TIDMBPC

RNS Number : 4442P

Bahamas Petroleum Company PLC

10 October 2019

NEITHER THIS ANNOUNCEMENT NOR ANY PART OF IT CONSTITUTES AN

OFFER TO SELL OR ISSUE OR THE SOLICITATION OF AN OFFER TO BUY,

SUBSCRIBE OR ACQUIRE ANY SECURITIES IN ANY JURISDICTION IN WHICH

ANY SUCH OFFER OR SOLICITATION WOULD BE UNLAWFUL AND THE

INFORMATION CONTAINED HEREIN IS NOT FOR PUBLICATION OR

DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF IRELAND, SOUTH AFRICA OR

ANY JURISDICTION IN WHICH SUCH PUBLICATION OR DISTRIBUTION WOULD BE

UNLAWFUL.

10 October 2019

Bahamas Petroleum Company plc

("Bahamas Petroleum" or the "Company")

Proposed open offer, progress on other funding and confirmation

of election for drilling rig

Bahamas Petroleum Company, the oil and gas exploration company

with significant prospective resources in licences in The

Commonwealth of The Bahamas, is pleased to announce a proposed open

offer to shareholders, and to advise of continued progress toward

drilling its first exploration well in The Bahamas in 2020.

Highlights

-- Proposed GBP7 million (c. US$8.5 million) open offer at a

price of 2 pence per share to enable all existing shareholders to

participate in the Company's next fundraising; Circular to launch

the open offer to be posted in the week commencing 14 October

2019

-- Entry into a subscription agreement for the previously

announced GBP10.25 million (c. US$12.5 million) conditional

convertible notes; farm-out discussions continue

-- Drilling schedule developed to target an initial exploration well in H1 2020

-- Company has sent notice to Seadrill nominating rig delivery

date (and expected well spud) for late Q1 2020 in accordance with

terms of the rig framework agreement; parties now progressing to

long-form legal documentation for rig contract

-- Continued progress on environmental permitting

Simon Potter, Chief Executive Officer of Bahamas Petroleum

Company, said:

"I am pleased to advise shareholders of continued progress

toward drilling an initial exploration well in The Bahamas during

2020. A farm-out remains our preferred funding option, and

constructive discussions continue. At the same time, we are moving

forward with additional components of a balanced funding strategy,

so that we can deliver on drilling regardless of the outcome of

these discussions. This includes giving our existing shareholders

the first opportunity to participate in our next fundraising via an

open offer. We have also signed the subscription agreement for our

previously announced convertible note facility, and we have

received a number of other funding proposals. Given the progress

made in relation to our funding strategy, we have notified Seadrill

of our desire to receive a rig in late Q1 2020, and we are now

working collaboratively with Seadrill on both finalising the

long-form rig contract and preparing for drilling."

Progress on Funding

A. Summary

As previously announced, the Company has a clear and unambiguous

obligation under its licences to drill an initial exploration well

in The Bahamas during 2020. Discharge of this obligation will then

allow the Company to enter the next exploration period, running for

a further three years, and in the event of commerciality seek a 30

year production lease that would allow for a commercial development

of any discovered reserves.

Over the last six months the Company has revised its drilling

costs estimates to incorporate contracted pricing from service and

equipment providers, and also to reflect a well design and drilling

philosophy that will comply with the requirements of the Company's

licences whilst at the same time enable a full evaluation of the

target structures. Accordingly, the Company currently estimates a

cost to meet its drilling objectives in the range of US$20 million

- US$25 million (the ultimate amount of expenditure being dependent

to a large extent on the pace of drilling - the rate of penetration

or "ROP" - and the final drilled depth the well attains).

