Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REGULATION A UNDER THE SECURITIES ACT

OF 1933

OFFERING CIRCULAR BEING FILED PURSUANT

TO

RULE 253(g)(2)

DNA BRANDS,

INC.

(Exact name of issuer as specified in its

charter)

Colorado

(State or other jurisdiction of incorporation

or organization)

275 E. Commercial Blvd #301

Lauderdale by the Sea, FL 33308

(561) 654-5722

(Address, including zip code, and telephone

number,

including area code, of issuer’s principal

executive office)

URS Agents LLC

36 South 18th Avenue

Brighton, Colorado 80601

(Name, address, including zip code, and

telephone number,

including area code, of agent for service)

|

7371

|

|

26-0394476

|

|

(Primary Standard Industrial Classification Code Number)

|

|

(IRS Employer Identification Number)

|

This Offering Circular shall only be

qualified upon order of the Commission, unless a subsequent amendment is filed indicating the intention to become qualified by

operation of the terms of Regulation A.

Filed Pursuant to Rule 253(g)(2)

File No. 024-11053

Offering Circular Supplement dated December

11, 2020

DNA

Brands, Inc.

MAXIMUM

OFFERING AMOUNT:

$2,500,000

This is a public offering (the “Offering”)

of securities of DNA Brands, Inc., a Colorado corporation (the “Company”). We are offering a maximum of Fifteen Million

Six Hundred Twenty Five Thousand (15,625,000) shares (the “Maximum Offering”) of our common stock, par value $0.00001

(the “Common Stock”) at an offering price of Sixteen Cents ($0.16) per share (the “Shares”) on a “best

efforts” basis. This price and number of shares comprising the Maximum Offering is a reflection of the 200-to-1 reverse

stock split just effected by the Company on December 9, 2020 and adjusts the Offering Price and Maximum Offering of the Offering

Circular Supplement dated January 29, 2020 by a factor of 200. This Offering will expire on the first to occur of (a) the sale

of all 15,625,000 shares of Common Stock offered hereby, (b) February 15, 2020, subject to extension for up to one hundred-eighty

(180) days in the sole discretion of the Company, or (c) when the Company’s board of directors elects to terminate the Offering

(as applicable, the “Termination Date”). There is no escrow established for this Offering. We will hold closings upon

the receipt of investors’ subscriptions and acceptance of such subscriptions by the Company. If, on the initial closing

date, we have sold less than the Maximum Offering, then we may hold one or more additional closings for additional sales, until

the earlier of: (i) the sale of the Maximum Offering or (ii) the Termination Date. There is no aggregate minimum requirement for

the Offering to become effective, therefore, we reserve the right, subject to applicable securities laws, to begin applying “dollar

one” of the proceeds from the Offering in accordance with the Use of Proceeds section of this Offering Circular (See

section “Use of Proceeds”) and such other uses as more specifically set forth in this offering circular (“Offering

Circular”). We expect to commence the sale of the Shares as of the date on which the offering statement of which this Offering

Circular is a part (the “Offering Statement”) is qualified by the United States Securities and Exchange

Commission (the “SEC”).

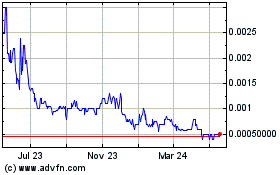

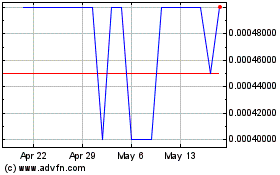

The Company’s

Common Stock is listed on the Over The Counter Bulletin Board (“OTCPNK”) under the symbol “DNAX,”

and qualified Pink Current Information Tier. For further information, see “Plan of Distribution – Exchange Listing”

of this Offering Circular.

Such Offering price and our valuation was determined by management in order to attract investors

in this Offering. The valuation of our currently outstanding shares of Common Stock and the $0.16 per share Offering price of

the Common Stock has been based upon the trading price and volume of trading of our Common Stock on the OTCPNK exchange and is

not based on book value, assets, earnings or any other recognizable standard of value.

Investing in

our Common Stock involves a high degree of risk. See “Risk Factors” for a discussion of certain risks that

you should consider in connection with an investment in our Common Stock.

THE U.S. SECURITIES AND EXCHANGE COMMISSION DOES NOT

PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE

ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN

EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES

OFFERED ARE EXEMPT FROM REGISTRATION.

|

|

|

Price to Public

|

|

|

Commissions

|

|

|

Proceeds to the Company

|

|

|

Per Share

|

|

$

|

0.16

|

|

|

$

|

0.00

|

|

|

$

|

0.16

|

|

|

Maximum Offering

|

|

$

|

2,500,000.00

|

|

|

$

|

0.00

|

|

|

$

|

2,500,000.00

|

|

THE SECURITIES UNDERLYING

THIS OFFERING STATEMENT MAY NOT BE SOLD UNTIL QUALIFIED BY THE SECURITIES AND EXCHANGE COMMISSION. THIS OFFERING CIRCULAR IS NOT

AN OFFER TO SELL, NOR SOLICITING AN OFFER TO BUY, ANY SHARES OF OUR COMMON STOCK IN ANY STATE OR OTHER JURISDICTION IN WHICH SUCH

SALE IS PROHIBITED.

INVESTMENT IN SMALL BUSINESS

INVOLVES A HIGH DEGREE OF RISK, AND INVESTORS SHOULD NOT INVEST ANY FUNDS IN THIS OFFERING UNLESS THEY CAN AFFORD TO LOSE THEIR

ENTIRE INVESTMENT. SEE “RISK FACTORS” FOR A DISCUSSION OF CERTAIN RISKS YOU SHOULD CONSIDER BEFORE PURCHASING ANY SHARES

IN THIS OFFERING.

AN OFFERING STATEMENT PURSUANT

TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION, WHICH WE REFER TO

AS THE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES

MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY

OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE

SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER

THE LAWS OF ANY SUCH STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE

WITHIN TWO (2) BUSINESS DAYS AFTER THE COMPLETION OF OUR SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR

THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

GENERALLY, NO SALE MAY BE

MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN TEN PERCENT (10%) OF THE GREATER OF YOUR ANNUAL

INCOME OR YOUR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION

THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR

GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

This Offering Circular follows

the disclosure format prescribed by Part I of Form S-1 pursuant to the general instructions of Part II(a) (1)(ii) of Form 1-A.

The date of this Offering Circular is

December 11, 2020

The Company

has not determined if it will require these services or such selected service providers. The Company reserves the right

to engage one or more FINRA-member broker-dealers or placement agents in its discretion. Does

not include expenses of the Offering, including fees for administrative, accounting, audit and legal services, FINRA

filing fees, fees for EDGAR document conversion and filing, and website posting fees, estimated to be as much as

$25,000.

TABLE

OF CONTENTS

We are offering

to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. You should

rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with any information

other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate

only as of its date, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery

of this Offering Circular nor any sale or delivery of our securities shall, under any circumstances, imply that there has been

no change in our affairs since the date of this Offering Circular. This Offering Circular will be updated and made available for

delivery to the extent required by the federal securities laws.

Unless otherwise indicated, data contained in this Offering Circular

concerning the business of the Company are based on information from various public sources. Although we believe that these data

are generally reliable, such information is inherently imprecise, and our estimates and expectations based on these data involve

a number of assumptions and limitations. As a result, you are cautioned not to give undue weight to such data, estimates or expectations.

