Form 8-K - Current report

February 09 2024 - 4:33PM

Edgar (US Regulatory)

false

0001029744

0001029744

2024-02-06

2024-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

|

February 6, 2024

Date of Report (Date of earliest event reported)

|

|

Sonic Foundry, Inc.

(Exact name of registrant as specified in its charter)

|

|

Maryland

(State or other jurisdiction

of incorporation)

|

000-30407

(Commission

File Number)

|

39-1783372

(IRS Employer

Identification No.)

|

|

222 W. Washington Ave

Madison, WI 53703

(Address of principal executive offices)

|

(608) 443-1600

(Registrant's telephone number)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

On February 9, 2024, Sonic Foundry, Inc. (the “Company”) consummated the previously-announced sale of (1) all of the assets of the Company and its wholly owned subsidiary Sonic Foundry Media Systems, Inc. (“SFMS” and, collectively with the Company, the “Sellers”) relating to the Mediasite business other than certain specified excluded assets and (2) all of the outstanding equity interests in the Company’s two foreign subsidiaries, Sonic Foundry International B.V. (formerly Media Mission B.V.) located in the Netherlands and Mediasite K.K. located in Japan (such transactions collectively, the “Mediasite Asset Sale”), pursuant to that certain Stock and Asset Purchase Agreement, dated as of January 2, 2024 (the “Purchase Agreement”), by and among the Company, SFMS, Enghouse Systems Limited (“Enghouse”) and certain wholly owned subsidiaries of Enghouse (collectively, the “Buyer”). The Purchase Agreement was previously filed as an annex to the Company’s Definitive Proxy Statement filed with the U.S. Securities and Exchange Commission (the “SEC”) on January 16, 2024 (the “Proxy Statement”).

Pursuant to the Purchase Agreement, the Buyer has acquired the Mediasite business and assumed certain liabilities for a purchase price of $15.5 million, which the Company estimates will provide it with approximately $2.2 million in cash at closing after repayment the Company’s outstanding debt to Neltjeberg Bay Enterprises, LLC, payment of amounts due to certain suppliers and estimated expenses relating to the transaction, and the Buyer's holdback of $1.0 million (the “Holdback”) which will be payable to the Sellers on the one year anniversary of closing to the extent such amount is not reduced by purchase price adjustments or indemnity or other claims under the Purchase Agreement. Post-closing adjustments to the purchase price in the Purchase Agreement include a final calculation of the amount by which the Sellers’ net cash assets at closing were less than $0 to adjust the estimated net cash assets adjustment at closing which reduced the purchase price paid at closing by $4.1 million, and the amount of Transferred Company Debt owed by its Japanese subsidiary of $0.6 million. The Purchase Agreement also contains provisions to reduce the purchase price based the amount of accounts receivable included in the transferred assets after closing that remains uncollected 180-days after closing (or in the case of certain unbilled accounts, one year after closing) and based on the amount of inventory included in the transferred assets that remains unsold one year after closing.

Following the closing of the Mediasite Asset Sale, the Company’s business operations are limited to the Vidable and Global Learning Exchange businesses, both of which generate limited revenues, negative cash flow and significant losses. As of the date of this report, the Company owes approximately $6.8 million to Mark Burish, and the Company may borrow additional amounts from Mr. Burish if he agrees in order to provide funds for the Company’s business. The Company also owes approximately $3.0 million to various trade creditors as of the date of this report. The Company’s Board of Directors plans to evaluate a number of strategic alternatives for the Company’s business after the closing of the Mediasite Asset Sale, which alternatives include selling some or all of the Company’s assets (including a potential sale of the Company’s Global Learning Exchange business to Mr. Burish in exchange for debt relief), restructuring the Company’s debt to Mr. Burish or seeking to obtain additional equity capital or other capital to refinance the Company’s debt. There can be no assurance that the Company will be able to reach any agreement with Mr. Burish or as to the terms of any such agreement. In addition, the Company’s ability to raise capital will depend on the capital markets and its financial condition at such time, and will be challenging due to the reduced size of the Company’s operations, the large amount of its outstanding debt and the recent delisting of the Company’s common stock from the NASDAQ Capital Market. The Company may not be able to engage in any of these activities or engage in these activities on desirable terms, which could result in a default on the Company’s debt obligations, its inability to continue as a going concern and the loss of all or a substantial part of the value of the Company’s common stock.

