TIDMBXP

RNS Number : 9344R

Beximco Pharmaceuticals Ltd

01 November 2023

1 November 2023

This announcement contains inside information as stipulated

under the UK version of the Market Abuse Regulation 596/2014 which

is part of English Law by virtue of the European (Withdrawal) Act

2018, as amended. On publication of this announcement via a

regulatory information service, this information is considered to

be in the public domain.

BEXIMCO PHARMACEUTICALS LIMITED.

Results for the year ended 30 June 2023

Beximco Pharmaceuticals Limited ("Beximco Pharma", "BPL" or "the

Company"; AIM Symbol: BXP, LEI No.: 213800IMBBD6TIOQGB56), the

fast-growing manufacturer of generic pharmaceutical products and

active pharmaceutical ingredients, today announces its audited

results for the year ended 30 June 2023.

Financial Highlights (consolidated)

-- Net sales increased 13.3% to Bangladesh Taka ("BDT")

39,266.7m / GBP288.6m (2021-22: BDT 34,669.2m / GBP309.7m). The

decline in revenue when translated to British Pounds reflects the

significant local currency depreciation over the period

o Domestic sales increased 14.1% to BDT 36,503m/ GBP268.3m

(2021-22: BDT 31,984.1m / GBP285. 8m)

o Export sales increased 2.9% to BDT 2,763.2m / GBP20.3m

(2021-22: BDT 2,685.1m / GBP24.0m)

-- Profit after tax decreased 9.5% to BDT 4,524.5m / GBP33.3m

(2021-22: BDT 4,998.6m / GBP44.7m)

-- EPS for the year amounted to BDT 10.34 (2021-22:BDT 11.48)

-- Recommended 35% cash dividend (BDT 3.5 per share)

-- Absence of non-recurring vaccine distribution fee income in

the reporting period and rising costs driven by significant

depreciation of domestic currency and high inflation impacted

profit despite growth in revenue

Operational Highlights - Continued focus on execution; enhanced

portfolio for domestic and global export markets

-- Launched 14 new generics in 23 different presentations in

Bangladesh, including Mulina (Lefamulin) an anti-infective drug for

the first time

-- Completed 33 new registrations of 19 generics (23

Presentations) in 17 other countries worldwide

-- Received three product approvals from the US FDA

o Eletriptan (an antimigraine drug), Oxybutynin (an

anticholinergic drug), and Nebivolol (a cardiovascular drug)

-- Obtained approvals from the Therapeutic Goods Administration

in Australia for three products

o Bromhexine tablet (a mucolytic), Doxylamine Succinate tablet

(an antihistamine), and Ibuprofen tablet (a non-steroidal

anti-inflammatory drug)

-- Secured Health Canada approval for Ketorolac tablet, a drug used for pain management

-- Earned the National Export Trophy (Gold) for a record seventh time

-- Won the Global Generics & Biosimilars (GGB) Awards 2022

in the category 'Acquisition of the Year'

Post Period Highlights

-- Launched 15 new generics (22 presentations) in the domestic

market in the first quarter, of which 10 were for the first time in

Bangladesh

-- Won National Export Trophy (Gold) for the eighth time

-- Nominated for the Global Generics & Biosimilars Awards

2023 as finalist in the category of "Company of the year, Asia

Pacific."

Beximco Pharma Managing Director Nazmul Hassan MP commented:

"We have once again been able to deliver significant revenue

growth for the financial year, which is a testament to the

underlying strength of the business. Our continued focus on

operational delivery meant that, over the period, we were able to

launch a range of new products, attain notable regulatory approvals

in key markets and continue to deliver high-quality, affordable

medicines to patients around the world. However, macroeconomic

factors resulting in double digit currency depreciation and

inflationary pressures across our supply chain impacted our bottom

line performance. As we begin the current financial year amidst

these headwinds, we continually focus on strategies to address the

challenges and deliver results for our shareholders."

Exchange rates of GBP1 = Taka 111.93 for 2021-22 numbers and

GBP1 = Taka 136.05 for 2022-23 numbers have been used in this

announcement.

For further information please visit www.beximcopharma.com or

enquire to:

Beximco Pharma

Nazmul Hassan MP, Managing Director

Tel: +880 2 586/11001, Ext.20080

S M Rabbur Reza, Chief Operating Officer

Tel: +880 2 58611001, Ext.20111

Mohammad Ali Nawaz, Chief Financial Officer

Tel: +880 2 58611001, Ext.20030

SPARK Advisory Partners Limited (Nominated Adviser)

Mark Brady / Andrew Emmott

Tel: +44 (0) 20 3368 3551 / 3555

SP Angel Corporate Finance LLP (Broker)

Matthew Johnson

Tel: +44 (0) 20 3470 0470

FTI Consulting

Simon Conway / Victoria Foster Mitchell

Tel: +44 (0) 20 3727 1000

Notes to Editors

About Beximco Pharmaceuticals Limited

Beximco Pharma is a leading manufacturer and exporter of

medicines based in Bangladesh. Since its inception in 1976, the

Company remains committed to health and wellbeing of people across

all the continents by providing access to contemporary medicines.