In this Offering Circular,

unless the context indicates otherwise, references to “DNA Brands,” “we,” the “Company,”

“our,” and “us” refer to the activities of and the assets and liabilities of the business

and operations of DNA Brands, Inc.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

Some of the statements

under “Summary,” “Risk Factors,” “Management’s Discussion and Analysis of

Financial Condition and Results of Operations,” "Our Business" and elsewhere in this Offering Circular

constitute forward-looking statements. Forward- looking statements relate to expectations, beliefs, projections, future plans

and strategies, anticipated events or trends and similar matters that are not historical facts. In some cases, you can identify

forward-looking statements by terms such as “anticipate”, “believe,” “could,”

“estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “should,” “will” and “would” or the negatives

of these terms or other comparable terminology.

You should not place undue

reliance on forward-looking statements. The cautionary statements set forth in this Offering Circular, including in “Risk

Factors” and elsewhere, identify important factors that you should consider in evaluating our forward-looking statements.

These factors include, among other things:

|

|

·

|

Our ability to effectively operate our business segments;

|

|

|

·

|

Our ability to manage our research, development, expansion, growth and operating expenses;

|

|

|

·

|

Our ability to evaluate and measure our business, prospects and performance metrics;

|

|

|

·

|

Our ability to compete, directly and indirectly, and succeed in the highly competitive and evolving ridesharing industry;

|

|

|

·

|

Our ability to respond and adapt to changes in technology and customer behavior; and

|

|

|

·

|

Our ability to protect our intellectual property and to develop, maintain and enhance a strong brand.

|

Although the forward-looking

statements in this Offering Circular are based on our beliefs, assumptions and expectations, taking into account all information

currently available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance

can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that

deviations from them will not be material and adverse. We undertake no obligation, other than as may be required by law, to re-issue

this Offering Circular or otherwise make public statements updating our forward-looking statements.

OFFERING CIRCULAR SUMMARY

This Offering Circular

contains a fair summary of the material terms of documents summarized herein. All concepts, goals, estimates and business intentions

are revealed and disclosed as such are known to management as of the date of this Offering Circular. Circumstances may change

so as to alter the information presented herein at a later date. This material will be updated by Amendment to this document and

by means of press releases and other communications to Shareholders. You should carefully read the entire Offering Circular, including

the risks associated with an investment in the company discussed in the “Risk Factors” section of this Offering Circular,

before making an investment decision. Some of the statements in this Offering Circular are forward-looking statements. See the

section entitled “Cautionary Statement Regarding Forward-Looking Statements.”

As used in this Offering Circular, all

references to “DNA Brands,” “capital stock,” “Common Stock,” “Shares,” “preferred

stock,” “stockholders,” “shareholders” applies only to DNA Brands, Inc. As used in this Offering

Circular, the terms “Company,” “we,” “our” or words of like import mean DNA Brands, Inc.,

and its direct and indirect subsidiaries. All references in this Offering Circular to “years” and “fiscal years”

means the twelve-month period ended December 31.

Corporate

History and Information

The

Company was formed in the state of Colorado with the filing of Articles of Incorporation on May 23, 2007 with the name of Famous

Products, Inc. At formation, the principal operations of the Company were as a full service, brand-marketing organization whose

activities are centered around its client's products, principally in the liquor industry. Brand marketing builds the value of

the brand by connecting it with target audiences to achieve strategic marketing objectives. It was comprised of one corporation

with a wholly-owned subsidiary, Fancy Face Promotions, Inc., a Colorado corporation. All of our operations are conducted through

this subsidiary. On January 22, 2008, the Company filed a registration statement on Form SB-2 reporting

$26,648 in assets which however consisted mostly of cash, $24,170. The company’s operations however consisted mostly of

providing services out of one principal location in the downtown Denver metropolitan area. These operations continued until July

7, 2010 when the Company changed to its current name, DNA Brands, Inc. Through to this name change event, though it was never

profitable, the Company was current in its filings requirements with the SEC reporting on its assets and operations in its fiscal

year reports for 2007, 2008 and 2009 (it has a fiscal year end date of Oct. 31). For its period ending Oct. 31, 2007, it reported

losses of $47,850 from its operations. For its fiscal year ending Oct. 31, 2008, it reported total revenues of $35,825 but reported

a net loss of $18,4883. For its fiscal year ending Oct. 31, 2009, it reported total revenues

of $6,214 and had operating expenses of $33,3614.

On

July 6, 2010, the Company changed its business plan acquiring Grass Roots Beverage Company, Inc. and all of the remaining assets,

liabilities and contract rights of DNA Beverage Corporation, and the Company amended its name to DNA Brands, Inc. on July 7, 2010.

Our mailing address

is DNA Brands, Inc., 275 E. Commercial Blvd. #301, Lauderdale by the Sea, FL 33308 and our telephone number is (561) 654-5722.

Our website address is www.dnabrandsinc.com. The information contained therein or accessible thereby shall not be

deemed to be incorporated into this Offering Circular.

Business Overview

On March 25, 2019, we

announced that we were shifting our primary corporate focus to the transportation/ridesharing industry with the signing of a fleet

agreement with the rideshare platform, Ridesharerental.com (http://www.Ridesharerental.com) (the “Rideshare Platform”).

As of the date of this Offering Circular, the Company’s operating business segments will be primarily focused on our Fleet

Agreement with Rideshare rental.com and the maintenance of a fleet of standard passenger vehicles to be made commercially available

for rent to rent to Uber and Lyft drivers in the South Florida Region (“Fleet Management”). Initially concentrating

in the South Florida region, DNA Brands is the First fleet operator in the State of Florida with www.RideshareRentals.com and anticipates

covering the whole state by years’ end.

The Company’s

Fleet Management business focuses on the maintenance of a fleet of standard passenger vehicles, to be subsequently rented directly

to drivers in the ridesharing economy. The Fleet Management business and vehicles are made commercially available through the

Rideshare Platform, which is available at www.ridesharerental.com. DNA Brands has obtained financing (discussed in more detail

below) in order to begin the fleet purchase process. The company fully intends to continue adding cars to its fleet monthly.

The most significant portion of the use of proceeds of this offering will be to add additional vehicles to our Fleet Management

business.

The Company now has

four vehicles in service.

Prior Financing

From mid-2013 through

the third quarter of 2019, the Company has been financed principally by four main investors, Dr. Thomas Rutherford, Kerry Goodman,

GPL Ventures, and Barry Romich (or related entities), two of whom (Dr. Rutherford and Mr. Goodman) are also shareholders of the

Company. The promissory notes and debentures representing their investments are included as exhibits to this Registration Statement.

The majority of the prior promissory notes and debentures issued by the Company, excluding those issued in 2019, were in default

as of the date of this Offering Circular. The Company has spoken with nearly all of the holders of the defaulted instruments and

other creditors of the Company, and feels that it has a good relationship with the holders and creditors. There can be no guarantee

that one or more noteholders or other creditors of the Company will not seek to enforce the Company’s payment obligations.

Additional information

about the notes and debentures can be found in the Section below entitled “DNA Brands Inc., Recent Financing Activities.”

Other investors also provided financing, information about which can also be found in the Section entitled “DNA Brands

Inc., Recent Financing Activities.”