The Company maintains a lean and efficient overhead burn rate,

and currently has sufficient cash available to meet general working

capital needs through to H2 2020. Over and above these general

working capital needs, it is necessary for the Company to develop a

degree of certainty as to the availability and timing of funding

for drilling costs, primarily in order to enable the Company to

nominate, confirm and proceed to a definitive contract for the rig,

and also to ensure other aspects required to commence drilling,

such as the procurement of long-lead items, provisioning and

ancillary equipment, are available. However, the bulk of the

Company's expected cash outflows, and thus the Company's actual

need for funding availability (outside of working capital), will

generally only arise shortly before and during the course of

drilling (thus late Q1 2020 and beyond).

It is in this context that that Board has determined to proceed,

in the first instance, with a proposed GBP7 million (approximately

US$8.5 million) open offer to existing shareholders at 2 pence per

share (the "Open Offer") with any entitlements not taken up by

qualifying shareholders sought to be placed with investors -

details are set out in Section B, below.

At the same time, the Company has entered into a subscription

agreement for the previously announced and approved GBP10.25

million (approximately US$12.5 million) conditional convertible

loan facility (the "Conditional Convertible Notes") - details are

set out in Section C, below.

In aggregate, therefore, the Open Offer (if fully subscribed or

if the entitlements not taken up are placed with investors) and the

Conditional Convertible Notes (if all conditions of the

subscription agreement are satisfied or waived and they are fully

subscribed) would raise an aggregate amount of approximately US$21

million, which exceeds the lower-end estimates for the total well

cost.

Finally, the Company wishes to note that even if the full GBP7

million is raised via the Open Offer (and all conditions of the

subscription agreement for the Conditional Convertible Notes are

satisfied or waived and they are fully subscribed) the farm-out

process would nonetheless continue, albeit in that context

concluding a farm-out would likely provide funds in excess of what

would be required to complete the initial well, thereby potentially

facilitating further exploration activity on the licences including

that of an additional well.

B. Open Offer

Rationale and Structure

The Board recognises and is grateful for the continued support

received from the Company's shareholders over an extended period of

time. Therefore, as a first step in a coordinated approach towards

meeting the Company's financing needs, the Board has decided to

provide an opportunity for all existing shareholders who qualify

("Qualifying Shareholders") to participate in a further issue of

new ordinary shares to raise up to GBP7 million at a price of 2

pence per share (the "Issue Price"), by way of the Open Offer. A

facility will also be put in place to enable Qualifying

Shareholders to increase their allocation subject to availability

(the "Excess Application Facility"). The Issue Price represents a

discount of approximately 10% to the closing price of the Company's

ordinary shares on 9 October 2019.

The directors of the Company (the "Directors") consider that the

Open Offer will represent an optimal mechanism to provide

shareholders with the opportunity to participate in the next phase

of the Company's progress, having regard to the funding needs of

the Company, the timing of those funding needs, cost implications

and market risks.

The Open Offer will launch and proceed by way of a circular to

shareholders ("Circular"), which will be posted to shareholders

during the week commencing 14 October 2019. The Circular will

include further information on the Open Offer and the terms and

conditions on which it is made, including an expected timetable of

principal events (including the record date) and the procedure for

application and payment. However, summary details of the Open Offer

are set out below.

Summary Details of Open Offer

Qualifying Shareholders will be those shareholders on the

register of members of the Company at the close of business on the

Open Offer record date (other than certain overseas shareholders),

further details of which will be provided in the Circular.

Qualifying Shareholders will also have the opportunity, provided

that they take up their Open Offer Entitlement in full, to apply

for excess Open Offer entitlements through the Excess Application

Facility. Instructions on how to do so will be contained within the

Circular and application form to shareholders ("Application Form").

Once subscriptions by Qualifying Shareholders under their

respective Open Offer entitlements have been satisfied, the Company

shall, in its absolute discretion, determine whether to meet any

excess applications in full or in part and no assurance can be

given that applications by Qualifying Shareholders under the Excess

Application Facility will be met in full, in part or at all.

The Open Offer is not being underwritten. It should also be

noted that the Open Offer is not a rights issue. Accordingly, the

Application Form to be included with the Circular will not be a

document of title and cannot be traded.