Company's broad portfolio of generics encompasses diverse delivery

systems such as tablets, capsules, liquids, semi-solids,

intravenous fluids, metered dose inhalers, dry powder inhalers,

sterile ophthalmic drops, insulins, prefilled syringes,

injectables, nebuliser solutions, oral soluble films etc. The

Company also undertakes contract manufacturing for multinational

and leading global generic pharmaceutical companies.

Beximco Pharma's state-of-the-art manufacturing facilities are

certified by global regulatory authorities of USA, Europe,

Australia, Canada, GCC and Latin America, among others and it has a

geographic footprint in more than 50 countries. More than 5,500

employees are driving the company towards achieving its aspiration

to be among the most admired companies in the world.

Beximco Pharmaceuticals Limited and its Subsidiaries

Consolidated Statement of Financial Position

As at June 30, 2023

Amount in

Taka

June 30, June 30,

2023 2022

ASSETS

Non-Current Assets 48,280,929,007 47,728,777,460

Property, Plant and Equipment- Carrying

Value 42,245,615,338 41,593,480,364

Right-of-use Assets 562,223,398 618,891,376

Intangible Assets 4,721,034,633 4,729,838,408

Deferred Tax Asset 56,512,081 88,640,228

Goodwill 674,570,185 674,570,185

Other Investments 20,973,372 23,356,899

Current Assets 20,875,854,240 18,419,258,282

Inventories 12,133,277,975 10,405,295,079

Spares & Supplies 819,740,355 718,797,256

Accounts Receivable 3,574,654,461 3,142,817,194

Loans, Advances and Deposits 2,984,876,883 2,787,039,904

Advance Income Tax 227,618,388 196,635,028

Cash and Cash Equivalents 1,135,686,178 1,168,673,821

-------------- ----------------

TOTAL ASSETS 69,156,783,247 66,148,035,742

-------------- ----------------

EQUITY AND LIABILITIES

Equity Attributable to the Owners of

the Company 43,680,703,738 40,600,497,817

Issued Share Capital 4,461,120,890 4,461,120,890

Share Premium 5,269,474,690 5,269,474,690

Excess of Issue Price over Face Value

of GDRs 1,689,636,958 1,689,636,958

Capital Reserve on Merger 294,950,950 294,950,950

Revaluation Surplus 1,141,177,755 1,116,896,688

Unrealized Gain/(Loss) 18,148,196 20,531,723

Retained Earnings 30,806,194,299 27,747,885,918

Non-Controlling Interest 3,938,962,240 4,035,506,641

TOTAL EQUITY 47,619,665,978 44,636,004,458

Non-Current Liabilities 8,272,093,233 8,776,099,208

Long Term Borrowings-Net of Current Maturity 2,550,833,254 3,454,188,843

Liability for Gratuity, Pension and WPPF

& Welfare Funds 3,170,764,435 2,785,072,661

Deferred Tax Liability 2,550,495,544 2,536,837,704

Current Liabilities and Provisions 13,265,024,036 12,735,932,076

Short Term Borrowings 6,621,170,271 6,850,550,319

Long Term Borrowings-Current Maturity 1,439,895,168 2,065,962,471

Creditors and Other Payables 3,531,707,176 2,478,930,393

Accrued Expenses 1,129,699,385 1,152,990,410

Dividend Payable / Unclaimed Dividend 88,465,109 88,049,428

Income Tax Payable 454,086,927 99,449,055

-------------- ----------------

TOTAL EQUITY AND LIABILITIES 69,156,783,247 66,148,035,742

-------------- ----------------

Beximco Pharmaceuticals Limited and its Subsidiaries

Consolidated Statement of Profit or Loss and Other Comprehensive

Income

For the Year ended June 30, 2023

Amount in Taka

July 2022- July 2021-

June 2023 June 2022

Net Revenue 39,266,662,237 34,669,172,052

Cost of Goods Sold (21,953,290,466) (18,848,962,107)

---------------- ----------------

Gross Profit 17,313,371,771 15,820,209,945

---------------- ----------------

Operating Expenses (10,097,131,808) (8,938,466,002)

---------------- ----------------

Administrative Expenses (1,180,124,415) (1,136,591,808)

Selling, Marketing and Distribution

Expenses (8,917,007,393) (7,801,874,194)

---------------- ----------------

Profit from Operations 7,216,239,963 6,881,743,943

Other Income 452,657,744 1,166,259,166

Finance Cost (1,285,698,253) (1,001,835,523)

