Bone Care International, Inc. Reports Third Quarter FY 2005

Financial Results - Quarterly Hectorol(R) Sales of $22.0 Million,

89% Increase - MIDDLETON, Wis., April 26 /PRNewswire-FirstCall/ --

Bone Care International, Inc. (NASDAQ:BCII) today announced

financial results for its third fiscal quarter and for the nine

months ended March 31, 2005. The company reported quarterly sales

for Hectorol(R) (doxercalciferol) of $22.0 million, compared to

$11.6 million for the third quarter of fiscal 2004, representing an

89 percent increase. The company achieved its fifth consecutive

quarter of increasing profitability with net income of $2.5

million, or $0.12 per share, compared with a net profit of

$302,000, or $0.02 per share, in the third quarter of fiscal 2004.

For the nine months ended March 31, 2005, Hectorol(R) sales were

$59.0 million, an increase of $30.1 million, or 104 percent, from

the same period in 2004. Net income was $5.6 million, or $0.27 per

share, for the first nine months ended March 31, 2005, compared

with a net loss of $2.3 million, or $0.16 per share, for the same

period in 2004. The company ended the quarter with $119 million in

cash and investments. "Bone Care again delivered a strong

performance during the third quarter," said Paul L. Berns,

President and Chief Executive Officer of Bone Care International.

"We continued to advance our Hectorol(R) brand as evidenced by the

first quarter in the history of the company where sales exceeded

$20 million. In addition to increasing sales revenues in the

quarter, we continued to execute strong fiscal management

represented by our fifth consecutive quarter of increasing

profitability. At the same time, we continue to make investments

necessary to serve patients' needs and to generate long- term

growth." Gross margins on sales of Hectorol(R) were 74 percent and

75 percent, for the third quarter and for the nine months ended

March 31, 2005, respectively. Research and development expense was

$3.1 million in the third quarter ended March 31, 2005, an increase

of $0.3 million, or 12 percent, from the third quarter of 2004. For

the nine months ended March 31, 2005, research and development

expense was $8.9 million, an increase of $2.3 million, or 35

percent, from the same period in 2004. These increases were

primarily attributed to a higher level of pre-clinical and clinical

study activities. Selling, general and administrative expense was

$11.2 million in the third quarter, an increase of $5.4 million, or

93 percent, from the third quarter of 2004. For the nine months

ended March 31, 2005, selling, general and administrative expense

was $31.7 million, an increase of $14.2 million, or 82 percent,

from the first nine months of fiscal 2004. Most of the increases in

both the third quarter and nine months ended March 31, 2005 were

related to the planned expansion of our sales organization,

marketing and co-promotion expenses related to the sales of

Hectorol(R) (doxercalciferol) 0.5 mcg Capsules and professional

fees related to legal activities and Sarbanes Oxley compliance.

"The outstanding performance by our organization has allowed us to

increase our sales guidance for fiscal 2005," said Mr. Berns. "We

are increasing our current sales range of $77 to $80 million to a

range of $82 to $83 million for fiscal 2005. Our continued momentum

is a direct reflection of the high level of execution by our

commercial organization and the dedication and support of the

entire company." Key events to note in the fourth fiscal quarter: *

In April, the company announced the appointment of Charles W.

Bishop, Ph.D., as Executive Vice President and Chief Scientific

Officer. * The company is scheduled to present at both the Deutsche

Bank Healthcare Conference in Baltimore and the R.W. Baird Growth

Stock Conference in Chicago in May. * The company will be

represented at the National Kidney Foundation meeting in

Washington, D.C. in May. Six posters and abstracts will be

presented covering a wide range of topics related to Hectorol(R)

and D hormone treatment. Additionally, the company will be

supporting, through an educational grant, a symposia related to the

essential role of Vitamin D hormone in managing secondary

hyperparathyroidism in early chronic kidney disease. Management

will host a conference call on Wednesday, April 27, 2005, at 9:00

a.m. CDT. The toll-free number within North America is

800-938-0653; the dial-in number for international participants is

973-321-1100. The call is available for playback until midnight on

April 30, 2005 at 877-519-4471 within North America and at

973-341-3080 for international callers. The playback pass code is

5909260. The call can also be accessed via webcast and will be

archived for playback at http://www.bonecare.com/conferencecall.

About Bone Care International Bone Care International

(http://www.bonecare.com/) is a specialty pharmaceutical company

engaged in the discovery, development and commercialization of

innovative therapeutic products to treat the unmet medical needs of

patients with debilitating conditions and life-threatening

diseases. Our current commercial and therapeutic focus is in

nephrology, utilizing Hectorol(R), a novel vitamin D hormone

therapy, to treat secondary hyperparathyroidism in patients with

moderate to severe chronic kidney disease and end-stage renal

disease. In addition to chronic kidney disease, the company is

developing vitamin D hormone therapies to treat hyperproliferative

disorders such as cancer and psoriasis. Contact: Bone Care

International, Inc. Brian J. Hayden Chief Financial Officer (608)

662-7800 This press release contains forward-looking statements.