Open Offer Shortfall

To the extent the Open Offer Shares are not taken up by

shareholders (including via the Excess Allocation Facility) the

Company has appointed Shore Capital, the Company's broker, to seek

to place those unsubscribed Open Offer Shares with institutional

investors at the Issue Price.

Management of the Company (collectively) has indicated an

intention to subscribe GBP250,000 of any shortfall in the Open

Offer.

C. GBP10.25 million Convertible Note Subscription Agreement

On 21 August 2019 the Company announced that it had entered into

a conditional agreement for GBP10.25 million (approximately US$12.5

million) convertible loan notes. Subsequently, the entry into this

conditional agreement was approved by shareholders of the Company

at the General Meeting held on 17 September 2019.

Further to that approval, the Company has now entered into a

subscription agreement (the "Convertible Note Subscription

Agreement") in relation to this convertible loan note investment,

with the key terms and conditions of this Convertible Note

Subscription Agreement summarised below.

Counterparty

The Convertible Note Subscription Agreement is entered into with

Australian-domiciled investment firms acting on behalf of interests

associated with Mr. Stephen Bizzell and Mr. Mark Carnegie

("Subscribers").

Mr. Bizzell and Mr. Carnegie each have a track record of

successful investment in a number of early-stage oil and gas

exploration businesses around the world. Investment funds

associated with Mr. Carnegie and Mr. Bizzell were also variously

early-stage investors in Arrow Energy Limited and Dart Energy

Limited, Australian-listed companies at which both the Company's

Chief Executive Mr. Simon Potter and the Company's Commercial

Director previously worked. Arrow Energy Limited was successfully

acquired by a consortium of Shell and Petrochina in 2011, and Dart

Energy Limited was acquired by AIM-listed iGas Energy Plc in

2014.

Convertible Note Subscription Agreement Key terms

Key terms of the Convertible Note Subscription Agreement are as

follows:

-- Amount: GBP10.25 million (approximately US$12.5 million,

being approximately half the upper end of the estimated range for

the cost of the initial exploration well)

-- Use of funds: Well finance and general strategic purposes

-- Form of investment: Convertible loan notes ("Conditional Convertible Notes")

-- Note Subscribers: Initially Bizzell Capital Partners Pty Ltd

(as to 50% of the Conditional Convertible Notes) and MH Carnegie

& Co Pty Ltd (as to 50% of the Conditional Convertible Notes)

