UNITED

STATES

SECURITIES

AND

EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE

14C INFORMATION

Information Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check the appropriate box:

|

x

|

Preliminary Information Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

¨

|

Definitive Information Statement

|

|

ARTEC GLOBAL MEDIA, INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required.

|

|

|

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

|

4)

|

Date Filed:

|

ARTEC GLOBAL MEDIA, INC.

249 South Highway 101, #324

Solana Beach, California 92075

(844) 505-2285

__________________________

INFORMATION STATEMENT

__________________________

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

__________________________

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS' MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN. THIS INFORMATION STATEMENT IS BEING FURNISHED

TO

YOU SOLELY

FOR

THE

PURPOSE OF INFORMING

YOU OF THE

MATTERS

DESCRIBED HEREIN.

Information Concerning the Actions by Written Consent

This Information Statement is being furnished to the stockholders of Artec Global Media, Inc., a Nevada corporation (the "

Company

", "

we

", "

us

" or "

our

"), pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the "

Exchange Act

"), and the rules and regulations promulgated thereunder, for the purpose of informing our stockholders that, on ____, 2016, our board of directors approved by written consent, and the stockholders holding a majority of the voting power of the Company, also approved by written consent, an amendment of the Articles of Incorporation of the Company to increase the total number of shares of common stock, par value $0.001 per share (hereinafter, our "

Common Stock

"), that the Company shall have authority to issue from 750,000,000 shares to 10,000,000,000 shares.

Under the laws of the State of Nevada and our bylaws, stockholder action may be taken by written consent without a meeting of the stockholders. The written consent of our board of directors and the written consent of the stockholders

holding a majority of the voting power of the Company are sufficient to approve the amendment described above (the "

Amendment

"). Therefore, no proxies or consents were or are being solicited in connection with the Amendment.

After the expiration of the twenty (20) day period required under Rule 14c-2 promulgated under the Exchange Act, and in accordance with the laws of the State of Nevada, we intend to file a Certificate of Amendment to our Articles of Incorporation to effect the Amendment. The proposed Certificate of Amendment, attached hereto as

Appendix A

, will become effective when it has been accepted for filing by the Secretary of State of the State of Nevada. Such filing will occur at least twenty (20) days after the Definitive Information Statement is filed with the Securities and Exchange Commission (the "

SEC

") and first sent or given to our stockholders.

Record Date

Our board of directors has fixed the close of business on ____, 2016 (the "

Record Date

"), as the record date for determining our stockholders who are entitled to receive this Information Statement. Only our stockholders of record as of the Record Date are entitled to notice of the information disclosed in this Information Statement. As of the Record Date,

there

were

699,217,523

shares of our Common Stock issued and outstanding.

Stockholders as of the Record Date who did not consent to the Amendment are not entitled to dissenters' rights or appraisal rights in connection with the Amendment

under the laws of the State of Nevada or under our bylaws.

Expenses

The cost of preparing and furnishing this Information Statement will be borne by us. We may request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of our Common Stock held on the Record Date.

Stockholders Sharing an Address

We will deliver, or cause to be delivered, only one copy of this Information Statement to multiple stockholders sharing an address unless we have received contrary instructions from one or more of the stockholders. We undertake to promptly deliver, or cause to be promptly delivered, upon written or oral request, a separate copy of this Information Statement to a stockholder at a shared address to which a single copy of this Information Statement is delivered.

A stockholder can notify us that the stockholder wishes to receive a separate copy of this Information Statement by contacting us at the address or phone number set forth above.

Conversely, if multiple stockholders sharing an address receive multiple Information Statements and wish to receive only one, such stockholders can notify us at the address or phone number set forth above.

Additional Information Regarding the Amendment

Overview

The

Amendment

will

have

the

effect

of

increasing

the

number

of

shares

of

Common

Stock

that

the

Company

is

authorized to issue from 750,000,000 shares to 10,000,000,000 shares.

Purpose

Our board of directors has determined that it is advisable and in the best interest of the Company to increase the number of authorized shares of Common Stock of the Company to have available additional authorized but unissued shares in an amount that is adequate to provide for the needs of the Company. Our board of directors has determined that it is advisable and in the best interest of the Company to increase the number of authorized shares of our Common Stock in order to ensure that the Company will satisfy its obligations under the existing convertible notes issued by the Company. The Company would be required to issue additional shares of our Common Stock upon conversion of such convertible notes and, under certain of those convertible notes, the Company is required to have in reserve certain quantities of authorized but unissued shares of our Common Stock. Generally, with respect to the convertible notes issued by the Company, both the quantity of shares of our Common Stock that the Company would be required to issue upon conversion and the quantity of authorized but unissued shares of our Common Stock that the Company is required to have in reserve increases if the market price of our Common Stock decreases. The newly authorized shares of Common Stock would be available for issuance from time to time as determined by our board of directors for any proper purpose, which may include, without limitation, the issuance of shares in connection with financing or acquisition transactions and other corporate opportunities.

