Big Food Encounters Familiar Challenges in Pet-Food Aisle

November 12 2018 - 5:59AM

Dow Jones News

By Annie Gasparro

Food makers betting on pets to make up for falling sales to

people are facing some familiar problems.

Pet foods with fancier ingredients are eating away at market

share for mainstream brands. Snacks for dogs and cats are selling

faster than meals. And a flood of new products is putting pressure

on prices.

"The challenges you see across both industries are actually

quite similar," said Chris Mondzelewski, vice president of customer

development at Mars Inc.'s North America petcare business. Mars

said sales of its largest brand, Pedigree, are growing more slowly

than sales of its premium pet foods.

Spending on pet food rose 30% per U.S. household between 2006

and 2010, according to Nielsen. Many of those consumers were young

people who bought pets and fed them grain-free kibble and

wild-caught tuna before having children or buying houses, analysts

said.

"They treat them like it was their firstborn child," said

Beverley Petrunich, owner of DoGone Fun, a dog day-care center in

Chicago.

But from 2010 to 2017, spending on pet food rose just 5%,

according to Nielsen. Many younger people who had put off children

and homeownership are reaching those milestones now.

Market-research firm Mintel expects pet-food sales to rise about 2%

to 3% annually for the next five years.

General Mills Inc., J.M. Smucker Co. and Nestlé SA each bought

pet-food brands in the past three years. Nestlé earmarked $320

million to build another U.S. pet food factory, its first in 20

years. Mars even expanded its bet on the pet industry, last year

paying $7.7 billion excluding debt for VCA Inc., a network of 800

animal hospitals, veterinary diagnostic labs and dog day-care

centers.

Some of those investments are already showing signs of strain in

a saturated market. More than 4,500 new pet-food products were

introduced last year, according to data analytics firm GfK, a 45%

increase from 2016. Most of those were premium products, which cost

more and often generate a higher profit margin for companies. The

rise in fancier pet foods boosted the average price to $2.55 a

pound at the end of 2017, from $1.71 a pound at the start of 2011,

according to GfK.

"When you put human grade meat into dog treats, the price point

gets high," said Mars' Mr. Mondzelewski.

General Mills bought Blue Buffalo pet food in April for $8

billion and put the premium brand on sale in more stores. General

Mills's pet-food sales at retailers subsequently rose 9% in the

latest quarter. That is better than the 2% drop for North American

sales of its packaged foods like Yoplait yogurt and Hamburger

Helper. But it is a slowdown from the double-digit sales growth

Blue Buffalo achieved for years before the deal.

Chief Executive Jeff Harmening said in an interview that he was

happy with Blue Buffalo's performance.

Smucker's pet-food sales fell 2% in its latest quarter,

excluding the $1.9 billion acquisition earlier this year of

celebrity chef Rachael Ray's Nutrish brand, a premium line that

says it uses "real chicken" and other high-end ingredients. The

sales drop reflected poor performance by brands like Gravy Train

and Kibbles 'n Bits that Smucker bought for $5.8 billion including

debt in 2015. Smucker executives said there is still more

opportunity for growth in pet food than human food, especially for

premium brands like Nutrish.

"Pet population growth is faster than with humans," said Bobby

Modi, head of pet strategy for the maker of Jif peanut butter and

Folgers coffee.

Sales of Nestlé's pet foods at U.S. supermarkets and drugstores

-- mostly mainstream brands like Purina -- fell 6% in the third

quarter, according to analyst Pablo Zuanic at Susquehanna

International Group. But sales of premium brands like the Castor

& Pollux label it acquired in 2015 rose.

"You have to stay relevant," said Nina Leigh Krueger, Nestlé's

president of Purina PetCare U.S.

Still, more-expensive pet food might not continue to bring

companies the margins that have helped them boost profits. Some pet

owners say there are limits to what they are willing to spend, and

there are more affordable all-natural options available now.

Jess Cummins said she feeds her cat, Poppyseed, a blend of

Mars's Iams brand that is meant to promote urinary tract

health.

It is a step up from Meow Mix, she said, but it isn't fresh tuna

fillets, said Ms. Cummins, a 27-year-old dog walker in Chicago. "I

just moved, so money is tight right now."

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

November 12, 2018 05:44 ET (10:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

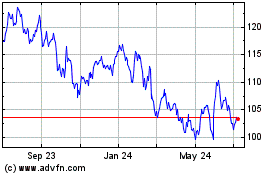

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024