(the "Subscribers"). However, The Convertible Note Subscription

Agreement contemplates that the Subscribers may assign their

Conditional Convertible Notes such that there may ultimately be

multiple note holders, who will be represented by a noteholder

trustee under the terms of a noteholder trust deed yet to be

entered into between the Company and the noteholder trustee

-- Term: 3 years

-- Coupon: 12% per annum, payable annually in arrears; the

Company can elect to capitalise interest accrued on the Conditional

Convertible Notes

-- Priority: On a return of capital (by way of liquidation or

otherwise) the Conditional Convertible Notes will rank senior to

all ordinary shares on issue to the extent of the principal plus

unpaid interest

-- Security: the Conditional Convertible Notes will be secured

by an appropriate first ranking security to be granted over all the

assets and undertakings of BPC, and will rank senior to all other

debt of BPC, and which security will be cross-guaranteed on a

secured basis by all members of the Company's group

-- Conversion: A holder of Conditional Convertible Notes may at

any time prior to maturity elect to convert the Conditional

Convertible Notes (principal plus any accrued interest) into fully

paid ordinary shares in BPC

-- Conversion Price: Given the pricing established for the Open

Offer, the conversion price of the Conditional Convertible Notes is

now set at 2.5 pence per share

-- Early Redemption: A holder of Conditional Convertible Notes

will be entitled to redeem the Conditional Convertible Notes at a

110% premium to face value if, as at 31 December 2020, employment

and executive retention arrangements between nominated key

executives and the Company are on terms that are not satisfactory

to the Subscribers. The Company may not redeem the Conditional

Convertible Notes early, unless agreed with the Subscribers

-- Dividends: No dividends may be declared or paid whilst the

Conditional Convertible Notes are on issue

-- Subscription Deadline: Subject to satisfaction of all

conditions precedent as described below, the Subscribers must

subscribe for the Conditional Convertible Notes by no later than 15

February 2020; a Subscriber may also elect to subscribe for the

Conditional Convertible Notes all or in part earlier than this date

but no sooner than 30 November 2019

-- Conditions to Completion: Completion of the subscription for

the Conditional Convertible Notes by the Subscribers will be

subject to a number of conditions first being met or satisfied or

otherwise waived. These conditions are:

o Any approvals, consents, waivers, exemptions or declarations

that are required by law, or by any Government Agency, to implement

the transactions contemplated by the Convertible Note Subscription

Agreement are granted, given, made or obtained on an unconditional

basis

o The Company entering into binding contracts with reputable

international companies so as to enable the Company (to the

satisfaction of each Subscriber, acting reasonably) to conduct the

intended drilling of the initial exploration well at the estimated

cost of that drilling, being:

-- A contract for provision of a drilling rig with a reputable

international rig company, on terms satisfactory to each

Subscriber, providing access to the appropriate drilling rig at an

acceptable cost, as needed for the task of conducting o the

drilling; and

-- A contract for integrated well services for the drilling with

a reputable international service company, on terms satisfactory to

each Subscriber, providing access to the appropriate services

needed for the task of conducting the drilling;

o The Subscribers being satisfied that the Company has

sufficient funds in cash (but not including committed cash or cash

subject to refund obligations) which, when aggregated with the

subscription amount of the Conditional Convertible Notes, would be

sufficient to fund the cost of the intended drilling operation in

full and the operating costs of the Company until the end of June

2021;

o A convertible note trust deed being entered into between the

Company and the convertible note trustee, on terms acceptable to

the Subscribers;

o Appropriate security documents being entered into between the

Company and the Subscribers and any other relevant parties, on

terms acceptable to the Subscribers;

o The Company securing all necessary permits and approvals for

the intended drilling operations from the Government of The

Bahamas, including all necessary environmental permits, and the

Company reaching agreement with the Government of The Bahamas and

making payment in relation to licence fees payable for the

remaining licence period to 31 December 2020, on terms satisfactory

to the Subscribers;

o Each Subscriber obtaining all approvals (including of its

investment committee) and satisfying all procedures it considers

necessary in relation to the transactions contemplated by this

agreement;

o Employment and executive retention arrangements between key

executives nominated by the Subscribers and the Company being

entered into or amended on terms satisfactory to each Subscriber

(acting reasonably); and

o No breaches of warranty or material adverse events have

occurred.

-- Under the terms of the conditional agreement entered into on

21 August 2019, and repeated now in the Convertible Note

Subscription Agreement, the Subscribers will be paid fees as

follows:

o An establishment fee of 3% of the subscribed amount, which the

Subscribers may elect to deduct from the relevant subscribed

amount;

o Options to subscribe for 25,000,000 ordinary shares in BPC

with an exercise price of 2 pence per share, exercisable at any

time within the four year period from their date of issue (which

will be on or around 14 October 2019); and

o On subscription of the Conditional Convertible Notes, two

further tranches of options to subscribe for ordinary shares in

BPC, of 12,500,000 options per tranche, the first with an exercise

price of 2.5 pence per share and the second with an exercise price

of 3 pence per share, exercisable at any time within the four year

period from the date of their issue. The number of these options to

be ultimately granted will depend on the amounts subscribed for. In

the event that the full amount of the Conditional Convertible Notes

is not subscribed for then the number of such options will be pro

rated down accordingly.

