TIDMCNS

RNS Number : 2863J

Corero Network Security PLC

26 April 2022

26 April 2022

Corero Network Security plc (AIM: CNS)

("Corero," the "Company" or the "Group")

Full year results

Record performance, strong customer traction and maiden

profit

Corero Network Security plc (AIM: CNS), a leading provider of

real-time high-performance, automatic Distributed Denial of Service

("DDoS") cyber defense solutions, announces its audited results for

the year ended 31 December 2021.

Financial Highlights:

-- Strong revenue growth in the period:

o Revenues increased 24% to $20.9 million (2020: $16.9

million)

o Annualised Recurring Revenues(1) ("ARR") up 31% to $12.8

million as at 1 January 2022 (1 January 2021: $9.8 million)

o Revenue from DDoS Protection-as-a Service (DDPaaS) contracts

increased to $4.0 million (2020: $2.9 million)

-- Gross margins of 85% (2020: 77%)

-- EBITDA(2) of $4.0 million (2020: EBITDA loss of $1.4 million)

- a transformation of $5.4 million

-- Adjusted EBITDA(3) of $4.1 million (2020: loss of $0.6 million)

-- Profit before taxation of $1.4 million (2020: loss before taxation of $4.0 million)

-- Earnings and diluted earnings per share of 0.3 cents (2020: loss per share of 0.8 cents)

-- Net cash(4) at 31 December 2021 of $8.4 million (2020: $7.6 million)

Operational Highlights:

-- Significant financial and operational progress, leveraging

sales and marketing initiatives alongside established Strategic

Alliances and Channel Partners

-- Secured 44 new customers in the period (2020: 42 customers),

adding six new countries - Corero now active with customers across

47 countries worldwide

o 18 new customers added through Corero's strategic partnership

with Juniper Networks (2020: 17 new customers)

-- Strong growth supported by an expanding DDoS mitigation

marketplace , which continues to be fueled by the acceleration of

digitisation and the ongoing need for business continuity

-- ARR increased to $12.8 million, underpinning future earnings

growth and reinforcing the importance of Corero's solutions for our

customers

-- The Group continues to prioritise its market coverage, and

remains committed to ongoing investment across its technology

platform and teams' expansion to strengthen its market-leading

position

Outlook

-- Demand for DDoS mitigation continues to drive record level of

activity and pipeline and ongoing new-business momentum, as

reflected in both profit and ARR growth

-- Corero has enhanced its growth pillars to deliver sustainable

growth, namely market reach, operations, technology and financial

performance

-- The Group has very limited exposure to Russia and Ukraine

both operationally and from a revenue generation perspective, and

therefore expects the conflict to have little direct impact on

Corero

-- The Board is therefore confident in Corero's medium- to long-term growth prospects

Lionel Chmilewsky, Chief Executive Officer of Corero,

commented:

"I am delighted to be presenting an outstanding set of financial

results including new financial and customers traction. This is

testament to our customers appreciation of our solutions and

services, our talented people and know-how and our market-leading

solutions.

We have secured 44 new customers in 2021 and have, in parallel,

significantly strengthened the relationship and level of activity

with our strategic alliances and channel partners.

The expansion of our portfolio with the addition of our Edge

Threat Defense solution has also increased our addressable

market.

We have exited 2021 with a strong new international business

pipeline, and we continue to significantly invest in our Sales and

Marketing resources and capabilities to strengthen our market reach

and penetration.

I feel confident that our strategy and recent achievements will

allow us to deliver sustainable growth for our business in the mid

and long term.

(1) Defined as the normalised annualised recurring revenue and

includes recurring revenues from contract values of annual support,

software subscription and from DDoS Protection-as-a-Service

contracts.

(2) Defined as Earnings before Interest, Taxation, Depreciation and Amortisation.

