UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

| ☑ | QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the quarterly period ended March 31, 2024

Or

| ☐ | TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from________ to ___________

Commission

File No. 000-54090

CAREVIEW

COMMUNICATIONS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

95-4659068 |

|

|

| (State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer Identification

No.) |

405

State Highway 121, Suite B-240, Lewisville, TX 75067

(Address

of principal executive offices)

(972)

943-6050

(Registrant’s

telephone number)

N/A

(Former

name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of

the Act: None

| Title of each

class |

|

Trading Symbol |

|

Name

of each exchange on which registered |

| Common

Stock, 0.001 par value per share |

|

CRVW |

|

OTC Markets |

| |

|

|

|

|

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑

No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive

Data File required to be submitted pursuant to Rule 405 of Regulation S- T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

|

|

|

| Non-accelerated filer |

☑ |

Smaller reporting

company |

☑ |

| |

|

|

|

| |

|

Emerging growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☑

The

number of shares outstanding of each of the issuer’s classes of Common Stock as of May 14, 2024 was 583,880,748.

PART I - FINANCIAL INFORMATION

Item. 1 Financial Statements

CAREVIEW

COMMUNICATIONS, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

| | |

March 31, | | |

| |

| | |

2024 | | |

December 31, | |

| | |

(Unaudited) | | |

2023 | |

| ASSETS | |

| Current Assets: | |

| | | |

| | |

| Cash | |

$ | 1,249,580 | | |

$ | 1,145,871 | |

| Accounts receivable | |

| 1,214,697 | | |

| 1,167,934 | |

| Inventory | |

| 337,897 | | |

| 294,435 | |

| Other current assets | |

| 247,153 | | |

| 335,091 | |

| Total current assets | |

| 3,049,327 | | |

| 2,943,331 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 266,517 | | |

| 317,626 | |

| | |

| | | |

| | |

| Intangible assets, net | |

| 413,861 | | |

| 406,301 | |

| Operating lease asset | |

| 253,956 | | |

| 292,990 | |

| Other assets, net | |

| 288,853 | | |

| 302,010 | |

| Total other assets | |

| 956,670 | | |

| 1,001,301 | |

| Total assets | |

$ | 4,272,514 | | |

$ | 4,262,258 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 655,649 | | |

$ | 598,095 | |

| Notes payable | |

| 20,000,000 | | |

| 20,000,000 | |

| Notes payable - related parties | |

| 700,000 | | |

| 700,000 | |

| Deferred revenue | |

| 2,221,176 | | |

| 1,752,061 | |

| Accrued interest payable | |

| 17,281,264 | | |

| 16,479,139 | |

| Operating lease liability | |

| 190,991 | | |

| 188,184 | |

| Other current liabilities | |

| 254,086 | | |

| 489,497 | |

| Total current liabilities | |

| 41,303,166 | | |

| 40,206,976 | |

| | |

| | | |

| | |

| Long-term Liabilities: | |

| | | |

| | |

| Operating lease liability | |

| 93,426 | | |

| 139,099 | |

| Other liabilities | |

| 107,601 | | |

| 178,907 | |

| Total long-term liabilities | |

| 201,027 | | |

| 318,006 | |

| Total liabilities | |

| 41,504,193 | | |

| 40,524,982 | |

| | |

| | | |

| | |

| Stockholders’ Deficit: | |

| | | |

| | |

| Preferred stock - par value $0.001; 20,000,000 shares authorized; no shares issued and outstanding | |

| — | | |

| — | |

| Common stock - par value $0.001; 800,000,000 shares authorized; 583,880,748 issued and outstanding, respectively | |

| 583,881 | | |

| 583,881 | |

| Additional paid in capital | |

| 171,091,620 | | |

| 171,038,349 | |

| Accumulated deficit | |

| (208,907,180 | ) | |

| (207,884,954 | ) |

| Total stockholders’ deficit | |

| (37,231,679 | ) | |

| (36,262,724 | ) |

| Total liabilities and stockholders’ deficit | |

$ | 4,272,514 | | |

$ | 4,262,258 | |

The

accompanying footnotes are an integral part of these consolidated financial statements.

CAREVIEW

COMMUNICATIONS INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE THREE MONTHS ENDED MARCH 31, 2024 AND 2023

(Unaudited)

| | |

| | |

| |

| | |

Three Months Ended | |

| | |

March 31,

2024 | | |

March 31,

2023 | |

| Revenues | |

| | |

| |

| Subscription-based lease revenue | |

| 1,021,599 | | |

| 1,217,497 | |

| Sales-based equipment package revenue | |

| 568,394 | | |

| 136,296 | |

| Sales-based software bundle revenue | |

| 613,245 | | |

| 428,466 | |

| Total revenues | |

| 2,203,238 | | |

| 1,782,259 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Cost of equipment | |

| 49,183 | | |

| 31,934 | |

| Network operations | |

| 843,300 | | |

| 705,042 | |

| General and administration | |

| 617,785 | | |

| 697,766 | |

| Sales and marketing | |

| 327,684 | | |

| 168,419 | |

| Research and development | |

| 527,475 | | |

| 518,632 | |

| Depreciation and amortization | |

| 71,198 | | |

| 176,831 | |

| Total operating expense | |

| 2,436,625 | | |

| 2,298,624 | |

| | |

| | | |

| | |

| Operating loss | |

| (233,387 | ) | |

| (516,365 | ) |

| | |

| | | |

| | |

| Other income and (expense) | |

| | | |

| | |

| Interest expense | |

| (802,125 | ) | |

| (831,334 | ) |

| Interest income | |

| 13,286 | | |

| 887 | |

| Total other income (expense) | |

| (788,839 | ) | |

| (830,447 | ) |

| | |

| | | |

| | |

| Provision for income taxes | |

| — | | |

| — | |

| | |

| | | |

| | |

| Net loss | |

$ | (1,022,226 | ) | |

$ | (1,346,812 | ) |

| | |

| | | |

| | |

| Net loss per share | |

$ | (0.00 | ) | |

$ | (0.01 | ) |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding, basic, and diluted | |

| 583,880,748 | | |

| 144,791,859 | |

The

accompanying footnotes are an integral part of these consolidated financial statements.

CAREVIEW

COMMUNICATIONS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

FOR THE THREE MONTHS ENDED MARCH 31, 2024 AND 2023

(Unaudited)

| | |

| | |

| | |

Additional | | |

| | |

| |

| | |

Common Stock | | |

Paid in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Total | |

| Balance, December 31, 2022 | |

| 141,880,748 | | |

$ | 141,881 | | # |

$ | 127,130,055 | | # |

$ | (203,932,665 | ) | # |

$ | (76,660,729 | ) |

| Options granted as compensation | |

| — | | |

| — | | |

| 62,260 | | |

| — | | |

| 62,260 | |

| Debt to equity conversion at $0.10 | |

| 262,000,000 | | |

| 262,000 | | |

| 25,938,000 | | |

| — | | |

| 26,200,000 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (1,346,812 | ) | |

| (1,346,812 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, March 31, 2023 | |

| 403,880,748 | | |

$ | 403,881 | | |

$ | 153,130,315 | | |

$ | (205,279,477 | ) | |

$ | (51,745,281 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, December 31, 2023 | |

| 583,880,748 | | |

$ | 583,881 | | |

$ | 171,038,349 | | |

$ | (207,884,954 | ) | |

$ | (36,262,724 | ) |

| Options granted as compensation | |

| — | | |

| — | | |

| 53,271 | | |

| — | | |

| 53,271 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (1,022,226 | ) | |

| (1,022,226 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, March 31, 2024 | |

| 583,880,748 | | |

$ | 583,881 | | |

$ | 171,091,620 | | |

$ | (208,907,180 | ) | |

$ | (37,231,679 | ) |

The

accompanying footnotes are an integral part of these consolidated financial statements.

