China's Meituan-Dianping Files for IPO, Reveals Loss of Nearly $3 Billion in 2017 -- 2nd Update

June 25 2018 - 12:17AM

Dow Jones News

By Liza Lin and Stella Yifan Xie

HONG KONG-- Fast-growing Chinese technology startup

Meituan-Dianping applied to list in Hong Kong and seeks to raise

billions of dollars to help finance its growth strategy in what is

a highly competitive internet marketplace.

The Beijing-based online services provider is one of the

country's most valuable private tech companies. Its current

investors include Priceline Group Inc., the Canada Pension Plan

Investment Board and Chinese social media and gaming firm Tencent

Holdings Ltd. Meituan said it lost money last year but its revenue

more than doubled, and it expects to maintain rapid growth as more

Chinese consumers spend money online.

Meituan didn't disclose how much it plans to raise in the stock

sale, but the company is targeting a valuation of more than $60

billion, according to people familiar with the matter. Companies

listing in Hong Kong typically sell at least 10% of their shares

when they go public. Goldman Sachs, Morgan Stanley, and Bank of

America Merrill Lynch are the main banks handling Meituan's

IPO.

In a filing with Hong Kong's stock exchange, Meituan said it

generated 33.9 billion yuan ($5.2 billion) in revenue in 2017, up

161% from a year earlier.

The company posted a loss of 18.99 billion yuan last year, its

prospectus said.

The company also said its adjusted net loss was 2.85 billion

yuan in 2017, about half of what it was for the two years before

that. The adjusted figure strips out share-based compensation

expenses and gains and losses from investments, asset sales and

discontinued operations. Meituan said it had 19.4 billion in cash

equivalents at the end of last year.

Meituan's initial public offering, which is likely to occur in

the coming months, is part of wave of expected listings by Chinese

tech unicorns, a term used to describe private companies with

valuations greater than $1 billion. Last week, Chinese smartphone

maker Xiaomi Corp. set in motion a Hong Kong IPO that seeks to

raise as much as $6.1 billion. It is aiming for a valuation of $55

billion to $70 billion.

Meituan, ride-hailing firm Didi Chuxing Technology Co. and

mobile content firm Beijing Bytedance Technology Co. have been

labeled by market participants as an up-and-coming trio of

influential internet companies, behind giants like Tencent and

Alibaba Group Holding Ltd.

Founded in 2010 by Chinese entrepreneur Wang Xing, Meituan has

become one of the world's most valuable private startups by

creating a platform that provides services to China's growing

middle class. In 2015, it completed a merger with Dianping, a

review site. The startup was valued at $30 billion in October after

it raised $4 billion from investors in China, the U.S. and

elsewhere.

The Chinese internet firm doesn't have a single equivalent

counterpart in the U.S. Instead, it sells vouchers like Groupon

Inc., provides reviews and listings like Yelp Inc. and offers food

delivery like Grubhub Inc. It also sells movie tickets and offers

hotel and travel bookings. Meituan said it served 310 million

"transacting users" last year, referring to customers who made at

least one transaction on its platform.

Its food-delivery service competes with an Alibaba unit for

dominance. Both firms offer discounts to attract and retain

customers. And a recent foray into ride hailing could provoke a

costly fight with Didi, which is backed by Japan's SoftBank Group

Corp.

Along with revenue from deliveries, the company makes money from

selling ads to merchants. Other revenue streams include taking

commissions from sales of discount vouchers and selling business

services to Chinese merchants seeking to digitize their

operations.

Meituan had a 59% share of China's "on demand" food delivery

market in the first quarter of this year, according to data from

iResearch Consulting Group that was cited by the company. Alibaba's

Ele.me delivery unit is Meituan's biggest competitor in China.

Write to Liza Lin at Liza.Lin@wsj.com and Stella Yifan Xie at

stella.xie@wsj.com

(END) Dow Jones Newswires

June 25, 2018 00:02 ET (04:02 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

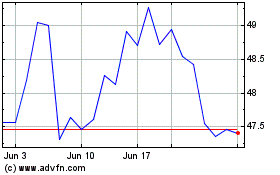

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

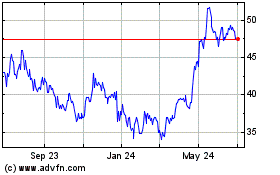

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024