false

0001776932

A1

0001776932

2024-01-23

2024-01-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

| Date

of Report (Date of earliest event reported): |

January

23, 2024 |

MEDMEN

ENTERPRISES INC.

(Exact

name of registrant as specified in its charter)

| British

Columbia |

|

000-56199 |

|

98-1431779 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

6501

Congress Ave., Boca Raton, Florida 33487

(Address,

including zip code, of principal executive offices)

| Registrant’s

telephone number, including area code |

(424)

330-2082 |

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None.

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of Each Exchange on Which Registered |

| |

|

|

|

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item

5.02. |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

As

previously reported in a Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on

January 24, 2024, the board of directors of MedMen Enterprises Inc. (the “Company”) appointed Richard P. Ormond as its

Chief Restructuring Officer on January 23, 2024. Mr. Ormond will provide restructuring services to the Company pursuant to a

consulting agreement (the “Consulting Agreement”), dated January 23, 2024, between the Company and Stone Blossom

Capital, LLC (“SBC”), of which Mr. Ormond is the principal. The Company agreed to pay SBC a non-refundable initial

payment of $180,000 for the first four months of services and $45,000 per month thereafter until the termination of the Consulting

Agreement, as well as reimbursement of reasonable out-of-pocket expenses. The Consulting Agreement has a minimum initial term of six

months and can be renewed on a monthly basis or terminated upon ten days written notice thereafter. The Company has also engaged

Buchalter, APC, of which Mr. Ormond is a shareholder, for legal services.

Richard

P. Ormond, 51, has been a lawyer at Buchalter, APC since March 2003 and a shareholder at that firm since 2007. Mr. Ormond is the

co-founder and chairman of Ejudicate, Inc., d/b/a Brief.com, an online dispute resolution company, and the principal of Stone

Blossom Capital LLC, a receivership, ABC and restructuring business focused on the cannabis industry, since January 2020. From

January 2020 to May 2021, Mr. Ormond was a professor at Loyola Law School, where he taught a cannabis business law course focusing

on finance, regulatory compliance and corporate governance. Mr. Ormond holds a Bachelor’s Degree in Political Science from the

University of California, Los Angeles and a Juris Doctor degree from the University of San Diego School of Law.

Other

than as described herein, there are no arrangements or understandings between Mr. Ormond and any other person pursuant to which he was

appointed to serve as Chief Restructuring Officer and Mr. Ormond does not have a direct or indirect material interest in any “related

party” transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K. There are no family relationships between

Mr. Ormond and any director or executive officer of the Company.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits

| † |

The

Company has omitted portions of the referenced exhibit pursuant to Item 601(b)(10)(iv) of Regulation S-K because it (a) is not material

and (b) is the type of information that the Company both customarily and actually treats as private and confidential. The Company

hereby agrees to furnish supplementally the omitted information to the SEC upon request. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated:

January 30, 2024 |

MEDMEN

ENTERPRISES INC. |

| |

|

| |

|

/s/

Amit Pandey |

| |

By: |

Amit

Pandey |

| |

Its: |

Chief

Financial Officer |

Exhibit

10.1

CERTAIN

IDENTIFIED INFORMATION MARKED BY [*] HAS BEEN EXCLUDED FROM THIS

EXHIBIT

BECAUSE IT IS BOTH NOT MATERIAL AND IS THE TYPE OF INFORMATION THAT THE

REGISTRANT

CUSTOMARILY AND ACTUALLY TREATS AS PRIVATE AND CONFIDENTIAL.

Stone

Blossom Capital LLC

Consulting Agreement

THIS

AGREEMENT (the “Agreement”) is made as of January 23, 2024, by and between Stone Blossom Capital, LLC (“Consultant”)

and Medmen Enterprises Inc. and its affiliates and subsidiaries (collectively the “Company”).

Company

desires to retain Consultant to render business advice as further set forth in Appendix A (the “Services”). With the

consideration of the covenants herein as well as other valuable consideration receipt whereof is hereby acknowledged, Consultant and

Company agree as follows:

1. Incorporation

of Recitals and Attachments. All the foregoing Recitals are hereby incorporated herein and made a part hereof by this reference. Further,

any terms, conditions and provisions of all attachments, exhibits and appendices to this Agreement are incorporated and made a part hereof

by this reference.