The Company, in the ordinary course of business, considers various possible means and strategies to expand its business, which may include, among other things, possible acquisitions of complementary businesses and other businesses. At the present time, the Company has not entered into any definitive agreement with any person or entity that entails any contemplated merger, consolidation, acquisition or similar business transaction, and there are no assurances that the Company will enter into any such transaction. The increase in the number of authorized shares of Common Stock of the Company as described in this Information Statement is for the purpose of addressing the obligations under existing convertible notes issued by the Company and for other corporate purposes generally, as described in the preceding paragraph, rather for any specific contemplated transaction(s).

Certain Risks Associated with the Increase in Authorized Stock

An issuance of additional shares of our Common Stock could, under certain circumstances, have the effect of delaying or preventing a change in control of the Company by increasing the number of outstanding shares that are entitled to vote and by increasing the number of votes required to approve a change in control. The ability of our board of directors to issue additional shares of our Common Stock could discourage an attempt by a party to acquire control of the Company. Such issuances could therefore deprive stockholders of benefits that could result from such an attempt, such as the realization of a premium over the market price of the shares that such an attempt could cause. Moreover, the issuance of additional shares of our Common Stock to persons whose interests are aligned with that of our board of directors could make it more difficult to remove incumbent officers and directors from office, even if such change were to be favorable to stockholders generally.

Although the Amendment could, under certain circumstances, have an anti-takeover effect, the Amendment was neither proposed nor approved in response to any effort of which we are aware to obtain or change control of the Company, nor is it part of a plan by management to recommend a series of similar actions having an anti-takeover effect.

Interests of Certain Persons in or Opposition to Matters to be Acted Upon

Except as disclosed elsewhere in this Information Statement, none of the following persons has any substantial interest, direct or indirect, by security holdings or otherwise in any matter to be acted upon:

|

|

·

|

any director or officer of the Company;

|

|

|

·

|

any proposed nominee for election as a director of the Company; and

|

|

|

·

|

any associate or affiliate of any of the foregoing persons.

|

The stockholdings of our directors and officers are listed below in the section entitled "Security Ownership of Certain Beneficial Owners and Management." No director has advised us that he intends to oppose any action described herein.

Security Ownership of Certain Beneficial Owners

The tables below set forth certain information, as of the Record Date, regarding the beneficial ownership of each class of our capital stock by each director and officer of the Company, and all directors and officers of the Company as a group.

|

|

|

Common Stock

|

|

Name of Beneficial Owner

|

|

Number of Shares Beneficially

Owned

(1)(2)

|

|

|

Percentage

of Class

(1)(2)

|

|

|

|

Directors and Officers

|

|

|

|

|

|

|

|

|

Caleb Wickman

|

|

|

607,000,000

|

(3)

|

|

|

38.0

|

%

|

(3)

|

|

A. Stone Douglass

|

|

|

300,000,000

|

(4)

|

|

|

18.8

|

%

|

(4)

|

|

Timothy Honeycutt

|

|

|

37,000,000

|

(5)

|

|

|

2.3

|

%

|

(5)

|

|

All directors and officers, as a group

|

|

|

944,000,000

|

|

|

|

59.1

|

%

|

|

_______________

|

(1)

|

Under Exchange Act Rule 13d-3, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise has or shares: (i) voting power which includes the power to vote, or to direct the voting of, such security; and/or (ii) investment power which includes the power to dispose, or to direct the disposition of, such security. In addition, a security is deemed to be beneficially owned by a person if the person has the right to acquire the security within 60 days. All amounts and percentages shown in the table are estimated as described herein, the number of shares beneficially owned is rounded to the nearest million, and percentages are rounded to the nearest one-tenth of one percent. The number of shares shown in this table exceeds the number of shares of Common Stock that were outstanding as of the Record Date.

|

|

|

|

|

(2)

|

Pursuant to the Certificate of Designation, Preferences and Rights of Series A Convertible Preferred Stock, which the Company filed with the office of the Secretary of State of the State of Nevada, (i) the Company's Series A Convertible Preferred Stock votes together with the Common Stock and (ii) for each share of the Series A Convertible Preferred Stock held by a holder thereof, such holder is entitled (in any stockholders' meeting and in any action to be voted on or consented to by the stockholders) to the voting rights that such holder would have if such holder were holding 1,000,000 shares of Common Stock.