CAREVIEW

COMMUNICATIONS, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED MARCH 31, 2024 AND 2023

(Unaudited)

| | |

| | |

| |

| | |

Three Months Ended | |

| | |

March 31,

2024 | | |

March 31,

2023 | |

| CASH FLOWS FROM OPERATING ACTIVITES | |

| | | |

| | |

| Net loss | |

$ | (1,022,226 | ) | |

$ | (1,346,812 | ) |

| Adjustments to reconcile net loss to net cash flows provided by (used in) operating activities: | |

| | | |

| | |

| Depreciation | |

| 60,327 | | |

| 102,509 | |

| Amortization of intangible assets | |

| 5,503 | | |

| 59,879 | |

| Amortization of deferred installation costs | |

| 5,368 | | |

| 14,443 | |

| Non-cash lease expense | |

| 39,034 | | |

| 33,265 | |

| Stock based compensation related to options granted | |

| 53,271 | | |

| 62,260 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (46,762 | ) | |

| (403,515 | ) |

| Inventory | |

| (43,462 | ) | |

| 15,714 | |

| Other current assets | |

| 87,938 | | |

| 10,532 | |

| Accounts payable | |

| 57,554 | | |

| 51,694 | |

| Accrued Interest | |

| 802,125 | | |

| 802,125 | |

| Other current liabilities | |

| (235,411 | ) | |

| (88,910 | ) |

| Deferred revenue | |

| 405,428 | | |

| 636,451 | |

| Deferred sales commissions | |

| 3,691 | | |

| 11,322 | |

| Operating lease liability | |

| (42,866 | ) | |

| (35,511 | ) |

| Net cash flows provided by (used in) operating activities | |

| 129,512 | | |

| (74,554 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Purchase of property and equipment | |

| (9,219 | ) | |

| — | |

| Patent, trademark, and other intangible asset costs | |

| (13,062 | ) | |

| — | |

| Net cash flows used in investing activities | |

| (22,281 | ) | |

| — | |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| Repayment of vehicle loan | |

| (3,522 | ) | |

| (3,639 | ) |

| Net cash flows used in financing activities | |

| (3,522 | ) | |

| (3,639 | ) |

| | |

| | | |

| | |

| Increase (decrease) in cash | |

| 103,709 | | |

| (78,193 | ) |

| Cash, beginning of period | |

| 1,145,871 | | |

| 520,166 | |

| Cash, end of period | |

$ | 1,249,580 | | |

$ | 441,973 | |

| | |

| | | |

| | |

| SUPPLEMENTAL SCHEDULE OF NON-CASH FINANCING ACTIVITES | |

| | | |

| | |

| Non-cash debt-to-equity conversion | |

| — | | |

| 26,200,000 | |

The

accompanying footnotes are an integral part of these consolidated financial statements.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

1 – BASIS OF PRESENTATION AND RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

Interim

Financial Statements

The

accompanying unaudited interim condensed consolidated financial statements of CareView Communications, Inc. (“CareView”,

the “Company”, “we”, “us” or “our”) have been prepared in accordance with generally accepted

accounting principles in the United States of America (“GAAP”) for interim financial information and with the instructions

to Form 10-Q. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements.

In the opinion of management, such financial statements include all adjustments (consisting solely of normal recurring adjustments)

necessary for the fair statement of the financial information included herein in accordance with GAAP and the rules and regulations

of the Securities and Exchange Commission (the “SEC”). The balance sheet at December 31, 2022 has been derived from

the audited consolidated financial statements at that date but does not include all of the information and footnotes required

by GAAP for complete financial statements. The preparation of financial statements in conformity with GAAP requires management

to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent

assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period.

Actual results could differ from those estimates. Results of operations for interim periods are not necessarily indicative of

results for the full year. The accompanying unaudited condensed consolidated financial statements should be read in conjunction

with the audited consolidated financial statements and related notes included in our Annual Report on Form 10-K for the year ended

December 31, 2023 as filed with the SEC on March 29, 2024.

Revenue

Recognition

We

recognize revenue in accordance with Accounting Standards Codification (“ASC”) Topic 606 (“ASC 606").

For our subscription service contracts, we have employed the practical expedient discussed in ASC 606-10-55-18 related to invoicing

as we have the right to consideration from our customers in the amount that corresponds directly with the value to the customer

of our performance completed to date and therefore, we recognize revenue upon invoicing as further discussed below.

In

accordance with ASC 606, revenue is recognized when a customer obtains control of promised goods or services. The amount of revenue

recognized reflects the consideration to which we expect to be entitled to receive in exchange for these goods or services. The

provisions of ASC 606 include a five-step process by which we determine revenue recognition, depicting the transfer of goods or

services to customers in amounts reflecting the payment to which we expect to be entitled in exchange for those goods or services.

ASC 606 requires us to apply the following steps: (1) identify the contract with the customer; (2) identify the performance obligations

in the contract; (3) determine the transaction price; (4) allocate the transaction price to the performance obligations in the

contract; and (5) recognize revenue when, or as, we satisfy the performance obligation. For those customers for which we are required

to collect sales taxes, we record such sales taxes on a net basis which has no effect on the amount of revenue or expenses recognized

as the sales taxes are a flow through to the taxing authority.

We

enter into contracts with customers that may provide multiple combinations of our products, software solutions, and other related

services, which are generally capable of being distinct and accounted for as separate performance obligations. Performance obligations

that are not distinct at contract inception are combined.

Customer

contract fulfillment typically involves multiple procurement promises, which may include various equipment, software subscription,

project-related installation and training services, and support. We allocate the transaction price to each performance obligation

based on estimated relative standalone selling price. Revenue is then recognized for each performance obligation upon transferring

control of the hardware, software, and services to the customer and in an amount that reflects the consideration we expect to

receive and the estimated benefit the customer receives over the term of the contract.

Generally,

we recognize revenue under each of our performance obligations as follows:

| ● | Subscription

services – We recognize subscription revenues monthly over the contracted license

period. |

| ● | Equipment

packages – We recognize equipment revenues when control of the devices has been

transferred to the client (“point in time”). |

| ● | Software

bundle and related services related to sales-based contracts – We recognize our

software subscription, installation, training, and other services on a straight-line

basis over the estimated contracted license period (“over time”). |

The

Company earns sales-based contract revenue from services rendered under specific agreements, which hinge on a third-party reseller

who possesses the exclusive authority to engage directly with veteran-owned hospitals. Evaluating the Company’s role in these

contracts necessitates assessing whether it functions as the principal or agent, a determination that involves analyzing the extent

of control the Company wields over the contracts.

Following

its assessment, the Company reports revenue from services provided under such contracts on a gross basis. This decision is justified

by the Company’s primary responsibility to fulfill the contractual obligations, including delivery and installation of equipment

and software, training, and its control over other services within the contract period. Furthermore, the Company directly sets

the contract price with its customers based on the services outlined in the statement of work. As the Company is responsible for

fulling this promise and maintains control, the Company is acting as the principal.

Disaggregation

of Revenue

The

following presents gross revenues disaggregated by our business models:

| | |

| | |

| |

| | |

Three Months Ended

March 31, | |

| | |

2024 | | |

2023 | |

| Sales-based contract revenue | |

| | | |

| | |

| Equipment package, net (point in time) | |

$ | 568,394 | | |

$ | 136,296 | |

| Software bundle (over time) | |

| 613,245 | | |

| 428,466 | |

| Total sales-based contract revenue | |

| 1,181,639 | | |

| 564,762 | |

| | |

| | | |

| | |

| Subscription-based lease revenue | |

| 1,021,599 | | |

| 1,217,497 | |

| Gross revenue | |

$ | 2,203,238 | | |

$ | 1,782,259 | |

Contract

Liabilities

Our

subscription-based contracts payment arrangements are required to be paid monthly which are recognized into revenue when received.