2. Consulting

Duties and Obligations. Consultant agrees to provide the Services to Company and such other tasks and duties, as the Company may deem

necessary to complete the Services. The Consultant and Company agree that Consultant will not provide any legal advice or legal

services in connection with the Services.

3. Non-exclusive.

The Services provided by Consultant are non-exclusive and Consultant is free to provide similar services to other non-related clients.

4. Legal

Representations. Consultant possesses the academic background and professional experience necessary to perform the Services. Company

acknowledges that a principal of Consultant is affiliated with Buchalter APC and cannot provide any legal advice to Company. Any legal

advice for the Company must be obtained from other attorneys (not Richard P. Ormond) as Company may require. Consultant is permitted

to engage Buchalter APC for and on behalf of itself or on behalf of the Company, if necessary, as set forth in Appendix A.

5. Compensation.

See Appendix A.

6. Term

and Termination. This Agreement is for a minimum six-month term (“Initial Term”) and can be renewed on a month-to-month basis

thereafter. This Agreement may be terminated upon ten (10) days written notice, subject to the compensation terms set forth in Appendix

A.

7. Independent

Contractor

| |

(1) |

The

Company and Consultant acknowledge and agree that Consultant has no power or authority to act for, or on behalf of, the Company or

to bind the Company to any matter without the prior, written approval of the Company. Consultant is authorized by Company to provide

similar services and advice to other clients. |

| |

|

|

| |

(2) |

Both

Consultant and the Company acknowledge and agree that the relationship created by this Agreement is that of independent contractor

and not that of employee and employer. Consultant is responsible for the payment of any taxes, including but not limited to all federal,

state, and local personal and business income taxes, sales and use taxes, other business taxes and license fees arising out of the

activities of Consultant. Consistent with the full performance of the terms of this Agreement, Consultant shall have sole control

of the manner and means of performing under this Agreement. |

| |

|

|

| |

(3) |

Consultant

is responsible for all office and other expenses incurred by Consultant in connection with the performance of services hereunder.

As further set forth in Appendix |

Stone

Blossom Capital LLC

Consulting Agreement

A, travel related expenses incurred by the Consultant while fulfilling this Agreement will be reimbursed by the Company, subject to

Company’s prior review and approval.

Expense

reports must be provided to the Company for reimbursement.

8.

Projections; Reliance; Limitation of Duties. You understand that the services to be rendered by the CONSULTANT may include the

preparation of projections and other forward-looking statements, and that numerous factors can affect the actual results of the

Company’s operations, which may materially and adversely differ from those projections and other forward-looking statements.

In addition, the CONSULTANT will be relying on information provided by other members of the Company’s management in the

preparation of those projections and other forward-looking statements. CONSULTANT makes no representation or guarantee that an

appropriate restructuring proposal or strategic alternative can be formulated for the Company, that any restructuring proposal or

strategic alternative selected by CONSULTANT will be more successful than all other possible restructuring proposals or strategic

alternatives, that restructuring or liquidation is the best course of action for the Company or, if formulated, that any proposed

restructuring plan, liquidation plan or strategic alternative will be accepted by any of the Company’s creditors, shareholders

and other constituents.

9. No

Third-party Beneficiary. The Company acknowledges that all advice (written or oral) given by Consultant to the Company in connection

with this engagement is intended solely for the benefit and use of the Company (limited to its Board of Directors and management) in

considering the matters to which this engagement relates. The Company agrees that no such advice shall be used for any other purpose

or reproduced, disseminated, quoted or referred to at any time in any manner or for any purpose other than accomplishing the tasks referred

to herein without Consultant’s prior approval (which shall not be unreasonably withheld), except as required by law.