The Ridesharing Industry

At the

most basic level, real-time ridesharing is a service that arranges one-time shared rides on very short notice. The internet-connected,

global positioning system (“GPS”) enabled device automatically detects your current location, takes the home

location that you have programmed in previously and searches the database for drivers traveling a similar route and willing to

pick up passengers. According to Wikipedia.org, “real-time” ridesharing is defined as “a single, or

recurring Rideshare trip with no fixed schedule, organized on a one-time basis, with matching of participants occurring as little

as a few minutes before departure or as far in advance as the evening before a trip is scheduled to take place”.

The

growth of the ridesharing economy has resulted in increasing consumer demand for ridesharing services, provided by transportation

network companies (“TNC”) such as Lyft, DIDI, VIA, Juno, Gett and Uber, that offer a ridesharing economy service

through mobile applications. Ridesharing apps connect people who need a ride with people who have a vehicle and time to drive

- notably, not necessarily people who are licensed taxi drivers. Companies like Lyft, DIDI, VIA, Juno, Gett and Uber provide a

smartphone app that lets consumers hail a ride, set their destination, and pay without leaving the app itself. The benefits to

the consumer is ease of use, availability of rides, and sometimes lower prices than traditional taxis. Many companies require

at least some sort of certification for the drivers and take a portion of the drivers’ fares. Drivers can choose when they

work (though they can receive bonuses for logging a certain number of hours) and provide their own vehicles. Early entrants in

the TNC app space, like Uber and Flywheel, were founded around 2009. Overall, the industry has raised more than $10 billion in

venture funding.

We believe that we have strong economic prospects by virtue of the following dynamics of the industry:

|

|

·

|

Continued

Growth in Ridesharing Market. The ridesharing services market has grown faster,

gone to more places and has produced robust growth and consumer traffic figures since

commercial introduction in approximately 2009. The pace of growth is also picking up.

It has been reported that Uber took six (6) years before it reached a billion rides in

December of 2015, but it took only six (6) months for Uber to get to two billion rides.

In the U.S., the number of users of ridesharing services is estimated to increase from

8.2 million in 2014 to 20.4 million in 2020, producing a compounded annual growth rate

(“CAGR”) of approximately 13.92% over the seven-year period.

|

|

|

·

|

Globalization

of Ridesharing. In the same vein, ridesharing which started as an experiment

in California has grown into a global marketplace over a short period of time. Asia has

emerged as a geographical territory to drive future growth. For example, Didi Chuang,

the Chinese ridesharing company, completed 1.43 billion rides just in 2015 and it now

claims to have 250 million users in 360 Chinese cities. Ridesharing is also acquiring

deep roots in both India and Malaysia, and is making advances in Europe and Latin America,

despite regulatory pushback.

|

|

|

·

|

Expanding

Choices. Consumer options in ridesharing are expanding to attract an even larger

audience, such as carpooling and private bus services. The expansion of consumer options

has also attracted mass transit customers to more expensive luxury options. In addition,

it has been reported that dominant TNC businesses are experimenting with pre-scheduled

rides and multiple stops on single trip gain to meet customer needs. Our Fleet Management

business and fleet of rental vehicles are designed to put more certified ridesharing

vehicles on the roadways to meet the increasing consumer demand of the availability of

ridesharing services.

|

Our Opportunity

The increasing

demand for ridesharing services has produced an increase in demand by TNC businesses for more ridesharing drivers and vehicles

on the road at any given time. The growing demographic of ridesharing drivers, as determined on a global basis, has drawn ridesharing

drivers to the ridesharing marketing to perform services for a host of private TNC businesses focused on ridesharing, such as Uber

and Lyft. The Company believes that private ridesharing TNC businesses are hiring more than an estimated 50,000 drivers a month

to keep pace with the current commercial demand for ridesharing services.

Complicating

this matter further, many potential ridesharing drivers drawn to the ridesharing market are being rejected or turned away from

driving for the private ridesharing TNCs on account of the fact that many potential ridesharing driver’s personal vehicles

are failing to meet the Ridesharing Qualification Requirements imposed on all ridesharing drivers and vehicles by the private

ridesharing TNCs. The Ridesharing Qualification Requirements include not only certain requirements on all ridesharing drivers

and their respective vehicles (the “Driver Qualification Requirements”) but also additional vehicle safety

tests, inspections and precautions on all ridesharing vehicles to be utilized by drivers under employment with the private ridesharing

TNCs. Generally, the vehicle safety tests, inspections and precautions require all vehicles to pass a standard vehicle inspection

test administered by the respective TNC employer (the “Vehicle Qualification Requirements”, together with the

Driver Qualification Requirements, the “Ridesharing Qualification Requirements”). For more information,

see “Ridesharing Qualification Requirements”. The Company estimates that approximately 30%-50% of potential

ridesharing drivers do not own or have access to a car or vehicle that will meet the Ridesharing Qualification Requirements. Further,

the Company believes that this issue surrounding the Ridesharing Qualifications Requirements are exacerbating the problem and

resulting in a shortfall of ridesharing drivers on the road at any given time. Private ridesharing TNCs have responded to this

issue by actively pursuing programs to get eligible ridesharing drivers into qualified cars that meet the Ridesharing Qualification

Requirements. The Company believes that the TNC line of business and immense capital requirements in developing a fleet management

business to service the growing ridesharing industry on such a large scale will restrict the ability of the private ridesharing

TNCs to dominate the ridesharing vehicle rental market. Additionally, under the general rules being enforced by the leading TNCs,

TNCs are restricted from owning a fleet of vehicles or partaking in the fleet management business. Further, despite the financial

resources and scale of the dominant TNCs in the ridesharing business, the Company believes that third-party vehicle rental providers

are a necessity to the growth and service of a robust ridesharing market.

Our Concurrent and Recent Financing Activities.

DNA Brands Inc., Recent Financing Activities

In February 2011, the Company issued a convertible

debenture to an existing shareholder in the amount of $500,000. The debenture bears interest at 12% per annum and carries an annual

transaction fee of $30,000, of which both are payable in quarterly installments commencing in May 2011. These costs are recorded

as interest expense in the Company's financial statements. In addition, as further inducement for loaning the Company funds, the

Company issued 125,000 restricted shares of its common stock to the holder upon execution. The common shares were valued at $31,250,

their fair market value, and recorded as discount to the debenture. These costs will be amortized using the effective interest

method over the term of the debenture and recorded as interest expense in the Company's financial statements.

In

June 2011, the Company issued a convertible debenture to an existing shareholder in the amount of $125,000. The debenture bears

interest at 12% per annum, which is payable in the Company’s common stock at the time of maturity. The debenture is convertible

at any time prior to maturity into 150,000 shares of the Company’s common stock. This beneficial conversion feature was

valued at $90,750, using Black-Scholes methodology, and recorded as a discount to the debenture. These costs will be amortized

using the effective interest method over the term of the debenture and recorded as interest expense in the Company's financial

statements.

In

July and August 2011, the Company issued a series of secured convertible debentures to accredited investors aggregating $275,000

in gross proceeds. All proceeds from these debentures are to be utilized solely for the purpose of funding raw materials and inventory

purchases through the use of an escrow agent. The debentures bear interest at 12% per annum, payable in monthly installments.