Forward Looking Statements

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include statements that are not historical facts and can be identified by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “will,” “would” or similar expressions and the negatives of those terms These types of statements address matters that are subject to many risks and uncertainties. Actual results could differ materially from the forward-looking guidance the Company provides. These risks and uncertainties include but are not limited to: the amount of costs, fees and expenses related to the Mediasite Asset Sale; additional potential adjustments to the purchase price for the Mediasite Asset Sale pursuant to the Purchase Agreement which may reduce the amount of the Holdback the Company receives or require the Company to make payments to the Buyer; risks relating to plans for the Company after the closing of the Mediasite Asset Sale, the Company’s high level of debt and its ability to continue as a going concern; and other risks disclosed in the Company’s annual report on Form 10-K and its other filings with the SEC. These filings can be accessed on-line at www.sec.gov and other websites or can be obtained from the Company’s investor relations department. All of the information and disclosures the Company makes in this report, including any forward-looking statements, are as of the date given and the Company assumes no obligation to update or change this information, regardless of subsequent events.

|

Item 5.07.

|

Submission of Matters to a Vote of Security Holders.

|

A special meeting of the stockholders of the Company (the "Special Meeting") was held on February 6, 2024 to vote on matters relating to the Purchase Agreement. A total of 12,139,360 shares of the Company’s common stock were eligible to vote at the Special Meeting. The matters voted on at the Special Meeting were as follows:

|

1.

|

Mediasite Asset Sale Proposal:

|

The stockholders voted to approve the Purchase Agreement, the sale of the Mediasite business as contemplated by the Purchase Agreement and the other transactions contemplated by the Purchase Agreement.

|

Votes For

|

Votes Against

|

Abstentions

|

Broker Non-Votes

|

|

9,411,113

|

161,624

|

875

|

0

|

|

2.

|

Advisory Compensation Proposal:

|

The stockholders voted to approve a non-binding, advisory proposal to approve compensation that will or may become payable to the Company’s named executive officers in connection with the Mediasite Asset Sale.

|

Votes For

|

Votes Against

|

Abstentions

|

Broker Non-Votes

|

|

9,213,726

|

302,835

|

57,051

|

0

|

The shareholders voted in favor of approving the adjournment of the Special Meeting.

|

Votes For

|

Votes Against

|

Abstentions

|

Broker Non-Votes

|

|

9,310,435

|

196,859

|

66,318

|

0

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(b) Pro Forma Financial Information.

The unaudited pro forma condensed consolidated balance sheet of the Company as of September 30, 2023 and the unaudited pro forma condensed consolidated statement of operations of the Company for the year ended September 30, 2023 are incorporated by reference from the Proxy Statement.

(d) Exhibits.

The following exhibits are filed herewith:

|

Exhibit

No.

|

|

Document

|

| |

|

|

|

2.1

|

|

Stock and Asset Purchase Agreement, dated as of January 2, 2024, among Sonic Foundry, Inc., Sonic Foundry Media Systems, Inc., Enghouse Interactive, Inc., Enghouse Holdings (UK) Limited, Enghouse (Netherlands) Holdings B.V. and Enghouse Systems Limited (incorporated by reference to Annex A of the Proxy Statement as filed with the SEC on January 16, 2024).

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Sonic Foundry, Inc.

(Registrant)

| February 9, 2024 |

By: /s/ Ken Minor |

| |

Ken Minor |

| |

Chief Financial Officer |

v3.24.0.1

Document And Entity Information

|

Feb. 06, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Sonic Foundry, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 06, 2024

|

| Entity, Incorporation, State or Country Code |

MD

|

| Entity, File Number |

000-30407

|

| Entity, Tax Identification Number |

39-1783372

|

| Entity, Address, Address Line One |

222 W. Washington Ave

|

| Entity, Address, City or Town |

Madison

|

| Entity, Address, State or Province |

WI

|

| Entity, Address, Postal Zip Code |

53703

|

| City Area Code |

608

|

| Local Phone Number |

443-1600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001029744

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

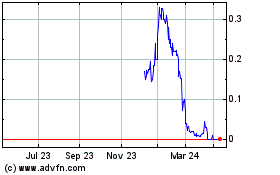

Sonic Foundry (CE) (USOTC:SOFO)

Historical Stock Chart

From Mar 2024 to Apr 2024

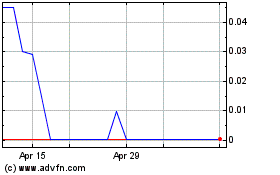

Sonic Foundry (CE) (USOTC:SOFO)

Historical Stock Chart

From Apr 2023 to Apr 2024