Allied Energy, Inc. Provides Operations Updates

BOWLING

GREEN, KY-- (Marketwire – May 24, 2013) - Allied Energy, Inc.

(“Company”)

(OTCMarkets: AGGI) today announced updates relating to its

operations.

Drilling Update:

J.T. Fields-Berry

Wells, Caldwell County, TX:

During March 2013,

the Company began the development of five

wells in Caldwell County, TX, consisting of four existing wells and

one

newly-drilled well. Our engineers are targeting both the Buda and

Austin Chalk

formations in each of the wells; thus far, one well has been

completed in both

zones, three wells have been completed in the Buda formation only,

and one well

has been completed in the Austin Chalk formation only.

As of May 2013, the wells

have been

placed on pump and are now in the “flow-back” stage, during which

time

remaining treatment fluids are being recovered. We are beginning to

see an “oil

cut” in the returning fluids, with total average

aggregate production for all five wells ranging from 25 to 30

barrels of oil

per day (“bopd”).

The costs of developing the wells located within the J.T.

Fields-Berry lease are being funded by a general partnership

sponsored by the

Company. The partnership holds an aggregate majority working

interest in

the J.T. Fields-Berry wells. The Company holds a 0.1% working

interest

(0.075% net revenue interest), inclusive of its interests in the

general

partnership.

Clark #1 Test Well,

Milam County, TX:

During August 2012, the Company

participated with an industry partner in the drilling of the Clark

#1 test

well, with the objective of testing the Pecan Gap formation.

The Pecan Gap formation was determined

to be non-productive, and Allied has elected to move “up-hole” to

test and

attempt completion in the Navarro Sands formation, which is known

to be

productive in the area. Upon that

election, the industry partner transferred its interest to Allied,

and the Company

now owns a 100.0% working interest (77.25% net revenue interest) in

the Clark

#1 test well.

Pearson C1 Test Well,

Milam County, TX:

During August 2012, the Company participated with an industry

partner in

the drilling of the Pearson C1 test well, with the objective of

testing the

Pecan Gap formation. The Pecan Gap

formation was determined to be non-productive, and Allied has

elected to move

“up-hole” to test and attempt completion in the Navarro Sands

formation, which

is known to be productive in the area.

Upon that election, the industry partner transferred its interest

to

Allied, and the Company now owns a 100% working interest (77.25%

net revenue

interest) in the Pearson C1 test well.

Non-Commercial

Well Update:

#1 Konvicka Well, Lavaca County,

Texas: During December 2011, the

Company purchased working interests in the #1 Konvicka

well located on the Yoakum East Property lease. In January

2012, in an attempt to increase production, a

fracking operation was scheduled and completed. Due to

unknown reasons, the procedure failed. The Company’s engineer

has finalized a

report of the failed procedure, and there are no further plans to

re-complete

the well. The costs of developing the #1 Konvicka well were funded

by general

partnerships sponsored by the Company.

Production Update:

Ragsdale #2

Well:

During March 2013, the Ragsdale #2 well, located in Cherokee

County, TX,

was completed and placed on pump.

The well produced approximately 20 bopd during initial

production

testing and during April 2013, it produced a total of 159 barrels

of oil.

The drilling and completion of the Ragsdale #2 well was funded by

two

general partnerships sponsored by the Company. The

partnerships hold a majority working interest in the

Ragsdale #2 well. The Company

holds a 0.25% working interest (0.1875% net revenue interest) in

the well,

inclusive of its interests in the general partnerships.

E. Cantrell

#1:

The

E. Cantrell #1 well, located in Wood County,

TX, was placed into production during February 2013. The E.

Cantrell #1 well

produced 243 barrels of oil during the month March 2013 and 72

barrels of oil during

the month of April 2013.

The E. Cantrell #1 well was funded by two general partnerships

sponsored

by the Company. The partnerships

hold a majority working interest in the E. Cantrell #1

prospect. The Company holds a 0.05037% working

interest (0.03777% net revenue interest) in the well, inclusive of

its

interests in the general partnerships.

Acquisition

Update:

Acquisition of

Additional Acreage in Milam County, TX:

During May

2013, the Company acquired a lease in Milam County, TX, comprising

240 acres.

Additional Working

Interest Acquired in the High Island Block 19S

Prospect:

In May 2013, the Company entered into an agreement to purchase

an

additional 77% working interest in the High Island 19S Prospect,

which brings

the Company’s total working interest ownership to 80% and a

corresponding net

revenue interest ranging between 59.2% and 63.2%.