|

|

|

|

|

(3)

|

Caleb Wickman owned 7,000,000 shares of Common Stock as of the Record Date. But, by virtue of the 600 shares of Series A Convertible Preferred Stock owned by Mr. Wickman as of the Record Date, he also had the voting rights that he would have if he were holding 600,000,000 shares of Common Stock. Mr. Wickman's percentage shown in the table was calculated as follows: 100% * [(7,000,000 + 600,000,000) / (900,000,000 + the number of shares of Common Stock that were outstanding as of the Record Date)], where 900,000,000 represents the voting rights associated with all 900 shares of Series A Convertible Preferred Stock that were outstanding as of the Record Date.

|

|

|

|

|

(4)

|

A. Stone Douglass owned 0 shares of Common Stock as of the Record Date. But, by virtue of the 300 shares of Series A Convertible Preferred Stock owned by Mr. Douglass as of the Record Date, he had the voting rights that he would have if he were holding 300,000,000 shares of Common Stock. Mr. Douglass's percentage shown in the table was calculated as follows: 100% * [300,000,000 / (900,000,000 + the number of shares of Common Stock that were outstanding as of the Record Date)].

|

|

|

|

|

(5)

|

Timothy Honeycutt held 0 shares of Common Stock as of the Record Date. The number of shares beneficially owned by Mr. Honeycutt shown in the table was calculated based on his right to acquire shares of Common Stock within 60 days of the Record Date. Mr. Honeycutt's percentage shown in the table was calculated as follows: 100% * [37,000,000 / (900,000,000 + the number of shares of Common Stock that were outstanding as of the Record Date)].

|

As of the Record Date, there were no Schedule 13D, Schedule 13G or similar public filings made by any other beneficial owner of shares of Common Stock that report beneficial ownership by such owner of a number of shares that exceeds five (5%) of the number shares of Common Stock that were issued and outstanding as of the Record Date. However, the Company previously issued certain convertible promissory notes and, depending on certain factors such as the outstanding balance of such note and the price of the Common Stock, one or more of such notes might permit the holder thereof to convert the outstanding balance of such note into a number of shares of Common Stock that could potentially exceed five (5%) of the number of shares of Common Stock that are then issued and outstanding.

|

|

|

Class A Convertible Preferred Stock

|

|

|

Name of Beneficial Owner

|

|

Number of Shares Beneficially Owned

|

|

|

Percentage

of Class

|

|

|

Directors and Officers

|

|

|

|

|

|

|

|

Caleb Wickman

|

|

|

600

|

|

|

|

66.67

|

%

|

|

A. Stone Douglass

|

|

|

300

|

|

|

|

33.33

|

%

|

|

Timothy Honeycutt

|

|

|

0

|

|

|

|

0.00

|

%

|

|

All directors and officers, as a group

|

|

|

900

|

|

|

|

100.00

|

%

|

As of the Record Date, Mr. Wickman and Mr. Douglass are the only beneficial owners of shares of Series A Convertible Preferred Stock.

Additional Information About the Company

We file annual, quarterly and other reports with the SEC. The Company's filings with the SEC are available to the public on the SEC's website at www.sec.gov and on our corporate website at www.artecglobalmedia.com. You may also read and copy, at the SEC's prescribed rates, any document that we file with the SEC at the SEC's Public Reference Room located at 100 F Street, NE, Washington, D.C. 20549. You can call the SEC at 1-800-SEC-0330 to obtain information on the operation of the Public Reference Room. You may also request a copy of the Company's filings with the SEC, at no cost, by writing to us at 249 South Highway 101, #324, Solana Beach, California 92075 or by contacting us by phone at (844) 505-2285.

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

|

|

By Order of the Board of Directors:

|

|

|

|

|

|

|

|

Date: ____, 2016

|

By:

|

/s/ Caleb Wickman

|

|

|

|

|

Caleb Wickman

|

|

|

|

|

President and Treasurer, and

Member of the Board of Directors

|

|

Appendix A

7

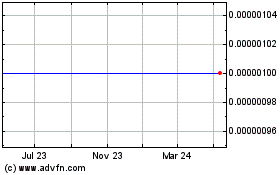

Artec Global Media (CE) (USOTC:ACTL)

Historical Stock Chart

From Mar 2024 to Apr 2024

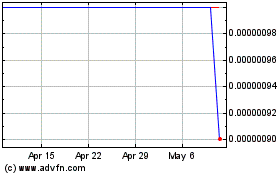

Artec Global Media (CE) (USOTC:ACTL)

Historical Stock Chart

From Apr 2023 to Apr 2024