Some customers choose to pay their subscription fee in advance. Customer payments received in advance of satisfaction of the related

performance obligations are deferred as contract liabilities. These amounts are recorded as “deferred revenue” in

our condensed consolidated balance sheet and recognized into revenues over time.

Our

sales-based contract payment arrangements with our customers typically include an initial equipment payment due upon signing of

the contract and subsequent payments when certain performance obligations are completed. Customer payments received in advance

of satisfaction of related performance obligations are deferred as contract liabilities. These amounts are recorded as “deferred

revenue” in our condensed consolidated balance sheet and recognized into revenues as either a point in time or over time.

During

the three months ended March 31, 2024 and 2023, a total of $0 and $8,517, respectively, of subscription-based deferred

contract liability was recognized as revenue. The table below details the subscription-based contract liability activity

during the three months ended March 31, 2024 and 2023, included in the Other current liabilities.

| | |

| | |

| |

| | |

Three Months Ended

March 31, | |

| | |

2024 | | |

2023 | |

| Balance, beginning of period | |

$ | — | | |

$ | 21,145 | |

| Additions | |

| — | | |

| — | |

| Transfer to revenue | |

| — | | |

| (8,517 | ) |

| Balance, end of period | |

$ | — | | |

$ | 12,628 | |

During

the three months ended March 31, 2024 and 2023, a total of $613,245, and $550,190, respectively, of sales-based

deferred contract liability was recognized as revenue. The table below details the subscription-based contract liability

activity during the three months ended March 31, 2024 and 2023, included in the Other current liabilities.

| | |

| | |

| |

| | |

Three Months Ended

March 31, | |

| | |

2024 | | |

2023 | |

| Balance, beginning of period | |

$ | 1,922,925 | | |

$ | 869,485 | |

| Additions | |

| 1,014,578 | | |

| 1,184,917 | |

| Transfer to revenue | |

| (613,245 | ) | |

| (550,190 | ) |

| Balance, end of period | |

$ | 2,324,258 | | |

$ | 1,504,212 | |

As

of March 31, 2024, the aggregate amount of deferred revenue from subscription-based contracts and sales-based contracts allocated

to performance obligations that are unsatisfied or partially satisfied is $2,324,258 and will be recognized into revenue over

time as follows:

| Years Ending December 31, | | |

Amount | |

| 2024 | | |

$ | 1,767,540 | |

| 2025 | | |

| 556,718 | |

| Thereafter | | |

| — | |

| | | |

$ | 2,324,258 | |

Based

on our contracts, except for initial equipment sales, we invoice customers once our performance obligations have been satisfied,

at which point payment is unconditional. Accounts receivable is recorded when the right to consideration becomes unconditional

and are reported accordingly in our consolidated financial statements.

We

defer and capitalize all costs associated with the installation of the CareView System into a healthcare facility until the CareView

System is fully operational and accepted by the healthcare facility. Installation costs are specifically identifiable based on

the amounts we are charged from third party installers or directly identifiable labor hours incurred for each installation. Upon

acceptance, the associated costs are expensed on a straight-line basis over the life of the contract with the healthcare facility.

These costs are included in network operations on the accompanying consolidated statements of operations.

The

table below details the activity in these deferred installation costs during the periods ended March 31, 2024 and 2023, included

in other assets in the accompanying unaudited consolidated balance sheet.

| | |

| | |

| |

| | |

Three Months Ended

March 31, | |

| | |

2024 | | |

2023 | |

| Balance, beginning of period | |

$ | 48,309 | | |

$ | 33,461 | |

| Additions | |

| — | | |

| — | |

| Transfer to expense | |

| (5,368 | ) | |

| (14,443 | ) |

| Balance, end of period | |

$ | 42,941 | | |

$ | 19,018 | |

Significant

Judgements When Applying Topic 606

Contracts

with our customers are typically structured similarly and include various combinations of our products, software solutions, and

related services. Determining whether the various contract promises are considered distinct performance obligations that should

be accounted for separately versus together may require significant judgment.

Contract

transaction price is allocated to distinct performance obligations using estimated standalone selling price. We determine standalone

selling price maximizing observable inputs such as standalone sales, competitor standalone sales, or substantive renewal prices

charged to customers when they exist. In instances where standalone selling price is not observable, we utilize an estimate of

standalone selling price. Such estimates are derived from various methods that include cost plus margin, and historical pricing

practices. Judgment may be required to determine standalone selling prices for each performance obligation and whether it depicts

the amount we expect to receive in exchange for the related good or service.

Contract

modifications occur when we and our customers agree to modify existing customer contracts to change the scope or price (or both)

of the contract or when a customer terminates some, or all, of the existing services provided by us. When a contract modification

occurs, it requires us to exercise judgment to determine if the modification should be accounted for as a separate contract, the

termination of the original contract and creation of a new contract, a cumulative catch-up adjustment to the original contract,

or a combination.

Contracts

with our customers include a limited warranty on our products covering materials, workmanship, or design for the duration of the

contract. We do not offer paid additional extended or lifetime warranty packages. We determined the limited warranty in our contract

is not a distinct performance obligation. We do not believe our estimates of warranty costs to be significant to our determination

of revenue recognition, and therefore, did not reserve for warranty costs.

Leases

The

Company has an operating lease primarily consisting of office space with a remaining lease term of 17 months. At the lease commencement

date, an operating lease liability and related operating lease asset are recognized. The operating lease liabilities are calculated

using the present value of lease payments. The discount rate used is either the rate implicit in the lease, when known, or our

estimated incremental borrowing rate. Operating lease assets are valued based on the initial operating lease liabilities plus

any prepaid rent and direct costs from executing the leases.

Earnings (Loss) Per Share

We

calculate earnings per share (“EPS”) in accordance with GAAP, which requires the computation and disclosure of two

EPS amounts, basic and diluted. Basic EPS is computed based on the weighted average number of common shares outstanding during

the period. Diluted EPS is computed based on the weighted average number of common shares outstanding plus all potentially dilutive

common shares outstanding during the period under the treasury stock method. Such potential dilutive common shares consist of

stock options, warrants to purchase our Common Stock (the “Warrants”) and convertible debt. Potential common shares

totaling 73,616,280 and 225,461,922 at March 31, 2024 and 2023, respectively, have been excluded from the diluted earnings per

share calculation as they are anti-dilutive due to our reported net loss. The 73,616,280 potential common shares consist of 67,921,835

stock options and 5,694,445 warrants.

New Accounting

Pronouncements

ASU

2020-06

ASU

2020-06 simplifies the accounting for convertible debt instruments and convertible preferred stock by removing the existing guidance

in ASC 470-20, Debt: Debt with Conversion and Other Options, that requires entities to account for beneficial conversion features

and cash conversion features in equity, separately from the host convertible debt or preferred stock. The guidance in ASC 470-20

applies to convertible instruments for which the embedded conversion features are not required to be bifurcated from the host

contract and accounted for as derivatives. In addition, the amendments revise the scope exception from derivative accounting in

ASC 815-40 for freestanding financial instruments and embedded features that are both indexed to the issuer’s own stock

and classified in stockholders’ equity, by removing certain criteria required for equity classification. These amendments

are expected to result in more freestanding financial instruments qualifying for equity classification (and, therefore, not accounted

for as derivatives), as well as fewer embedded features requiring separate accounting from the host contract. The amendments in

ASU 2020-06 further revise the guidance in ASC 260, Earnings Per Share, to require entities to calculate diluted earnings per

share (EPS) for convertible instruments by using the if-converted method. In addition, entities must presume share settlement

for purposes of calculating diluted EPS when an instrument may be settled in cash or shares. We, a smaller reporting company as

defined by the SEC, will adopt ASU 2020-06 effective for fiscal year 2024. As of 2024, the Company does not have any preferred

stock or convertible debt.

