TIDMSLI

3 August 2020

STANDARD LIFE INVESTMENTS PROPERTY INCOME TRUST LIMITED (LSE: SLI)

LEI: 549300HHFBWZRKC7RW84

Unaudited Net Asset Value as at 30 June 2020

Net Asset Value and Valuations

* Net asset value ("NAV") per ordinary share was 79.6p (Mar 2020 - 83.2p), a

decline of 4.3%, resulting in a NAV total return, including dividends, of

-3.0% for Q2 2020;

* The portfolio valuation (before CAPEX) reduced by 2.5% on a like for like

basis, whilst the IPD/MSCI Monthly Index dropped by 3.6% over the same

period.

Investment and letting activity

* One letting was completed in Q2 securing GBP110,000 per annum in rent to an

existing tenant expanding their business, who also extended their original

lease.

* The Company completed a lease renewal and a lease restructure securing GBP

491,788 per annum, a 19.5% increase on the previous rents.

Financial Position and Gearing

* Strong balance sheet with significant financial resources available of GBP41

million (GBP14 million currently drawn from its GBP55 million low cost,

revolving credit facility.

* As at 30 June 2020, the Company had a Loan to Value ("LTV") of 26.2%* which

remains at the lower end of the Company's peer group and the wider REIT

sector. The debt currently has an overall blended interest rate of 2.59%

per annum. Loan covenants for the quarter ended 30 June 2020, as reported

to the Royal Bank of Scotland ("RBS"), have been comfortably met as set out

below.

*LTV calculated as debt less cash and cash held by managing agents divided by

portfolio value

Actual Interest Cover 437% (Limit 175%)

Requirement

LTV 27.3%** (Limit 55%)

**Loan value less cash held in RBS accounts only divided by pledged portfolio

Rent collection

As at close of business on 22 July 2020, the Company had received payments

reflecting 60% of rents due for what can collectively be termed advance billing

for the third quarter of the year; this comprises both old and new English

quarter days (24th June and 1st July) and the Scottish quarter day (28th May).

The figures below include those tenants with whom it has been agreed, and have

paid, on a monthly in advance basis. Assuming those tenants continue to pay

rent monthly the collection figure should increase to 69%. The statistics,

split between sectors, are shown below.

Q3 % of rent demanded % collected

at 22 July

2020

Industrial 50 68

Office 35 59

Retail 7 40

Leisure 5 20

Other (Data 3 0

Centre)

At the same date (22nd July), rent due for the second quarter (Scottish quarter

day February, 25th March, 1st April, 1st May, 1st June) collection levels stand

at a combined 83%.

It is expected both the Q2 and Q3 figures will continue to improve as we

continue to engage with our tenants; something we have always done, but now

being more important than ever. The aim is to work with our tenants to find

mutually suitable solutions to the challenges of COVID-19 on our respective

businesses. Depending on the situation, the Company is agreeing to rental

deferments with some tenants with repayment periods to suit the businesses,

rent free periods in exchange for amended lease terms (generally an extension

of leases) and, in extremis, rental write offs (generally with the smallest

tenants who have no means of paying). Several tenants have chosen not to pay

and not to engage and they are generally tenants that can afford to pay but are

using the current Government protection designed for tenants that cannot pay to

delay making any payment. We will continue to chase these companies with

vigour.

Dividends

The Board recognises the importance of dividends to its shareholders especially

when the COVID-19 crisis has forced many companies, across multiple sectors of

the economy, to cancel or suspend their dividends. The Board has taken the

decision to maintain a quarterly dividend but at the reduced rate of 60% of

last year's level for this quarter equating to a dividend of 0.714p per share.

The Board is of the opinion that this rate balances the need for shareholders

to continue receiving income during this difficult period while maintaining a

prudent approach given the rent collection rates presently being experienced

for both Quarter 2 and Quarter 3.

The Board will continue to monitor closely the evolution of COVID-19, together

with its impact on rent receipts and recurring earnings. The Board will keep

the Company's future dividend policy under review, aiming to strike a balance

between rental income and shareholders' dividend requirements, noting that rent

collections are forecast to improve on the assumption that more of the economy

begins to open up as lockdown eases.

Net Asset Value ("NAV")

The unaudited net asset value per ordinary share of Standard Life Investments

Property Income Trust Limited ("SLIPIT") at 30 June 2020 was 79.6p. The net

asset value is calculated under International Financial Reporting Standards

("IFRS").

The net asset value incorporates the external portfolio valuation by Knight

Frank LLP at 30 June 2020 of GBP447.3 million and contained a material

uncertainty clause as a result of the COVID-19 pandemic over 47.3% of the

portfolio, set out below.

