cMoney – Provides a Safe and Total Solution

June 15 2011 - 8:00AM

Business Wire

cMoney, Inc. (OTCBB:CMEY), is a Houston-based company that is at

the forefront of global mobile phone-based payments and money

transfers, while using the POS and ATM payment systems. The cMoney

solution utilizes secure patent pending technology for mobile phone

users, retailers, and financial institutions, and continues to

innovate and strengthen the cMoney brand globally. In this fast

moving mobile to mobile payments market segment, cMoney

analyzes the weaknesses of current market competitors.

cMoney Solution – With the

early release of the NFC application and capabilities by various

companies, including Apple’s anticipated release of the iPhone 5,

(now postponed: http://www.businessinsider.com/iphone-nfc-2011-3

and Google’s Mobile Wallet, using Android, there has already been a

big concern for the security risk associated with transferring

funds on consumers' mobile devices. It has been noted according to

this one article:

http://www.eweekeurope.co.uk/news/serious-security-bugs-found-in-android-kernel-11040?utm_source=dft.ba&utm_medium=link

that Google’s Android has experienced “88 flaws that could expose

their user’s data…..a total of 359 bugs, about one-quarter of which

were classified as high-risk.” Google's (Android) integrity was

also recently questioned by a Motorola executive; sighting the

ability of nearly any entity to design an Android App that could

maliciously access data on the user's phone and could also damage

the phone handset as well. http://bit.ly/jdzg6k In a similar

regard, Google recently had to use a remote kill switch to remove

malicious Apps from users' phones.

http://mobile.eweek.com/c/a/Security/Google-Removes-26-Apps-With-DroidDream-Light-Malware-from-Android-Market-662791/

NFC is new technology to the consumers; however merchants,

mobile carriers, and other affiliates are finding it difficult to

troubleshoot the many problem areas. The NFC technology requires an

embedded chip to be built into the cell phone that stores the

consumer’s personal data leaving private information open to

security risks, in the event your phone is lost or stolen. In

addition, all systems using the Near Field Communications hardware

("NFC"), including Google Wallet, will be prone to possible theft

of personal information and fraudulent purchases. In an article

highlighting the ease with which the Starbucks mobile App was

hacked, the author likened the threat to all NFC phones.

http://www.nearfieldcommunicationsworld.com/2011/02/09/35844/hacker-shows-how-to-crack-starbucks-mobile-payments-app/

cMoney, by comparison, is structured to use the consumer’s

existing cell phone via an uploadable application, without the purchase of an NFC phone and

will provide a platform for the consumer to store and access up to

(30) thirty debit and/or credit cards. The cMoney solution stores

no personal information on our customer’s phone leaving them with

the peace of mind that their data is always safe.

It is anticipated that the mobile to mobile payments market will

explode in the next couple of years. In fact, according to this

article:

http://www.mobilecommercedaily.com/2011/01/26/mobile-payments-could-reach-1-trillion-by-2015-luciano-group

to the tune of approximately one trillion dollars, “if retailers

receive lower payment processing fees based on a more efficient

system.”

cMoney competitors have a very limited means of generating

revenue for their company. cMoney currently has (14) fourteen

sources of generating cash flow and as the mobile payment sector

continues to grow, the cMoney technology will dominate in this

market, while providing consumers lower transaction fees. This is

one of many reasons why cMoney will provide the consumer with the

total solution.

Ongoing Research – Our

cMoney solution continues to receive positive feedback from our

business and technology developers, shareholders and also

consumers.

Moving forward towards submission of

S-1 – cMoney continues, with its previously

announced partners, to prepare for the submission of its expedited

Form S-1/A which is greatly anticipated by cMoney shareholders.

cMoney CEO

comments -

Mr. Matthews, CEO of cMoney stated, “I would like to take this

opportunity to thank all of our shareholders for continuing to keep

cMoney in an active – trading momentum status. We are helping to

make consumers aware of our exciting alternative to the NFC

technology. cMoney will revolutionize our daily financial world and

we will continue to provide more information to our shareholders

and consumers about the developments of our cMoney solution and its

technology that has been designed over the last (5) five years,

awaiting for the right time for its deployment.” cMoney is a game

changer for the entire mobile payment market and has NO COMPETITION, as we will continue to “Move Money

At The Speed of NOW!”

About cMoney,

Inc.

cMoney, Inc., a Houston-based technology company that provides

innovative secure mobile payment solutions for mobile phone users,

retailers and financial institutions, has developed an innovative

way to send money and pay for goods and services using a mobile

phone and the text messaging system protected by patents. Scheduled

to debut in 2011, the pioneering technology will create a “virtual

wallet” that will eliminate exposure to identity and credit card

theft for users. It can be used anywhere that cash, checks, ATM’s

or credit cards are accepted. For more information,

visit www.cmoney.com or

contact contactus@cmoney.com

Forward-Looking

Statements

Certain statements in this press release may constitute

"forward-looking statements". Forward-looking statements provide

current expectations of future events based on certain assumptions

and include any statement that does not directly relate to any

historical or current fact. Actual results may differ materially

from those indicated by such forward-looking statements as a result

of various important factors, including: risks related to the

integration of acquisitions and the ability to market successfully

acquired technologies and products; the ability of cMoney, Inc.

(“the Company”) to effectively compete; the timing and

effectiveness of the planned launch of the new cMoney solution; the

inability to adequately protect Company intellectual property and

the potential for infringement or breach of license claims of or

relating to third party intellectual property; risks related to

data and information security vulnerabilities; ineffective

management of, and control over, the Company's growth and

international operations; adverse results in litigation; and

changes in and a dependence on key personnel. The forward-looking

statements included in this press release represent the Company's

views as of the date of this press release and these views could

change. However, while the Company may elect to update these

forward-looking statements at some point in the future, the Company

specifically disclaims any obligation to do so. These

forward-looking statements should not be relied upon as

representing the Company's views as of any date subsequent to the

date of the press release.

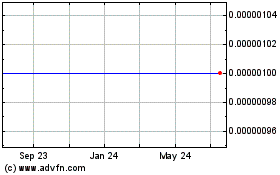

cMoney (CE) (USOTC:CMEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

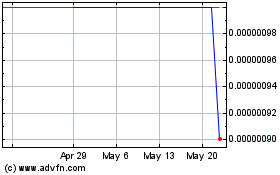

cMoney (CE) (USOTC:CMEY)

Historical Stock Chart

From Apr 2023 to Apr 2024