ASU

2022-03

ASU

2022-03 clarifies that a “contractual sale restriction prohibiting the sale of an equity security is a characteristic of

the reporting entity holding the equity security” and is not included in the equity security’s unit of account. Accordingly,

an entity should not consider the contractual sale restriction when measuring the equity security’s fair value (i.e., the

entity should not apply a discount related to the contractual sale restriction, as stated in ASC 820-10-35-36B as amended by the

ASU). In addition, the ASU prohibits an entity from recognizing a contractual sale restriction as a separate unit of account.

Under the existing guidance in ASC 820-10-35-6B, “although a reporting entity must be able to access the market, the reporting

entity does not need to be able to sell the particular asset or transfer the particular liability on the measurement date to be

able to measure fair value on the basis of the price in that market.” ASU 2022-03 clarifies that an entity should apply

this existing guidance when measuring the fair value of equity securities that are subject to contractual sale restrictions (i.e.,

a contractual sale restriction on the reporting entity that prevents the sale of an equity security in the market does not prevent

the entity from measuring the fair value of the equity security on the basis of the price in that principal market). ASU 2022-03

for the Company will be effective for fiscal year 2024. For 2024, no contractual sale restriction exists with the Company.

NOTE

2 – GOING CONCERN, LIQUIDITY AND MANAGEMENT’S PLAN

Accounting

standards require management to evaluate our ability to continue as a going concern for a period of one year after the date of

the filing of this Form 10-Q (“evaluation period”). In evaluating the Company’s ability to continue as a going

concern, management considers the conditions and events that raise substantial doubt about the Company’s ability to continue

as a going concern for a period of twelve months after the Company issues its financial statements. For the three months ended

March 31, 2024, management considers the Company’s current financial condition and liquidity sources, including current

funds available, forecasted future cash flows, and the Company’s conditional and unconditional obligations due within 12

months of the date these financial statements are issued.

The

Company is subject to risks like those of healthcare technology companies whereby revenues are generated based on both sales-based

and subscription-based models, which assume dependence on key individuals, uncertainty of product development, generation of revenues,

positive cash flow, dependence on outside sources of capital, risks associated with research, development, and successful testing

of its products, successful protection of intellectual property, ability to maintain and grow its customer base, and susceptibility

to infringement on the proprietary rights of others. The attainment of profitable operations is dependent on future events, including

obtaining adequate financing to fulfill the Company’s growth and operating activities and generating a level of revenues

adequate to support the Company’s cost structure.

As

of March 31, 2024, the Company had a working capital deficit of $38,253,839. Management has evaluated the

significance of the conditions described above in relation to the Company’s ability to meet its obligations and concluded

that, without additional funding, the Company will not have sufficient funds to meet its obligations within one year from the

date the consolidated financial statements were issued. While management will look to continue funding operations by increased

sales volumes and raising additional capital from sources such as sales of its debt or equity securities or loans to meet operating

cash requirements, there is no assurance that management’s plans will be successful.

On

March 30, 2023, noteholders owning Replacement Notes in an aggregate of $26,200,000, entered into a Replacement Note Conversion

Agreement, wherein the Replacement Notes were converted into shares of the Company’s common stock at a conversion price

of $0.10 per share, resulting in the issuance of an aggregate of 262,000,000 shares (the “Conversion Shares”).

Upon

this conversion, and as of March 31, 2024, the Company’s officers and board of directors held the majority of the Company’s

outstanding voting stock. With controlling interest of the majority of outstanding shares, the Company’s majority shareholders

voted to amend its articles of incorporation to increase the authorized shares available for issuance from 500,000,000 to 800,000,000,

with an effective date of May 22, 2023.

On

May 24, 2023, noteholders owning Replacement Notes in the aggregate of $18,000,000, presented Conversion Notices, per the

terms of the Replacement Notes, to the Company to convert the Replacement Notes into 180,000,000 shares of the Company’s

common stock at a conversion price of $0.10 per share.

Management

continues to monitor the immediate and future cash flows needs of the company in a variety of ways which include forecasted net

cash flows from operations, capital expenditure control, new inventory orders, debt modifications, increases in sales outreach,

streamlining and controlling general and administrative costs, competitive industry pricing, sale of equities, debt conversions,

new product or services offerings, and new business partnerships.

The

Company’s net losses, cash outflows, and working capital deficit raise substantial doubt about the Company’s ability

to continue as a going concern. The accompanying consolidated financial statements have been prepared assuming that the Company

will continue as a going concern. This basis of accounting contemplates the recovery of the Company’s assets and the satisfaction

of liabilities in the normal course of business. A successful transition to attaining profitable operations is dependent upon

achieving a level of positive cash flows adequate to support the Company’s cost structure.

NOTE

3 – STOCKHOLDERS’ EQUITY

Warrants

to Purchase Common Stock of the Company

We

use the Black-Scholes-Merton option pricing model (“Black-Scholes Model”) to determine the fair value of Warrants.

The Black-Scholes Model requires the use of a number of assumptions including volatility of the stock price, the weighted average

risk-free interest rate, and the weighted average term of the Warrant.

The

risk-free interest rate assumption is based upon observed interest rates on zero coupon U.S. Treasury bonds whose maturity period

is appropriate for the term of the Warrants and is calculated by using the average daily historical stock prices through the day

preceding the grant date. Estimated volatility is a measure of the amount by which our stock price is expected to fluctuate each

year during the expected life of the award. Our estimated volatility is an average of the historical volatility of our stock prices

(and that of peer entities whose stock prices were publicly available) over a period equal to the expected life of the awards.

A

summary of our Warrants activity and related information follows:

| | |

Number of

Shares Under

Warrant | | |

Range of

Warrant Price

Per Share | | |

Weighted

Average

Exercise

Price | | |

Weighted

Average

Remaining

Contractual

Life | |

| Balance at December 31, 2023 | |

| 5,694,445 | | |

| $0.01-$0.03 | | |

$ | 0.024 | | |

| 3.5 | |

| Granted | |

| — | | |

| — | | |

| — | | |

| — | |

| Expired | |

| — | | |

| — | | |

| — | | |

| — | |

| Canceled | |

| — | | |

| — | | |

| — | | |

| — | |

| Balance at March 31, 2024 | |

| 5,694,445 | | |

| $0.01-$0.03 | | |

$ | 0.024 | | |

| 2.3 | |

Options

to Purchase Common Stock of the Company

During

the three months ended March 31, 2024, 30,207,858 options to purchase our Common Stock were granted having a fair value of $1,812,671

and exercise price of $0.06 per share. During the three months ended March 31, 2024, 650,000 options expired, and 120,000 options

were terminated.

A

summary of our stock option activity and related information follows:

| | |

Number of

Shares

Under

Options | | |

Weighted

Average

Exercise

Price | | |

Weighted

Average

Remaining

Contractual

Life | | |

Aggregate

Intrinsic

Value | |

| Balance at December 31, 2023 | |

| 38,483,977 | | |

$ | 0.09 | | |

| 5.2 | | |

$ | 314,925 | |

| Granted | |

| 30,207,858 | | |

| 0.06 | | |

| 9.6 | | |

| — | |

| Forfeited/Expired | |

| (770,000 | ) | |

| 0.58 | | |

| — | | |

| — | |

| Exercised | |

| — | | |

| — | | |

| — | | |

| — | |

| Balance at March 31, 2024 | |

| 67,921,835 | | |

$ | 0.07 | | |

| 7.2 | | |

$ | 526,525 | |

| | |

| | | |

| | | |

| | | |

| | |

Vested and Exercisable at March 31, 2024

| |

| 36,634,310 | | |

$ | 0.08 | | |

| 5.0 | | |

$ | 526,425 | |

Share-based

compensation expense for Options charged to our operating results for the three months ended March 31, 2024 and 2023 were $53,271

and $62,260, respectively. The estimate of forfeitures is to be recorded at the time of grant and revised in subsequent periods

if actual forfeitures differ from the estimates. We have not included an adjustment to our stock-based compensation expense based

on the nominal amount of the historical forfeiture rate. We do, however, revise our stock-based compensation expense based on

actual forfeitures during each reporting period.