Withdrawal from

Participation:

North Constitution

“Hooks” Prospect:

In October 2012, the Company

entered into an agreement to participate with industry partners in

the drilling

of a well in Jefferson County, TX.

During March 2013, the Company executed an “exit agreement”

which

formally withdrew the Company from any participation or involvement

in the

North Constitution “Hooks” Prospect.

Disposition of

Certain General Partnerships:

Rogers County,

Oklahoma:

The

Company continues to evaluate all the interests of the general

partnerships for

which the Company acts as managing general partner in Rogers

County, OK. The Company is conducting a review of

production and expense records to determine the financial condition

of the

partnerships and the status of each of the partnerships wells, a

large majority

of which may be non-commercial.

Based upon the findings of the review, we have begun to make

specific

recommendations either to 1) “shut-in” wells that might benefit by

a future

rebound in the market prices of gas, 2) plug and abandon wells

deemed to be

non-commercial, or 3) continue to operate wells that are profitable

or may be

candidates for enhancement procedures or re-engineering to improve

production.

It is anticipated that some of the general partnerships sponsored

by the

Company holding interests in wells in Rogers County, Oklahoma may

be terminated

due to non-profitable operations.

About

Allied Energy:

Allied

Energy, Inc. is engaged in the oil and gas exploration and

development

business, with operations located primarily in Texas, Oklahoma and

Ohio. The Company sponsors oil & gas

partnerships through which it raises funds for the drilling and

development of

oil & gas wells. The Company

serves as managing general partner of the partnerships and often

owns differing

partnership interests in the partnerships and/or differing direct

interests in

the properties in which the partnerships

participate.

The

Company’s subsidiaries include Allied Operating, LLC and Allied

Operating,

Texas, LLC, two operating companies that are used to undertake,

either directly

or through third-party contracting entities, the drilling,

development and

operations of the oil & gas drilling partnerships sponsored by

the Company,

as well as for other non-affiliated oil and gas companies that are

joint interest

owners in drilling activities owned primarily by partnerships

sponsored by the

Company. The Company is also

majority owner of Allied Gas Transmission, Inc., which owns the

pipeline system

used to transmit production from gas wells located in Rogers

County, Oklahoma

to gas purchasers.

The

Company’s ultimate strategic focus is on the development of oil and

natural gas

production and reserves. The

Company believes that its oil and natural gas development strategy

will provide

growth to the Company in the future.

For more information:

www.alliedenergy.com

Forward-Looking

and Continuing Statements:

Certain

statements in this release and the attached corporate profile that

are not

historical facts are "forward-looking statements" within the

meaning

of the Private Securities Litigation Reform Act of 1995. Such

statements may be identified by

the use of words such as "anticipate," "believe,"

"expect," "future," "may," "will,"

"would," "should," "plan," "projected,"

"intend," and similar expressions. Such forward-looking

statements involve known and unknown

risks, including, but not limited to, geological and geophysical

risks inherent

to the oil and gas industry, and uncertainties and other factors

that may cause

the actual results, price of oil and natural gas, state of the

economy,

industry regulation, reliance upon expert recommendations and

opinions, and

performance or achievements of the Company to be materially

different from

those expressed or implied by such forward-looking

statements. The Company's future operating results

are dependent upon many factors, including but not limited to: (i)

the

Company’s ability to obtain sufficient capital or strategic

business

arrangements to fund its drilling plans; (ii) the Company’s ability

to build

the management and human resources and infrastructure necessary to

support the

growth of its business; (iii) competitive factors and developments

beyond the

Company's control, including but not limited to the strength of the

overall

economy; and (iv) other risk factors inherent to the oil and gas

industry.

Contact:

Heather Age

Allied Energy,

Inc.

2427

Russellville Road

Bowling Green,

KY 42101

Phone:

800-330-2535

Fax: 800-251-9322

Website:

http://www.alliedenergy.com

Email:

info@alliedenergy.com

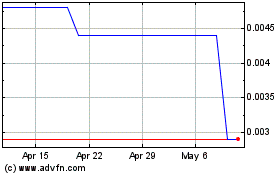

Allied Energy (PK) (USOTC:AGGI)

Historical Stock Chart

From Apr 2024 to May 2024

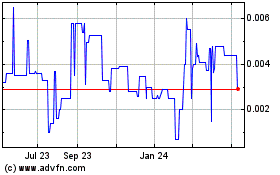

Allied Energy (PK) (USOTC:AGGI)

Historical Stock Chart

From May 2023 to May 2024