(3) Defined as Earnings before Interest, Taxation, Depreciation

(including DDPaaS assets' depreciation which is charged to cost of

sales) and Amortisation, before share-based payments, and less

unrealised foreign exchange differences on an intercompany loan,

and PPPL forgiveness - Fully adjusted basis.

(4) Defined as cash at bank less debt.

The information contained within this announcement was deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014, as amended by regulation 11 of the

Market Abuse (Amendment) (EU Exit) Regulations 2019/310, prior to

release of this announcement. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Enquiries:

Corero Network Security plc

Lionel Chmilewsky, Chief Executive Officer Tel: +44(0) 1494 590

Neil Pritchard, Chief Financial Officer 404

C anaccord Genuity Limited Tel: +44(0) 20 7523

(Nominated Adviser and Broker) 8000

Simon Bridges / Andrew Potts

Vigo Consulting Tel: +44(0) 20 7390

0230

Jeremy Garcia / Kendall Hill

corero@vigoconsulting.com

About Corero Network Security

Corero Network Security plc is a global leader in real-time,

high-performance, automatic DDoS cyber defense solutions. Both

Service and Hosting providers, alongside digital enterprises across

the globe rely on Corero's award winning cybersecurity technology

to eliminate the threat of Distributed Denial of Service (DDoS) to

their digital environment through automatic attack detection and

mitigation, coupled with network visibility, analytics and

reporting. Corero's industry leading SmartWall and SecureWatch

technology provides scalable protection capabilities against

external DDoS attackers and internal DDoS botnets in the most

complex edge and subscriber environments, while enabling a more

cost-effective economic model than previously available. Corero's

key operational centers located in Marlborough, Massachusetts, USA

and Edinburgh, UK, with the Company's headquartered in Amersham,

UK. The Company is also listed on the London Stock Exchange's AIM

market under the ticker CNS. For more information, visit

www.corero.com .

CHIEF EXECUTIVE'S STRATEGIC UPDATE AND OPERATIONAL REVIEW

Introduction

2021 was an extremely productive year for Corero, culminating in

the Group reporting a maiden profit before tax for the year ended

31 December 2021 of $ 1.4 million (2020: loss of $4.0 million). The

strong performance reflects the successful implementation of our

growth strategy, with the Group delivering continued sales momentum

across our operational footprint. We improved against all financial

KPIs in the year, achieving positive EBITDA ahead of market

expectations at $ 4.0 million (2020: negative EBITDA of $1.4

million).

In addition, and reflecting the ongoing demand for our products,

the Company increased revenues by 24% to $20.9 million in 2021

(2020: $16.9 million).

Corero also increased Annualised Recurring Revenues ("ARR")

during the year to $ 12.8 million as at 1 January 2022 (ARR at 1

January 2021: $9.8 million), which is a strategically important KPI

as it provides visibility and an underpin for future earnings.

This record performance, driven by our highly talented and

dedicated workforce, was achieved despite the ongoing backdrop of

the Covid-19 pandemic as well as the well documented global supply

chain challenges, which are also creating both opportunities and

challenges across our business.

The Board of Directors believes that Corero now has the

financial and operational platform from which to generate future

sustainable growth, with the Company's:

-- access to large and high growth end markets;

-- strong performance of its market-leading technology and global customer service;

-- proprietary intellectual property that underpins its solutions;

-- highly scalable revenue model alongside its relatively short

time to market for development; and

-- strong base of existing customers and strategic partnerships.

Strategic Progress

We made significant operational and financial progress in 2021,

placing our customers at the heart of everything that we do, as

well as leveraging our routes to market to ultimately grow market

share.

Key strategic progress included:

-- Increasing our international presence: during 2021, we

secured 44 new customers, adding customers in six new countries,

with customers in fifteen new countries added over the last two

years. Our solutions are now deployed with customers across 47

countries worldwide and across the continents.

-- Leveraging our existing strategic partnerships and developing

new ones: 18 customers were added through our partnership with

Juniper in the year and we continue to grow our business with GTT.

Furthermore, we made progress in 2021 towards the addition of new

and complementary alliances.

