Global Stocks Gain on Hopes for Rate Cut

July 19 2019 - 6:13AM

Dow Jones News

By Nathan Allan

--Markets in Europe and Asia tick higher

--Brent crude gains on Iran tensions

--U.S. futures trade up

Global stocks rose Friday as investors welcomed comments from a

Federal Reserve official that seemed to strengthen the case for an

interest-rate cut.

Automotive, chemical and food-and-beverage companies led gains

on the pan-continental Stoxx Europe 600 index, which rose 0.4% to

reverse a two-day losing streak.

Brewer Anheuser-Busch InBev was among Europe's biggest gainers,

rising nearly 5% after the Budweiser maker agreed to sell its

Australian subsidiary to Japan's Asahi Group Holdings Ltd. in an

$11.3 billion deal in an effort to pare its debt load.

German luxury car maker BMW AG rose about 1% after nominating

its head of production, Oliver Zipse, to be the next chief

executive. Evercore ISI analyst Arndt Ellinghorst said Mr. Zipse's

appointment was a decision made in favor of stability and

continuity in a volatile world.

Meanwhile, France's Publicis Groupe dropped 8.6% after the

advertising giant cut its outlook, prompting a downgrade from

analysts at Liberum.

In Asia, most benchmark gauges traded higher. Hong Kong's Hang

Seng Index rose more than 1%, buoyed by consumer-goods

companies.Japan's Nikkei 225 index climbed 2%.

In the U.S., future contracts tied to the S&P 500 index rose

about 0.3%. Friday is poised to be another big day for investors in

financial stocks, with BlackRock, State Street and American Express

all poised to report second-quarter results.

U.S. stocks closed higher on Thursday after Federal Reserve Bank

of New York President John Williams said central banks must take

swift action when faced with adverse economic conditions, which

some investors interpreted as signaling a 0.5% rate cut in July.

However, the bank later said Mr. Williams didn't intend to signal

any specific policy changes. Still, short-term Treasury yields fell

sharply on Thursday following those remarks.

The yield on the 10-year Treasury note rose to 2.041% Friday,

while the 2-year note rate, sensitive to shifting expectations for

Fed policy, ticked up to 1.781%, according to data from FactSet.

The WSJ Dollar Index climbed 0.3% to 89.89.

Investors will also be watching for University of Michigan's

July consumer confidence data. Economists surveyed by The Wall

Street Journal forecast the consumer sentiment index logged in at

99.0 in the beginning of July, up slightly from 98.2 at the end of

June.

Such a rise could reduce the likelihood of a large rate cut by

the Federal Reserve at the end of the month and provide some

support for the U.S. dollar, Rabobank said.

Meanwhile, global oil benchmark Brent crude rose nearly 1.4%,

rebounding from the month's lows and marking a second day of

volatility in the prices. Iran denied that the U.S. Navy downed one

of its drones in the Strait of Hormuz, following several close

encounters between American warships and the Iranian military on

Thursday in the vital oil shipping route that further raised

tensions between the nations.

-- Lauren Almeida contributed to this article

(END) Dow Jones Newswires

July 19, 2019 05:58 ET (09:58 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

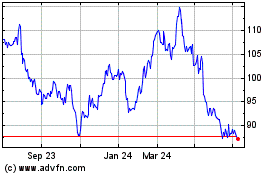

Bayerische Motoren Werke (TG:BMW)

Historical Stock Chart

From Mar 2024 to Apr 2024

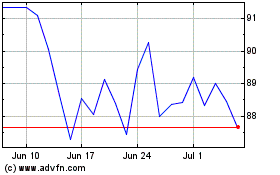

Bayerische Motoren Werke (TG:BMW)

Historical Stock Chart

From Apr 2023 to Apr 2024