TIDMALF

RNS Number : 6827P

Alternative Liquidity Fund Limited

11 October 2019

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, TO US PERSONS OR IN OR INTO THE

UNITED STATES, OR INTO OR FROM ANY EEA STATE (OTHER THAN THE UNITED

KINGDOM) CANADA, AUSTRALIA, JAPAN, NEW ZEALAND OR THE REPUBLIC OF

SOUTH AFRICA.

This announcement is an advertisement and not a prospectus. This

announcement does not constitute or form part of, and should not be

construed as, any offer for sale or subscription of, or

solicitation of any offer to buy or subscribe for, any securities

in Alternative Liquidity Fund Limited (the "Company") or securities

in any other entity, in any jurisdiction, including the United

States, nor shall it, or any part of it, or the fact of its

distribution, form the basis of, or be relied on in connection

with, any contract or investment decision whatsoever, in any

jurisdiction. This announcement does not constitute a

recommendation regarding any securities. Any investment decision

must be made exclusively on the basis of the final prospectus

published by the Company and any supplement thereto.

11 October 2019

ALTERNATIVE LIQUIDITY FUND LIMITED

LEI: 213800R5CHD76J3LU713

PUBLICATION OF PROSPECTUS AND CIRCULAR

Introduction

Alternative Liquidity Fund Limited has today published a

prospectus in relation to the issue of up to 100 million new

Ordinary Shares pursuant to a 12 month placing programme (the

"Placing Programme"). The Company has also today published a

circular, the purpose of which is to convene an extraordinary

general meeting at which the appropriate shareholder authority will

be sought to issue, on a non pre-emptive basis, up to 100 million

new Ordinary Shares pursuant to the Placing Programme. The

Extraordinary General Meeting will be held at 10.00 a.m. on 5

November 2019 at Sarnia House, Le Truchot, St Peter Port, Guernsey

GY1 1GR.

The Placing Programme

It is intended that the net proceeds of the Placing Programme

will be invested in line with the Company's new investment policy

in a diversified portfolio of illiquid funds, funds of funds

including hedge funds, private equity funds, real estate funds,

infrastructure, private investment funds and other alternative and

absolute return investment vehicles across the world. In accordance

with the new investment policy, the net proceeds of the Placing

Programme are permitted to be invested principally in a segregated

portfolio of the Warana SP Master Fund SPC (herein referred to as

the Warana Master Fund) and/or new segregated portfolios which are

launched, in the future, provided that such portfolio has

substantially the same investment policy as the Company and the

same terms of investment are offered to the Company as those

currently contained within the Information and Subscription

Agreement.

The price of the new Ordinary Shares to be issued pursuant to

the Placing Programme will be determined by the Board at the time

of each placing under the Placing Programme. The price of the new

Ordinary Shares pursuant to the first Placing is expected to be

US$1.00 and for each Placing thereafter it will be calculated by

applying a premium to the net asset value per Ordinary Share

rounded to two decimal places. The Placing Programme Price will be

announced through a Regulatory Information Service on the Business

Day prior to the close of the relevant placing under the Placing

Programme.

Benefits

The Board believes that the introduction of the new share class

and the Placing Programme offer the following benefits for

Shareholders.

-- Given the Company's current investment portfolio (renamed the

Realisation Portfolio) is in its realisation stage, the Proposals

will provide Existing Shareholders with a clear realisation

strategy and the potential for a longer-term investment horizon due

to the rights of automatic conversion that are included in the New

Articles.

-- The Proposals are expected to provide an attractive overall

investment proposition, further diversifying the Company's

investment base, including the possible opportunity to offer

Shareholders exposure to the Warana Master Fund's (or subsequent

segregated portfolios launched in the future under the Warana SP

Master Fund SPC's) range of assets, which aim to provide investors

with attractive, risk-adjusted returns over a multi-year

period.

-- Increasing the Company's issued share capital through the

Placing Programme will result in the fixed costs of the Company

being spread over a larger asset base and, as a result, the ongoing

charges ratio should be lower.

Expected Timetable

Date

Placing Programme opens 11 October 2019

------------------------------------

EGM 10.00 a.m. 5 November 2019

------------------------------------

Admission and dealings in Ordinary 6 November 2019 to 9 October

Shares commence 2020

------------------------------------

Publication of Placing Programme the Business Day prior to the

Price in respect of each Placing close of the relevant Placing

under the Placing Programme under the Placing Programme

------------------------------------

Crediting of CREST accounts 8.00 a.m. or as soon as practicable

in respect of new Ordinary Shares thereafter on each day Ordinary

Shares are issued

------------------------------------

Share certificates in respect Approximately one week following

of new Ordinary Shares dispatched the issue of any Ordinary Shares

(if applicable)

------------------------------------

Placing Programme closes 9 October 2020

------------------------------------

Notes

The prospectus and circular will shortly be available for

inspection at the National Storage Mechanism which is located at

http://www.morningstar.co.uk/uk/nsm.do.

