SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of report (Date of earliest event

reported): March 17, 2015

TRULI

MEDIA GROUP, INC.

(Exact name of registrant as specified

in Charter)

| Oklahoma |

|

000-53641 |

|

26-3090646 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File No.) |

|

(IRS Employee

Identification No.) |

515 Chalette Drive

Beverly Hills,

CA 90210

(Address of Principal Executive Offices)

Registrant's telephone number,

including area code: (310) 274-0224

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

☐ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

Agreement and Plan of Merger

On March 17, 2015 (“Effective

Date”), Truli Media Group, Inc. (the “Company”) effected a merger, with its newly formed wholly-owned subsidiary,

Truli Media Group, Inc., a Delaware corporation (“TMG”) for the purposes of changing the state of incorporation to

Delaware (the “Merger”). On the Effective Date, the company also completed a reverse stock split as described below.

Prior to the Merger, the Company was the sole stockholder of TMG. Upon completion of the Merger, TMG will be the surviving entity.

The Merger was effected through an agreement and plan of merger (“Merger Agreement”).

The Merger, including

the Merger Agreement were approved by the board of directors of the Company and a majority of the outstanding capital stock by

the stockholders pursuant to a written consent (“Written Consent”).

A certificate of merger

was filed with both the Oklahoma Secretary of State and the Delaware Secretary of State on February 27, 2015. As a result of the

Merger, the Company is subject to the certificate of incorporation (“Certificate”) and bylaws (“Bylaws”)

of TMG and shall be further governed by the Delaware General Corporation Law.

On the Effective Date,

(i) every fifty (50) shares of the Company’s issued and outstanding common stock (“Common Stock”) was converted

into one (1) share of common stock TMG (“TMG Stock”) (the “Stock Split”). Every option and right to acquire

the Company’s Common Stock and every outstanding warrant or right outstanding to purchase the Company’s Common Stock

will automatically be converted into options, warrants and rights to purchase TMG Stock whereby each option, warrant or right to

purchase fifty (50) shares of Common Stock will be converted into one (1) option, warrant or right to purchase TMG Stock at 5,000%

of the of the exercise, conversion or strike price of such converted options, warrants and rights. The stockholders of the Company

will receive no fractional shares of TMG and shall instead have every fractional share, option, warrant or right to purchase TMG

Stock rounded up to the next whole number. Additionally, all debts and obligations of the Company will be assumed by TMG.

The Company filed a preliminary

information statement on Schedule 14C with the Securities and Exchange Commission on January 12, 2015, and a definitive information

statement was mailed to the Company’s shareholders of record on January 26, 2015. The information statement further described

the Merger, Merger Agreement, Stock Split and the Plan as described in Item 5.02 below.

Item 3.03 Material Modification to Rights

of Security Holders.

The information

provided in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The Company’s board

additionally approved the Company’s 2014 equity compensation plan (“Plan”), form of restricted stock unit agreement

(“RSU Agreement”), restricted stock award agreement (“RSA Agreement”) and stock option agreement (“Option

Agreement”). The holders of a majority of the voting capital stock of the Company approved the Plan, RSU Agreement, RSA Agreement

and Option Agreement in the Written Consent.

Item 5.03 Amendments to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

The information provided

in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.03.

Item 5.07 Submission of Matters

to a Vote of Security Holders.

The information

provided in Item 1.01 and Item 5.02 of this Current report on Form 8-K are incorporated by reference into this Item 5.07. As of

the record date (December 19, 2014) we had 127,682,295 shares entitled to vote. The voting results are as follows:

| 1. | Reverse Merger into Subsidiary |

| Votes For | | |

Votes not Solicited |

| | 65,443,847 | | |

| 62,238,448 |

| Votes For | | |

Votes not Solicited |

| | 65,443,847 | | |

| 62,238,448 |

| 3. | 2014 Equity Compensation Plan |

| Votes For | | |

Votes not Solicited |

| | 65,443,847 | | |

| 62,238,448 |

Item 8.01 Other

Events.

