WaterPure International Inc (OTCMKTS: WPUR) Heating Up after Co Announces it is Exploring Multiple Merger & Acquisition Opportunities

August 16 2022 - 9:00AM

InvestorsHub NewsWire

Dallas, TX --

August

16, 2022 -- InvestorsHub NewsWire -- Via Microcapdaily -- WaterPure

International Inc (OTCMKTS:

WPUR) is heating up after the Company announced it is in

discussions exploring multiple merger and acquisition

opportunities. In June, WPUR management announced plans to address

current economic conditions and to explore alternative growth

strategies in the ongoing pursuit of the company’s mission. Since

that time, the company has pursued a number of merger and

acquisition opportunities that could take advantage of reduced

valuations for various assets in reaction to current economic

conditions and at the same time, give WPUR the potential to rapidly

expand and transform. Reverse merger stocks can be more

explosive than biotech’s when the incoming Company has real value

but is undiscovered to investors and we have covered many on the

website that have gone from pennies to dollars. WPUR has plenty of

room for growth from current levels trading at a$825,550 total

market valuation. OS Is 343,979,185 and there are 177,712,391

shares in the float. Currently WPUR has just $400k in assets and

$1.5 million in liabilities with no

revenues.

WaterPure International Inc (OTCMKTS:

WPUR) is a water and electric utilities

innovation technology company bringing proprietary technology to

make water and electric utilities more efficient, cost effective

and carbon neutral. WPUR has partnered extensively with

Alternet Systems, Inc. (OTC Pink: ALYI) to provide off grid

electric vehicle charging solutions. WPUR will implement a

solar powered solution for PJET’s student housing

project.

WPUR is up big after the Company

announced it is in discussions exploring multiple merger and

acquisition opportunities. In June, WPUR management announced plans

to address current economic conditions and to explore alternative

growth strategies in the ongoing pursuit of the company’s mission.

Since that time, the company has pursued a number of merger and

acquisition opportunities that could take advantage of reduced

valuations for various assets in reaction to current economic

conditions and at the same time, give WPUR the potential to rapidly

expand and transform.

WPUR is a development stage company

that currently owns various assets with proprietary properties

applicable to the delivery of clean water. The company has also

been working to develop and acquire clean electricity production

and delivery technologies. WPUR’s mission is to improve overall

global sustainability by finding profitable new efficiencies and

new technologies to manage water supplies that reverse the growing

global water scarcity, and introduce new electricity production

technologies that reduce carbon

emissions.=

Management is optimistic that current

economic conditions can create new accelerated growth and

transformation opportunities where WPUR enters new sustainability

markets beyond water and electricity. The company anticipates

entering into an agreement to take advantage of such an accelerated

growth opportunity around the time it publishes the annual report

for the period ending June 30, 2022.

Currently trading at a $825,550 total

market valaution, WPUR has 343,979,185 shares

outstanding and there are 177,712,391 shares in the float.

Currently WPUR has just $400k in assets and $1.5 million in

liabilities with no revenues and is “pink current” WPUR recently

announced it is in discussions exploring multiple merger and

acquisition opportunities. In June, WPUR management announced plans

to address current economic conditions and to explore alternative

growth strategies in the ongoing pursuit of the company’s mission.

Since that time, the company has pursued a number of merger and

acquisition opportunities that could take advantage of reduced

valuations for various assets in reaction to current economic

conditions and at the same time, give WPUR the potential to rapidly

expand and transform. Reverse merger stocks can be more explosive

than biotech’s when the incoming Company has real value but is

undiscovered to investors and we have covered many on the website

that have gone from pennies to dollars. WPUR has a history of nice

moves running to $0.049 in October 2021. We

will be updating on WPUR when more details emerge so make sure you

are subscribed to Microcapdaily.

See also Microcap Daily recent

articles on TVPC,

INTK

and PRRY.

Source - Microcapdaily

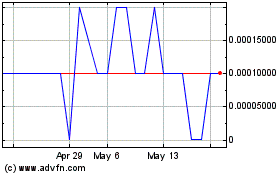

Industrial Nanotech (PK) (USOTC:INTK)

Historical Stock Chart

From Apr 2024 to May 2024

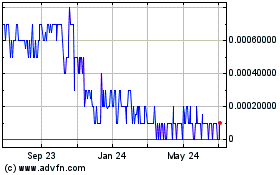

Industrial Nanotech (PK) (USOTC:INTK)

Historical Stock Chart

From May 2023 to May 2024