The debentures are convertible at any time prior to maturity at a conversion price equal to 80% of the average share price of

the Company’s common stock for the 10 previous trading days prior to conversion, but not less than $0.70. In addition, as

further inducement for loaning the Company funds, the Company issued the lenders 68,750 restricted shares of its common stock

and 137,500 common stock warrants exercisable at $1.25 per share. As a result, the Company had to allocate fair market value to

each the beneficial conversion feature, restricted shares and warrants. The common shares were valued at $30,938, their fair market

value. The Company determined the fair market value of the warrants as $94,255 using the Black-Scholes valuation model. Since

the combined fair market value allocated to the warrants and beneficial conversion feature cannot exceed the convertible debenture

amount, the beneficial conversion feature was valued at $149,807, the ceiling of its intrinsic value. These costs will be amortized

using the effective interest method over the term of the debenture and recorded as interest expense in the Company's financial

statements.

In

February 2012, the Company issued a convertible debenture to an existing shareholder in the amount of $75,000. The debenture bears

interest at 12% per annum, which is payable in the Company’s common stock at the time of maturity. The debenture is convertible

at any time prior to maturity into 280,000 shares of the Company’s common stock. As further inducement, the Company issued

the lender 280,000 common stock warrants exercisable at $1.50 per share. If unexercised, the warrants will expire on January 31,

2017. Using the Black-Scholes model, the warrants were valued at $63,620 and recorded as a discount to the principal amount of

the debenture. This discount is amortized using the effective interest method over the term of the debenture and recorded as interest

expense in the Company's financial statements.

In

February and June 2012, the Company converted $524,950 of its loans payable to officers into convertible debentures. These debentures

were offered by the Company’s officers to certain accredited investors and a majority portion of the proceeds therefrom

were deposited with the Company. The debentures had no maturity date and bear no interest. Therefore, these debentures

were payable on demand and were originally classified as a current liability. The debentures were convertible at any time into

3,499,667 shares, or $0.15 per share of common stock. The Company determined that these terms created a beneficial conversion

feature. Using the Black- Scholes model, the beneficial conversion feature was valued at $524,950, the ceiling of its intrinsic

value. Due to the nature of the debentures, the full value of the beneficial conversion feature was immediately recorded as interest

expense in the Company’s financial statements. In August 2012, these convertible debentures were converted into 3,499,666

shares of the Company’s common stock.

On

April 9, 2012, the Company executed an Investment Banking and Advisory Agreement with Charles Morgan Securities, Inc., New York,

NY (“CMI”), wherein CMI agreed to provide consulting, strategic business planning, financing on a “best efforts”

basis and investor and public relations services, as well as to assist the Company in its efforts to raise capital through the

issuance of debt or equity. The agreement provided for CMI to engage in two separate private offerings with the initial private

placement offering up to $3.0 million and the second private placement offering up to an additional $3.0 million; each on a “best

efforts” basis. In connection with this agreement the Company issued 750,000 shares valued at $0.25 per share or a total

value of $187,500. This amount was fully amortized in the Company's financial statements as of December 31, 2012.

In

July 2012, the Company received proceeds from convertible debentures totaling $182,668 in connection with the CMI agreement. The

debentures bear interest at 12% per annum, which is payable in cash or the Company’s common stock at the time of conversion

or maturity. The debentures are convertible at any time prior to maturity at a conversion price equal to the lesser of 75% of

the average share price of the Company’s common stock for the five previous trading days prior to conversion or $0.35, but

not less than $0.15. In the event that the Company offers or issues shares of its common stock at a share price less than $0.15,

the floor conversion price will adjust to the new lower price. The Company determined that the terms of the debentures created

a beneficial conversion feature. Using the Black-Scholes model, the beneficial conversion feature was valued at $160,813 and recorded

as a discount to the principal amount of the debentures. The discount is amortized using the effective interest method over the

term of the debenture and recorded as interest expense in the Company's financial statements.

On

August 7, 2012, the Company issued a convertible debenture in the amount of $50,000. The debenture does not bear interest. As

an inducement, the Company agreed to issue the lender 20,000 shares of its common stock. The common shares were valued at their

trading price on the date of the agreement and recorded as interest expense in the Company’s results of operations. The

Company determined that the terms of the debenture created a beneficial conversion feature. Using the Black-Scholes model, the

beneficial conversion feature was valued at $50,000, the ceiling of its intrinsic value, and recorded as a discount to the principal

amount of the debenture. The discount is amortized using the effective interest method over the term of the debenture and recorded

as interest expense in the Company's financial statements. During the second quarter of 2013, the conversion terms of this note

were modified and the note was converted into 1,500,000 shares of common stock.

On

September 25, 2012, the Company issued a convertible debenture in the amount of $50,000. The debenture bears interest at 6% per

annum, which is payable in the Company’s common stock at the time of conversion or maturity. The debenture is convertible

at any time prior to maturity at a conversion price equal to 70% of the lowest closing bid price of the Company’s common

stock on the four previous trading days prior to and day of conversion, but not less than $0.0001. The Company determined that

the terms of the debenture created a beneficial conversion feature. Using the Black-Scholes model, the beneficial conversion feature

was valued at $50,000, the ceiling of its intrinsic value, and recorded as a discount to the principal amount of the debenture.

The discount is amortized using the effective interest method over the term of the debenture and recorded as interest expense

in the Company's financial statements. During the second quarter of 2013, the lender converted $23,000 of principal into 919,403

shares of common stock in accordance with the conversion terms of the debenture.

On

November 1, 2012, the Company issued a convertible debenture in the amount of $80,000. The debenture bears interest at 12% per

annum, which is payable in the Company’s common stock at the time of conversion or maturity. The debenture is convertible

at any time prior to maturity at a conversion price equal to 70% of the average closing bid price of the Company’s common

stock on the 30 previous trading days prior to the day of conversion. The Company determined that the terms of the debenture created

a beneficial conversion feature. Using the Black-Scholes model, the beneficial conversion feature was valued at $56,286, the ceiling

of its intrinsic value, and recorded as a discount to the principal amount of the debenture. The discount is amortized using the

effective interest method over the term of the debenture and recorded as interest expense in the Company's financial statements.

During

the second quarter of 2013, the Company recorded $65,000 in gross proceeds from the issuance of three convertible debentures.

The debentures bear interest at 12% per annum, which is payable in cash at the time of maturity. The debentures are convertible

at any time prior to maturity into 216,667 shares of the Company’s common stock. As further inducement, the Company issued

the lenders 216,667 common stock warrants exercisable at $1.50 per share. If unexercised, the warrants will expire on February

28, 2017. Using the Black-Scholes model, the warrants were valued at $69,455 and recorded as a discount up to the principal amount

of the debentures. This discount is amortized using the effective interest method over the term of the debenture and recorded

as interest expense in the Company's financial statements. As of December 31, 2013, two of the debentures totaling $35,000 in

principal value were converted into 316,667 shares of common stock. Some of the original conversion terms were modified prior

to the notes’ conversions. The remaining $30,000 debenture is in default, as its maturity date was April 25, 2013.

On

September 17, 2013, the Company issued a convertible debenture in the amount of $50,000. The debenture bears interest at 6% per

annum, which is payable in the Company’s common stock at the time of conversion or maturity. The debenture is convertible

at any time prior to maturity at a conversion price equal to 70% of the lowest closing bid price of the Company’s common

stock on the four previous trading days prior to and day of conversion, but not less than $0.0001. The Company determined that

the terms of the debenture created a beneficial conversion feature. Using the Black-Scholes model, the beneficial conversion feature

was valued at $50,000, the ceiling of its intrinsic value, and recorded as a discount to the principal amount of the debenture.