-- Board Rights: Effective from subscription of the Conditional

Convertible Notes (i.e. only once funds are advanced to BPC) and

until such time as the Conditional Convertible Notes are redeemed,

the Subscribers will have the right to appoint a maximum of two (2)

directors to the Board of BPC (but, for so long as both Simon

Potter and Eytan Uliel are members of the Board, the right of

appointment shall be reduced to only one (1)).

D. Further Information

Attention is drawn to the fact that, as detailed above,

availability of funds from the Convertible Note Subscription

Agreement remains conditional on a number of conditions first

having been satisfied. To the extent the conditions are not

satisfied there is a risk that the Company will not be able to

receive the funding contemplated in the Convertible Note

Subscription Agreement, unless those conditions are waived by the

Subscribers. However, given that a number of the conditions are

necessary prerequisites to drilling commencing, and given that

funds are not actually required until closer to the time that

drilling commences, the Directors are confident that the conditions

precedent can be satisfied in a timely manner such that funding

under the Convertible Note Subscription Agreement will be available

when required.

Assuming (i) the conditions set out in the Convertible Note

Subscription Agreement are either satisfied or waived and the

Conditional Convertible Notes are fully subscribed, (ii) 3 full

years of interest is capitalized into the debt principal of the

Conditional Convertible Notes and not paid in cash, and (iii) all

principal and capitalized interest is fully converted, the

Conditional Convertible Notes would result in the issue of

approximately 560 million ordinary shares in the capital of the

Company to the noteholders, and the Company will have received

GBP10.25 million in funding.

Therefore, when considered in aggregate, the Open Offer (if

fully taken up) and the proceeds of the Convertible Note

Subscription Agreement (assuming all the conditions set out in the

Convertible Note Subscription Agreement are either satisfied or

waived and the Conditional Convertible Notes are fully subscribed,

and further assuming all interest is capitalized and all principal

and capitalized interest is ultimately converted) would result in a

maximum of approximately 910 million new ordinary shares being

issued, and total funding inflows over the next 6 months of

GBP17.25 million (approximately US$21 million), which would be an

amount sufficient to meet the estimated costs of drilling of the

initial exploration well at the lower end of the current estimated

cost range.

Shareholders should note however that there remains a high

degree of uncertainty in relation to both the Open Offer and

Conditional Convertible Notes, given that ultimate quantum of

funding to be received from both is dependent on the occurrence of

future events outside of the control of the Company.

Specifically:

-- Funding from the Convertible Note Subscription Agreement

remains subject to certain conditions precedent as set out in that

agreement first being satisfied on or prior to 15 February 2020

(unless said conditions are waived by the noteholders) - these have

been detailed above;

-- the amount raised under the Open Offer will depend on the

extent to which shareholders take up their entitlements under the

Open Offer and/or the extent to which any shortfall thereunder is

taken up or subsequently placed; and

-- the Company continues to work on securing a farm-out, which

if successful could materially increase the amount of capital

available to the Company, which could offset all or a considerable

portion of the costs in respect of the intended drilling or

alternatively provide funds in excess of that required to complete

the initial well, thereby potentially facilitating further

exploration activity on the licences including that of an

additional well.

In circumstances where suitable funds are not raised via the

Open Offer (if the Open Offer raises less than US$7.5 million and

the placement of the Open Offer Shortfall as described above is

unsuccessful in raising the balance), or where the conditions

precedent set out in the Convertible Note Subscription Agreement

are not satisfied (or waived), or if a farm-out is not secured, the

Company would not have sufficient cash to complete the drilling of

the planned initial exploration well in H1 2020. In such

circumstances the Company would look to secure funding by way of

alternative sources. There can be no assurance, however, that the

Company would be successful in securing any such alternative

funding. Excluding any costs relating to the planned initial

exploration well in H1 2020, the Company currently has sufficient

cash available to meet general working capital needs through to H2

2020.

Election for Drilling Rig and Anticipated Well Spud Date

On 21 August 2019, the Company announced that it had entered

into a Framework Agreement for the provision of a sixth-generation

drilling rig during the first half of 2020 (the "Framework

Agreement"). The Framework Agreement was entered into with

Seadrill, one of the world's largest drilling companies.

