Ariana Resources PLC UPDATE ON CAPITAL REDUCTION PROCEEDINGS (4855B)

June 10 2021 - 4:58AM

UK Regulatory

TIDMAAU

RNS Number : 4855B

Ariana Resources PLC

10 June 2021

10 June 2021

AIM: AAU

UPDATE ON CAPITAL REDUCTION PROCEEDINGS

Ariana Resources plc ("Ariana" or "the Company"), the AIM-listed

exploration and development company operating in Europe, is pleased

to provide an update concerning the proposed reduction of share

capital via a cancellation of the Company's share premium account,

the cancellation of the deferred shares, and the authority for the

Company to buy back shares, as detailed in the circular to

shareholders (the "Circular") on 08 February 2021.

The Company confirms that the first court hearing has completed

as expected by the Board, and that it is now working towards the

second hearing later in June. An update to the market, including

detail of the Company's dividend policy, will be provided in early

July.

Dr. Kerim Sener, Managing Director, commented:

"We are pleased to announce that the first court hearing in

relation to the Company's capital reduction has now completed as we

had hoped. The second court date is set for late June, following

which we intend to provide an update to the market on this process

and the Company's dividend policy, which I expect will be in early

July.

"We remain confident that the court proceedings will complete as

intended and will notify the market of any significant developments

as and when they occur."

Contacts:

Ariana Resources plc Tel: +44 (0) 20 7407 3616

Michael de Villiers, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited - Nominated Tel: +44 (0) 20 7628 3396

Adviser and Broker

Roland Cornish / Felicity Geidt

Panmure Gordon (UK) Limited - Broker Tel: +44 (0) 20 7886 2500

John Prior / Hugh Rich / Atholl

Tweedie

Yellow Jersey PR Limited - Public Tel: +44 (0) 7951 402 336

Relations

Dom Barretto / Joe Burgess / Henry arianaresources@yellowjerseypr.com

Wilkinson

Editors' Note:

About Ariana Resources:

Ariana is an AIM-listed mineral exploration and development

company with an exceptional track-record of creating value for its

shareholders through its interests in active mining projects and

investments in exploration companies. Its current interests include

gold production in Turkey and copper-gold exploration and

development projects in Cyprus and Kosovo.

The Company holds 23.5% interest in Zenit Madencilik San. ve

Tic. A.S. a joint venture with Ozaltin Holding A.S. and Proccea

Construction Co. in Turkey which contains a depleted total of c.

2.1 million ounces of gold and other metals (as at July 2020). The

joint venture comprises the Kiziltepe Mine and the Tavsan and

Salinbas projects.

The Kiziltepe Gold-Silver Mine is located in western Turkey and

contains a depleted JORC Measured, Indicated and Inferred Resource

of 227,000 ounces gold and 0.7 million ounces silver (as at April

2020). The mine has been in profitable production since 2017 and is

expected to produce at a rate of c.20,000 ounces of gold per annum

to at least the mid-2020s. A Net Smelter Return ("NSR") royalty of

2.5% on production is being paid to Franco-Nevada Corporation.

The Tavsan Gold Project is located in western Turkey and

contains a JORC Measured, Indicated and Inferred Resource of

253,000 ounces gold and 3.7 million ounces silver (as at June

2020). The project is being progressed through permitting and an

Environmental Impact Assessment, with the intention of developing

the site to become the second joint venture gold mining operation.

A NSR royalty of up to 2% on future production is payable to

Sandstorm Gold.

The Salinbas Gold Project is located in north-eastern Turkey and

contains a JORC Measured, Indicated and Inferred Resource of 1.5

million ounces of gold (as at July 2020). It is located within the

multi-million ounce Artvin Goldfield, which contains the "Hot Gold

Corridor" comprising several significant gold-copper projects

including the 4 million ounce Hot Maden project, which lies 16km to

the south of Salinbas. A NSR royalty of up to 2% on future

production is payable to Eldorado Gold Corporation.

Ariana is currently earning-in to 75% of Western Tethyan

Resources Ltd ("WTR"), which operates across Eastern Europe and is

based in Pristina, Republic of Kosovo. The company is targeting its

exploration on major copper-gold deposits across the

porphyry-epithermal transition.

Ariana is also earning-in to 50% of UK-registered Venus Minerals

Ltd ("Venus") and has to date earned into an entitlement to 26%.

Venus is focused on the exploration and development of copper-gold

assets in Cyprus which contain a combined JORC Inferred Resource of

9.5Mt @ 0.65% copper (excluding additional gold, silver and

zinc).

Panmure Gordon (UK) Limited is broker to the Company and

Beaumont Cornish Limited is the Company's Nominated Adviser and

Broker.

For further information on Ariana you are invited to visit the

Company's website at www.arianaresources.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFMMPTMTABMIB

(END) Dow Jones Newswires

June 10, 2021 04:58 ET (08:58 GMT)

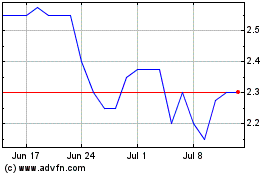

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Apr 2023 to Apr 2024