10. No

Guaranty of Results. The Company agrees that Consultant cannot, and is not, guarantying any results. Because the information needed to

provide our services, prepare and review financial analyses and reports, business analysis, various financial reports and documents and

a Company wind down plan, will be based on assumptions and information provided by the Company, and their advisors, appraisers, accountants,

and lawyers, the Company will assume full and complete responsibility for the information prepared. The Company understands and acknowledges

that Consultant’s work effort, analysis and advice are inherently subjective and that reasonable professionals/individuals reviewing

the same information may reach entirely different conclusions. The Company releases Consultant from all responsibility as to the reliability

and accuracy of the information provided to Consultant. While we will use our reasonable efforts in assisting the Company to achieve

its goals, Consultant cannot guaranty any results or assume any responsibility for the Company’s ultimate financial position or

survival.

11. Conflicts.

Consultant is not currently aware of any relationship that would create a conflict of interest with the Company or those parties-in-interest

of which you have made us aware. Because Consultant provides business fiduciary services and serves clients in numerous cases, both in

and out of court, it is possible that Consultant may have rendered services to or have business associations with other entities or people

which had or have or may have relationships with the Company, including creditors of the Company. Consultant will not represent, and

Consultant has not represented, the interests of any such entities or people in connection with this matter.

12.

Confidentiality / Non-Solicitation. Consultant shall keep as confidential all non-public information received from the Company in

conjunction with this engagement, except (I) as requested by the Company or its legal counsel; (ii) as required by legal proceedings

or (iii) as reasonably required in the performance of this engagement. All obligations as to non-disclosure shall cease as to any

part of such information to the extent that such information is or becomes public other than because of a breach of this

provision.

Stone

Blossom Capital LLC

Consulting Agreement

13. Hold

Harmless. The Company shall hold harmless Consultant to the same extent as the most favorable indemnification it extends to its officers

or directors, whether under the Company’s charter, bylaws, or other organizational documents or policies (collectively, “Corporate

Documentation”), applicable law, or otherwise, and no reduction or termination in any of the benefits provided under any such indemnities

shall affect the benefits provided to Consultant. Absent actual fraud or willful misconduct on the part of Consultant, no action may

be brought against the Consultant by or on behalf of any Director or member of the Company or any shareholder or their assigns or successors

in interest, for and on account of or with reference to actions, acts or conduct of Consultant (or Richard Ormond), or in connection

with any of the duties or functions undertaken or performed Consultant. In the event of any such action against Consultant, Consultant

shall be entitled to have advanced, from time to time, by the Company, funds for costs reasonably necessary in connection with the defense

of such action or actions. The Consultant shall be covered as an officer under the Company’s director and officer liability insurance

policies. Consultant shall, in addition, be entitled to obtain a director and officer liability insurance policy, of its choosing, covering

Consultant only for all insurable risks, at the sole cost of the Company, for a minimum of USD$5,000,000. The Company shall also maintain

any such insurance coverage for Consultant for a period of not less than six (6) years following the date of the termination of Consultant’s

services hereunder. The provisions of this section are contractual obligations and no change in applicable law or the Company’s

Corporate Documentation shall affect Consultant’s rights hereunder.

14. Insurance

and Indemnity.

| |

(1) |

Company

will add Consultant as an additional insured on its Errors & Omissions policy and its Director and Officer policy. This is a

mandatory condition of this Agreement. |

| |

|

|

| |

(2) |

COMPANY

WILL DEFEND, INDEMNIFY AND HOLD CONSULTANT HARMLESS FROM ALL CLAIMS ASSERTED AGAINST CONSULTANT RELATED TO OR IN CONNECTION WITH

COMPANY AND ITS AFFILIATES. SEE APPENDIX B FOR ADDITIONAL INDEMNITY TERMS. |

15.

Amendments. All amendments, modifications or additions to this Agreement shall be in writing and signed by both parties.

16. Invalidity

or Unenforceability. If any one or more of the provisions contained herein shall for any reason be held to be invalid, illegal or unenforceable

in any respect, such invalidity, illegality or unenforceability shall not affect any other provisions of this Agreement, and this Agreement

shall be construed thereafter as if such invalid, illegal or unenforceable provision had never been contained herein.

17. Headings.

The paragraph headings of this Agreement and its Appendices are for convenience or reference only and shall not define or limit any of

the terms or provisions hereof.