On March 17, 2015,

the Company announced the completion of the Merger and Stock Split as described in Item 1.01. A copy of the press release is attached

to this report as Exhibit 99.01.

Item 9.01 Financial Statements and

Exhibits.

Exhibit

Number |

|

Description |

| |

|

|

| 2.01 |

|

Merger Agreement (1) |

| 3.01(i) |

|

Certificate of Incorporation of TMG (2) |

| 3.02(ii) |

|

Bylaws of TMG (3) |

| 4.01 |

|

Truli Media Group, Inc. 2014 Equity Compensation Plan (4) |

| 4.02 |

|

Restricted Stock Unit Agreement (4) |

| 4.03 |

|

Restricted Stock Award Agreement (4) |

| 4.04 |

|

Stock Option Agreement (4) |

| 99.01 |

|

Press Release Dated March 17, 2015 |

| (1) | Filed as Appendix A on Information Statement on Schedule 14C filed on January 26, 2015 (File No. 000-53641). |

| (2) | Filed as Appendix B on Information Statement on Schedule 14C filed on January 26, 2015 (File No. 000-53641). |

| (3) | Filed as Appendix C on Information Statement on Schedule 14C filed on January 26, 2015 (File No. 000-53641). |

| (4) | Filed as Appendix E on Information Statement on Schedule 14C filed on January 26, 2015 (File No. 000-53641). |

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the Registrant has duly caused this Report on Form 8-K to be signed on its behalf by the undersigned

hereunto duly authorized.

Dated: March 17, 2015

| |

TRULI MEDIA GROUP, Inc. |

| |

|

|

| |

By: |

/s/ Michael Jay Solomon |

| |

|

Michael Jay Solomon

Chief Executive Officer |

INDEX

OF EXHIBITS

| Exhibit Number |

|

Description |

| |

|

|

| 2.01 |

|

Merger Agreement (1) |

| 3.01(i) |

|

Certificate of Incorporation of TMG (2) |

| 3.02(ii) |

|

Bylaws of TMG (3) |

| 4.01 |

|

Truli Media Group, Inc. 2014 Equity Compensation Plan (4) |

| 4.02 |

|

Stock Option Agreement (4) |

| 4.03 |

|

Restricted Stock Award Agreement (4) |

| 4.04 |

|

Restricted Stock Unit Agreement (4) |

| 99.01 |

|

Press Release Dated March 17, 2015 |

| (1) | Filed as Appendix A on Information Statement on Schedule 14C filed on January 26, 2015 (File No. 000-53641). |

| (2) | Filed as Appendix B on Information Statement on Schedule 14C filed on January 26, 2015 (File No. 000-53641). |

| (3) | Filed as Appendix C on Information Statement on Schedule 14C filed on January 26, 2015 (File No. 000-53641). |

| (4) | Filed as Appendix E on Information Statement on Schedule 14C filed on January 26, 2015 (File No. 000-53641). |

5

Exhibit 99.1

Truli Media Group Provides Shareholder Update on

Substantial Content Acquisition Gains in Last Quarter of 2014 and Announces Effectiveness of Reverse Stock Split

LOS ANGELES, CA--(Marketwired - Mar 17, 2015) - Truli

Media Group, Inc. (OTCQB: TRLI), parent company of www.Truli.com, a global, faith and family

friendly media content platform and social community hub, today is providing shareholders with an update on the substantial content

acquisition gains that took place during the last quarter of 2014 and announced the effectiveness of Truli's merger into its wholly

owned subsidiary also named Truli Media Group, Inc. and a fifty-to-one reverse stock split. The merger is being undertaken

to change the company's domicile to Delaware. Effective March 17, 2015, Truli Media Group will be a Delaware corporation and its

stock will trade under the symbol TRLID for a period of twenty business days. The symbol will revert back to TRLI at such

time. After giving effect to the merger and reverse stock split, Truli has 2,553,683 shares of common stock issued and outstanding.