-- Intensifying our relationships with global, major and tier

one accounts: expanding with large existing customers and adding

new ones, with significant traction continued to be achieved in the

Hosting Providers, Service Providers and SaaS Enterprise

segments.

-- Better monetising our existing services and introducing new

services: we continue to explore and provide service initiatives

that enhance the protection and network security visibility for our

customers.

-- Amplifying our demand generation programmes: increased

advertising and marketing efforts have included thought leadership

pieces, webinar and other speaking opportunities and segment

targeted campaigns.

-- Continuing to increase our technological innovation

leadership: since the start of 2013 we have invested over $33

million to-date in R&D, and in 2021 we introduced 100G adoption

enablement, multi-tbps provider edge and flow detect and redirect

to deliver the widest portfolio of on-premises, and indeed other

solutions for our customers; an offering unrivalled by our

competitors.

DDoS Market Dynamics

DDoS attacks continue to be prevalent as a means of

cyber-attack, as camouflage for a ransomware attack and even with

Ransom-driven attacks.

The global DDoS protection market was worth c.$3.4 billion in

2021 and is expected to reach $6.8 billion by 2026 at a CAGR of

15.1%. Within this, c.$1.5 billion is the total addressable market

for Corero's SmartWall solution, with c.$715 million representing

our serviceable addressable market. To quantify this, there were

nearly 30,000 daily DDoS attacks recorded in the first half of

2021, a doubling in 24 months.

The DDoS mitigation marketplace continues to grow apace as a

result of the global acceleration of digitalisation and the growing

need for enterprises to ensure business continuity. This is set to

continue with the ongoing proliferation of IoT devices and the

roll-out of 5G networks and the increase in cloud services creating

a large expansion opportunity for Corero.

Financial Summary

The Group delivered a profit primarily due to increased revenues

coupled with ongoing margin improvement and maintained operating

expenses.

The Group generated revenues of $20.9 million in 2021 (2020:

$16.9 million), with total operating expenses at a similar level

before share-based payments of $ 16.1 million (2020: $16.4 million)

while continuing to invest in sales and marketing expansion and

R&D efforts.

-- Operating expenses net of capitalised R&D costs and

before depreciation and amortisation of intangible assets and

before share-based payments were $ 13.9 million (2020: $14.1

million). Capitalised R&D costs were $ 1.8 million (2020: $1.4

million)

-- Operating expenses include a foreign exchange gain of $ 0.2

million (2020: foreign exchange loss of $0.3 million)

-- Depreciation and amortisation of intangible assets was

slightly lower at $ 2.2 million (2020: $2.3 million)

-- The Company received a $0.6 million credit from the

forgiveness of the PPP loan previously received by its US trading

subsidiary in 2020 under the US CARES Act (2020: no credit

received).

The Company delivered its maiden positive EBITDA performance of

$ 4.0 million (2020: negative EBITDA of $1.4 million), a

transformation of $5.4 million, and Adjusted EBITDA of positive $

4.1 million (2020: negative EBITDA of $0.6 million).

In addition, Corero has achieved its maiden profit before

taxation of $ 1.4 million (2020: loss before taxation of $4.0

million) including amortisation of capitalised R&D costs of $

1.9 million (2020: $1.9 million). Profit after taxation was $ 1.5

million (2020: loss after taxation of $ 3.8 million), following a

UK R&D tax credit of $0.1 million (2020: two years' equivalent

of R&D tax credits of $0.2 million). The reported earnings per

share was therefore 0.3 cents (2020: loss per share 0.8 cents).

In terms of overall position, Corero held net cash of $8.4

million at 31 December 2021 (31 December 2020: $5.4 million; H1

2020 $3.3 million), comprising:

-- Cash at bank of $11.2 million as at 31 December 2021 (2020: $10.1 million); and,

-- Debt of $ 2.8 million (2020: $2.5 million)

In April 2021, the Company entered into a new banking facility

for up to GBP3.0 million (c.$4.1 million), the net proceeds of

which are being used for working capital purposes and our on-going

investment programme to support our growth strategy ahead.

