City of London Investment Group PLC QUARTERLY FUNDS UNDER MANAGEMENT ("FUM") UPDATE (2678W)

April 16 2019 - 2:00AM

UK Regulatory

TIDMCLIG

RNS Number : 2678W

City of London Investment Group PLC

16 April 2019

City of London Investment Group PLC

16 April 2019

CITY OF LONDON INVESTMENT GROUP PLC

("City of London", "the Group" or "the Company")

INTERIM MANAGEMENT STATEMENT

QUARTERLY FUNDS UNDER MANAGEMENT ("FUM") UPDATE

City of London (LSE: CLIG), a leading specialist asset

management group offering a range of institutional products

investing in closed-end funds, announces that as at 31 March 2019,

FuM were US$5.3 billion (GBP4.1 billion). This compares with US$4.6

billion (GBP3.6 billion) at the Company's half-year on 31 December

2018. A breakdown by strategy follows:

FuM ($mn) Strategy Index

Mar-19 Dec-18 % Net %

(estimate) inc/dec Flows inc/dec

EM 4,180 3,732 12% 45 MSCI EM 10%

DEV 660 495 33% 101 MSCI ACWI 12%

Frontier 201 197 2% - MSCI Frontier 7%

Opportunistic ACWI/Barclays

Value 227 199 14% 7 Global Agg 7%

------

5,268 4,623 153

---------------- ------ ------- -------- ------ --------------- --------

The Emerging Market, Developed and Opportunistic Value

Strategies outperformed due to narrowing discounts and to a lesser

extent, positive NAV performance. The Frontier Strategy

underperformed largely due to unfavourable NAV performance.

During the period under review, the Developed and EM strategies

recorded net inflows of US$101 million and US$45 million,

respectively. Net flows in the Opportunistic Value and Frontier

strategies were essentially flat.

With regard to business development, the Group continues to

maintain an active pipeline across all of its major CEF offerings,

with increased interest continuing to be seen in the non-Emerging

Market CEF strategies (i.e. Developed, Opportunistic Value).

Operations

The Group's income currently accrues at a weighted average rate

of approximately 76 basis points of FuM, net of third party

commissions. "Fixed" costs are cGBP1.1 million per month, and

accordingly the current run-rate for operating profit, before

profit-share of 30% and an estimated EIP charge of 5%, is

approximately GBP1.5 million per month based upon current FuM and a

US$/GBP exchange rate of US$1.3 to GBP1 as at 31 March 2019.

Dividends

An interim dividend of 9 pence per share plus a special dividend

of 13.5 pence per share was paid on 22 March 2019. The Board will

announce the final dividend on Tuesday 16 July 2019 in its

pre-close trading update.

For further information, please visit http://www.citlon.co.uk/

or contact:

Tom Griffith, CEO

City of London Investment Group PLC

Tel: 001-610-380-0435

Martin Green

Zeus Capital Limited

Financial Adviser & Broker

Tel: +44 (0)20 3829 5000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTZMGMDRKVGLZM

(END) Dow Jones Newswires

April 16, 2019 02:00 ET (06:00 GMT)

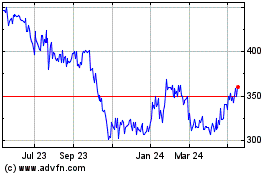

City Of London Investment (LSE:CLIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

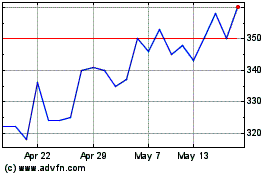

City Of London Investment (LSE:CLIG)

Historical Stock Chart

From Apr 2023 to Apr 2024