Profit Before Contribution to

WPPF & Welfare Funds 6,383,199,454 7,046,167,586

Contribution to WPPF & Welfare

Funds (314,430,512) (359,222,585)

---------------- ----------------

Profit Before Tax 6,068,768,942 6,686,945,001

Income Tax Expenses (1,544,300,452) (1,688,316,804)

---------------- ----------------

Current Tax (1,468,598,852) (1,191,180,488)

Deferred Tax Income/ (Expense) (75,701,600) (497,136,316)

---------------- ----------------

Profit After Tax 4,524,468,490 4,998,628,197

Profit/(Loss) Attributable to:

---------------- ----------------

Owners of the Company 4,614,066,147 5,123,136,712

Non-Controlling Interest (89,597,657) (124,508,515)

---------------- ----------------

4,524,468,490 4,998,628,197

Other Comprehensive Income/(Loss) (2,383,527) 6,764,517

---------------- ----------------

Total Comprehensive Income 4,522,084,963 5,005,392,714

Total Comprehensive Income Attributable

to:

---------------- ----------------

Owners of the Company 4,611,682,620 5,129,901,229

Non-Controlling Interest (89,597,657) (124,508,515)

---------------- ----------------

4,522,084,963 5,005,392,714

================ ================

Earnings Per Share (EPS) 10.34 11.48

Beximco Pharmaceuticals Limited and its Subsidiaries

Consolidated Statement of Changes in Equity

For the Year Ended June 30, 2023

As at June 30, 2023

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Share Share Excess Capital Revaluation Unrealized Retained Equity Non- Total

Capital Premium of Issue Reserve Surplus Gain/ Earnings attributable Controlling Equity

Price on Merger (Loss) to Owners Interests

over of the

Face Company

Value

of GDRs

------------- ------------- ------------- ------------- --------------- ----------- ------------------------ --------------- ------------- ---------------

Balance

as on July

01, 2022 4,461,120,890 5,269,474,690 1,689,636,958 294,950,950 1,116,896,688 20,531,723 27,747,885,918 40,600,497,817 4,035,506,641 44,636,004,458

------------- ------------- ------------- ------------- --------------- ----------- ------------------------ --------------- ------------- ---------------

Total Comprehensive Income:

Profit for

the Year - - - - - - 4,614,066,147 4,614,066,147 (89,597,657) 4,524,468,490

------------- ------------- ------------- ------------- --------------- ----------- ------------------------ --------------- ------------- ---------------

Other

Comprehensive

Income/(Loss) - - - - - (2,383,527) - (2,383,527) - (2,383,527)

------------- ------------- ------------- ------------- --------------- ----------- ------------------------ --------------- ------------- ---------------

Transfer

from deferred

tax - - - - 28,647,841 - - 28,647,841 - 28,647,841

------------- ------------- ------------- ------------- --------------- ----------- ------------------------ --------------- ------------- ---------------

Transactions with the Shareholders:

Cash Dividend - - - - - - (1,561,392,312) (1,561,392,312) (6,946,744) (1,568,339,056)

------------- ------------- ------------- ------------- --------------- ----------- ------------------------ --------------- ------------- ---------------

Adjustment

for

Depreciation

on Revalued

Assets - - - - (5,634,546) - 5,634,546 - - -

------------- ------------- ------------- ------------- --------------- ----------- ------------------------ --------------- ------------- ---------------

Adjustment

for Deferred

Tax on

Revalued

Assets - - - - 1,267,772 - - 1,267,772 - 1,267,772

------------- ------------- ------------- ------------- --------------- ----------- ------------------------ --------------- ------------- ---------------

Balance

as on June

30, 2023 4,461,120,890 5,269,474,690 1,689,636,958 294,950,950 1,141,177,755 18,148,196 30,806,194,299 43,680,703,738 3,938,962,240 47,619,665,978

------------- ------------- ------------- ------------- --------------- ----------- ------------------------ --------------- ------------- ---------------

Number of Shares 446,112,089

Net Asset Value (NAV)

Per Share Tk. 97.91

-------------------------------------------- --------------------- ------------- -------------------- ------------------------ --------------- ------------- ---------------

As at June 30, 2022

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------

Share Share Excess Capital Revaluation Unrealized Retained Equity Non- Total

Capital Premium of Issue Reserve Surplus Gain/ Earnings attributable Controlling Equity

Price on (Loss) to Owners Interests

over Merger of the

Face Company

Value

of GDRs

------------- ------------- ------------- ----------- ------------- ---------- --------------- --------------- ------------- ---------------

Balance

as on July

01, 2021 4,461,120,890 5,269,474,690 1,689,636,958 294,950,950 1,121,824,646 13,767,206 24,179,782,862 37,030,558,202 334,306,627 37,364,864,829

------------- ------------- ------------- ----------- ------------- ---------- --------------- --------------- ------------- ---------------