At

March 31, 2024, total unrecognized estimated compensation expense related to non-vested Options granted prior to that date was

approximately $1,820,686, which is expected to be recognized over a weighted-average period of 2.8 years. No tax benefit was realized

due to a continued pattern of operating losses.

NOTE

4 – OTHER CURRENT ASSETS

Other

current assets consist of the following:

| | |

March 31,

2024 | | |

December

31,

2023 | |

| Prepaid insurance | |

$ | 98,613 | | |

$ | 180,267 | |

| Other prepaid expenses | |

| 56,559 | | |

| 62,843 | |

| Sales tax overpayment | |

| 91,981 | | |

| 91,981 | |

| TOTAL OTHER CURRENT ASSETS | |

$ | 247,153 | | |

$ | 335,091 | |

NOTE

5 – INVENTORY

Inventory

is valued at the lower of cost, determined on a first-in, first-out (FIFO), or net realizable value. Inventory items are analyzed

to determine cost and net realizable value and appropriate valuation adjustments are then established.

Inventory

consists of the following:

| | |

March 31,

2024 | | |

December 31,

2023 | |

| Equipment components | |

$ | 337,897 | | |

$ | 294,435 | |

| TOTAL INVENTORY | |

$ | 337,897 | | |

$ | 294,435 | |

NOTE

6 – PROPERTY AND EQUIPMENT

Property

and equipment consist of the following:

| | |

March 31,

2024 | | |

December

31,

2023 | |

| Network equipment | |

$ | 9,204,511 | | |

$ | 9,204,511 | |

| Office equipment | |

| 251,173 | | |

| 241,955 | |

| Vehicles | |

| 133,616 | | |

| 133,616 | |

| Test equipment | |

| 230,365 | | |

| 230,365 | |

| Furniture | |

| 92,097 | | |

| 92,097 | |

| Warehouse equipment | |

| 18,788 | | |

| 18,788 | |

| Leasehold improvements | |

| 5,121 | | |

| 5,121 | |

| | |

| 9,935,671 | | |

| 9,926,453 | |

| Less: accumulated depreciation | |

| (9,669,154 | ) | |

| (9,608,827 | ) |

| TOTAL PROPERTY AND EQUIPMENT, NET | |

$ | 266,517 | | |

$ | 317,626 | |

Depreciation

expense for the three months ended March 31, 2024 and 2023 was $60,327 and $102,509, respectively.

NOTE

7 – INTANGIBLE ASSETS, NET

Intangible

assets consist of the following:

| | |

| | | |

| | | |

| | |

| | |

March 31, 2024 | |

| | |

Cost | | |

Accumulated Amortization | | |

Net | |

| Patents and trademarks | |

$ | 879,493 | | |

$ | 482,524 | | |

$ | 396,969 | |

| Other intangible assets | |

| 33,299 | | |

| 16,407 | | |

| 16,892 | |

| TOTAL INTANGIBLE ASSETS | |

$ | 912,792 | | |

$ | 498,931 | | |

$ | 413,861 | |

| | |

| | | |

| | | |

| | |

| | |

December

31, 2023 | |

| | |

Cost | | |

Accumulated

Amortization | | |

Net | |

| Patents and trademarks | |

$ | 879,492 | | |

$ | 478,250 | | |

$ | 401,242 | |

| Other intangible assets | |

| 20,237 | | |

| 15,178 | | |

| 5,059 | |

| TOTAL INTANGIBLE ASSETS | |

$ | 899,729 | | |

$ | 493,428 | | |

$ | 406,301 | |

Amortization expense for the three months

ended March 31, 2024 and 2023 was $5,503 and $59,879, respectively.

Other assets consist of the following:

| | |

| | | |

| | | |

| | |

| | |

March 31, 2024 | |

| | |

Cost | | |

Accumulated Amortization | | |

Net | |

| Deferred installation costs | |

$ | 1,397,720 | | |

$ | 1,354,778 | | |

$ | 42,942 | |

| Deferred sales commission | |

| 505,049 | | |

| 348,978 | | |

| 156,071 | |

| Prepaid license fee | |

| 249,999 | | |

| 206,283 | | |

| 43,716 | |

| Security deposit | |

| 46,124 | | |

| — | | |

| 46,124 | |

| TOTAL OTHER ASSETS | |

$ | 2,198,892 | | |

$ | 1,910,039 | | |

$ | 288,853 | |

| | |

| | | |

| | | |

| | |

| | |

December 31, 2023 | |

| | |

Cost | | |

Accumulated Amortization | | |

Net | |

| Deferred installation costs | |

$ | 1,397,720 | | |

$ | 1,349,410 | | |

$ | 48,310 | |

| Deferred sales commissions | |

| 439,221 | | |

| 279,459 | | |

| 159,762 | |

| Prepaid license fee | |

| 249,999 | | |

| 202,185 | | |

| 47,814 | |

| Security deposit | |

| 46,124 | | |

| — | | |

| 46,124 | |

| TOTAL OTHER ASSETS | |

$ | 2,133,064 | | |

$ | 1,831,054 | | |

$ | 302,010 | |

NOTE 8 – OTHER CURRENT LIABILITIES

Other current liabilities consist of the

following:

| | |

March 31,

2024 | | |

December

31,

2023 | |

| Allowance for system removal | |

| 54,802 | | |

| 54,802 | |

| Accrued paid time off | |

| 66,171 | | |

| 164,566 | |

| Deferred officer compensation (1) | |

| 49,528 | | |

| 49,528 | |

| Other accrued liabilities | |

| 83,585 | | |

| 220,601 | |

| TOTAL OTHER CURRENT LIABILITIES | |

$ | 254,086 | | |

$ | 489,497 | |

| (1) | | Remaining salary payable for Steve Johnson, CEO, between February 15, 2018 and September

30, 2020. |

NOTE 9 – INCOME TAXES

Deferred income tax assets and liabilities

are determined based upon differences between the financial reporting and tax bases of assets and liabilities and are measured

using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. We do not expect to pay

any significant federal or state income tax for 2024 because of the losses recorded during the three months ended March 31, 2024

and net operating loss carry forwards from prior years. In assessing the realizability of deferred tax asset, including the net

operating loss carryforwards (NOLs), the Company assesses the available positive and negative evidence to estimate if sufficient

future taxable income will be generated to utilize its existing deferred assets. The ultimate realization of deferred tax assets

is dependent upon the generation of future taxable income during the period when those temporary differences become deductible.

Accounting standards require the consideration of a valuation allowance for deferred tax assets if it is “more likely than

not” that some component or all the benefits of deferred tax assets will not be realized. As of March 31, 2024, we maintained

a full valuation allowance for all deferred tax assets. Based on these requirements, no provision or benefit for income taxes has

been recorded. There were no recorded unrecognized tax benefits at the end of the reporting period.

The Tax Cuts and Jobs Act (the “Act”)

was signed into law on December 22, 2017. Among its numerous changes to the Internal Revenue Code, the Act reduces U.S. corporate

rates from 35% to 21%. Additionally, the Act limits the use of net operating loss carry backs, however any future net operating

losses will instead be carried forward indefinitely. Net operating losses generated from January 1, 2018 are limited to offset

80% of current income, with the remainder of the net operating loss continuing to carry forward indefinitely. Net operating losses

incurred before January 1, 2018 are not subject to the 80% limitations and will begin to expire in 2029. Based on an initial assessment

of the Act, the Company believes that the most significant impact on the Company’s unaudited condensed consolidated financial

statements will be limitations in tax deductions on interest expense. Under the Act, interest deductions disallowed from current

income will carryforward indefinitely. The Act did not impact management’s valuation allowance position.

