Brunner Investment Trust PLC Edison issues review on The Brunner Inv. Trust

June 13 2018 - 6:55AM

RNS Non-Regulatory

TIDMBUT

Brunner Investment Trust PLC

13 June 2018

London, UK, 13 June 2018

Edison issues review on The Brunner Investment Trust (BUT)

The Brunner Investment Trust (BUT) has recently announced a

refinancing of its second (and last) tranche of high-cost debt

(GBP28m). It placed a GBP25m note at a record low rate of 2.84% for

30-year debt, made possible due to declining UK government bond

yields as a result of recent political concerns in Italy. The

remaining GBP14.4m costs (including accrued interest) to repay the

debt will be financed by existing assets and bank debt, and will

meaningfully lower BUT's overall weighted average interest costs

from 7.7% to 2.9% pa. Manager Lucy Macdonald describes this as an

exciting development, as it will allow the trust to have a more

efficient balance sheet and provides greater flexibility to

increase the dividend in real terms. Coupled with the lower cost of

debt, a potentially higher yield could lead to a narrowing in the

trust's discount. BUT has a distinguished distribution track

record, growing dividends for the last 46 consecutive years.

BUT is trading at a 9.6% discount to cum-income NAV, with debt

at fair value. This is narrower than the averages of the last one,

three, five and 10 years (range of 10.6% to 13.0%). There is room

for the discount to narrow further following the meaningful

reduction in the trust's cost of debt and the potential for higher

dividend growth. BUT's current dividend yield is 2.1%.

Click here to view the full report.

All reports published by Edison are available to download free

of charge from its website

www.edisoninvestmentresearch.com

About Edison: Edison is an investment research and advisory

company, with offices in North America, Europe, the Middle East and

AsiaPac. The heart of Edison is our world-renowned equity research

platform and deep multi-sector expertise. At Edison Investment

Research, our research is widely read by international investors,

advisers and stakeholders. Edison Advisors leverages our core

research platform to provide differentiated services including

investor relations and strategic consulting.

Edison is authorised and regulated by the Financial Conduct

Authority.

Edison is not an adviser or broker-dealer and does not provide

investment advice. Edison's reports are not solicitations to buy or

sell any securities.

For more information please contact Edison:

Mel Jenner, +44 (0)20 3077 5720

Sarah Godfrey, +44 (0)20 3681 2519

Investmenttrusts@edisongroup.com

Learn more at www.edisongroup.com and connect with Edison

on:

LinkedIn https://www.linkedin.com/company/edison-investment-research

Twitter www.twitter.com/Edison_Inv_Res

YouTube www.youtube.com/edisonitv

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NRALLFEIRFIVLIT

(END) Dow Jones Newswires

June 13, 2018 06:55 ET (10:55 GMT)

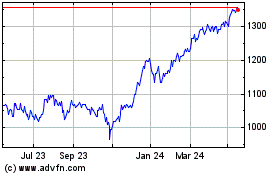

Brunner Investment (LSE:BUT)

Historical Stock Chart

From Mar 2024 to Apr 2024

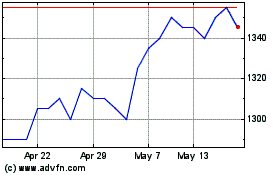

Brunner Investment (LSE:BUT)

Historical Stock Chart

From Apr 2023 to Apr 2024