The purpose of the Framework Agreement was to record the

commercial desire of the parties to work together for the purposes

of Seadrill offering a drilling rig to BPC in order that it can

undertake the Drilling Plan, to stipulate the process by which that

working relationship shall be developed over the coming months

leading up to entry into a definitive legal agreement for provision

of the drilling rig (the "Rig Contract") and thereafter conduct of

drilling operations, to set out certain key commercial terms,

schedule and operating parameters to be included in the Rig

Contract, and to define the pre-conditions to enter into the Rig

Contract.

Further, the Framework Agreement required BPC, on or before 11

October 2019 (or such later date as the parties may mutually agree)

to notify Seadrill that it wishes to "Go-Firm". Given the greater

certainty and progress made in relation to funding, the Company has

thus now advised Seadrill that it wishes to "Go-Firm" on the

provision of a drilling rig. Accordingly, the Company has notified

Seadrill of its desire to secure a rig for an intended spud date in

late Q1 2020. Over the coming weeks the Company and Seadrill will

be working to finalise the Rig Contract, confirm the rig selection,

and agree the critical drilling plan dates.

It should be noted that the governing document in relation to

provision of the drill rig will be the Rig Contract, which remains

to be entered into and is subject to Seadrill's Board approval

process for contract commitment. Accordingly, for the avoidance of

doubt, the election for the drilling rig and the "Go-Firm" notice

does not obligate BPC to incur any costs. BPC will keep

shareholders appraised of developments as this process

progresses.

Farm-out Process

As previously announced, the Company's farm-out process

continues, with a number of parties engaged in ongoing discussions,

due diligence and/or commercial interaction. It remains the

Company's preference to secure funding through this structure,

albeit the Company's attitude to potential farm-in terms in ongoing

negotiations will necessarily reflect the funding status of the

initial well at the time a farm-out is successfully concluded (if

at all).

To the extent that a farm-out is successfully concluded on terms

acceptable to the Company, the amount of capital available to the

Company would materially increase, and as previously noted could be

materially additive to the funds raised through the Open Offer and

Conditional Convertible Notes as detailed in this announcement.

Such funding could be applied towards all or a considerable portion

of the costs in respect of the intended drilling, or alternatively

proceeds from any farm-out could be applied to a broader work

program than the current single well the Company intends to drill

in 2020.

The Company will make further announcements in relation to the

farm-out as appropriate.

Environmental Update

Background

In 2012, in accordance with the requirements under prevailing

laws in The Bahamas, BPC completed an Environmental Impact

Assessment ("EIA"), which was reviewed and accepted on behalf of

the Government of The Bahamas ("Government") by the Bahamas

Environment, Science and Technology ("BEST") Commission.

Subsequently, in 2016, new laws and regulations pertaining

specifically to the petroleum industry were adopted in The Bahamas.

These new laws and regulations introduced for the first time an

entirely new concept of Environmental Authorisation ("EA"), as a

required mandatory step before drilling activities commence. In

April 2018, BPC submitted an EA application in compliance with this

new regulation. BPC's EA application included, inter alia, an

updated EIA and an Environmental Management Plan ("EMP").

EA Process Update

BPC's EA, including its EMP, was reviewed by energy consultants

Black & Veatch ("B&V") as external consultant advisers to

BEST, who have submitted an initial report on their assessment to

the Government. B&V's methodology and mode of analysis

consisted primarily of a "gap analysis", in which B&V sought to

identify any gaps in the EA / EMP documentation provided by BPC

against any applicable laws, regulations and applied international

standards.

Encouragingly, in the context of the volume of materials

submitted by BPC, B&V identified only a relatively small number

of gaps, with the majority of the gaps identified relating to rig

specific information or site specific information which was either

unavailable or insufficiently detailed at the time of the initial

submission of BPC's EIA, EMP and thus overall EA.