The effective tax rate for the three months

ended March 31, 2024 was different from the federal statutory rate due primarily to change in the valuation allowance and nondeductible

interest and amortization expense.

NOTE 10 – AGREEMENT WITH PDL BIOPHARMA, INC.

On June 26, 2015, we entered into a Credit

Agreement (as subsequently amended) with PDL BioPharma, Inc. (“PDL”), as administrative agent and lender (“the Lender”)

(the “PDL Credit Agreement”). Under the PDL Credit Agreement the Lender made available to us up to $40 million in two

tranches of $20 million each. Tranche One was funded on October 8, 2015 (the “Tranche One Loan”). Pursuant to the terms

of the PDL Credit Agreement and having not met the Tranche Two Milestones by July 26, 2017, the Tranche Two funding was terminated

in full.

On February 28, 2023, the Company, the Borrower, the Subsidiary

Guarantor, the Lender and the Tranche Three Lenders entered into a Twenty-Eighth Amendment to Modification Agreement (the “Twenty-Eighth

Modification Agreement Amendment”), pursuant to which the parties agreed to amend the Modification Agreement to provide that

the dates on which the Lender may elect, in the Lender’s sole discretion, to terminate the Modification Period would be July

31, 2018 and March 31, 2023 (with each such date permitted to be extended by the Lender in its sole discretion); and that the Borrower’s

(i) interest payments that would otherwise be due under the Credit Agreement on December 31, 2018, March 31, 2019, June 30, 2019,

September 30, 2019, December 31, 2019, March 31, 2020, June 30, 2020, September 30, 2020 and October 7, 2020 and (ii) payments

for principal and for any other Obligations then outstanding under the Tranche One Loan and the Tranche Three Loans that would

otherwise be due under the Credit Agreement on October 7, 2020, would each be deferred until March 30, 2023 (the end of the extended

Modification Period).

On March 31, 2023, the Company, the Borrower, the Subsidiary

Guarantor, the Lender and the Tranche Three Lenders entered into a Twenty-Ninth Amendment to Modification Agreement (the “Twenty-Ninth

Modification Agreement Amendment”), pursuant to which the parties agreed to amend the Modification Agreement to provide that

the dates on which the Lender may elect, in the Lender’s sole discretion, to terminate the Modification Period would be July

31, 2018 and April 30, 2023 (with each such date permitted to be extended by the Lender in its sole discretion); and that the Borrower’s

(i) interest payments that would otherwise be due under the Credit Agreement on December 31, 2018, March 31, 2019, June 30, 2019,

September 30, 2019, December 31, 2019, March 31, 2020, June 30, 2020, September 30, 2020 and October 7, 2020 and (ii) payments

for principal and for any other Obligations then outstanding under the Tranche One Loan and the Tranche Three Loans that would

otherwise be due under the Credit Agreement on October 7, 2020, would each be deferred until April 30, 2023 (the end of the extended

Modification Period). Under debt modification/troubled debt guidance, we determined that the first of the eight amendments had

no cash flow impact, and therefore, had no impact on accounting. Amendments nine through ten qualified for modification accounting,

while the final nineteen amendments qualified for troubled debt restructuring accounting. As appropriate, we expensed the legal

costs paid to third parties. For the three months ended March 31, 2024 and 2023, pursuant to the terms of the PDL Modification

Agreement, as amended, $802,125 was recorded as interest expense on the accompanying unaudited condensed consolidated

financial statements.

On April 29, 2023, the Company, the Borrower, the Subsidiary

Guarantor, the Lender and the Tranche Three Lenders entered into a Thirtieth Amendment to Modification Agreement (the “Thirtieth

Modification Agreement Amendment”), pursuant to which the parties agreed to amend the Modification Agreement to provide that

the dates on which the Lender may elect, in the Lender’s sole discretion, to terminate the Modification Period would be July

31, 2018 and May 31, 2023 (with each such date permitted to be extended by the Lender in its sole discretion); and that the Borrower’s

(i) interest payments that would otherwise be due under the Credit Agreement on December 31, 2018, March 31, 2019, June 30, 2019,

September 30, 2019, December 31, 2019, March 31, 2020, June 30, 2020, September 30, 2020 and October 7, 2020 and (ii) payments

for principal and for any other Obligations then outstanding under the Tranche One Loan and the Tranche Three Loans that would

otherwise be due under the Credit Agreement on October 7, 2020, would each be deferred until May 31, 2023 (the end of the extended

Modification Period).

On May 31, 2023 (the “Effective Date”), the Company,

the Borrower, the Lender, Steven G. Johnson, President and Chief Executive Officer of the Company, and Dr. James R. Higgins, a

director of the Company, entered into a Seventh Amendment to Credit Agreement (the “Seventh Credit Agreement Amendment”),

pursuant to which the parties agreed to amend the Credit Agreement to, among other things, (i) provide that, after the Effective

Date, all accrued but unpaid interest (including interest accrued but unpaid prior to the Effective Date and excluding interest

payable on the Maturity Date, in connection with any prepayment, or in the event of an Event of Default, which interest will be

payable in cash) accruing on Tranche One Loans and Tranche Three Loans will be paid-in-kind on each Interest Payment Date by being

added to the aggregate principal balance of the respective loans in arrears on each Interest Payment Date; (ii) require certain

mandatory prepayments of the loans by the Company, including (A) quarterly prepayments in the amount, if any, that the Company’s

Excess Cash Flow exceeds $600,000, (B) monthly transfers to the Inventory Reserve Account in the amount, if any, the Company’s

cash exceeds $1,200,000, (C) prepayment in the amount, if any, the Company’s Inventory Reserve Account exceeds $600,000,

and (D) prepayment in the amount, if any, of 100% of the gross proceeds of any indebtedness incurred by the Company (other

than permitted indebtedness); and (iii) extend the Maturity Date to December 31, 2024.

On September 30, 2023 (the “Effective Date”), the

Company, the Borrower, the Lender, Steven G. Johnson, President and Chief Executive Officer of the Company, and Dr. James R. Higgins,

a director of the Company, entered into an Eighth Amendment to Credit Agreement (the “Eighth Credit Agreement Amendment”),

pursuant to which the parties agreed to amend the Credit Agreement to modify certain texts originating within the Seventh Credit

Agreement. Stricken texts include “all accrued but unpaid interest (including interest accrued but unpaid prior to the Effective

Date and excluding interest payable on the Maturity Date, in connection with any prepayment, or in the event of an Event of Default,

which interest will be payable in cash) accruing on Tranche One Loans and Tranche Three Loans will be paid-in-kind on each Interest

Payment Date by being added to the aggregate principal balance of the respective loans in arrears on each Interest Payment Date.”

Additional texts include Release of Claims, which “in consideration of the Lender’s and Agent’s agreements contained

in this Amendment, each of Holdings, the Borrower and the Subsidiary Guarantor hereby releases and discharges the Lender and the

Agent and their affiliates, subsidiaries, successors, assigns, directors, officers, employees, agents, consultants and attorneys

(each, a “Released Person”) of and from any and all other claims, suits, actions, investigations, proceedings or demands,

whether based in contract, tort, implied or express warranty, strict liability, criminal or civil statute or common law of any

kind or character, known or unknown, which Holdings, the Borrower or the Subsidiary Guarantor ever had or now has against the Agent,

any Lender or any other Released Person which relates, directly or indirectly, to any acts or omissions of the Agent, any Lender

or any other Released Person relating to the Credit Agreement or any other Loan Document on or prior to the date hereof.”