Outlook

The demand for DDoS mitigation solutions continues to remain

strong in all our key territories and markets. The global

acceleration of hybrid working and internet usage due to the

Covid-19 pandemic, and now with the uncertainty created as a result

of current situation in Ukraine with consequent increased DDoS

attack activity, continues to accelerate these trends and the need

for Corero's solutions.

The Group has minimal exposure to Russia and Ukraine both

operationally and from a revenue generation perspective and

therefore we expect the conflict to have little direct impact on

our business. We also continue to monitor the semiconductor supply

chain shortage closely, and encouragingly there are signs that this

is beginning to abate globally.

2021 was a milestone year for Corero as we achieved our first

profit, supported by strong revenue growth and heightened demand

for our products. The Board of Directors believe that there is

significant scope to build on this success, leveraging our

technologically superior solutions and enhanced customer-centric

sales strategy, which is already yielding results. To this end,

Corero will continue to invest in people, marketing and its

solutions in the current financial year to provide an even wider

and stronger platform for growth for the future.

In summary, Corero has been building and enhancing its

operational and financial platform to deliver sustainable growth

given the market opportunities available to our business. This

gives us confidence in Corero's medium to long-term growth

prospects.

Lionel Chmilewsky

Chief Executive Officer

25 April 2022

Consolidated Income Statement

for the year ended 31 December 2021

Year ended 31 December Year ended 31 December

2021 2020

Continuing operations $'000 $'000

Revenue 20,895 16,877

Cost of sales (3,112) (3,832)

----------------------- -----------------------

Gross profit 17,783 13,045

Operating expenses (16,120) (16,431)

-------------------------------------------------------------------- ----------------------- -----------------------

Consisting of:

Operating expenses before depreciation and amortisation (13,928) (14,114)

Depreciation and amortisation of intangible assets (2,192) (2,317)

-------------------------------------------------------------------- ----------------------- -----------------------

Profit/(loss) from operations 1,663 (3,386)

Share-based payments (522) (359)

----------------------- -----------------------

Operating profit/(loss) 1,141 (3,745)

Other income 637 -

Finance income 1 16

Finance costs (406) (301)

----------------------- -----------------------

Profit/(loss) before taxation 1,373 (4,030)

Taxation credit 149 246

----------------------- -----------------------

Profit/(loss) after taxation 1,522 (3,784)

----------------------- -----------------------

Profit/(loss) after taxation attributable to equity owners of the

parent 1,522 (3,784)

----------------------- -----------------------

Basic and diluted earnings/(loss) per

share

Cents Cents

Basic earnings/(loss) per share 0.3 (0.8)

Diluted earnings/(loss) per share 0.3 (0.8)

----------------------- -----------------------

EBITDA(1) 3,970 (1,428)

Adjusted EBITDA - for DDPaaS depreciation, share based payments, unrealised foreign exchange

differences on intercompany loan and PPPL forgiveness(1) 4,150 (551)

(1) See note 2 for reconciliation.

Consolidated Statement of Comprehensive Income

for the year ended 31 December 2021

Year ended 31 December Year ended 31 December

2021 2020

$'000 $'000

-------------------------------------------------------------------- ----------------------- -----------------------

Profit/(loss) for the year 1,522 (3,784)

Other comprehensive (expense)/income:

-------------------------------------------------------------------- ----------------------- -----------------------

Items reclassified subsequently to profit or loss upon

derecognition:

Foreign exchange differences (122) 216

-------------------------------------------------------------------- ----------------------- -----------------------

Other comprehensive (expense)/income for the period net of taxation

attributable to the equity

owners of the parent (122) 216

-------------------------------------------------------------------- ----------------------- -----------------------

Total comprehensive income/(expense) for the year attributable to

the equity owners of the

parent 1,400 (3,568)

