TIDMAEO

RNS Number : 7793U

Aeorema Communications Plc

23 January 2017

Aeorema Communications plc / Index: AIM / Epic: AEO / Sector:

Media

23 January 2017

Aeorema communications plc ('Aeorema' or 'the Company')

Interim Report

Aeorema Communications plc, the AIM-traded live events agency,

announces its results for the six months ended 31 December

2016.

Overview

-- Pre-tax profits of GBP77,180 on a turnover of GBP1,575,470

-- Awards wins in film and events

-- Robust cash position of GBP1,151,766

Chairman's Statement

During the period, we maintained our position as a leading

London based live events agency with award wins and home and

abroad.

Despite this, the trading environment in the events sector has

been uncertain, in part due to the post-Brexit market uncertainty,

causing clients to be more hesitant in their event planning budgets

and resulting in some contracts to be either postponed or

cancelled. Against this background, Aeorema traded in line with

management expectations for the first half of the year and

maintained its strong cash position, but the second half remains

challenging as previously reported.

However, we believe that these are short-term challenges and in

the longer term we remain confident that our strategy and strong

market reputation in the delivery of creative and diverse live

events will see Aeorema prosper. As such, we continue to

differentiate ourselves in the market with our distinct skill-set,

working with several blue-chip corporations and attracting a

pipeline of potential quality business.

Our robust balance sheet with GBP1,151,766 cash in the bank and

revenue generation of GBP1,575,470 is something we are proud of.

During the six months, we achieved a pre-tax profit of GBP77,180

and operational costs were GBP699,836.

Aeorema is powered by the hard work and commitment of all our

employees; I would like to thank them for their efforts and

dedication, as well as our shareholders for their continued

support.

M Hale

Chairman

20 January 2017

For further information visit www.aeorema.com or contact:

Gary Fitzpatrick Aeorema Communications plc Tel: 020 7291

0444

Marc Milmo/Catherine Leftley Cantor Fitzgerald Europe Tel: 020

7894 7000

Isabel de Salis St Brides Partners Tel: 020 7236 1177

AEOREMA COMMUNICATIONS PLC

CONDENSED CONSOLIDATED INCOME STATEMENT

For the period ended 31 December 2016

Unaudited Unaudited Audited

6 Months 6 Months Year

to 31 to 31 to

December December 30 June

2016 2015 2016

Notes GBP GBP GBP

Continuing Operations

Revenue 1,575,470 1,591,114 4,583,050

Cost of sales (798,814) (795,832) (2,779,903)

Gross profit 776,656 795,282 1,803,147

Administrative expenses (699,836) (715,202) (1,463,899)

Operating profit 76,820 80,080 339,248

Finance income 360 396 917

Profit before taxation 77,180 80,476 340,165

Taxation 5 (24,847) (16,565) (66,663)

Profit for the period

from continuing operations 52,333 63,911 273,502

Basic and diluted earnings

per share from continuing

operations

Basic (pence) 6 0.57823 0.70616 3.02195

Diluted (pence) 6 0.55968 0.68350 2.92500

========== ========== ============

There are no other comprehensive income items

AEOREMA COMMUNICATIONS PLC

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

For the period ended 31 December 2016

Unaudited Unaudited Audited

6 Months 6 Months Year

to 31 to 31 to

December December 30 June

2016 2015 2016

GBP GBP GBP

Non-current assets

Intangible assets 365,154 365,154 365,154

Property, plant and

equipment 50,958 99,560 60,259

Deferred taxation - - 6,075

416,112 464,714 431,488

Current assets

Trade and other receivables 651,502 747,770 1,174,337

Cash and cash equivalents 1,151,766 1,372,589 1,427,723

---------- ---------- ----------

1,803,268 2,120,359 2,602,060

Total assets 2,219,380 2,585,073 3,033,548

========== ========== ==========

Current liabilities

Trade and other payables 636,320 839,868 1,340,583

Current tax payable 83,205 57,000 66,043

---------- ---------- ----------

719,525 896,868 1,406,626

Non-current liabilities

Deferred taxation 1,610 4,322 -

---------- ---------- ----------

1,610 4,322 -

Net assets 1,498,245 1,683,883 1,626,922

========== ========== ==========

Equity attributable

to equity holder:

Share capital 1,131,313 1,131,313 1,131,313

Share premium 7,063 7,063 7,063

Merger reserve 16,650 16,650 16,650

Capital contribution

reserve 257,812 257,812 257,812

Retained earnings 85,407 271,045 214,084

Total equity 1,498,245 1,683,883 1,626,922

========== ========== ==========

AEOREMA COMMUNICATIONS PLC

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the period ended 31 December 2016

Share Share Merger Capital Retained Total

capital Premium reserve contribution earnings equity

reserve

GBP GBP GBP GBP GBP GBP

At 1 July

2015 1,131,313 7,063 16,650 257,812 471,202 1,884,040

Payment of

dividends - - - - (271,515) (271,515)

Comprehensive

income for

the period - - - - 63,911 63,911

Share based

payment - - - - 7,447 7,447

At 31 December

2015 1,131,313 7,063 16,650 257,812 271,045 1,683,883

At 1 January

2016 1,131,313 7,063 16,650 257,812 271,045 1,683,883

Payment of

dividends - - - - (271,515) (271,515)

Comprehensive

income for

the period - - - - 209,591 209,591

Share based

payment - - - - 4,963 4,963

At 30 June

2016 1,131,313 7,063 16,650 257,812 214,084 1,626,922

At 1 July

2016 1,131,313 7,063 16,650 257,812 214,084 1,626,922

Payment of

dividends - - - - (181,010) (181,010)

Comprehensive

income for

the period - - - - 52,333 52,333

At 31 December

2016 1,131,313 7,063 16,650 257,812 85,407 1,498,245

AEOREMA COMMUNICATIONS PLC

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

For the period ended 31 December 2016

Unaudited Unaudited Audited

6 Months 6 Months Year

to 31 to 31 to

December December 30 June

2016 2015 2016

GBP GBP GBP

Cash flow from operating

activities

Profit before taxation 77,180 80,476 340,165

Adjustments for:

Depreciation of property,

plant and equipment 25,235 26,031 44,101

Share based payment expense - 7,447 12,410

Finance income (360) (396) (917)

---------- ---------- ----------

Operating cash flow before

movement in working capital 102,055 113,558 395,759

Decrease in trade and

other payables (704,264) (572,475) (71,760)

Decrease in trade and

other receivables 522,835 604,629 178,061

Cash (used) in / generated

from operating activities (79,374) 145,712 502,060

Taxation paid - - (51,452)

Cash flow from investing

activities

Finance income 360 396 917

Purchase of property,

plant and equipment (15,933) (60,457) (39,225)

Net cash used in investing

activities (15,573) (60,061) (38,308)

Cash flow from financing

activities

Dividends paid (181,010) (271,515) (543,030)

---------- ---------- ----------

Net cash used in financing

activities (181,010) (271,515) (543,030)

Net decrease in cash and

cash equivalents (275,957) (185,864) (130,730)

---------- ---------- ----------

Cash and cash equivalents

at beginning of period 1,427,723 1,558,453 1,558,453

Cash and cash equivalents

at end of period 1,151,766 1,372,589 1,427,723

========== ========== ==========

AEOREMA COMMUNICATIONS PLC

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For the period ended 31 December 2016

1. General information

Aeorema Communications plc is a public limited company

incorporated within the United Kingdom. The company is domiciled in

the United Kingdom and its principal place of business is 23-31

Great Titchfield Street, London, W1W 7PA. The Company's ordinary

shares are traded on AIM market of the London Stock Exchange.

These condensed consolidated interim financial statements for

the period ending 31 December 2016 (including comparatives for the

periods ended 31 December 2015 and 30 June 2016) were approved by

the board of directors on 20 January 2017.

The financial information set out in this interim report does

not constitute statutory accounts for the purposes of section 434

of the Companies Act (2006). The Group's statutory financial

statements for the year ended 30 June 2016, prepared under

International Financial Reporting Standards (IFRS), have been filed

with the Registrar of Companies. The auditor's report for those

financial statements was unqualified and did not contain a

statement under section 498 (2) or section 498 (3) of the Companies

Act (2006).