Statements relating to future sales, costs of sales, other

expenses, profitability, financial resources, or products and

production schedules, or statements that predict or indicate future

events and trends and which do not relate solely to historical

matters identify forward-looking statements. Forward-looking

statements are made pursuant to the safe harbor provisions of

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934 and are based on management's

beliefs as well as assumptions made by and information currently

available to management. Accordingly, the Company's actual results

may differ materially from those expressed or implied in such

forward-looking statements due to known and unknown risks and

uncertainties that exist in the Company's operations and business

environment, including, among other factors, the ability of the

Company and each of its suppliers of doxercalciferol, Hectorol(R)

Injection and Hectorol(R) Capsules to meet the Company's

anticipated production schedules, technical risks associated with

the development of new products, regulatory policies in the United

States and other countries, risks associated with our ability to

avoid or minimize delays in/or interruption of the manufacture and

supply of our products, including the approvals of regulatory

authorities in connection therewith, reimbursement policies of

public and private health care payors, introduction and acceptance

of new drug therapies, competition from existing products and from

new products or technologies, the failure by the Company to produce

anticipated cost savings or improve productivity, the timing and

magnitude of capital expenditures and acquisitions, currency

exchange risks, economic and market conditions in the United

States, Europe and the rest of the world, and other risks

associated with the Company's operations. The Company disclaims any

obligation to update any such factors or to publicly announce any

revisions to any of the forward-looking statements contained herein

to reflect future events or developments. BONE CARE INTERNATIONAL,

INC. CONDENSED STATEMENTS OF OPERATIONS (unaudited) For the Three

Months Ended For the Nine Months Ended March 31, March 31, 2005

2004 2005 2004 PRODUCT SALES $21,989,005 $11,617,323 $58,955,861

$28,857,850 COST AND OPERATING EXPENSES: Cost of product sales

5,743,386 2,744,371 14,448,524 7,227,293 Research and development

3,133,790 2,794,542 8,902,450 6,606,760 Selling, general and

administrative 11,234,852 5,803,602 31,735,003 17,431,151

20,112,028 11,342,515 55,085,977 31,265,204 Income (loss) from

operations 1,876,977 274,808 3,869,884 (2,407,354) INTEREST INCOME,

net 667,150 27,324 1,720,727 129,409 NET INCOME (LOSS) $2,544,127

$302,132 $5,590,611 $(2,277,945) Net income/(loss) per common share

- basic $0.13 $0.02 $0.28 $(0.16) Net income/(loss) per common

share - diluted $0.12 $0.02 $0.27 $(0.16) Shares used in computing

basic net income/(loss) per common share 20,034,545 14,329,963

19,630,778 14,290,162 Shares used in computing diluted net

income/(loss) per share 21,113,361 16,555,748 20,978,178 14,290,162

Certain prior period amounts in the financial statements have been

reclassified to conform to the fiscal 2005 presentation. BONE CARE

INTERNATIONAL, INC. CONDENSED BALANCE SHEETS (Unaudited) March 31,

2005 June 30, 2004 ASSETS CURRENT ASSETS: Cash and cash equivalents

$78,751,817 $45,325,671 Marketable securities 40,248,991 68,776,698

Accounts receivable, net 10,634,176 4,732,698 Inventory 8,114,473

6,785,288 Other current assets 3,037,476 2,336,362 Total current

assets 140,786,933 127,956,717 Marketable securities - non current

- 908,376 Property, plant and equipment, net 2,573,550 1,526,638

Patent fees, net 1,969,488 1,785,045 Goodwill 359,165 359,165

$145,689,136 $132,535,941 LIABILITIES AND SHAREHOLDERS' EQUITY

CURRENT LIABILITIES: Accounts payable 9,839,937 6,490,488 Accrued

compensation payable 1,905,810 2,890,728 Accrued clinical study and

research costs 554,525 1,001,818 Deferred revenues 395,607 -

Allowance for sales returns 90,419 100,000 Other accrued

liabilities 173,115 214,010 Total current liabilities 12,959,413

10,697,044 Long-term liabilities 61,168 100,388 SHAREHOLDERS'

EQUITY: Preferred stock - - Common stock 183,621,987 178,868,933

Unearned compensation (1,803,854) (2,411,054) Accumulated other

comprehensive loss (20,819) - Accumulated deficit (49,128,759)

(54,719,370) Total shareholders' equity 132,668,555 121,738,509

$145,689,136 $132,535,941 DATASOURCE: Bone Care International, Inc.

CONTACT: Brian J. Hayden, Chief Financial Officer of Bone Care

International, Inc., +1-608-662-7800 Web site:

http://www.bonecare.com/ http://www.bonecare.com/conferencecall

Copyright

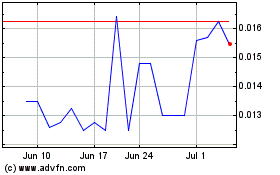

BCII Enterprises (PK) (USOTC:BCII)

Historical Stock Chart

From Apr 2024 to May 2024

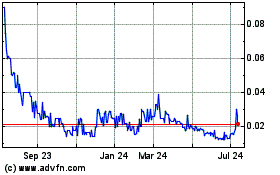

BCII Enterprises (PK) (USOTC:BCII)

Historical Stock Chart

From May 2023 to May 2024