-------------------------------------------------------------------- ----------------------- -----------------------

Consolidated Statement of Financial Position

as at 31 December 2021

As at 31 December As at 31 December

2021 2020

$'000 $'000

Assets

Non-current assets

Goodwill 8,991 8,991

Acquired intangible assets 4 9

Capitalised development expenditure 4,528 4,646

Property, plant and equipment - owned assets 796 1,099

Leased right of use assets 145 237

Trade and other receivables 859 694

15,323 15,676

Current assets

Inventories 57 98

Trade and other receivables 3,206 3,714

Cash and cash equivalents 11,201 10,140

----------------- -----------------

14,464 13,952

----------------- -----------------

Total assets 29,787 29,628

----------------- -----------------

Liabilities

Current Liabilities

Trade and other payables (4,068) (6,461)

Lease liabilities (94) (86)

Deferred income (4,677) (3,444)

Borrowings (1,421) (2,073)

(10,260) (12,064)

Net current assets 4,204 1,888

Non-current liabilities

Trade and other payables (143) (402)

Lease liabilities (78) (171)

Deferred income (2,147) (2,705)

Borrowings (1,356) (405)

----------------- -----------------

(3,724) (3,683)

----------------- -----------------

Net assets 15,803 13,881

----------------- -----------------

Capital and reserves attributable to the equity owners of the parent

Share capital 6,914 6,914

Share premium 82,122 82,122

Capital redemption reserve 7,051 7,051

Share options reserve 1,490 968

Foreign exchange translation reserve (1,506) (1,384)

Accumulated profit and loss reserve (80,268) (81,790)

----------------- -----------------

Total shareholders' equity 15,803 13,881

----------------- -----------------

Consolidated Statement of Cash Flows

for the year ended 31 December 2021

Year ended 31 December Year ended 31 December

2021 2020

Operating activities $'000 $'000

Profit/(loss) before taxation for the year 1,373 (4,030)

Adjustments for movements:

Amortisation of acquired intangible assets 5 6

Amortisation of capitalised development expenditure 1,872 1,933

Depreciation - owned assets 604 514

Depreciation - leased assets 93 119

Finance income (1) (16)

Finance expense 388 274

Finance lease interest costs 18 27

Share based payments expense 522 359

Paycheck Protection Program Loan forgiveness (637) -

Cash generated from/(used) in operating activities before movement in

working capital 4,237 (814)

Movement in working capital:

Decrease in inventories and sales evaluation assets 175 45

(Increase)/decrease in trade and other receivables 223 (1,187)

(Decrease)/increase in trade and other payables (1,999) 6,852

---------------------- ----------------------

Net movement in working capital (1,601) 5,710

Cash generated from operating activities 2,636 4,896

Taxation received 149 246

---------------------- ----------------------

Net cash generated from operating activities 2,785 5,142

Cash flows from investing activities

Purchase of intangible assets - (8)

Investment in development expenditure (1,754) (1,410)

Purchase of property, plant and equipment (421) (1,015)

Net cash used in investing activities (2,175) (2,433)

Cash flows from financing activities

Proceeds from borrowings 2,683 637

Finance income 1 16

Finance expense (238) (206)

Repayments of borrowings (1,738) (1,187)

Lease liability payments (103) (136)

---------------------- ----------------------

Net cash generated from/(used in) financing activities 605 (876)

Increase in cash and cash equivalents 1,215 1,833

---------------------- ----------------------

Effects of exchange rates on cash and cash equivalents (154) (14)

Cash and cash equivalents at 1 January 10,140 8,321

---------------------- ----------------------

Cash and cash equivalents at 31 December 11,201 10,140

---------------------- ----------------------

Consolidated Statement of Changes in Equity

for the year ended 31 December 2021

Total

Foreign Accumulated attributable

Capital Share exchange profit and to equity

Share Share redemption options translation loss owners of

capital premium reserve reserve reserve reserve the parent

$'000 $'000 $'000 $'000 $'000 $'000 $'000

1 January 2020 6,914 82,122 7,051 609 (1,600) (78,006) 17,090

Loss for the year - - - - - (3,784) (3,784)