There has been huge disruption and exceptional circumstances in global markets,

including the UK commercial property market as a result of COVID-19. As a

result of this disruption and exceptional circumstances, a significant number

of the valuations provided by Knight Frank, and on which the NAV detailed in

this statement is based, are subject to a 'material valuation uncertainty'

qualification as follows:

"The outbreak of the COVID-19, declared by the World Health Organisation as a

"Global Pandemic" on the 11th March 2020, has impacted global financial

markets. Travel restrictions have been implemented by many countries.

Observable market activity - that provides the empirical data for us to have an

adequate level of certainty in the valuation - is being impacted in the case of

some properties but excludes Industrials and food stores which equates to 52.7%

of the portfolio. In the case of the properties not excluded, as at the

valuation date, we consider that we can attach less weight to previous market

evidence for comparison purposes, to inform opinions of value. Indeed, the

current response to COVID-19 means that we are faced with an unprecedented set

of circumstances on which to base a judgement. Our valuations of these

properties are therefore reported as being subject to 'material valuation

uncertainty' as set out in VPS 3 and VPGA 10 of the RICS Valuation - Global

Standards. Consequently, less certainty - and a higher degree of caution -

should be attached to our valuation than would normally be the case. Given the

unknown future impact that COVID-19 might have on the real estate market, we

recommend that you keep the valuation of the whole portfolio under frequent

review. For the avoidance of doubt, the inclusion of the 'material valuation

uncertainty' declaration above does not mean that the valuation cannot be

relied upon. Rather, the declaration has been included to ensure transparency

of the fact that - in the current extraordinary circumstances - less certainty

can be attached to the valuation than would otherwise be the case. The material

uncertainty clause is to serve as a precaution and does not invalidate the

valuation".

Breakdown of NAV movement

Set out below is a breakdown of the change to the unaudited NAV calculated

under IFRS over the period 1 April 2020 to 30 June 2020.

Per Share (p) Attributable Comment

Assets (GBPm)

Net assets as at 31 March 2020 83.2 338.6

Unrealised decrease in valuation -2.8 -11.3 Like for like reduction

of property portfolio of 2.5% in property

valuations.

CAPEX in the quarter -0.4 -1.6 Predominantly CAPEX at

Sandy installing

Photovoltaic cells on

the roof and also

Hagley Road,

Birmingham.

Net income in the quarter after -0.3 -1.0 Rolling 12 month

dividend (full dividend paid in dividend cover of 90%

May 2020)

Interest rate swaps mark to -0.1 -0.7 Increase in swap

market revaluation liabilities in the

quarter as interest

rates fell due to

COVID-19

Other movements in reserves 0.0 -0.2 Movement in lease

incentives in the

quarter

Net assets as at 30 June 2020 79.6 323.8

European Public Real 30 Jun 31 Mar

Estate

Association ("EPRA")* 2020 2020

EPRA Net Asset Value GBP327.9m GBP342.0m

EPRA Net Asset Value per 80.6p 84.1p

share

The Net Asset Value per share is calculated using 406,865,419 shares of 1p each

being the number in issue on 30 June 2020.

* The EPRA net asset value measure is to highlight the fair value of net assets

on an on-going, long-term basis. Assets and liabilities that are not expected

to crystallize in normal circumstances, such as the fair value of financial

derivatives, are therefore excluded.

Investment Manager Portfolio Activity & Review

The second quarter of 2020, running from end March to end June, was totally

dominated by COVID-19. Everyone involved in the running of the Company was

working from home, and for much of the time the country was in lockdown. These

conditions make communication and process even more important, and the Manager

and Board have remained focused on the delivery of the Company's objectives.

The Investment Manager has concentrated on tenant engagement and rent

collection. Although only one letting and two lease renewals / regears were

completed during the course of the quarter many conversations occurred, not

only with existing tenants, but also with new prospective tenants on a number

of our vacant properties. SLIPIT takes pride in being actively managed, and

several purchases and sales are being considered as we continue with the aim of

meeting the Company's objectives.

We also continue to invest in our assets to provide energy efficient solutions

and there has been significant progress in this area. At the end of the quarter

we completed the installation of a major Photo Voltaic (PV) scheme on one of

our assets. It is the largest undertaken by Aberdeen Standard Investments in

the UK, and the power will be sold to the tenant. The scheme is expected to

produce, and therefore save, the equivalent of 229 tonnes of operational CO2 in

the first year of operation, and the power output is the equivalent of the

yearly electricity usage of 230 homes. The Company will receive a yield of

circa 7% from the investment.

The Social aspect of ESG is harder to define and measure in real estate.

