TIDMBOD

RNS Number : 7794T

Botswana Diamonds PLC

25 March 2019

25(th) March 2019

Botswana Diamonds PLC ("Botswana Diamonds" or the "the

Company")

Interim Statement and Financial Results for the Six Months Ended

31(st) December 2018

Botswana Diamonds (AIM: BOD) is on track to commence bulk

sampling and become a diamond producer by mid-2019.

Highlights

-- The Thorny River project is on target to commence bulk

sampling and produce diamonds. Agreements have been finalised with

a mining contractor and a diamond processor. Delineation drilling

is completed. Assuming final permits are obtained, bulk sampling

will commence in May.

-- A study of the Heritage Concession in the Marange Diamond

Fields in Zimbabwe yielded positive results. Botswana Diamonds has

a joint venture agreement with Vast Resources plc ('Vast') to

develop Heritage.

-- A report on the Maibwe prospect in Botswana has been

completed and sent to BCL, the 51% owner of the licences. We expect

that BCL will offer their stake for sale.

Botswana

1. Heavy mineral sampling over the eight previously discovered

and announced geophysical anomalies in the Gope Region of the

Kalahari Desert was completed. A total of 267 kimberlitic indicator

minerals were discovered, which included 41 garnets, 13 chromites,

139 ilmenites, 4 chrome diopsides and 70 olivines. A grain analysis

by Remote Exploration Services of Cape Town concluded that the

sources were likely to be local due to the abundance, size and

fresh surface textures of the indicator minerals.

2. Botswana Diamonds now holds 100% of the equity in Sunland

Minerals, having acquired for a nominal sum the 50% previously held

by Alrosa as part of the Company's joint venture with Alrosa. A

potential new investor, itself a large diamond producer with new

ideas and keen to find new kimberlites in Botswana, is interested

in acquiring 50% of Sunland.

3. A report has been completed on the Maibwe licences in the

Gope region of the Kalahari. The report was prepared for the

liquidator of BCL which holds a 51% interest in Maibwe. Botswana

Diamonds holds a net 15% interest in the company. It is expected

that the liquidator will offer the BCL stake for sale.

South Africa

(A) The development of the Thorny River diamond dyke project is

underway. A mining contractor has been appointed. Agreement to

process the kimberlites at a nearby processing plant is finalised.

Refurbishment of the plant is ongoing, with wet testing expected to

commence within weeks.

A drilling programme to delineate the dyke in order to optimise

bulk sampling is completed.

We expect bulk sampling to commence by mid 2019, ramping up to

20,000 tons a month.

(B) Following the re-discovery of eight kimberlite pipes in the

Free State of South Africa close to the iconic Koffiefontein and

Jagersfontein diamond mines, whole rock geochemistry, mineral

chemistry and detailed ground geophysics work was completed. A

phased drilling programme has been proposed and is in a planning

phase.

(C) Desktop study work continues on the Palmietgat

kimberlites.

Zimbabwe

Botswana Diamonds signed a Memorandum of Understanding ('MoU')

with Vast, to develop diamond projects in Zimbabwe. Following the

signing of this MoU, an agreement was concluded to develop the

Heritage Concession in the Marange Diamond Fields. The concession

contains several targets for modern alluvial diamond placer

deposits; Grades of the known modern alluvial placers draining the

Marange Diamond Fields range in grade from 50 to 500 carats per

hundred tonne of ore (cpht), most typically 100-200 cpht. The next

step will be to investigate the potential of the modern alluvial

diamond deposits, as well as the older conglomerates on the

property. Assuming positive results, the field work will be closely

followed by drilling, pitting and bulk sampling, which will form

part of a pre-feasibility study, which may justify capital beyond

the initial US$1 million committed to the programme by Vast

Resources.

Corporate

Botswana Diamonds appointed Beaumont Cornish as the Nominated

Advisor in December 2018. We raised GBP370,000 at a placing price

of 0.55p per share, in January 2019.