Other comprehensive income - - - - 216 - 216

-------- -------- ----------- -------- ------------ ------------ -------------

Total comprehensive expense for the year - - - - 216 (3,784) (3,568)

-------- -------- ----------- -------- ------------ ------------ -------------

Contributions by and distributions to owners

Share based payments - - - 359 - - 359

-------- -------- ----------- -------- ------------ ------------ -------------

Total contributions by and distributions to owners - - - 359 - - 359

31 December 2020 and 1 January 2021 6,914 82,122 7,051 968 (1,384) (81,790) 13,881

Profit for the year - - - - - 1,522 1,522

Other comprehensive expense - - - - (122) - (122)

-------- -------- ----------- -------- ------------ ------------ -------------

Total comprehensive income for the year - - - - (122) 1,522 1,400

-------- -------- ----------- -------- ------------ ------------ -------------

Contributions by and distributions to owners

Share based payments - - - 522 - - 522

Total contributions by and distributions to owners - - - 522 - - 522

31 December 2021 6,914 82,122 7,051 1,490 (1,506) (80,268) 15,803

-------- -------- ----------- -------- ------------ ------------ -------------

1. General Information

This results announcement is presented in US Dollars ("$")

rounded to the nearest $'000 unless otherwise stated which

represents the presentation currency of the Group. The average

$-GBP sterling ("GBP") exchange rate, used for the conversion of

the Consolidated Income Statement for the 12 months ended 31

December 2021 was 1.38 (2020: 1.28). The closing $-GBP exchange

rate used for the conversion of the Group's assets and liabilities

at 31 December 2021 was 1.35 (2020: 1.37).

This results announcement has been prepared in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006. The "requirements of the

Companies Act 2006" here means accounts being prepared in

accordance with "international accounting standards" as defined in

section 474(1) of that Act, as it applied immediately before

Implementation Period (IP) completion day (end of transition

period), including where the Company also makes use of standards

which have been adopted for use within the United Kingdom in

accordance with regulation 1(5) of the International Accounting

Standards and European Public Limited Liability Company (Amendment

etc.) (EU Exit) Regulations 2019. The consolidated financial

statements have been prepared under the historical cost

convention.

The financial statements have been prepared on a going concern

basis.

The Directors have prepared detailed income statement, balance

sheet and cash flow projections for the period to 30 April 2023

("going concern assessment period"). The cash flow projections have

been subjected to sensitivity analysis at the revenue, cost and

combined revenue and cost levels under three different scenarios.

The cash flow projections show that the Group and Company will

maintain a positive cash balance through the going concern

assessment period under the base case and all three sensitivity

scenarios. In addition, the projections and sensitivity analyses

confirm that the bank loan covenants will be met during the going

concern assessment period.

The Directors are also not aware of any significant matters in

the remainder of calendar 2023 that occur outside the going concern

period that could reasonably possibly impact the going concern

conclusion.

The Directors continue to carefully monitor the impact of the

COVID-19 pandemic, and its impact on the macroeconomic environment,

on the operations of the Group and have a range of possible

mitigating actions, which could be implemented in the event of a

downturn of the business. However, with COVID-19 driving an

increased requirement for workforces to shift to home working and

heightened concerns relating to digital security and privacy the

Group has benefited from favourable market tailwind.

The Directors have also considered the geo-political

environment, including rising inflation in some of our key markets

and the conflict in Ukraine, and whilst the impact on the Group is

currently deemed minimal, the Directors remain vigilant and ready

to implement mitigation action in the event of a downturn in demand

or an impact on operations.

On this basis, the Directors have therefore concluded that it is

appropriate to prepare the financial statements on a going concern

basis.