Normally we focus on creating a place people want to be, with community spirit

through events, stalls, and food banks etc. in buildings, as well as providing

excellent changing facilities and amenity space. As most of our tenants have

not been in occupation the current "S" focus is on supporting the tenants who

most need our help. Although we have very little exposure to independent

retailers, we do have some, and where they have not been able to trade we have

wanted to support them - they have enough stress at the current time without

having to worry about rent. Unfortunately, we have also found some tenants

abusing the Government restrictions on Landlords being able to enforce lease

covenants. We have found a number of organisations that could pay but choose

not to, or are restructuring in such a manner that the landlord takes the brunt

of the pain, rather than equity and debt holders. Needless to say, we will

chase those tenants with vigour as and when Government restrictions allow.

There has been a lot of commentary about the future of the office, and whether

working from home will have a similar impact on the sector as internet shopping

had for retail. We certainly expect continued change, but do not foresee the

demise of the office - it remains an important environment for people to

socialize, learn, share, and develop. We are going to see more people work in

an agile way, not spending 5 days a week in the office, or 5 days a week

working from home. An early trend we have seen is increased demand for fully

fitted suites, and during lockdown we completed the lease on one, and agreed

terms on another - we had already rolled out fitted suites across our estate,

and believe our policy of investing in buildings that create an environment

where people want to work remains relevant.

The LTV of 26.2% provides plenty of headroom against banking covenants (values

can fall by 50% and rent by 60% before the covenants are under pressure based

on 30 June covenants). Over the quarter, the Company had an increase in the

level of liability of its interest rate swap from GBP3.38 million to GBP4.05

million. This negative impact on the NAV will unwind to GBP0 on maturity in 2023.

Investment Manager market review and outlook

* The last quarter has seen an unprecedented contraction in economic

activity, with Q2 2020 the worst quarter for the UK economy on record.

* As we move into summer and lockdown restrictions are gradually relaxed,

there is a degree of cautious optimism emerging. Non-essential retailers

have reported strong trade since reopening in mid-June. However,

restructuring activity in retail, through the use of company voluntary

arrangements and pre-pack administrations continues largely unabated. With

the government extending the moratorium on forfeiture and other measures

against tenants not paying rent, income from retail assets remains at an

unprecedentedly low ebb.

* The future of offices is a hot topic and a wealth of survey evidence points

to a structural rise in remote working. Job losses are set to depress

demand and create 'grey' space for sub-letting to reduce costs in the short

term. In contrast, the logistics sector remains very strong, with record

take-up so far this year.

* Early indications of investment volumes in Q2 suggest a total of around GBP3

billion, which is on track to be the weakest quarter since Property Data's

records began in 2000. Activity has collapsed across the board, with

physical inspections impossible for much of the quarter and constraint on

international travel largely excluding overseas investors. The lack of

foreign capital was most keenly felt in the office sector, as well as

alternatives, with a notable absence of the large portfolio deals seen in

recent quarters.

* We expect capital values to fall by more than 14% this year, leading to a

total return for the sector of -9.5%. This would be the second weakest

nominal return in the 40-year history of MSCI data. We continue to expect

retail to drag the market down, with shopping centre returns forecast to be

-30.5% this year. With the segment recording a -9.1% return in the first

quarter and the occupier outlook deteriorating substantially since, there

may still be further downside risk.

* We continue to expect leisure and hotels to have a very difficult year,

despite the recent approval of Travelodge's company voluntary arrangement

at least warding off imminent failure. We also now expect a more negative

year for central London offices. The sector's outlook remains subject to

much debate but we expect a combination of cyclical rises in unemployment

and structural change to the use of offices to lead many occupiers to

fundamentally reappraise their space requirements. "Grey" space available

for sub-let is expected to weigh on rents.

* We continue to anticipate performance to diverge substantially across the

risk spectrum in most segments. Challenges around rent collection will put

even greater emphasis on the stability and durability of income.

* The universe of assets where investors can have confidence in the

robustness of the income and the stability of rental values and yields has

narrowed considerably and price transparency remains low.

Investment outlook

* The structural shift to online shopping remains supportive of logistics,

particularly in urban areas, but the supply-chain disruption experienced

through this crisis and the long-term potential for 'de-globalisation'

flagged by ASI's Research Institute could imply a further driver of demand.

Larger inventories to create a greater buffer within existing supply chains

are the simplest near-term solution - and will require more warehousing for

storage.

* The office sector will be under intense scrutiny. In the short term the

performance drivers are going to be economic (reduced demand due to lower

job creation / higher job loss), however over the medium to long term the

influence of changes to working practices will have a greater impact. There

will be a greater emphasis on asset selection to achieve performance in the

future from the office sector.

* The continued low interest rate environment globally means there is still

significant amounts of global capital looking to invest in Real Estate, and

the UK provides higher yields than many other European and global

locations, however Brexit remains a UK specific risk.

* Although the initial bounce back from the lows of COVID-19 is encouraging,

it is clear that the road to full recovery will be long and bumpy. The risk

of second and third waves remains ever present, and this will impact on the

speed and depth of recovery and a return to what we might consider normal.