The Company's signing of a Framework Agreement for the provision

of a sixth generation drilling rig (and now "Go-Firm" election),

along with the issue of Notices of Award for provision of key well

services and equipment to Halliburton and BakerHughes GE (as

previously announced) means that, with the cooperation of these

service and equipment providers, BPC is now in a position to

provide all additional outstanding documentation and data, and BPC

considers that gaps identified by B&V can be readily closed in

the coming months.

The final substantive piece of data remaining to be collected as

part of the EA process is an Environmental Baseline Survey ("EBS").

This survey seeks to determine the environmental baseline

conditions (biological, chemical, physical) at the proposed

drilling location by providing measures of the environment against

which any effects from future operations may be compared. This

includes collection of samples (at a range of water depths and

distances from the proposed drill site) to characterise

macroinfauna, document physicochemical conditions and characterise

the water column. A photographic survey would be used to

characterise the seafloor substrates and associated biological

communities. By its very nature EBS data is typically collected

closer to the time of field activities commencing so as to provide

a relevant data point for later comparison. Terms of reference

defining the scope of the EBS have been prepared and submitted to

BEST for their review, prior to this work commencing.

Adviser Appointments

As noted, the Government agency tasked with working with BPC on

the EA process is the BEST Commission. BEST has appointed B&V

as expert consultant to BEST / Government for this purpose

(www.bv.com).

Likewise, BPC has made, and will continue to make, a number of

important appointments of international environmental consultants,

to ensure that the environmental planning and associated permitting

process is conducted in accordance with global best practice.

To-date, these include:

-- the appointment of Acorn International ("Acorn"), a leading

international environmental advisor (www.acornintl.net), to work

with the Company and liaise with B&V / BEST in finalising the

relevant EMP documentation,

-- the appointment of marine environmental consulting firm, CSA

Ocean Sciences (www.csaocean.com) to establish the terms of

reference for and thereafter (once agreed) undertake the EBS, which

as noted is a required component of the EMP documentation, and

-- in anticipation of future operations, BPC has applied for and

been accepted for membership of Oil Spill Response Limited

(www.oilspillresponse.com), the largest international

industry-funded cooperative which exists to respond to oil spills

wherever in the world they may occur, by providing preparedness,

response and intervention services and equipment.

BPC is also in the process of engaging a number of other

third-party consultants to conduct both field-based environmental

work necessary to completion of the EMP, and desktop studies to

identify and provide the necessary data to cover additional

potential well locations, which would provide the Company with a

degree of optionality should ongoing technical work identify more

optimal well locations or the availability of funding permit a

multi-well drilling strategy (and consistent with the capacity

under the rig framework agreement to consider a two well

exploration campaign).

Timeline

A timeline has been developed jointly by BPC, BEST and

Government representatives that would see work necessary for the

EMP process completed by end 2019 / early 2020, so as to enable

initial drilling activities to commence as planned in late Q1

2020.

For further information, please contact:

Bahamas Petroleum Company plc Tel: +44 (0) 1624

Simon Potter, Chief Executive Officer 647 882

Strand Hanson Limited - Nomad Tel: +44 (0) 20

Rory Murphy / James Spinney 7409 3494

Shore Capital Stockbrokers Limited Tel: +44 (0) 207

Jerry Keen / Toby Gibbs 408 4090

CAMARCO Tel: +44 (0) 20

Billy Clegg / James Crothers 3757 4983

www.bpcplc.com

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDEASEEFSLNFEF

(END) Dow Jones Newswires

October 10, 2019 02:00 ET (06:00 GMT)

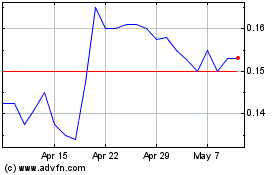

Challenger Energy (LSE:CEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Challenger Energy (LSE:CEG)

Historical Stock Chart

From Apr 2023 to Apr 2024