The prospectus and circular are also available in electronic

form on the Company's website at www.waranacap.com and copies are

available for collection during normal business hours on any

working day (Saturday, Sunday and public holidays excepted) until 9

October 2020 from the registered office of the Company and the

offices of Dickson Minto W.S., Broadgate Tower, 20 Primrose Street,

London EC2A 2EW.

Capitalised terms used but not defined in this announcement have

the same meanings as set out in the Company's prospectus dated

today, 11 October 2019.

For further information please contact:

Warana Capital, LLP +44 (0) 20 3551 2917

Tim Gardner tg@waranacap.com

Praxis Fund Services Limited +44 (0) 1481 737600

info@pfs.gg

Important Information

This announcement is for information purposes only and does not

purport to be full or complete and any decision regarding the

Prospectus and/or the Placing Programme should be made only on the

basis of the prospectus and circular published by the Company on 11

October 2019.

This announcement does not contain or constitute an offer for

sale or the solicitation of an offer to purchase securities in the

United States. The new Ordinary Shares in the Company have not been

and will not be registered under the US Securities Act of 1933, as

amended (the "Securities Act") or under any securities laws of any

state or other jurisdiction of the United States and may not be

offered, sold, taken up, exercised, resold, renounced, transferred

or delivered, directly or indirectly, within the United States

except pursuant to an applicable exemption from or in a transaction

not subject to the registration requirements of the Securities Act

and in compliance with any applicable securities laws of any state

or other jurisdiction of the United States. There will be no public

offer of the new Ordinary Shares in the United States.

The contents of this announcement, which have been prepared by

and are the sole responsibility of Alternative Liquidity Fund

Limited have been approved by Warana Capital LLP as a financial

promotion solely for the purposes of section 21(2)(b) of the

Financial Services and Markets Act 2000. However, this announcement

is for information purposes only and is not intended to and does

not constitute or form part of any offer or invitation to purchase

or subscribe for, or any solicitation to purchase or subscribe for,

any securities in any jurisdiction. No offer or invitation to

purchase or subscribe for, or any solicitation to purchase or

subscribe for, any securities will be made in any jurisdiction in

which such an offer or solicitation is unlawful. The information

contained in this announcement is not for release, publication or

distribution to persons in the United States, any member state of

the European Economic Area (other than the United Kingdom),

Australia, Canada, Japan, New Zealand or the Republic of South

Africa and should not be distributed, forwarded to or transmitted

in or into any jurisdiction, where to do so might constitute a

violation of local securities laws or regulations.

Dickson Minto W.S, which is authorised and regulated by the

Financial Conduct Authority, is acting only for the Company in

connection with the matters described in this announcement and is

not acting for or advising any other person, or treating any other

person as its client, in relation thereto and will not be

responsible for providing the regulatory protection afforded to

clients of Dickson Minto W.S. or advice to any other person in

relation to the matters contained herein.

None of the Company, Warana Capital LLP, Warana Capital LLC or

Dickson Minto W.S., or any of their respective affiliates, accepts

any responsibility or liability whatsoever for or makes any

representation or warranty, express or implied, as to this

announcement, including the truth, accuracy or completeness of the

information in this announcement (or whether any information has

been omitted from the announcement) or any other information

relating to the Company or associated companies, whether written,

oral or in a visual or electronic form, and howsoever transmitted

or made available or for any loss howsoever arising from any use of

the announcement or its contents or otherwise arising in connection

therewith. The Company, Warana Capital LLP, Warana Capital LLC and

Dickson Minto W.S. and their respective affiliates, accordingly

disclaim all and any liability whether arising in tort, contract or

otherwise which they might otherwise have in respect of this

announcement or its contents or otherwise arising in connection

therewith.

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED

STATES, ANY MEMBER STATE OF THE EUROPEAN ECONOMIC AREA (OTHER THAN

THE UNITED KINGDOM) AUSTRALIA, CANADA, JAPAN, NEW ZEALAND, THE

REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH THE

SAME WOULD BE UNLAWFUL

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

PDIGGGAGUUPBGAG

(END) Dow Jones Newswires

October 11, 2019 12:00 ET (16:00 GMT)

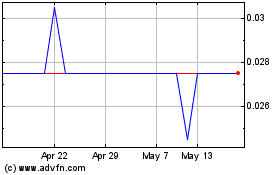

Alternative Liquidity (LSE:ALF)

Historical Stock Chart

From Mar 2024 to Apr 2024

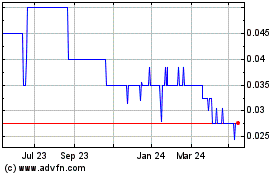

Alternative Liquidity (LSE:ALF)

Historical Stock Chart

From Apr 2023 to Apr 2024