Ashmore Group PLC Trading Statement (5579S)

July 09 2015 - 2:00AM

UK Regulatory

TIDMASHM

RNS Number : 5579S

Ashmore Group PLC

09 July 2015

Ashmore Group plc

+0700 9 July 2015

FOURTH QUARTER ASSETS UNDER MANAGEMENT STATEMENT

Ashmore Group plc ("Ashmore", "the Group"), the specialist

Emerging Markets asset manager, announces today the following

update to its assets under management ("AuM") in respect of the

quarter ended 30 June 2015.

Assets under Management

Actual Estimated Movement

31 March

2015 30 June 2015 Q4 vs Q3

Theme (US$ billion) (US$ billion) (%)

------------------- --------------- --------------- ----------

External debt 12.2 12.0 -1.6

------------------- --------------- --------------- ----------

Local currency(1) 15.1 15.2 +0.7

------------------- --------------- --------------- ----------

Corporate

debt 6.8 7.2 +5.9

------------------- --------------- --------------- ----------

Blended debt(1) 17.4 15.7 -9.8

------------------- --------------- --------------- ----------

Equities 4.3 3.8 -11.6

------------------- --------------- --------------- ----------

Alternatives 0.9 0.8 -11.1

------------------- --------------- --------------- ----------

Multi-strategy 1.7 1.6 -5.9

------------------- --------------- --------------- ----------

Overlay /

liquidity 2.7 2.6 -3.7

------------------- --------------- --------------- ----------

Total 61.1 58.9 -3.6

------------------- --------------- --------------- ----------

Assets under management decreased by US$2.2 billion during the

quarter to US$58.9 billion through net outflows of US$3.0 billion

and positive investment performance of US$0.8 billion.

The net outflow for the period was influenced by a small number

of relatively large and lower revenue margin redemptions in blended

debt and equities, which account for half of the net outflow in the

quarter. External debt, local currency, multi-strategy and

overlay/liquidity experienced modest net outflows. Capital was

returned to investors in the alternatives theme, while corporate

debt delivered a small net inflow. Subscriptions increased from the

preceding quarter, with a balance of new mandates and additional

funding from existing clients.

Emerging Markets assets performed well compared with Developed

Markets during the quarter, and Ashmore's absolute and relative

performance benefited from acquiring value over the previous six

months. Absolute performance was biased towards US

dollar-denominated and high yield assets, with good performance in

blended debt and corporate debt, and positive returns in external

debt and multi-strategy. Local currency experienced negative

performance, while performance in equities, alternatives and

overlay/liquidity was flat over the period.

Mark Coombs, Chief Executive Officer, Ashmore Group plc,

commented:

"Ashmore's investment processes delivered outperformance across

its themes this quarter after acquiring risk in 2014 and early 2015

at lower market levels. While Emerging Markets assets have

performed well and some value has been realised, value-based

investment opportunities remain across the range of Emerging

Markets asset classes, particularly in corporate debt and local

currency-denominated assets. Some investors are benefiting from

allocations added in recent quarters, however a broad-based

improvement in sentiment and activity levels continues to be held

back by uncertainty regarding factors such as the timing and impact

of US rate increases. We expect that once there is greater clarity,

the fundamental qualities of Emerging Markets coupled with the

inherent value that remains apparent today will lead to higher

levels of client activity and increased allocations."

Notes:

1. During the quarter, there was a US$0.5 billion

reclassification from blended debt to local currency following a

change in investment guidelines for those assets. The above

commentary on flows has been adjusted for the reclassification and

it had no other material impact at the Group level.

2. For the translation of US dollar-denominated balance sheet

items, the GBP/USD exchange rate was 1.5712 at 30 June 2015 (30

June 2014: 1.7106, 31 December 2014: 1.5577). For the translation

of US dollar management fees, the average GBP/USD exchange rate

achieved for the second half of the financial year was 1.5321 (H2

2013/14: 1.6734).

Ashmore will announce its preliminary results in respect of the

financial year to 30 June 2015 on 8 September 2015. There will be a

presentation for analysts at 0900 on that date at the offices of

Goldman Sachs at Peterborough Court, 133 Fleet Street, London, EC4M

2BB. A copy of the presentation will be made available on the

Group's website at www.ashmoregroup.com.

For further information please contact:

Ashmore Group plc

Paul Measday

Investor Relations +44 (0)20 3077 6278

FTI Consulting

Andrew Walton +44 (0)20 3727 1514

Paul Marriott +44 (0)20 3727 1341

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLLFLDDAITIIE

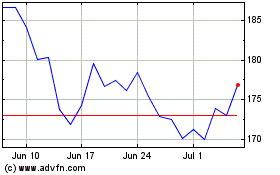

Ashmore (LSE:ASHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

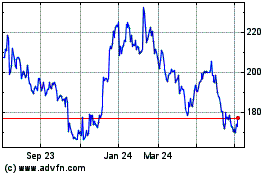

Ashmore (LSE:ASHM)

Historical Stock Chart

From Apr 2023 to Apr 2024