Accounting Treatment

In connection with the PDL Credit Agreement,

as amended, we issued the PDL Warrant to the Lender. As of March 31, 2024, the Amended PDL Warrant has not been exercised.

Due to the PDL Eighth Credit Agreement

Amendment, the calculations for the “interest paid-in-kind” and quarterly “prepayment(s)” were removed

effective with the year ending on December 31, 2023. The Company concluded that the Company is encountering financial hardship

and that a concession was not granted. As the Lender has not granted a concession, the guidance contained in ASC 470-50 Modification

and Extinguishment was applied. Given the present value of the cash flows under the Eighth Credit Agreement Amendment differed

by less than 10% from the present value of the remaining cash flows under the terms of the prior debt agreement, the debt was determined

to be not substantially different which resulted in modification accounting. The Company did not have any debt issuance costs,

only legal expenses.

NOTE 11 – AGREEMENT WITH HEALTHCOR

On April 21, 2011, we entered into a Note

and Warrant Purchase Agreement (as subsequently amended) with HealthCor Partners Fund, LP (“HealthCor Partners”) and

HealthCor Hybrid Offshore Master Fund, LP (“HealthCor Hybrid” and, together with HealthCor Partners, “HealthCor”)

(the “HealthCor Purchase Agreement”). Pursuant to the terms of the HealthCor Purchase Agreement, we sold and issued

Senior Secured Convertible Notes to HealthCor in the principal amount of $9,316,000 and $10,684,000, respectively (collectively

the “2011 HealthCor Notes”). The 2011 HealthCor Notes have a maturity date of April 20, 2021. We also issued Warrants

to HealthCor for the purchase of an aggregate of up to 5,488,456 and 6,294,403 shares, respectively, of our Common Stock at an

exercise price of $1.40 per share (collectively the “2011 HealthCor Warrants”). So long as no event of default has

occurred, the outstanding principal balances of the 2011 HealthCor Notes accrue interest from April 21, 2011 through April 20,

2016 (the “First Five-Year Note Period”) at the rate of 12.5% per annum, compounding quarterly and shall be added to

the outstanding principal balances of the 2011 HealthCor Notes on the last day of each calendar quarter. Interest accruing from

April 21, 2016 through April 20, 2021 (the “Second Five Year Note Period”) at a rate of 10% per annum, compounding

quarterly, may be paid quarterly in arrears in cash or, at our option, such interest may be added to the outstanding principal

balances of the 2011 HealthCor Notes on the last day of each calendar quarter. For the period from April 21, 2016 through September

30, 2018 interest has been added to the outstanding principal balance. Pursuant to the terms of the Ninth Amendment, the accrual

of interest has been suspended after September 30, 2018. From the date any event of default occurs, the interest rate, then applicable,

shall be increased by five percent (5%) per annum. HealthCor has the right, upon an event of default, to declare due and payable

any unpaid principal amount of the 2011 HealthCor Notes then outstanding, plus previously accrued but unpaid interest and charges,

together with the interest then scheduled to accrue (calculated at the default rate described in the immediately preceding sentence)

through the end of the First Five Year Note Period or the Second Five Year Note Period, as applicable. Subject to the terms of

the Ninth Amendment as discussed below, HealthCor’s ability to convert any portion of the outstanding and unpaid accrued

interest on and principal balances of the 2011 HealthCor Notes into fully paid and nonassessable shares of our Common Stock has

been eliminated. The warrants issued with this Note were cancelled with the Ninth-Amendment dated July 10, 2018.

On March 30, 2023, HealthCor noteholders

owning an aggregate of $36,000,000 Replacement Notes, entered into a Replacement Note Conversion Agreement, wherein half, fifty

percent, of the HealthCor Replacement Notes were converted into shares of the Company’s common stock at a conversion price

of $0.10 per share, resulting in the issuance of an aggregate of 180,000,000 shares. The other related and non-related parties

Replacement Notes of $8,200,000 were likewise converted into shares of the Company’s common stock at a conversion price of

$0.10 per share, resulting in the issuance of a combined total aggregate of 262,000,000 shares (the “Conversion Shares”).

The shares bear a lockup legend that expires December 31, 2023.

On May 24, 2023, HealthCor noteholders owning an aggregate of $18,000,000 Replacement

Notes, presented Conversion Notices, pursuant to the terms of the Replacement Note, for the conversion of the Replacement Notes

into 180,000,000 shares of the Company’s common stock at a conversion price of $0.10 per share. The shares

bear a lockup legend that expires December 31, 2023.

Accounting Treatment

When issuing debt or equity securities convertible into common

stock at a discount to the fair value of the common stock at the date the debt or equity financing is committed, a company is required

to record a beneficial conversion feature (“BCF”) charge. We had three separate issuances of equity securities convertible

into common stock that qualify under this accounting treatment, (i) the 2011 HealthCor Notes, (ii) the 2012 HealthCor Notes and

(iii) the 2014 HealthCor Notes. Because the conversion option and the 2011 HealthCor Warrants on the 2011 HealthCor Notes were

originally classified as a liability when issued due to the down round provision and the removal of the provision requiring liability

treatment, and subsequently reclassified to equity on December 31, 2011 when the 2011 HealthCor Notes were amended, only the accrued

interest capitalized as payment in kind (’‘PIK’’) since reclassification qualifies under this accounting

treatment. We recorded an aggregate of $0 and $0 in interest for the years ended December 31, 2023 and 2022, respectively,

related to these transactions. For the years ended December 31, 2023, and 2022, we recorded $0 and $0, respectively, of PIK

related to the notes included in the HealthCor Purchase Agreement. The face amount of the 2012 HealthCor Notes, 2014 HealthCor

Notes, the Fifth Amendment Notes and the Eighth Amendment Notes and all accrued PIK interest also qualify for BCF treatment as

discussed above. Under the accounting standards, we determined that the restructuring of the HealthCor notes, pursuant to the terms

of the Ninth Amendment, resulted in a troubled debt restructuring. As the future cash flows were greater than the carrying amount

of the debt at the date of the amendment, we accounted for the change prospectively using the new effective interest rate.

Warrants were issued with the Fourth, Fifth, Eighth, Ninth,

and Allonge 3 Amendment Notes and the proceeds were allocated to the instruments based on relative fair value as the warrants did

not contain any features requiring liability treatment and therefore were classified as equity. At each amendment date, the warrants

were recorded as debt discount, as a reduction of the net carrying amount of the debt. The debt discounts are amortized into interest

expense each period under the effective interest method. The value allocated to the Ninth Amendment Warrants was $378,000. The

value allocated to the Allonge 3 Amendment Warrants was $420,000.

NOTE 12 – JOINT VENTURE AGREEMENT

On December 31, 2019, the Company and Rockwell

entered into a Second Amendment to the Rockwell Note (the “Second Rockwell Note Amendment”) pursuant to which Rockwell

agreed to extend the term of the Rockwell Note by one year, to December 31, 2020, and agreed to extend the time to make the quarterly

payment that would otherwise be due on December 31, 2019 to January 31, 2020. We have evaluated the Second Amendment to the Rockwell

Note under ASC 470 and determined that the amendment should be treated as a debt modification.

As of March 31, 2022, the Rockwell Note

was paid off.

NOTE 13 – LEASE

Under ASC Topic 842, Leases (“ASC 842"), operating

lease expense is generally recognized evenly over the term of the lease. The Company has an operating lease primarily consisting

of office space with a remaining lease term of 17 months (Lease through August 31, 2025).

On March 4, 2020, we entered into the Fourth Amendment to Commercial

Lease Agreement (the “Lease Extension”), wherein we extended the Lease through August 31, 2025. The Lease Extension

contains a renewal provision under which the Lease has been extended for an additional five-year period under the same terms

and conditions of the original Lease Agreement. Management has identified this extension as a reassessment event, as we have elected

to exercise the Lease Extension option even though the Company had previously determined that it was not reasonably certain to

do so.