John Teeling

Chairman

22(nd) March 2019

This announcement contains inside information for the purposes

of Article 7 of Regulation 596/2014. The person who arranged for

the release of this announcement on behalf of the Company was John

Teeling, Director.

S

Enquiries:

Botswana Diamonds PLC

John Teeling, Chairman +353 1 833 2833

James Campbell, Managing Director +27 83 457 3724

Jim Finn, Director +353 1 833 2833

Beaumont Cornish - Nominated Adviser

Michael Cornish

Roland Cornish +44 (0) 020 7628 3396

SVS Securities Plc - Broker

Tom Curran

Ben Tadd +44 (0) 20 3700 0100

Blytheweigh - PR +44 (0) 20 7138 3206

Julia Tilley +44 (0) 207 138 3553

Fergus Cowan +44 (0) 207 138 3208

Teneo

Luke Hogg +353 (0) 1 661 4055

Alan Tyrrell +353 (0) 1 661 4055

www.botswanadiamonds.co.uk

Botswana Diamonds plc

Financial Information (Unaudited)

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

Six Months Six Months Year

Ended Ended Ended

31 Dec 31 Dec 30 Jun

18 17 18

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

REVENUE - - -

Cost of sales - - -

-------------------- -------------------- ---------------

GROSS PROFIT - - -

( 190 ( 178 ( 378

Administrative expenses ) ) )

Impairment of exploration ( 180

and evaluation assets - - )

-------------------- -------------------- ---------------

( 190 ( 178 ( 558

OPERATING LOSS ) ) )

( 190 ( 178 ( 558

LOSS BEFORE TAXATION ) ) )

Income tax

expense - - -

-------------------- -------------------- ---------------

( 190 ( 178 ( 558

LOSS AFTER TAXATION ) ) )

Exchange difference on translation ( 72

of foreign operations - 1 )

TOTAL COMPREHENSIVE INCOME FOR THE ( 190 ( 177 ( 630

PERIOD ) ) )

==================== ==================== ===============

LOSS PER SHARE - basic and

diluted (0.04p) (0.04p) (0.12p)

==================== ==================== ===============

CONDENSED CONSOLIDATED BALANCE 31 Dec 31 Dec 30 Jun

SHEET 18 17 18

unaudited unaudited audited

ASSETS: GBP'000 GBP'000 GBP'000

NON-CURRENT ASSETS

Intangible

assets 8,364 8,155 8,234

Financial

assets - 1 -

-------------------- -------------------- ---------------

8,364 8,156 8,234

-------------------- -------------------- ---------------

CURRENT ASSETS

Trade and other receivables 12 50 25

Cash and cash equivalents 39 230 260

-------------------- -------------------- ---------------

51 280 285

TOTAL ASSETS 8,415 8,436 8,519

-------------------- -------------------- ---------------

LIABILITIES:

CURRENT

LIABILITIES

( 386 ( 237 ( 300

Trade and other payables ) ) )

-------------------- -------------------- ---------------

TOTAL ( 386 ( 237 ( 300

LIABILITIES ) ) )

NET ASSETS 8,029 8,199 8,219

==================== ==================== ===============

EQUITY

Share capital - deferred

shares 1,796 1,796 1,796

Share capital - ordinary

shares 1,273 1,148 1,273

Share premium 10,099 9,751 10,099

Share based payments

reserve 104 104 104

Retained ( 4,260 ( 3,690 ( 4,070

deficit ) ) )

Translation

reserve - 73 -

( 983 ( 983 ( 983

Other reserves ) ) )

-------------------- -------------------- ---------------

TOTAL EQUITY 8,029 8,199 8,219

==================== ==================== ===============

CONDENSED CONSOLIDATED STATEMENT OF CHANGES

IN EQUITY

Share based

Share Share Payment Retained Translation Other Total

Capital Premium Reserves Deficit Reserve Reserve Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 30 June ( 3,512 ( 983

2017 2,745 9,085 97 ) 72 ) 7,504

Issue of

shares 199 670 - - - 869

Share issue ( 4

expenses - ( 4 ) - - - )

Share based

payment - - 7 - - - 7

Total

comprehensive ( 178 ( 177

income ) 1 - )