The discount is amortized using the effective interest method over the term of the debenture and recorded as interest expense

in the Company's financial statements.

On

October 31, 2013, the Company issued a convertible debenture in the amount of $204,000. The debenture bears interest at 18% per

annum, which is payable in the Company’s common stock at the time of conversion or maturity. The debenture is convertible

at any time prior to maturity at a conversion price equal to 50% of the lowest closing bid price of the Company’s common

stock on the twenty previous trading days prior to and day of conversion. The Company determined that the terms of the debenture

created a beneficial conversion feature. Using the Black-Scholes model, the beneficial conversion feature was valued at $204,000,

the ceiling of its intrinsic value, and recorded as a discount to the principal amount of the debenture. The discount is amortized

using the effective interest method over the term of the debenture and recorded as interest expense in the Company's financial

statements.

On

November 6, 2013, the Company issued a convertible debenture in the amount of $53,000. The debenture bears interest at 8% per

annum, which is payable in the Company’s common stock at the time of conversion or maturity. The debenture is convertible

at any time prior to maturity at a conversion price equal to 58% of the average of the 3 lowest share closing bid prices of the

Company’s common stock on the ten previous trading days prior to and day of conversion. The Company determined that the

terms of the debenture created a beneficial conversion feature. Using the Black-Scholes model, the beneficial conversion feature

was valued at $48,533, its intrinsic value, and recorded as a discount to the principal amount of the debenture. The discount

is amortized using the effective interest method over the term of the debenture and recorded as interest expense in the Company's

financial statements.

On

November 6, 2013, the Company issued a convertible debenture in the amount of $125,000. The debenture bears interest at 10% per

annum, which is payable in the Company’s common stock at the time of conversion or maturity. The debenture is convertible

at any time prior to maturity at a conversion price equal to 50% of the lowest share closing bid price of the Company’s

common stock on the twenty previous trading days prior to and day of conversion. The Company determined that the terms of the

debenture created a beneficial conversion feature. Using the Black-Scholes model, the beneficial conversion feature was valued

at $125,000, the ceiling of its intrinsic value, and recorded as a discount to the principal amount of the debenture. The discount

is amortized using the effective interest method over the term of the debenture and recorded as interest expense in the Company's

financial statements.

On

November 6, 2013, the Company issued a convertible debenture in the amount of $80,000. The debenture bears no interest and is

payable in the Company’s common stock at the time of conversion or maturity. The debenture is convertible at any time prior

to maturity at a conversion price equal to 50% of the average share closing bid price of the Company’s common stock on the

thirty previous trading days prior to and day of conversion. The Company determined that the terms of the debenture created a

beneficial conversion feature. Using the Black-Scholes model, the beneficial conversion feature was valued at $80,000, the ceiling

of its intrinsic value, and recorded as a discount to the principal amount of the debenture. The discount is amortized using the

effective interest method over the term of the debenture and recorded as interest expense in the Company's financial statements.

On

November 21, 2013, the Company issued a convertible debenture in the amount of $100,000. The debenture bears interest at 12% per

annum, which is payable in the Company’s common stock at the time of conversion or maturity. The debenture is convertible

at any time prior to maturity at a conversion price equal to 50% of the lowest share intra-day price of the Company’s common

stock on the ten previous trading days prior to and day of conversion. The Company determined that the terms of the debenture

created a beneficial conversion feature. Using the Black-Scholes model, the beneficial conversion feature was valued at $100,000,

the ceiling of its intrinsic value, and recorded as a discount to the principal amount of the debenture. The discount is amortized

using the effective interest method over the term of the debenture and recorded as interest expense in the Company's financial

statements.

June

10, 2014, the Company issued a convertible debenture of $75,000 to Coventry Enterprises LLC bearing 8% interest per annum. This

debenture is in default.

April

22, 2014, the Company issued a 1 year convertible debenture of $77,500, maturing April 22, 2015, to Tidepool Ventures Inc. Bearing

10% interest per annum. This note has a Conversion factor of 45% of market price. Market price is calculated by the average of

the lowest Bid price for the trailing ten business days to the market. (Representing a 55% discount to market price). This note

was sold to World Market Ventures LLC and converted into common stock.

April

22, 2014, the Company issued a 1 year maturity convertible debenture of $110,000 to Iconic Holding LLC. Bearing 5% interest per

annum, maturing April 22 2015. This note has a Conversion factor of 50% of market price. Market price is calculated by the average

of the lowest Bid price for the trailing ten business days. (Representing a 50% discount to market price). $32,250 Was converted

into Common stock for 2016. This note is in default.

May

2, 2014, the Company issued a 1 year convertible debenture to LG Capital funding LLC of $37,500 maturing May 2, 2015. Bearing

8% annual interest. This note has a conversion factor of 50% of market price. Market price is calculated by taking the average

of the lowest Bid price for the trailing ten business days. (Representing a 50% discount to market price). This note is in default.

June

10, 2014, the Company issued a 1 year maturity convertible debenture of $75,000 to Coventry Enterprises LLC bearing 8% interest

per annum maturing June 10, 2015. This note has a conversion factor of 60% of market price. Market price is calculated by taking

the average of the lowest Bid price for the trailing ten business days. (Representing a 40% discount to market price). This note

is in default. $63K, was converted into Common stock for the year 2016.

Oct.

7, 2014, the Company issued a 1 year Convertible Debenture to Coventry Enterprises LLC for $30,000. Bearing 8% per annum. Maturing

Oct. 7, 2015. This note has a Conversion ratio with a 50% of market price. Market price is Calculated by taking the average of

the lowest Bid price for the trailing ten business days. (Representing a 50% discount to market price). This note is in default.

Jan.

14, 2016 the company issued a convertible debenture to Darren Marks for $25,000 bearing 8% interest per annum. Maturing Jan. 14,

2015. This note has a Conversion factor of 40% of market price. Market price is calculated by the average of the lowest bid price

of the trailing 5 business days (Representing a 60% discount to market). This note is in default.

Jan.

14, 2016 the company issued a convertible debenture to Darren Marks for $50,000 bearing 8% interest per annum. Maturing Jan. 14,

2015. This note has a Conversion factor of 40% of market price. Market price is calculated by taking the average of the lowest

bid price of the trailing 5 business days. (Representing a 60% discount to market price). This note is in default.

Jan.

14, 2016 the company issued a convertible debenture to Melvin Leiner for $50,000 bearing 8% interest per annum. Maturing Jan. 14,

2017. This note has a Conversion factor of 40% of market price. Market price is calculated by taking the average of the lowest

bid price of the trailing 5 business days. (Representing a 60% discount to market price). This note is in default.

Feb.

1, 2016 the company issued a convertible debenture to Andrew Telsey for $30,000, bearing 8% Interest per annum. Maturing Feb. 1,

2017. This note has a conversion of 60% of market value. Market price is calculated by taking the average of the lowest bid price

of the trailing 5 business days. (Representing a 40% discount to market price). This Note is in default.

Feb.

1, 2016, the Company issued a convertible Note to Darren Marks for $70,500, bearing 8% interest per annum. Maturing Feb. 1, 2017.

This note has a conversion factor of 40% of market price. Market price is calculated by taking the average of the lowest bid price

of the trailing 5 business days. (Representing a 60% discount to market Price). This Note is in default.