18. Notices.

Any notices or other communications contemplated or required under this Agreement, to be effective, shall be in writing and shall be

given via personal delivery or via U.S. Certified mail, return receipt requested, at the following addresses.

If

to Consultant:

|

|

If

to Company: |

|

With

a copy to: |

| Richard

Ormond |

|

|

|

|

| [*] |

|

|

|

|

Stone

Blossom Capital LLC

Consulting Agreement

19. Governing

Law. This Agreement shall be governed by the laws of the State of California.

20.

Arbitration. ANY DISPUTE OR CONTROVERSY ARISING OUT OF OR IN CONNECTION WITH THIS AGREEMENT SHALL BE SETTLED EXCLUSIVELY BY A SINGLE

ARBITRATOR AT ADR, SUBJECT TO ADR RULES THEN IN PLACE, LOCATED IN THE COUNTY OF LOS ANGELES, CALIFORNIA.

21. Attorney’s

Fees. In the event that any dispute between Consultant and Company should result in litigation or arbitration, the prevailing party in

such dispute shall be entitled to recover from the other party all reasonable and documented out-of-pocket fees, costs and expenses of

enforcing any right of the prevailing party, including without limitation, reasonable attorneys’ fees and expenses, all of which

shall be deemed to have accrued upon the commencement of such action and shall be paid whether or not such action is prosecuted to judgment.

IN

WITNESS WHEREOF, the Parties agree to and execute this Agreement effective as of 12/1/23.

MEDMEN

ENTERPRISES INC. by and on behalf of itself and all of its affiliates.

| By:

|

/s/

Amit Pandey |

|

| Its:

|

Chief

Financial Officer |

|

| Name: |

Amit

Pandey |

|

Stone Blossom

Capital LLC

| /s/

Richard Ormond |

|

| Richard

Ormond, Principal |

|

Stone

Blossom Capital LLC

Consulting Agreement

APPENDIX

A

SERVICES

AND COMPENSATION

SERVICES

General

Duties: Consultant will be engaged as Company’s Chief Restructuring Officer to work with Company to develop and implement a restructuring

or insolvency plan. This may include recommending an insolvency proceeding for the Company (and its subsidiaries and affiliates).

Additional

Services. The CONSULTANT will provide, among others, the following services to the Company.

| |

(i) |

Management

of the affairs of the Company. |

| |

|

|

| |

(ii) |

Surveying

Company assets wherever located, and assessing all Company assets, including gathering appraisals of value of assets where necessary. |

| |

|

|

| |

(iii) |

Assess

the best method to monetize Company assets to optimize cash proceeds. |

| |

|

|

| |

(iv) |

Develop

and execute a plan for the orderly winddown of Company operations and affairs. |

| |

|

|

| |

(v) |

Consultant

is authorized to employ agents, accountants, forensic accountants, security, computer forensics, IT services, specialist attorneys,

professionals, locksmiths and management Consultants to protect, preserve and maintain the Company’s assets and books and records,

and assist in the orderly winddown of the Company’s affairs. The costs for these professionals will be paid for by Company. |

| |

|

|

| |

(vi) |

Hire

and terminate employees as necessary in the best interests of the Company. |

| |

|

|

| |

(vii) |

Coordination

with the Company’s counsel, with respect to the preparation of pleadings, court-filings, administrative filings, for any proceedings

on behalf of the Company, and in the negotiation and resolution of any claims against the Company. |

| |

|

|

| |

(viii) |

Review

and evaluation of claims asserted against the Company and the resolution of disputed claims asserted against the Company. |

| |

|

|

| |

(ix) |

Appearance

at any proceedings or hearings in any Court, as appropriate and necessary. |

| |

|

|

| |

(x) |

Communicating

with creditors and with other parties-in-interest of the Company. |

| |

|

|

| |

(xi) |

Performance

of the services typical of CRO and such other services as may be mutually agreed upon by the Company and Consultant in furtherance

of a resolution of the Company’s affairs and its assets. |

Consultant’s

Professionals. In the ordinary course of its business, to address and efficiently handle business responsibilities, Consultant may retain

other professionals to provide administrative support and services. Fees and expenses for services provided and expenses incurred by

Consultant are the sole responsibility of the Company.

