Bluebird Merchant Ventures Limited Completion of Gubong Feasibility Report (2360W)

July 31 2018 - 2:01AM

UK Regulatory

TIDMBMV

RNS Number : 2360W

Bluebird Merchant Ventures Limited

31 July 2018

31 July 2018

Bluebird Merchant Ventures Ltd

(the "Company" or "Bluebird")

Report On The Feasibility Of Reopening The Gubong Mine Is

Completed

Bluebird Merchant Ventures (EPIC: BMV), the Asian focused

resource development group is pleased to announce that it has

completed the report on the feasibility of reopening the Gubong

mine, and delivered it to its partner, Southern Gold.

Highlights:

-- Report on the feasibility of reopening the Gubong mine has been completed

-- The pre-construction phase has commenced

-- Production timetable on schedule, targeting first gold pour in the fourth quarter of 2019

This feasibility report is the final deliverable needed for the

formation of the 50:50 joint venture with Southern Gold. Ongoing

costs will now be shared equally between the two partners, with

Bluebird as the operator of the joint venture. The work carried out

by the Company over the past 12 months supports its previously

stated view that the establishment of a low capital cost mine at

Gubong is achievable. To reduce risk and improve accuracy, further

verification work will be undertaken prior to making a decision to

start construction.

The pre-construction work programme at Gubong encompasses

further exposure of the underground workings to allow for

additional sampling and subsequent metallurgical test work. This

will increase the initial mine inventory and reduce risk.

Following the progress at the project to date, it appears that

Gubong will be the first mine, in the Company's portfolio, to

produce gold next year.

Colin Patterson, CEO, commented:

"We are delighted that such progress has been made towards the

commencement of our joint venure partnership with Southern Gold for

the Gubong mine. They are proven partners who will share both their

expertise and the projects' ongoing costs. We look forward to a

productive working relationship.

"The report on the feasibility of reopening the Gubong mine has

further bolstered our expectations for the project. We continue to

expect that first gold will be produced at Gubong in the fourth

quarter of next year and that output can be increased to 100,000oz

per annum within five years."

"The great news for shareholders is that the cost of reopening

old mines is just a fraction of that of a new mine. Our projects

have substantial existing development and we have already

identified some of the initial low cost resource available to be

processed into gold. Gubong has all the makings of becoming a

'company maker' and we look forward to advancing the project

towards our production goals."

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION EU 596/2014 ("MAR")

Enquiries:

Bluebird Merchant Ventures Ltd +44 (0) 7797 859986

Jonathan Morley-Kirk, Non-Executive

Chairman

SP Angel Corporate Finance LLP

Ewan Leggat

Smaller Company Capital Ltd + 44 (0) 20 3470 0470

Rupert Williams/Jeremy Woodgate +44 (0) 20 3651 2910

Blytheweigh +44 (0) 20 7138 3204

Tim Blythe / Julia Tilley /

Simon Woods

www.bluebirdmv.com

@BluebirdIR

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCDDGDRSDXBGIG

(END) Dow Jones Newswires

July 31, 2018 02:01 ET (06:01 GMT)

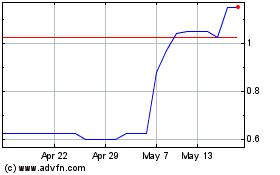

Bluebird Merchant Ventures (LSE:BMV)

Historical Stock Chart

From Mar 2024 to Apr 2024

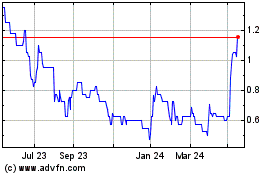

Bluebird Merchant Ventures (LSE:BMV)

Historical Stock Chart

From Apr 2023 to Apr 2024