Feb.

1, 2016, the Company issued a convertible Note to Melvin Leiner for $106,632.70, bearing 8% interest, with a conversion ratio,

of 40% market price. Maturing Feb. 1, 2017. Market price is calculated by taking the average of the lowest bid price of the trailing

5 business days. Discount to market. (Representing a 60% discount to market price). This Note is in default.

April

16, 2016, the Company issued a convertible debenture to Tidepool Ventures group for $10,000 bearing 5% interest per annum. Maturing

April 16, 2017. This note has a conversion ratio of 45% of market price. Market price is calculated by taking the average of the

lowest bid price of the trailing 5 business days. (Representing a 55% discount to market). This debenture is in default.

April

26, 2016, the Company issued a convertible debenture to Iconic Holdings LLC for $25,000 bearing 10% interest per annum

Maturing April 26, 2017. This note has a conversion ratio of 50% of market price. Market price is calculated by taking the

average of the lowest bid price of the trailing 5 business days. (Representing a 50% discount to market price). This note is

in default.

June

10, 2016, the Company issued a convertible debenture to Tidepool Ventures LLC for $3,000 bearing 5% interest per annum. Maturing

June 10, 2017. This note has a conversion ratio of 50% of market price. Market price is calculated by taking the average of the

lowest bid price of the trailing 5 business days. (Representing 50% discount to market price). This note is in default.

June

29, 2016, the Company issued a convertible debenture to Tidepool Ventures LLC of Eight thousand seven hundred fifty dollars

($8,750) bearing 5% interest per annum. Maturing June 29, 2017. This Note has a conversion factor of 50% of market price.

Market price is calculated by taking the average of the lowest bid price of the trailing 5 business days. (Representing a 50%

discount to market price). This note is in default.

August

12, 2016, the Company issued a convertible debenture to Tidepool Ventures LLC $3,000 bearing 5% interest per annum. Maturing August

12, 2017. This note has a conversion factor of 50% of market price. Market price is calculated by taking the average of the lowest

bid price of the trailing 5 business days. (Representing a 50% discount to market price). This debenture is in default.

Sept

7, 2016, the Company issued a convertible debenture to Dr. Rutherford for $20,000 Bearing 5% interest per annum. Maturing September

7, 2017. This note has a conversion of 50% discount of market price. Market price is calculated by taking the average of the lowest

bid price of the trailing 5 business days. (Representing a 50% discount to market price). This note is in default.

May

21, 2017, Company issued a convertible Promissory Note to Heidi Michitsch for One Hundred Thousand Dollars, bearing 9.875% interest

($100K). This note is in default.

November

24, 2017, the Company issued a convertible debenture to Mr. Fred Rosen for Four Thousand Dollars ($4,000), for funds loaned to

the company. This note is in default.

On

November 25, 2017, the Company issued a Convertible Note for Twenty Thousand Dollars USD ($20,000) Dr. Thomas Rutherford, for

funds loaned to the company. This note is in default.

On

November 29, 2017, company issued a Convertible Promissory Note to Mr. Joseph Gibson, for Five Thousand Dollars USD ($5,000) USD.

This note is in default.

On

or about November 30, 2017, the Company issued a Convertible Promissory Note to Dr. Doug Engers Five Thousand USD ($5K) for funds

loaned to the Company. This note is in default.

On

or about December 13, 2017, the Company issued a Convertible Promissory Note to Barry Romich of Ten Thousand dollars USD ($10,000),

for funds loaned to the company. This note is in default.

On

or about December 15, 2017, the Company issued a Convertible Promissory Note to Mr. Kerry Goodman for One hundred Thousand Dollars

USD ($100K, $50K cashed late December, $50K cashed early February). This note is in default.

On

or about December 31, 2017, company issued a Convertible promissory Note payable to Ms. Heidi Michitsch of Six thousand Dollars

USD ($6K) for Back Salaries Due, Q4 2017. This note is in default.

On

Dec. 31, 2017, the Company issued a Convertible promissory Note to CEO Adrian P. McKenzie or his company PBDC LLC in the amount

of Thirty One Thousand, two hundred and Eighty USD ($31,280). This Promissory Note covers monies loaned to the company for the

Token Talk Acquisition and Back Salaries owed to Mr. McKenzie over the given time period. This note is in default.

On

or about August 13, 2018, the Company issued a Convertible Note of Fifty Thousand Dollars USD in exchange for Fifty Thousand Dollar

USD ($50,000) Loan to the Company, to the BA Romich Trust. This note is in default.

On

or about August 13, 2018, the Company issued a Convertible note in the amount of Fifty Thousand Dollars USD ($50,000) as a Charitable

donation to the Romich Foundation. This note is in default.

On

or November 18, 2018, the Company issued a convertible promissory Note to Dr. Thomas Rutherford for One Hundred Thousand Dollars

USD ($100,000), for funds loaned to the company. This note is in default.

Risks Related to

Our Business

Our business

and our ability to execute our business strategy are subject to a number of risks as more fully described in the section titled

“Risk Factors.” These risks include, but are not limited to the following:

|

|

·

|

Our limited operating history by which potential investors may measure our chances of achieving success in under our business

model. In addition, our executive officers have a lack of experience in managing companies similar to the Company.

|

|

|

·

|

Federal or state regulations concerning the ridesharing industry or adoption of new regulations that could have a material

adverse effect on our business segments.

|

|

|

·

|

Our ability to pay significant indebtedness.

|

|

|

·

|

Our ability to effectively operate our business segments and respond to the highly competitive and rapidly evolving marketplace

and regulatory environment in which we intend to operate.

|

|

|

·

|

Our ability to manage our expansion, growth and operating expenses.

|

|

|

·

|

Our management team’s lack of prior managerial experience within a highly competitive industry, such as the vehicle rental

business or transportation industry, subjects our Company to certain qualitative risks and uncertainties.

|

|

|

·

|

Our ability to compete, directly and indirectly, and succeed in the highly competitive and evolving ridesharing industry.

|

|

|

·

|

No active market for our common stock exists or may develop, and you may not be able to resell your common stock at or above

the initial public offering price.

|

|

|

·

|

Our ability to protect our intellectual property and to develop, maintain and enhance a strong brand.

|

REGULATION A+

We are offering our

Common Stock pursuant to recently adopted rules by the Securities and Exchange Commission mandated under the Jumpstart Our Business

Startups Act of 2012, or the JOBS Act. These offering rules are often referred to as “Regulation A+.” We are

relying upon “Tier 1” of Regulation A+, which allows us to offer of up to $20 million in a 12-month period.

In accordance with

the requirements of Tier 1 of Regulation A+, we will be required to update certain issuer information by electronically filing

a Form 1-Z exit report with the Commission on EDGAR not later than 30 calendar days after termination or completion of an offering.