Jim Dickson, Truli's VP of Content and Distribution,

stated, "Truli continued to make great strides in adding new and original content to Truli.com with 49 new content partners

in the 4th quarter of 2014. The new partners have already added almost 1,100 programs to the platform. This

surpasses our set goal and allows us to offer more new programs to our vast library and to grow our subscriber base as we touch

these new content partner's constituents."

Michael Solomon, founder, Chairman and CEO of Truli

Media Group, recognized for his vision in the development of many successful media projects, commented: "These numbers

reflect a growing desire for what Truli.com has to offer content owners seeking a worldwide distribution platform for their positive

and entertaining content. Our objective is for Truli to be the destination platform designed for all people searching

for content that is safe for the family and encompasses positive principles."

Solomon continued, "It is imperative that we

continue to grow our partnership program as we develop a world class library of content for the family. This is an integral

step as we prepare for the commercialization of our web property for both desktop and mobile users. Additionally, we are pleased

to announce our reverse stock split as we believe that the new capital structure is more appropriate for our shareholders and for

our firm based on our stage of development as a public company."

About Truli Media Group (www.Truli.com):

Truli Media Group, through Truli.com, offers a unique

distribution platform focused on family-friendly and inspirational content that is free for users to view, interact and engage

with on any mobile apparatus such as tablets, phones, smart TV, etc. Truli is free for ministries as many additional sermons are

delivered weekly from hundreds of churches, as well as music videos, film/television content, sports, comedy and educational programs.

Truli will derive revenue through the sale of advertising and revenue splits for Pay Per View (PPV) content and products offered

on the site. Truli offers a single platform that is flexible and easy to access to connect users, enabling the delivery of

relevant and family content to a targeted community market of 100+ million people in the U.S., and 700+ million outside the U.S. Also,

Truli Español is already a major content provider to Spanish speakers throughout the world.

Safe Harbor Statement:

This news release contains statements that involve

expectations, plans or intentions (such as those relating to future business or financial results, new features or services, or

management strategies) and other factors discussed from time to time in the Company's Securities and Exchange Commission filings.

These statements are forward-looking and are subject to risks and uncertainties, so actual results may vary materially. You can

identify these forward-looking statements by words such as "may," "should," "expect," "anticipate,"

"believe," "estimate," "intend," "plan" and other similar expressions. Our actual results

could differ materially from those anticipated in these forward-looking statements as a result of certain factors not within the

control of the company. The company cautions readers not to place undue reliance on any such forward-looking statements, which

speak only as of the date made. The company disclaims any obligation subsequently to revise any forward-looking statements to reflect

events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

CONTACT INFORMATION

Truli Contact:

Jim Dickson

VP Content and Distribution

(303) 810-4050

Email Contact

www.truli.com

Investors:

Alan Sheinwald

Capital Markets Group

(914) 669-0222

Email Contact

Unencrypted Contact)

Truli Contact:

Jim Dickson

VP Content and Distribution

(303) 810-4050

jim@trulimediagroup.com

www.truli.com

Investors:

Alan Sheinwald

Capital Markets Group

(914) 669-0222

alan@capmarketsgroup.com

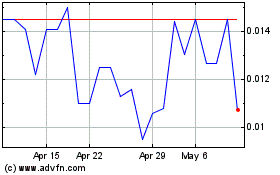

1933 Industries (QB) (USOTC:TGIFF)

Historical Stock Chart

From Apr 2024 to May 2024

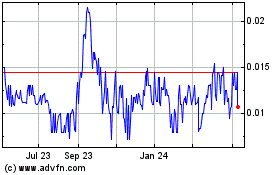

1933 Industries (QB) (USOTC:TGIFF)

Historical Stock Chart

From May 2023 to May 2024