Reporting.

CONSULTANT shall report to the Board of Directors of the Company.

While

unlikely, if Consultant requires independent legal counsel for any reason related to this Agreement or the Services, Company agrees that

Consultant can engage Buchalter, APC as its counsel, and agrees to waive any potential conflicts. Legal fees are exclusive of the compensation

set forth below.

Stone

Blossom Capital LLC

Consulting Agreement

COMPENSATION

Consultant

will be paid forty-five thousand dollars per month until the termination of this Agreement. If this engagement lasts longer than the

Initial Term, Consultant will be paid forty-five thousand dollars per month until such engagement is terminated.

In

addition, Consultant will be reimbursed by the Company for the reasonable out-of-pocket expenses incurred in connection with this assignment,

such as reasonable out-of-town travel, reasonable out-of-town lodging, duplications, computer research, messenger and technology charges.

All fees and expenses due to Consultant will be billed monthly at cost, with no markup.

Upon

execution of this Agreement a non-refundable initial payment of $180,000 shall be wired to Consultant (reflecting the first four months

of the Initial Term). This payment is exclusive of any additional legal retainers needed for the Company or Consultant.

Consultant

Wire Instructions:

[*]

Stone

Blossom Capital LLC

Consulting

Agreement

APPENDIX

B

GUARANTY

AND INDEMNITY BY SECURED LENDER (“Guarantor”)

By

signing here, for good consideration, which is acknowledged herein Guarantor agrees, unconditionally, to be jointly and severally responsible

to pay all the fees due to Consultant in the event Company (as defined in the Agreement) does not meet its payment obligations set forth

herein. This includes any legal fees or other fees incurred by Consultant as well as any indemnities that remain unpaid.

GUARANTOR

AGREES TO DEFEND, INDEMNIFY AND HOLD CONSULTANT HARMLESS FROM ALL CLAIMS ASSERTED AGAINST CONSULTANT RELATED TO OR IN CONNECTION WITH

COMPANY AND ITS AFFILIATES, AND THIS AGREEMENT INCLUDING ANY AND ALL LEGAL FEES INCURRED BY CONSULTANT. CONSULTANT IS ENTITLED TO SEEK

ITS OWN INDEPENDENT COUNSEL TO DEFEND ANY AND ALL CLAIMS AT GUARANTOR’S EXPENSE, TO BE PAID AT THE TIME THAT SUCH LEGAL FEES AND

COSTS ARE INCURRED, INCLUDING BUT NOT LIMITED TO ARBITRATION FEES AND COSTS.

Governing

Law. This Guaranty shall be governed by the laws of the State of California.

Arbitration.

ANY DISPUTE OR CONTROVERSY ARISING OUT OF OR IN CONNECTION WITH THIS GUARANTY SHALL BE SETTLED EXCLUSIVELY BY A SINGLE ARBITRATOR AT

ADR, SUBJECT TO ADR RULES THEN IN PLACE, LOCATED IN THE COUNTY OF LOS ANGELES, CALIFORNIA.

If

any dispute between Consultant and Guarantor. should result in litigation or arbitration, prevailing party is entitled to recover all

reasonable fees, costs and expenses of enforcing any right including without limitation reasonable attorneys’ fees and expenses,

all of which shall be deemed to have accrued upon the commencement of such action and shall be paid whether such action is prosecuted

to judgment.

| Stone

Blossom Capital LLC |

|

| |

|

| |

|

| Richard

Ormond, Principal |

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

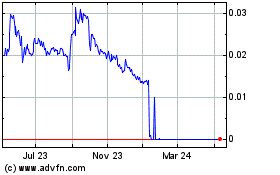

Medmen Enterprises (CE) (USOTC:MMNFF)

Historical Stock Chart

From Mar 2024 to Apr 2024

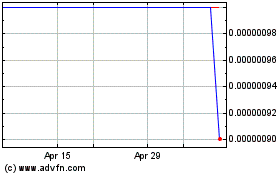

Medmen Enterprises (CE) (USOTC:MMNFF)

Historical Stock Chart

From Apr 2023 to Apr 2024