects or its operational upside. The Fund also

believes that its strategic value is considerably in excess of its

current market capitalisation.

Over the period, the De La Rue share price increased by

29.2%.

Allied Minds plc ("Allied Minds")

Following its initial investment in the fourth quarter of 2018,

the Fund focused on securing a major reduction in the excessive

parent company costs of Allied Minds: ongoing HQ expenses were

running at an estimated US$17-20 million at the time. These have

now been reduced to approximately $5.75 million per annum. In

response to concerted pressure exerted by the Fund, Allied Minds

ended its extraordinary practice of paying management 10% of gains

arising from any successful individual investment, without taking

account of the losses incurred on other investments in the

portfolio (the "Phantom Plan").

In October 2020, Allied Minds released its interim results and

referred to the "underlying strength of the portfolio". Spin Memory

was described as "the preeminent MRAM IP provider [...]

transforming the semiconductor industry". Reassuringly, it was

stated that "Spin Memory has made significant progress against its

key operational objectives since its last funding round". Allied

Minds'43% shareholding in Spin Memory, based on that last funding

round, was valued at $77 million. This compares with its $44

million cash cost since 2006. In July 2020, Allied Minds invested a

further $4 million into Spin Memory. Spin Memory's carrying value

therefore comprised around 35% of net asset value. After 15 years,

Spin Memory remains a "pre-revenue" business.

Following this update, the Fund held detailed discussions with

the board of Allied Minds and expressed its concerns.

On 4 January 2021, Allied Minds announced that due to COVID-19,

the required testing of Spin Memory's chip had been delayed for

nearly nine months, that this delay had affected Spin Memory's

ability to secure new customers and that as a result, this, coupled

with an unexpected loss of a government bid in late Q4 2020, Spin

Memory is now facing liquidity issues. The contemplated funding

round is expected to be at a far lower valuation than its carrying

value.

On 15 January 2021, Allied Minds announced that its Chief

Executive had "decided to step down from the board with immediate

effect." Going forward, the portfolio will be managed by the three

non-executive directors. The Fund welcomes the streamlined

management of the portfolio, in which three companies comprise more

than 90% of the latest reported carrying value.

The Fund notes that the current 28p share price compares with an

estimated 26p per share carrying value of the 36.6% holding in

Federated Wireless together with parent company cash of 6p per

share. Holdings in BridgeComm, Orbital Sidekicks, TableUp and Spark

Insights are together valued at 12p per share. Whilst there is

uncertainty as to the current value of the Spin Memory holding, the

Fund estimates that at least 5p per share could be achievable.

Overall, therefore, to trade at the Fund's estimated net asset

value of Allied Minds, the share price would have to increase by

75%.

The Fund expects the Allied Minds board to proactively seek to

realise the inherent value of the portfolio in a timely manner and

return proceeds to shareholders. It should be open to any structure

that could achieve this objective including, if considered

appropriate, reversing Federated Wireless into a Special Purpose

Acquisition Vehicle (SPAC).

Over the period, the share price of Allied Minds declined by

10%.

Hurricane Energy plc ("Hurricane")

During the quarter, Hurricane maintained guidance of producing

average daily production of between 12,000 and 14,000 barrels a day

for the period from September to December 2020. Earlier this month,

the company confirmed that it had achieved average daily production

of 12,500 barrels per day. The Fund believes that production uptime

of 98% is impressive. Partially reflecting the recent sharp

recovery in crude oil prices, Hurricane reported cash at 31

December of $106 million, an increase of $19 million from a month

earlier.

From the Fund's detailed engagement, it is clear that the board

of Hurricane does not seem to be focusing on the upside potential

of the fractured basement play within Hurricane's licences. It is

unclear why Hurricane is not keen to tie back the existing Lincoln

Crestal well which was reported to have tested at a sustained

commercial rate. Production from Lincoln could significantly

increase overall output with minimal pressure drawdown at

Lancaster. The Fund is unconvinced that investment in water

injection at Lancaster will stabilise pressure decline in the

reservoir and increase recovery. The Lancaster basement play may

contain resources greatly in excess of the pool currently being

developed by the Early Production System at Lancaster. The Fund

believes a farm-out ought to provide the optimum mechanism to both

fully access and maximise the value of Hurricane's substantial

assets.

Over the period, the Hurricane share price declined by

30.7%.

GI Dynamics Inc ("GI Dynamics")

The company had a successful inspector audit in November 2020

and continues to make progress toward gaining regulatory approval

to commercialize in Europe.

The Fund is delighted that Joseph Virgilio was appointed the

company's CEO in November 2020.

Transactions in Own Shares

Over the quarter to 31 December 2020, the Fund bought back

6,149,567 of its own ordinary shares at an average price of 82.61p

per share as part of its buyback programme.

The buyback contributed 2.9% to NAV per share growth.

Interim dividend declaration

On 23 December 2020, the Fund announced the declaration of an

interim dividend of 2.5 pence per share in respect of the financial

year ending 30 June 2021. This dividend will be payable, to

shareholders on the register as at 8 January 2021, on or around 5

February 2021.

For further enquiries please contact:

Crystal Amber Fund Limited

Chris Waldron (Chairman)

Tel: 01481 742 742

www.crystalamber.com

Allenby Capital Limited - Nominated Adviser

David Worlidge/Liz Kirchner

Tel: 020 3328 5656

Winterflood Investment Trusts - Broker

Joe Winkley/Neil Langford

Tel: 020 3100 0160

Crystal Amber Advisers (UK) LLP - Investment Adviser

Richard Bernstein

Tel: 020 7478 9080

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVUURNRARUAUAR

(END) Dow Jones Newswires

January 25, 2021 02:00 ET (07:00 GMT)

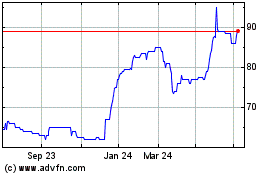

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

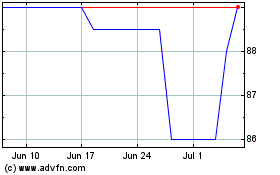

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Apr 2023 to Apr 2024