The interim financial statements have been prepared using the

accounting policies set out in the Group's 2016 statutory accounts

and have not been audited.

Copies of the annual statutory financial statements and the

interim report can be found on our website at www.aeorema.com or

can be requested from the Company Secretary at the Company's

registered office: 64 New Cavendish Street, London, W1G 8TB.

2. Basis of preparation

These condensed consolidated interim financial statements for

the period ended 31 December 2016 have been prepared in accordance

with IAS 34, 'Interim Financial Reporting' as adopted by the

European Union. The interim condensed consolidated financial

statements should be read in conjunction with the annual financial

statements for the year ended 30 June 2016, which have been

prepared in accordance with IFRS as adopted by the European

Union

3. Summary of significant accounting policies

The accounting policies adopted are consistent with those of the

annual financial statements for the year ended 30 June 2016, as

described in those annual financial statements. There has been no

impact on the Group's financial position or performance from new

and amended IFRS and IFRIC interpretations mandatory as of 1 July

2016.

4. Revenue and segmental results

The Company uses several factors in identifying and analysing

reportable segments, including the basis of organisation such as

differences in products and geographical areas. The Board of

Directors, being the chief operating decision makers, have

determined that for the period ended 31 December 2016 there is only

one reportable operating segment.

5. Income tax charge

Income period tax is accrued based on the estimated average

annual effective income tax rate of 20 percent (2015: 20

percent).

6. Earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the year.

Diluted earnings per share are calculated by dividing the profit

attributable to ordinary owners of the parent by the weighted

average number of ordinary shares outstanding during the year plus

the weighted average number of ordinary shares that would have been

issued on the conversion of all dilutive potential ordinary shares

in ordinary shares.

The following reflects the income and share data used and

dilutive earnings per share computations:

Unaudited Unaudited Audited

6 Months 6 Months Year

to 31 December to 31 to 30

2016 December June

2015 2016

Earnings per share

attributable to owners

of parent 52,333 63,911 273,502

Number of shares

Basic weighted average

number of shares 9,050,500 9,050,500 9,050,500

Effect of dilutive

share options 300,000 300,000 300,000

Diluted weighted average

number of shares 9,350,500 9,350,500 9,350,500

7. Dividends

During the interim period a dividend of 2 pence (2015: 3 pence)

per share was paid to holders of the Company's ordinary shares.

8. Related party transactions

The Group has a related party relationship with its subsidiaries

and its directors. Transactions between Group companies, which are

related parties, have been eliminated on consolidation and are

therefore not included in these consolidated interim financial

statements.

Unaudited Unaudited

6 months 6 months

to 31 to 31

December December

2016 2015

GBP GBP

Subsidiaries

Amounts owed by/(to) subsidiaries 504,015 400,973

---------- ----------

Amounts owed by/(to) subsidiaries 504,015 400,973

Harris & Trotter LLP is a firm in which S Haffner and S

Garbutta are members. The following was charged to the Group in

respect of professional services.

Unaudited Unaudited

6 Months 6 Months

to 31 to 31

December December

2016 2015

Harris & Trotter LLP GBP GBP

Aeorema Communications plc 7,500 6,000

Aeorema Limited 2,450 1,900

---------- ----------

9,950 7,900

Fees charged to Aeorema Communications plc include GBP7,500

(2015: GBP5,000) for the services of Stephen Haffner (2015: Stephen

Garbutta) as a non-executive director of that company.

The compensation of key management (including directors) of the

Group is as follows:

Unaudited Unaudited

6 Months 6 Months

to 31 to 31

December December

2016 2015

GBP GBP

Short-term employee benefits 112,000 109,810

Post-employment benefits 20,496 31,708

---------- ----------

132,496 141,518

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR OKKDBOBKDDDB

(END) Dow Jones Newswires

January 23, 2017 02:00 ET (07:00 GMT)

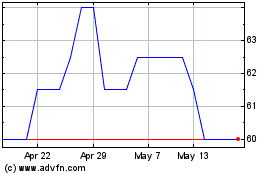

Aeorema Communications (LSE:AEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aeorema Communications (LSE:AEO)

Historical Stock Chart

From Apr 2023 to Apr 2024