NCI at

the date

of

acquisition-SPP - - - - - - - - 3,857,134,718 3,857,134,718

------------- ------------- ------------- ----------- ------------- ---------- --------------- --------------- ------------- ---------------

Total Comprehensive Income:

Profit for

the Year - - - - - - 5,123,136,712 5,123,136,712 (124,508,515) 4,998,628,197

------------- ------------- ------------- ----------- ------------- ---------- --------------- --------------- ------------- ---------------

Other

Comprehensive

Income/(Loss) - - - - - 6,764,517 - 6,764,517 - 6,764,517

------------- ------------- ------------- ----------- ------------- ---------- --------------- --------------- ------------- ---------------

Transactions with the Shareholders:

Cash Dividend - - - - - - (1,561,392,312) (1,561,392,312) (31,426,189) (1,592,818,501)

------------- ------------- ------------- ----------- ------------- ---------- --------------- --------------- ------------- ---------------

Adjustment

for

Depreciation

on Revalued

Assets - - - - (6,358,656) - 6,358,656 - - -

------------- ------------- ------------- ----------- ------------- ---------- --------------- --------------- ------------- ---------------

Adjustment

for Deferred

Tax on Revalued

Assets - - - - 1,430,698 - - 1,430,698 - 1,430,698

------------- ------------- ------------- ----------- ------------- ---------- --------------- --------------- ------------- ---------------

Balance

as on June

30, 2022 4,461,120,890 5,269,474,690 1,689,636,958 294,950,950 1,116,896,688 20,531,723 27,747,885,918 40,600,497,817 4,035,506,641 44,636,004,458

------------- ------------- ------------- ----------- ------------- ---------- --------------- --------------- ------------- ---------------

Number of Shares 446,112,089

Net Asset Value (NAV)

Per Share Tk. 91.01

---------------------------------------------- ------------- ----------- ------------- ---------- --------------- --------------- ------------- ---------------

Beximco Pharmaceuticals Limited and its Subsidiaries

Consolidated Statement of Cash Flows

For the Year ended June 30, 2023

Amount in Taka

July 2022-June July 2021-

2023 June 2022

Cash Flows from Operating Activities:

---------------- ----------------

Receipts from Customers and Others 39,440,236,428 36,145,521,249

Payments to Suppliers and Employees (30,943,666,211) (28,584,815,294)

---------------- ----------------

Cash Generated from Operations 8,496,570,217 7,560,705,955

Interest Paid (1,272,368,534) (1,002,350,838)

Interest Received 5,529,516 3,055,358

Income Tax Paid (1,144,944,341) (1,347,234,025)

Net Cash Generated from Operating Activities 6,084,786,858 5,214,176,450

Cash Flows from Investing Activities:

---------------- ----------------

Acquisition of Property, Plant and Equipment (2,410,765,411) (2,815,211,828)

Intangible Assets (299,262,244) (124,286,166)

Investment in Subsidiary - (4,766,635,704)

Disposal of Property, Plant and Equipment 23,353,504 24,063,832

Disposal of Intangible Assets 67,725,000 -

Dividend Received 1,931,517 2,015,444

Net Cash Used in Investing Activities (2,617,017,634) (7,680,054,422)

Cash Flows from Financing Activities:

---------------- ----------------

Net Increase /(Decrease) in Long Term

Borrowings (1,763,267,386) 2,730,647,211

Net Increase/(Decrease) in Short Term

Borrowings (229,380,048) 1,507,676,748

Dividend Paid (1,567,923,375) (1,623,098,759)

---------------- ----------------

Net Cash (Used in) / from Financing

Activities (3,560,570,809) 2,615,225,200

Increase/(Decrease) in Cash and Cash

Equivalents (92,801,585) 149,347,228

Cash and Cash Equivalents at Beginning

of Year 1,168,673,821 973,963,625

Effect of Exchange Rate Changes on Cash

and Cash Equivalents 59,813,942 45,362,968

---------------- ----------------

Cash and Cash Equivalents at End of

Year 1,135,686,178 1,168,673,821

Net Operating Cash Flows Per Share 13.64 11.69

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FLFSDIILLVIV

(END) Dow Jones Newswires

November 01, 2023 03:00 ET (07:00 GMT)

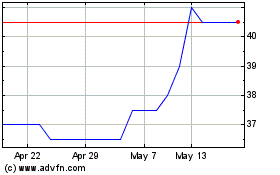

Beximco Pharma (LSE:BXP)

Historical Stock Chart

From Apr 2024 to May 2024

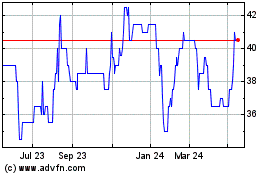

Beximco Pharma (LSE:BXP)

Historical Stock Chart

From May 2023 to May 2024