------------------ ---------------- -------------------- ---------------- -------------------- -------------------- ---------------

At 31 December ( 3,690 ( 983

2017 2,944 9,751 104 ) 73 ) 8,199

Issue of

shares 125 377 - - - 502

Share issue ( 29 ( 29

expenses - ) - - - )

Total

comprehensive ( 380 ( 453

income - ) ( 73 ) - )

------------------ ---------------- -------------------- ---------------- -------------------- -------------------- ---------------

At 30 June ( 4,070 ( 983

2018 3,069 10,099 104 ) - ) 8,219

Total

comprehensive ( 190 ( 190

income - - ) - - )

--------------------

At 31 December ( 4,260 ( 983

2018 3,069 10,099 104 ) - ) 8,029

================== ================ ==================== ================ ==================== ==================== ===============

CONDENSED CONSOLIDATED CASH

FLOW Six Months Six Months Year

Ended Ended Ended

31 Dec 31 Dec 30 Jun

18 17 18

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

CASH FLOW FROM OPERATING

ACTIVITIES

Loss for the ( 190 ( 178 ( 558

period ) ) )

Impairment of exploration and evaluation

assets - - 180

Exchange ( 68

movements - 4 )

-------------------- -------------------- ---------------

( 190 ( 174 ( 446

) ) )

Movements in Working ( 182 ( 109

Capital 99 ) )

-------------------- -------------------- ---------------

NET CASH USED IN OPERATING ( 356 ( 555

ACTIVITIES ( 91 ) ) )

-------------------- -------------------- ---------------

CASH FLOWS FROM INVESTING

ACTIVITIES

Exploration costs ( 130 ( 382 ( 625

capitalised ) ) )

-------------------- -------------------- ---------------

NET CASH USED IN INVESTING ( 130 ( 382 ( 625

ACTIVITIES ) ) )

-------------------- -------------------- ---------------

CASH FLOWS FROM FINANCING

ACTIVITIES

Proceeds from share

issue - 869 1,371

Share issue ( 33

costs - ( 4 ) )

-------------------- -------------------- ---------------

NET CASH GENERATED IN INVESTING ACTIVITIES - 865 1,338

-------------------- -------------------- ---------------

NET (DECREASE)/INCREASE IN CASH AND ( 221

CASH EQUIVALENTS ) 127 158

Cash and cash equivalents at beginning

of the period 260 106 106

Effect of foreign exchange ( 4

rate changes - ( 3 ) )

CASH AND CASH EQUIVALENT AT THE

OF THE PERIOD 39 230 260

==================== ==================== ===============

Notes:

1. INFORMATION

The financial information for the six months ended 31 December

2018 and the comparative amounts for the six months ended 31

December 2017 are unaudited. The financial information above does

not constitute full statutory accounts within the meaning of

section 434 of the Companies Act 2006.

The Interim Financial Report has been prepared in accordance

with IAS 34 Interim Financial Reporting as adopted by the European

Union.

The accounting policies and methods of computation used in the

preparation of the Interim Financial Report are consistent with

those used in the Group 2018 Annual Report, which is available at

www.botswanadiamonds.co.uk

The interim financial statements have not been audited or

reviewed by the auditors of the Group pursuant to the Auditing

Practices board guidance on Review of Interim Financial

Information.

2. DIVID

No dividend is proposed in respect of the period.

3. LOSS PER SHARE

Basic loss per share is computed by dividing the loss after

taxation for the period available to ordinary shareholders by the

weighted average number of ordinary shares in issue and ranking for

dividend during the period.

Diluted loss per share is computed by dividing the loss after

taxation for the period by the weighted average number of ordinary

shares in issue, adjusted for the effect of all dilutive potential

ordinary shares that were outstanding during the period.

The following table sets forth the computation for basic and

diluted earnings per share (EPS):

Six Months Six Months

Ended Ended Year Ended

31 Dec 31 Dec 30 Jun

18 17 18

GBP'000 GBP'000 GBP'000

Numerator

For basic and diluted EPS retained

loss (190) (178) (558)

============== ============== ==============

No. No. No.