The Company has further concluded that the Lease Extension has

no effects on the classification of the Lease. Rent expense for the three months ended March 31, 2024, and 2023 was $77,573 and $75,887,

respectively.

Undiscounted Cash Flows

Future lease payments included in the measurement of operating

lease liability on the condensed consolidated balance sheet as of March 31, 2024, for the following five fiscal years and thereafter

as follows:

Quarter ending

March 31, 2024 | |

Operating

Leases | |

| Remaining 2024 | |

$ | 166,619 | |

| 2025 | |

| 150,679 | |

| | |

| | |

| Total minimum lease payments | |

| 317,298 | |

| Less effects of discounting | |

| (32,881 | ) |

| Present value of future minimum lease payments | |

$ | 284,417 | |

Cash Flows

The table below presents certain information

related to the cash flows for the Company’s operating lease for the three months ended March 31, 2024:

| | |

Three Months Ended

March 31,

2024 | |

| Cash paid for amounts included in the measurement of lease liabilities: | |

| | |

| | |

| | |

| Operating cash flows for operating leases | |

$ | 81,405 | |

NOTE 14 – SUBSEQUENT EVENTS

The Company has evaluated subsequent events

through May 14, 2024.

Item 2. Management’s Discussion and Analysis of Financial

Condition and Results of Operations

General

The following discussion

and analysis provide information which our management believes to be relevant to an assessment and understanding of our results

of operations and financial condition. This discussion should be read together with our condensed consolidated financial statements

and the notes to the financial statements, which are included in this Quarterly Report on Form 10-Q (the “Report”). This

information should also be read in conjunction with the information contained in our Form 10-K filed with the Securities and Exchange

Commission (the “SEC”) on March 29, 2024. The reported results will not necessarily reflect future results of operations

or financial condition.

Throughout this Report,

the terms “we,” “us,” “our,” “CareView,” or “Company” refers to CareView Communications,

Inc., a Nevada corporation, and unless otherwise specified, includes our wholly owned subsidiaries, CareView Communications, Inc.,

a Texas corporation (“CareView-TX”).

We maintain a website

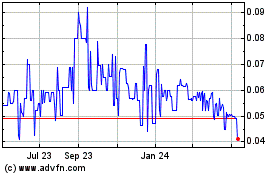

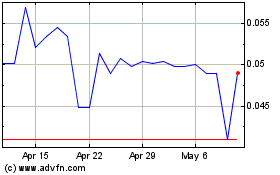

at www.care-view.com and our Common Stock trades on the OTCQB under the symbol “CRVW.’’

Company Overview and Recent Developments

As

a leader in turnkey patient video monitoring solutions, CareView is redefining the standard of patient safety in hospitals and

healthcare facilities across the country. For over a decade, CareView has relentlessly pursued innovative ways to increase patient

protection, providing next generation solutions that lower operational costs and foster a culture of safety among patients, staff,

and hospital leadership. With installations in more than 150 hospitals, CareView has proven that its innovative technology is

creating a culture of patient safety where patient falls have decreased by 80% and sitter costs reduced by more than 65%. Anchored

by the CareView Patient Safety System® and CareView Patient Care SystemTM, this modular, scalable solution

delivers flexible configurations to fit any facility while significantly increasing patient safety, care, and operational savings.

All configurations feature HD cameras, high-fidelity 2-way audio/video, LCD displays for the ultimate in capability, flexibility,

and affordability.

SitterView®

and TeleMedView™ allows hospital staff to use CareView’s high-quality video cameras with pan-tilt-zoom and 2-way video

functionality to observe and communicate with patients remotely. With CareView, hospitals are safely monitoring more patients while

providing a higher level of care by leveraging CareView’s patented technology, a portfolio that includes 40 patents. TeleMedView

leverages the CareView Mobile Controller’s built-in monitor and can work with the CareView Portable Controller as well. Usage

of SitterView and TeleMedView has increased in response to a growing demand for remote patient monitoring driven by increasing

demands for care and staffing shortages in the healthcare industry.

The CareView

Patient Safety System enables virtual nursing workflows for patient observation, companionship, care concierge, and administrative

tasks can ease workloads and improve care delivery. Hybrid patient care, the combination of bedside and virtual care, allows hospitals

to keep nurses working at the top of their licenses and creates flexible and scalable workforce options. CareView’s integrations

with existing clinical workflow and patient engagement tools allow providers to access patient rooms virtually from within the

EHR workflow. CareView then becomes the centralized hub for a patient-centric, interconnected virtual care system.

In October

2022, CareView received Innovative Technology Designation after the Innovative Technology Exchange in Dallas, Texas. Every year,

healthcare experts serving on the member-led councils of Vizient, Inc., (“Vizient”), the nation’s largest healthcare

performance improvement company, review select products and technologies for their potential to enhance clinical care, patient

safety, healthcare worker safety or to improve business operations of healthcare organizations. Vizient’s diverse membership

and customer base includes academic medical centers, pediatric facilities, community hospitals, integrated health delivery networks,

and non-acute health care providers, and represents more than $130 billion in annual purchase volume. Technology designations are

awarded to previously contracted products to signal to healthcare providers the impact of these innovations on patient care and

business models of healthcare organizations.

CareView Patient Safety System

Our CareView

Patient Safety System provides innovative ways to increase patient protection, provides advanced solutions that lower operational

costs, and helps hospitals foster a culture of safety among patients, staff, and hospital leadership. We understand the importance

of providing high quality patient care in a safe environment and believe in partnering with hospitals to improve the quality of

patient care and safety by providing a system that monitors continuously. We are committed to providing an affordable video monitoring

tool to improve the practice of nursing, create a better work environment and make the patient’s hospital stay more satisfying.

Our suite of products and services can simplify and streamline the task of preventing and managing patients’ falls, enhance

patient safety, improve quality of care, and reduce costs. Our products and services can be used in all types of hospitals, nursing

homes, adult living centers, and selected outpatient care facilities domestically and internationally.

The CareView

Patient Safety System includes CareView’s SitterView, providing a clear picture of up to 40 patients at once, allowing staff

to intervene and document patient risks more quickly. SitterView features intuitive decision support pathway, guiding staff alarm

response and pan- tilt-zoom functionality, allowing staff to home in on areas of interest. CareView’s new Analytics Dashboard

provides real-time metrics on utilization, compliance, and outcome data by day, week, month, and quarter. Outcomes are automatically

compared to organizational goals to evaluate real-time ROI.

CareView’s

next generation of in-room camera; the CareView Controller features an HD camera, high-fidelity 2-way audio, and an LCD display,

harnessing increased performance to deliver the ultimate in capability, flexibility, and affordability for all types of hospitals.

Building on top of CareView’s patented Virtual Bed Rails® and Virtual Chair Rails® predictive technology, the CareView

Controller uses machine learning to differentiate between normal patient movements and behaviors of a patient at risk. This technology

results in less false alarms, faster staff intervention, and a significant reduction in patient falls.

The CareView

Controller is available in multiple configurations for permanent or temporary situations; the CareView Mobile, Portable, and Fixed

Controller. For situations that demand that the camera come to the patient, the CareView Mobile Controller on wheels comes with

an uninterrupted external power supply for situations where power may not be readily available and can operate on the facility’s

wireless network. For monitoring patients within a general care unit, the CareView Portable Controller can be easily removed from

mounts and moved where the workflow dictates, making this application perfect for general use. For high-risk patient rooms where

behavior and self-harm may be a factor, or where a patient must be continuously monitored, the CareView Fixed Controller can be

installed seamlessly in the ceiling tiles leaving no exposed wiring making it ligature resistant.

The CareView

Patient Safety System can be easily configured to meet the individual privacy and security requirements of any hospital or nursing