THE OFFERING

|

Issuer:

|

|

DNA Brands, Inc.

|

|

|

|

|

|

Shares Offered:

|

|

A maximum of Fifteen Million Six Hundred Twenty Five Thousand

(15,625,000) shares of our Common Stock (the “Maximum Offering”), at an offering price of Sixteen Cent ($0.16)

per share (the “Shares”).

|

|

|

|

|

|

Number of shares of Common Stock Outstanding before the Offering:

|

|

4,494,935 shares of Common Stock.

|

|

|

|

|

|

Number of shares of Common Stock to be Outstanding after the Offering:

|

|

20,119,935 shares of Common Stock if the Maximum Offering is sold.

|

|

|

|

|

|

Price per Share:

|

|

Sixteen Cents ($0.16).

|

|

|

|

|

|

Listing:

|

|

Our shares of Common Stock

are listed on Over the Counter Pink Sheets exchange under the symbol “DNAX.”

|

|

|

|

|

|

|

|

There can be no assurance that

the Company Common Stock sold in this Offering will be continue to be approved for listing on OTCPNK or other recognized securities

exchange. For more information see the section “Risk Factors.”

|

|

|

|

|

|

Maximum Offering:

|

|

Fifteen Million Six Hundred Twenty Five Thousand (15,625,000)

shares of our Common Stock (the “Maximum Offering”), at an offering price of Sixteen Cents ($0.16) per share

(the “Offering Price”), for total gross proceeds of Two Million Five Hundred Thousand Dollars ($2,500,000).

|

|

|

|

|

|

Use of Proceeds:

|

|

If we sell all of the Shares being offered, our net proceeds

(after our estimated Offering expenses) will be $2,500,000. We will use these net proceeds for the operation of our business segments,

working capital and general corporate purposes, and such other purposes described in the “Use of Proceeds” section

of this Offering Circular.

|

|

|

|

|

|

Risk Factors:

|

|

Investing in our Common Stock involves a high degree of risk. See “Risk Factors”.

|

RISK FACTORS

An investment in our Common

Stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information

included in this Offering Circular, before making an investment decision. If any of the following risks actually occurs, our business,

financial condition or results of operations could suffer. In that case, the trading price of our shares of common stock could

decline and you may lose all or part of your investment.

The discussions and information

in this Offering Circular may contain both historical and forward-looking statements. To the extent that the Offering Circular

contains forward-looking statements regarding the financial condition, operating results, business prospects, or any other aspect

of our business, please be advised that our actual financial condition, operating results, and business performance may differ

materially from that projected or estimated by us in forward-looking statements. We have attempted to identify, in context, certain

of the factors we currently believe may cause actual future experience and results to differ from our current expectations. See

“Cautionary Note Regarding Forward Looking Statements” above for a discussion of forward-looking statements and the

significance of such statements in the context of this Offering Circular.

RISKS RELATED

TO OUR COMPANY

We

have a limited operating history in the rideshare industry on which to judge our business prospects and management.

We

have limited operating history as a rideshare company upon which to base an evaluation of our business and prospects. You must

consider the risks and difficulties we face as a small operating company with limited operating history.

On

March 25, 2019, we announced that we were shifting our primary corporate focus in the transportation/ridesharing industry towards

the vehicle rental business with a focus on the maintenance of a fleet of standard passenger vehicles to be made commercially

available for rent to rideshare drivers. We have limited operating history in the vehicle rental, fleet management and transportation

industry.

If we do not successfully address these risks, our business, prospects, operating results and financial condition will

be materially and adversely harmed. Operating results for future periods are subject to numerous uncertainties and we cannot assure

you that the Company will achieve or sustain profitability. The Company’s prospects must be considered in light of the risks

encountered by small operating companies with limited operating history, particularly companies in new and rapidly evolving markets.

Operating results will depend upon many factors, including our success in attracting and retaining motivated and qualified personnel,

our ability to establish short term credit lines or obtain financing from other sources, such as the contemplated Regulation A+

offering, our ability to develop and market new products, control costs, and general economic conditions. We cannot assure you

that the Company will successfully address any of these risks.

We

will need but may be unable to obtain additional funding on satisfactory terms, which could dilute our shareholders or impose

burdensome financial restrictions on our business.

We

have relied upon cash from financing activities and in the future, we hope to rely more predominantly on revenues generated

from operations to fund all of the cash requirements of our activities. However, there can be no assurance that we will be

able to generate significant cash from our operating activities in the future to funds our continuing operations. Future

financings may not be available on a timely basis, in sufficient amounts or on terms acceptable to us, if at all. Any debt

financing or other financing of securities senior to the Common Stock will likely include financial and other covenants that

will restrict our flexibility. Any failure to comply with these covenants would have a material adverse effect on our

business, prospects, financial condition and results of operations because we could lose our existing sources of funding and

impair our ability to secure new sources of funding. However, there can be no assurance that the Company will be able to

generate any investor interest in its securities.

We

have a history of losses and we expect significant increases in our costs and expenses to result in continuing losses for at least

the foreseeable future.

For the

fiscal year ended December 31, 2018, we generated a loss of approximately ($622,915), bringing the accumulated deficit to approximately

($2,430,455) at December 31, 2018. Increases in costs and expenses may result in a continuation of losses for the foreseeable future.

There can be no assurance that we will be commercially successful.

We

have outstanding debt and lease commitments, which is secured by our assets and it may make it more difficult for us to make payments

on the notes and our other debt and lease obligations.

As of December 31, 2018, we had outstanding

indebtedness totaling approximately $1,943,146. Our debt commitments could have important consequences to you. For example, they

could:

|

|

·

|

make it more difficult for us to obtain additional financing in the future for our acquisitions and operations, working capital

requirements, capital expenditures, debt service or other general corporate requirements;

|

|

|

·

|

require us to dedicate a substantial portion of our cash flows from operations to the repayment of our debt and the interest

associated with our debt rather than to other areas of our business;

|

|

|

·

|

limit our operating flexibility due to financial and other restrictive covenants, including restrictions on incurring additional

debt, creating liens on our properties, making acquisitions or paying dividends;

|

|

|

·

|

make it more difficult for us to satisfy our obligations with respect to the notes;

|

|

|

·

|

place us at a competitive disadvantage compared to our competitors that have less debt; and

|

|

|

·

|

make us more vulnerable in the event of adverse economic and industry conditions or a downturn in our business.

|

Our ability

to meet our debt service and lease obligations depends on our future financial and operating performance, which will be impacted

by general economic conditions and by financial, business and other competitive factors, many of which are beyond our control.

These factors could include operating difficulties, increased operating costs, competition, regulatory developments and delays

in our business strategies. Our ability to meet our debt service and lease obligations may depend in significant part on the extent

to which we can successfully execute our business strategy and successfully operate our business segments. We may not be able to

execute our business strategy and our business operations may be materially impacted.

If our

business does not generate sufficient cash flow from operations or future sufficient borrowings are not available to us under our

credit agreements or from other sources we might not be able to service our debt and lease commitments, including the notes, or

to fund our other liquidity needs. If we are unable to service our debt and lease commitments, due to inadequate liquidity or otherwise,

we may have to delay or cancel acquisitions, sell equity securities, sell assets or restructure or refinance our debt. We might

not be able to sell our equity securities, sell our assets or restructure or refinance our debt on a timely basis or on satisfactory

terms or at all. In addition, the terms of our agreements with original equipment manufacturers or debt agreements may prohibit

us from pursuing any of these alternatives.

To

service our debt, we will require a significant amount of cash. Our ability to generate cash depends on many factors beyond our

control.

Our

ability to make payments on our debt, and to refinance our debt and fund planned capital expenditures will depend on our

ability to generate cash in the future. This ability, to some extent, is subject to general economic, financial, competitive,

legislative, regulatory and other factors that are beyond our control.