Denominator

Weighted average number of ordinary

shares 509,282,508 444,239,174 470,397,102

============== ============== ==============

Loss per share - Basic and Diluted (0.04p) (0.04p) (0.12p)

============== ============== ==============

The following potential ordinary shares are anti-dilutive and

are therefore excluded from the weighted average number of shares

for the purposes of the diluted earnings per share:

No. No. No.

Share options 11,410,000 11,410,000 11,410,000

============== ============== ==============

4. INTANGIBLE ASSETS

31 Dec 31 Dec 30 June

18 17 18

GBP'000 GBP'000 GBP'000

Exploration and evaluation assets:

Cost:

Opening balance 9,063 8,415 8,415

Additions 130 389 648

9,193 8,804 9,063

======== ======== ========

Impairment:

Opening balance 829 649 649

Provision for impairment - - 180

-------- -------- --------

829 649 829

======== ======== ========

Carrying Value:

Opening balance 8,234 7,766 7,766

======== ======== ========

Closing balance 8,364 8,155 8,234

======== ======== ========

Exploration and evaluation assets relate to expenditure incurred

in exploration for diamonds in Botswana and South Africa. The

directors are aware that by its nature there is an inherent

uncertainty in exploration and evaluation assets and therefore

inherent uncertainty in relation to the carrying value of

capitalized exploration and evaluation assets.

On 11 November 2014 the Brightstone block was farmed out to BCL

Investments (Proprietary) Limited, a Botswana Company, who assumed

responsibility for the work programme. Botswana Diamonds retain a

15% carried interest.

On 16 August 2013 the Group entered into a joint venture

agreement with Alrosa Overseas SA a wholly owned subsidiary of OJSC

Alrosa of Russia to explore for diamonds in Botswana. On 15

November 2018 the director announced that the company now holds

100% of the equity in Sunland Minerals having acquired for a

nominal sum the 50% previously held by Alrosa as part of the

Company's joint venture with Alrosa.

On 6 February 2017 the Group entered into an Option and Earn-In

Agreement with Vutomi Mining Pty Ltd and Razorbill Properties 12

Pty Ltd (collectively known as 'Vutomi'), a private diamond

exploration and development firm in South Africa.

Pursuant to the terms of the Agreement, Botswana Diamonds has

agreed to pay Vutomi a total of GBP942,000 in cash, of which

GBP581,000 will be used to fund exploration activities. In

addition, the Company will issue 100 million ordinary shares of

0.25p each ("Ordinary Shares") to Vutomi shareholders. The

Agreement will be executed in three Phases after which the Company

will own 72% of Vutomi. The remaining 28% will continue to be held

by Vutomi's Black Economic Empowerment ('BEE') partners. The three

Phases are summarised below:

Exclusivity and Option Fee

Botswana Diamonds paid Vutomi an exclusivity and option fee of

GBP122,000, with GBP61,000 paid in cash and GBP61,000 paid in the

Company's Ordinary Shares at a price of 1.9p. The shares were

issued on 3 April 2017. Upon completion of this payment Phase 1 of

the earn-in commenced.

Phase 1

Phase 1 will last for a further 12 months, during which period

the Company will, subject to available funding, have the option to

pay Vutomi GBP215,000 to fund exploration activities to earn an

initial 15% of Vutomi. During Phase 1 Vutomi will grant the Company

the sole and exclusive right to fund exploration activities in, on

and under the Vutomi Prospecting Rights Area in order to prepare a

conceptual mining and development plan. The required mining permits

are in place.

On 29 September 2017, the company moved into Phase 2 of the

Option and Earn-In Agreement.

Phase 2

Phase 2 lasted until 5 January 2019 and the company extended

their option for a further 90 days, during which period the Company

will, subject to available funding, have the option to pay Vutomi

GBP366,000 to fund exploration activities to earn an additional 25%

of Vutomi.