The financial information set out above does not constitute the

Company's Annual Report and Accounts for the year ended 31 December

2021. The Annual Report and Accounts for 2020 have been delivered

to the Registrar of Companies and those for 2021 will be delivered

shortly. The auditor's report for the Company's 2021 Annual Report

and Accounts was unqualified and did not contain an emphasis of

matter paragraph nor any statement under Section 498 of the

Companies Act 2006.

Whilst the financial information included in this results

announcement has been prepared in accordance with UK adopted

international accounting standards in conformity with the

requirements of the Companies Act 2006, this announcement does not

itself contain sufficient information to comply with UK adopted

international accounting standards.

The Annual Report and Accounts for the year ended 31 December

2021 are available on the Company's website www.corero.com

/who-we-are/investor-relations .

The information in this results announcement was approved by the

Board on 25 April 2022.

2. Key performance measures

EBITDA and Adjusted EBITDA

Earnings before interest, tax, depreciation, and amortisation

("EBITDA") is defined as earnings from operations before interest,

tax, depreciation, and amortisation charges. The following is a

reconciliation of EBITDA and Adjusted EDITDA for the periods

presented:

Year ended Year

31 December ended 31 December

2021 2020

$'000 $'000

Profit/(loss) before taxation 1,373 (4,030)

Adjustments for:

Finance income (1) (16)

Finance expense 388 274

Finance lease interest costs 18 27

Depreciation - owned assets 222 259

Depreciation - lease liabilities 93 119

Amortisation of acquired intangible

assets 5 6

Amortisation of capitalised

development expenditure 1,872 1,933

------------- -------------------

EBITDA 3,970 (1,428)

Depreciation of DDoS Protection-as-a-Service

assets charged to cost of sales 382 255

Share based payments 522 359

Unrealised foreign exchange

differences on intercompany

loan (87) 263

Other income - PPPL forgiveness (637) -

------------- -------------------

Adjusted EBITDA - for DDPaaS

depreciation, share based payments,

unrealised foreign exchange

differences on intercompany

loan and PPPL forgiveness 4,150 (551)

------------- -------------------

3. Segment reporting and revenue

The Group is managed according to one business unit, Corero

Network Security, which makes up the Group's reportable operating

segment. This business unit forms the basis on which the Group

reports its primary segment information to the Board, which

management consider to be the Chief Operating Decision maker for

the purposes of IFRS 8 Operating Segments.

The Group's revenues from external customers are divided into

the following geographies:

2021 2020

$'000 $'000

The Americas 16,042 10,988

EMEA 2,778 4,323

APAC 2,075 1,278

ROW - 288

Total 20,895 16,877

------- -------

Revenues from external customers are identified by invoicing

systems and adjusted to take into account the difference between

invoiced amounts and deferred revenue adjustments as required by

IFRS accounting standards.

The revenue is analysed for each revenue category as:

2021 2020

$'000 $'000

Software licence and appliance revenue 10,337 8,446

DDoS Protection-as-a-Service revenue 4,025 2,876

Maintenance and support services

revenue 6,533 5,555

Total 20,895 16,877

------- -------

The revenue is analysed by timing of delivery of goods or

services as:

2021 2020

$'000 $'000

Point-in-time delivery 10,337 8,446

Over time 10,558 8,431

Total 20,895 16,877

------- -------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DDGDSLUDDGDU

(END) Dow Jones Newswires

April 26, 2022 02:02 ET (06:02 GMT)

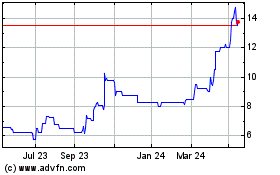

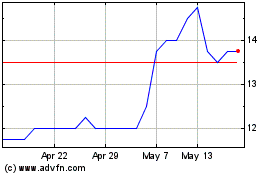

Corero Network Security (LSE:CNS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Corero Network Security (LSE:CNS)

Historical Stock Chart

From Apr 2023 to Apr 2024