* With all of the uncertainty currently prevailing, we remain firmly in a

risk off environment in real estate.

Net Asset analysis as at 30 June 2020 (unaudited)

GBPm % of net

assets

Industrial 235.5 72.7

Office 142.9 44.1

Retail 36.9 11.4

Other Commercial 32.0 9.9

Total Property Portfolio 447.3 138.1

Adjustment for lease incentives -5.2 -1.6

Fair value of Property Portfolio 442.1 136.5

Cash 5.0 1.5

Other Assets 17.4 5.4

Total Assets 464.5 143.4

Current liabilities -13.2 -4.1

Non-current liabilities (bank loans & swap) -127.5 -39.3

Total Net Assets 323.8 100.0

Breakdown in valuation movements over the period 1 April 2020 to 30 June 2020

Portfolio Exposure as Like for Like Capital Value

Value as at at 30 Jun Capital Value Shift (incl

30 Jun 2020 2020 (%) Shift (excl transactions

(GBPm) transactions & (GBPm)

CAPEX)

(%)

External valuation at 458.6

31 Mar 19

Retail 36.9 8.2 -5.5 -2.1

South East Retail 1.9 -7.1 -0.6

Retail Warehouses 6.3 -5.0 -1.5

Offices 142.9 31.9 -2.3 -3.5

London City Offices 3.0 -1.1 -0.2

London West End Offices 3.0 -2.2 -0.3

South East Offices 15.0 -3.1 -2.2

Rest of UK Offices 10.9 -1.7 -0.8

Industrial 235.5 52.7 -1.9 -4.5

South East Industrial 13.7 -1.6 -1.0

Rest of UK Industrial 39.0 -2.0 -3.5

Other Commercial 32.0 7.2 -3.6 -1.2

External valuation at 447.3 100.0 -2.5 447.3

30 Jun 20

Top 10 Properties

30 Jun 20 (GBPm)

Hagley Road, Birmingham 20-25

Symphony, Rotherham 15-20

The Pinnacle, Reading 15-20

Marsh Way, Rainham 10-15

Hollywood Green, London 10-15

Timbmet, Shellingford 10-15

New Palace Place, London 10-15

Basinghall Street, London 10-15

Badentoy, Aberdeen 10-15

Atos Data Centre, Birmingham 10-15

Top 10 tenants

Name Passing % of passing

Rent GBP rent

BAE Systems plc 1,257,640 4.6%

The Symphony Group Plc 1,225,000 4.5%

Schlumberger Oilfield UK plc 1,138,402 4.1%

Public Sector 1,158,858 4.2%

Timbmet Group Limited 799,683 2.9%

Atos IT Services UK Ltd 783,360 2.8%

CEVA Logistics Limited 671,958 2.4%

Timeline Wholesale services (UK) Ltd 635,554 2.3%

G W Atkins & Sons Ltd 625,000 2.3%

Multipacking Solutions UK Ltd 431,765 1.6%

Total 8,727,220 31.7%

Regional Split

South East 33.8%

West Midlands 14.9%

East Midlands 12.7%

North West 11.5%

Scotland 9.6%

North East 7.4%

South West 4.1%

London West End 3.0%

City of London 3.0%

The Board is not aware of any other significant events or transactions which

have occurred between 30 June 2020 and the date of publication of this

statement which would have a material impact on the financial position of the

Company.

The information contained within this announcement is deemed by the Company to

constitute inside information as stipulated under the Market Abuse Regulations

(EU) No. 596/2014). Upon the publication of this announcement via Regulatory

Information Service this inside information is now considered to be in the

public domain.

Details of the Company may also be found on the Investment Manager's website

at: www.slipit.co.uk

For further information:-

For further information:-

Jason Baggaley - Real Estate Fund Manager, Aberdeen Standard Investments

Tel: 07801039463 or jason.baggaley@aberdeenstandard.com

Oli Lord - Real Estate Deputy Fund Manager, Aberdeen Standard Investments

Tel: 07557938803 or oli.lord@aberdeenstandard.com

Graeme McDonald - Senior Fund Control Manager, Aberdeen Standard Investments

Tel: 07717543309 or graeme.mcdonald@aberdeenstandard.com

The Company Secretary

Northern Trust International Fund Administration Services (Guernsey) Ltd

Trafalgar Court

Les Banques

St Peter Port

GY1 3QL

Tel: 01481 745001

END

(END) Dow Jones Newswires

August 03, 2020 02:00 ET (06:00 GMT)

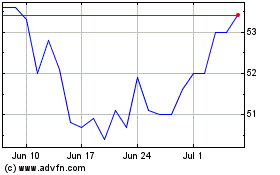

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Apr 2023 to Apr 2024