Phase 3

Phase 3 will commence within 90 days of the successful

completion of Phase 2. Pursuant to the Agreement, the Company will

have the option to issue the outstanding balance of 96.8m Ordinary

Shares, priced at VWAP, to Vutomi and, subject to available

funding, settle Vutomi's shareholders loan accounts of

approximately GBP300,000 in cash to earn a further 32% of

Vutomi.

Termination

At any point the Agreement will lapse if the Company does not

exercise its option regarding a specific Phase.

The directors believe that there were no facts or circumstances

indicating that the carrying value of intangible assets may exceed

their recoverable amount and thus no impairment review was deemed

necessary by the directors. The realisation of these intangible

assets is dependent on the successful discovery and development of

economic diamond resources and the ability of the Group to raise

sufficient finance to develop the projects. It is subject to a

number of significant potential risks, as set out below:

-- licence obligations;

-- exchange rate risks;

-- uncertainties over development and operational costs;

-- political and legal risks, including arrangements with

governments for licenses, profit sharing and taxation;

-- foreign investment risks including increases in taxes,

royalties and renegotiation of contracts;

-- title to assets;

-- financial risk management;

-- going concern; and

-- operational and environmental risks.

Included in additions for the period are GBPNil (June 2018:

GBP6,951) of share based payments, GBP7,791 (June 2018: GBP15,516)

of wages and salaries and GBP44,969 (June 2018: GBP90,443) of

directors remuneration.

5. SHARE CAPITAL

Deferred Shares Number Share Capital Share Premium

GBP'000 GBP'000

At 1 July 2017 and 1 July 2018 239,487,648 1,796,157 -

At 30 June 2018 and 31 December 2018 239,487,648 1,796,157 -

============ ============== ==============

Ordinary Shares Number Share Capital Share Premium

GBP'000 GBP'000

At 1 July 2017 379,562,908 949 9,085

Issued during the period 79,484,300 199 670

Share issue expenses - - (4)

At 31 December 2017 459,047,208 1,148 9,751

------------ -------------- --------------

Issued during the period 50,235,300 125 377

Share issue expenses - (29)

------------ -------------- --------------

At 30 June 2018 509,282,508 1,273 10,099

------------ -------------- --------------

Issued during the period - - -

At 31 December 2018 509,282,508 1,273 10,099

============ ============== ==============

Movements in share capital

On 3 August 2017, the Company raised GBP603,000 through the

issue of 48,240,000 new ordinary shares of 0.25p each at a price of

1.25p per share to provide additional working capital and fund

development costs. In addition, 31,244,300 warrants were also

exercised at a price of 0.85p per warrant for GBP265,577

On 20 December 2017, 235,300 warrants were exercised at a price

of 0.85p per warrant for GBP2,000.

On 14 February 2018, the Company raised GBP500,000 through the

issue of 50,000,000 new ordinary shares of 0.25p each at a price of

1p per share to provide additional working capital and fund

development costs.

6. POST BALANCE SHEET EVENTS

On 23(rd) January 2019 the Company announced that they had

raised GBP370,000 via the placing of 67,272,727 new ordinary shares

at a placing price of 0.55p per share. Each placing share has one

warrant attached with the right to subscribe for one new ordinary

share at 0.6p per new ordinary share for a period of two years from

23(rd) January 2019.

The net proceeds of the placing will fund ongoing diamond

exploration in South Africa and Botswana and will also provide the

Company with additional working capital.

7. APPROVAL

The Interim Report for the period to 31(st) December 2018 was

approved by the Directors on 22(nd) March 2019.

8. AVAILABILITY OF REPORT

The Interim Statement will be available on the website at

www.botswanadiamonds.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BUGDXUSDBGCD

(END) Dow Jones Newswires

March 25, 2019 03:00 ET (07:00 GMT)

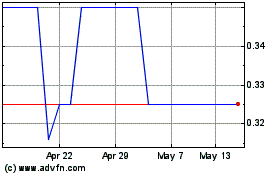

Botswana Diamonds (LSE:BOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Botswana Diamonds (LSE:BOD)

Historical Stock Chart

From Apr 2023 to Apr 2024