Mortgage Rates Change Slightly, Freddie Mac Says

September 23 2021 - 10:29AM

Dow Jones News

By Dave Sebastian

Mortgage rates showed little change in the past week, according

to Freddie Mac's latest survey.

For the week ended Thursday, the rate on a 30-day fixed rate

mortgage averaged 2.88%, up slightly from 2.86% last week and lower

than the 2.9% rate it averaged a year earlier.

Homebuyers continue to snap up available inventory, which has

slightly improved, and home-price growth is moderating, said Sam

Khater, Freddie Mac's chief economist. But the next few months will

be choppy, as some homebuilders are signaling that they are going

to deliver less supply amid shortages of labor and materials, he

added.

Meanwhile, the slowdown in economic growth around the world has

led to "a flight to the quality of the U.S. financial markets," Mr.

Khater said. "This has led to a rise in foreign investor purchases

of U.S. Treasuries, causing mortgage rates to remain in place,

despite the increasing dispersion of inflation across different

consumer goods and services," he said.

Rates on 15-year fixed-rate mortgages averaged 2.15%, up from

2.12% in the previous week. Rates averaged 2.4% a year earlier,

according to Freddie Mac.

Five-year Treasury-indexed hybrid adjustable-rate mortgages, or

ARMs, on average stood at 2.43%, down from 2.51% last week and

lower than the 2.9% rate a year earlier.

Mortgage rates tend to move in the same direction as the yield

on the 10-year Treasury. Treasury yields rise when investors feel

confident enough in the economy to forgo safe-haven assets such as

bonds for riskier ones including stocks.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

September 23, 2021 10:14 ET (14:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

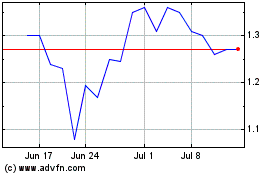

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

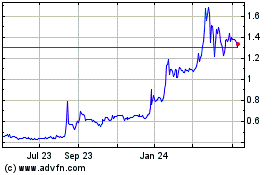

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Apr 2023 to Apr 2024