Solvay Confirms Surge in 3Q Sales, Earnings; Lifts Free Cash-Flow View

November 03 2022 - 2:29AM

Dow Jones News

By Joshua Kirby

Solvay SA said Thursday that it expects higher free cash-flow

for the year after confirming strong growth in earnings and sales

in the third quarter and higher expected earnings for the year.

The Belgian chemicals company now expects FCF at some 1 billion

euros ($987.4 million) in 2022, from a previous target of around

EUR750 million. The company backed higher guidance of around 28%

annual growth in earnings before interest, taxes, depreciation and

amortization, set alongside preliminary third-quarter results

published toward the end of last month.

Solvay confirmed the quarterly figures, which saw sales rise 30%

on the year to EUR3.61 billion thanks to higher prices amid largely

flat volumes, and underyling Ebitda rise 40% to EUR917 million

thanks to pricing power that offset cost inflation. The Ebitda

margin rose more than two percentage points to 25.4%, Solvay

said.

Underyling net profit meanwhile nearly doubled to EUR509

million, Solvay said.

"I could not be more... excited about our bright future as we

progress with our plan to separate into two independent, strong

companies," Chief Executive Ilham Kadri said, referring to the plan

set out earlier this year to break Solvay up into two separately

listed companies by the middle of next year.

Write to Joshua Kirby at joshua.kirby@wsj.com;

@joshualeokirby

(END) Dow Jones Newswires

November 03, 2022 02:14 ET (06:14 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

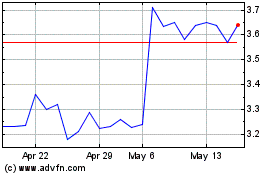

Solvay (PK) (USOTC:SLVYY)

Historical Stock Chart

From Apr 2024 to May 2024

Solvay (PK) (USOTC:SLVYY)

Historical Stock Chart

From May 2023 to May 2024