We do not

believe that our cash flow from operating activities and our existing capital resources, including the liquidity provided by our

credit agreements and lease financing arrangements, will be sufficient to fund our operations and commitments for the next twelve

months. We cannot assure you, however, that our business will generate sufficient cash flow from operations or that future borrowings

will be available to us in an amount sufficient to pay our debt or to fund our other liquidity needs. We may need to refinance

some or all of our debt on or before maturity, sell assets, reduce or delay capital expenditures or seek additional equity financing.

We cannot assure you that efforts to refinance any of our debt will be successful.

Our

debt and other commitments expose us to a number of risks, including:

Cash requirements for debt

and lease obligations. A significant portion of the cash flow we generate must be used to service the interest and principal

payments relating to our various financial commitments, $1,943,146 of long-term debt as of December 31, 2018. A sustained or significant

decrease in our operating cash flows could lead to an inability to meet our debt service requirements or to a failure to meet specified

financial and operating covenants included in certain of our agreements. If this were to occur, it may lead to a default under

one or more of our commitments. In the event of a default for this reason, or any other reason, the potential result could be the

acceleration of amounts due, which could have a significant and adverse effect on us.

Availability.

Because we finance the majority of our operating and strategic initiatives using a variety of commitments, including

$1,943,146 in total notes payable and loan facilities, we are dependent on continued availability of these sources of funds.

If these agreements are terminated or we are unable to access them because of a breach of financial or operating covenants or

otherwise, we will likely be materially affected.

Interest rate variability.

The interest rates we are charged on a substantial portion of our debt, including the Second Note payable, are variable, increasing

or decreasing based on changes in certain published interest rates. Increases to such interest rates would likely result in significantly

higher interest expense for us, which would negatively affect our operating results. Because many of our customers finance their

vehicle purchases, increased interest rates may also decrease vehicle sales, which would negatively affect our operating results.

We

face intense competition that may lead to downward pricing or an inability to increase prices.

The

vehicle rental and used-vehicle sale industries are highly competitive and are increasingly subject to substitution. We believe

that price is one of the primary competitive factors in the vehicle rental market and that technology has enabled cost-conscious

customers, including business travelers, to more easily compare rates available from rental companies. If we try to increase our

pricing, our competitors, some of whom may have greater resources and better access to capital than us, may seek to compete aggressively

on the basis of pricing. In addition, our competitors may reduce prices in order to, among other things, attempt to gain a competitive

advantage, capture market share, or to compensate for declines in rental activity. To the extent we do not match or remain within

a reasonable competitive margin of our competitors’ pricing, our revenues and results of operations, financial condition,

liquidity and cash flows could be materially adversely affected. If competitive pressures lead us to match any of our competitors’

downward pricing and we are not able to reduce our operating costs, then our margins, results of operations, financial condition,

liquidity and cash flows could be materially adversely affected.

Further,

we may in the future develop and launch other products or services that may be in direct competition with the various players

in the ridesharing industry, such as Uber and Lyft, and all of whom have greater resources than us. There are low barriers to

entry, and we expect that competition will intensify in the future. We believe that numerous factors, including price,

offerings, reliability, client base, brand name and general economic trends will affect our ability to compete successfully.

Our existing and future competitors may include many large companies that have substantially greater market presence and

financial, technical, marketing and other resources than we do. There can be no assurance that we will have the financial

resources, technical expertise or marketing and support capabilities to compete successfully. Increased competition could

result in significant competition, which in turn could result in lower revenues, which could materially adversely affect our

potential profitability.

We

face competition that may lead to downward pricing or an inability to increase prices.

The markets

in which we operate are highly competitive and are increasingly subject to substitution. We believe that price is one of the primary

competitive factors in the vehicle rental market and that the internet has enabled cost-conscious customers, including business

travelers, to more easily compare rates available from rental companies. If we try to increase our pricing, our competitors, some

of whom may have greater resources and better access to capital than us, may seek to compete aggressively on the basis of pricing.

In addition, our competitors may reduce prices in order to attempt to gain a competitive advantage, capture market share, or to

compensate for declines in rental activity. To the extent we do not match or remain within a reasonable competitive margin of our

competitors’ pricing, our revenues and results of operations, financial condition, liquidity and cash flows could be materially

adversely affected. If competitive pressures lead us to match any of our competitors’ downward pricing and we are not able

to reduce our operating costs, then our margins, results of operations, financial condition, liquidity and cash flows could be

materially adversely impacted.

We

face risks related to liabilities and insurance.

Our businesses

expose us to claims for personal injury, death and property damage resulting from the use of the vehicles rented by us, and for

employment-related injury claims by our employees. We cannot assure you that we will not be exposed to uninsured liability potentially

resulting in multiple payouts or otherwise, liabilities in respect of existing or future claims exceeding the level of our insurance,

availability of sufficient capital to pay any uninsured claims or the availability of insurance with unaffiliated carriers maintained

on economically reasonable terms, if at all. While we have insurance for many of these risks, we retain risk relating to certain

of these perils and certain perils are not covered by our insurance.

Regulatory issues. We are subject to

a wide variety of regulatory activities, including:

Governmental regulations,

claims and legal proceedings. Governmental regulations affect almost every aspect of our business, including the fair treatment

of our employees, wage and hour issues, and our financing activities with customers. We could also be susceptible to claims or

related actions if we fail to operate our business in accordance with applicable laws.

Vehicle Requirements. Federal

and state governments in our markets have increasingly placed restrictions and limitations on the vehicles sold in the market in

an effort to combat perceived negative environmental effects. For example, in the U.S., vehicle manufacturers are subject to federally

mandated corporate average fuel economy standards which will increase substantially through 2025. Furthermore, numerous states,

including California, have adopted or are considering requiring the sale of specified numbers of zero-emission vehicles. Significant

increases in fuel economy requirements and new federal or state restrictions on emissions on vehicles and automobile fuels in the

U.S. could adversely affect prices of and demand for the new vehicles that we sell.

Environmental regulations.

We are subject to a wide range of environmental laws and regulations, including those governing: discharges into the air and

water; the operation and removal of storage tanks; and the use, storage and disposal of hazardous substances. In the normal course

of our operations we use, generate and dispose of materials covered by these laws and regulations. We face potentially significant

costs relating to claims, penalties and remediation efforts in the event of non-compliance with existing and future laws and regulations.

Accounting rules and regulations.

The Financial Accounting Standards Board is currently evaluating several significant changes to generally accepted accounting

standards in the U.S., including the rules governing the accounting for leases. Any such changes could significantly affect our

reported financial position, earnings and cash flows. In addition, the Securities and Exchange Commission is currently considering

adopting rules that would require us to prepare our financial statements in accordance with International Financial Reporting Standards,

which could also result in significant changes to our reported financial position, earnings and cash flows.

Changes in ridesharing

Vehicle Requirements. Federal and state governments in our markets have increasingly placed restrictions and limitations on

the vehicles sold in the market in an effort to combat perceived negative environmental effects. For example, in the U.S., vehicle

manufacturers are subject to federally mandated corporate average fuel economy standards which will increase substantially through

2025. Furthermore, numerous states, including California, have adopted or are considering requiring the sale of specified numbers

of zero-emission vehicles. Significant increases in fuel economy requirements and new federal or state restrictions on emissions

on vehicles and automobile fuels in the U.S. could adversely affect prices of and demand for the new vehicles that we sell.

Changes