0000880984

false

--12-31

0000880984

2023-09-05

2023-09-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported) September 5, 2023

ACORN

ENERGY, INC.

(Exact

name of Registrant as Specified in its Charter)

| Delaware |

|

001-33886

|

|

22-2786081 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

file

Number) |

|

(IRS

Employer

Identification

No.) |

| 1000

N West St., Suite 1200, Wilmington, Delaware |

|

19801 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code (410) 654-3315

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-2 under the Exchange Act (17 CFR 240.14a-2) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

|

|

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

3.03 Material Modification to Rights of Security Holders.

To

the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated

herein by reference.

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

1. Certificate

of Amendment to Certificate of Incorporation.

On

September 6, 2023, Acorn Energy, Inc. (the “Company”) filed a Certificate of Amendment to the Restated Certificate of Incorporation

of the Company with the Secretary of State of the State of Delaware (the “Certificate of Amendment”) to effect a 1-for-16

reverse stock split (the “reverse stock split”) of the shares of the Company’s common stock, par value $0.01 per share

(the “Common Stock”) on September 7, 2023 at 5:00 pm EDT. No fractional shares will be issued in connection with the reverse

stock split and stockholders will receive cash in lieu of fractional shares.

The

foregoing description of the Certificate of Amendment does not purport to be complete and is qualified in its entirety by reference to

the Certificate of Amendment, a copy of which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by

reference.

The

Company expects that the Common Stock will begin trading on a reverse-split-adjusted basis under the temporary symbol “ACFND,”

effective with the opening of the OTCQB market on Friday, September 8, 2023. The fifth character “D” will remain appended

to the Company’s symbol for 20 trading days, at which point it will revert back to “ACFN.” The new CUSIP number for

the Common Stock following the reverse stock split will be 004848206.

2. Amendment

to Bylaws.

On

September 5, 2023, the Company’s Board of Directors approved amendment of Sections 1, 2 and 3 of Article X of the Company’s

By-laws, to be effective upon consummation of the reverse split, in

order to more clearly provide for shares of the Company’s capital stock to be issued in

either uncertificated or certificated form.

The

foregoing description of the amendment to the Company’s Bylaws does not purport to be complete and is qualified in its entirety

by reference to the text of the amendment, a copy of which is filed as Exhibit 3.2 to this Current Report on Form 8-K and is incorporated

herein by reference.

Item

7.01 Regulation FD Disclosure.

On

September 7, 2023, the Company issued a press release announcing the anticipated completion of the reverse stock split. A copy of the

Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The

information contained in this Item 7.01 and the accompanying exhibit is being furnished and shall not be deemed filed for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of Section 18. Furthermore, the

information contained in this Item 7.01 and the accompanying exhibit shall not be deemed to be incorporated by reference in any filing

under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized on this 8th day

of September 2023.

| |

ACORN ENERGY, INC. |

| |

|

|

| |

By: |

/s/

Tracy S. Clifford |

| |

Name: |

Tracy

S. Clifford |

| |

Title: |

Chief

Financial Officer |

Exhibit 3.1

Exhibits

3.2

AMENDMENT

TO BY-LAWS

Sections

1, 2 and 3 of Article X of the Corporation’s By-laws shall be amended and restated in full to read as follows:

“SECTION

1. Form of Stock. The stock of the Corporation may be certificated or uncertificated, as provided under Delaware law, and shall

be entered in the books of the Corporation and recorded as they are issued. Any duly appointed officer of the Corporation is authorized

to sign stock certificates. Any or all of the signatures on any stock certificate may be a facsimile or electronic signature. In case

any officer, transfer agent or registrar who has signed or whose facsimile or electronic signature has been placed upon a stock certificate

has ceased to be such officer, transfer agent or registrar before such certificate is issued, it may be issued by the Corporation with

the same effect as if he or she were such officer, transfer agent or registrar at the date of issue.

SECTION

2. Notice Upon Issuance or Transfer. Within a reasonable time after the issuance or transfer of uncertificated stock and upon

the request of a stockholder, the Corporation shall send to the record owner thereof a written notice that shall set forth the name of

the Corporation, that the Corporation is organized under the laws of Delaware, the name of the stockholder, the number of shares and

class (and the designation of the series, if any) of the stock, and any restrictions on the transfer or registration of such shares of

stock imposed by the Corporation’s Restated Certificate of Incorporation, these By-laws, any agreement among stockholders or any

agreement between stockholders and the Corporation.

SECTION

3. Transfer and Registration of Stock. The transfer of stock and certificates of stock that represent shares of stock of the

Corporation shall be governed by Article 8 of Title 6 of the Delaware Code (the Uniform Commercial Code — Investment Securities,

as amended from time to time). Registration of transfers of shares of the stock of the Corporation shall be made only on the books of

the Corporation by the registered holder thereof, or by his attorney thereunto authorized by power of attorney duly executed and filed

with the Secretary or Assistant Secretary of the Corporation, and, with respect to transfers of certificated stock, on the surrender

of the certificate(s) for such shares properly endorsed or accompanied by a stock power properly executed.”

Exhibits

99.1

Remote

Monitoring and Control Solutions Provider Acorn Announces 1-for-16 Reverse Stock Split Intended to Make its Shares Accessible to a Broader

Range of Investors

Wilmington,

DE – September 7, 2023 – Acorn Energy, Inc. (OTCQB: ACFN), a provider of

remote monitoring and control solutions for stand-by power generators, gas pipelines, air compressors and other critical industrial equipment,

announced that its Board of Directors has approved a reverse split of its Common Stock at a ratio of 1-for-16. The reverse split is intended

to increase the market price of the Company’s Common Stock and make Acorn’s shares accessible to a broader range of investors,

including institutions and those unable to purchase or recommend low-priced stocks.

Jan

Loeb, Acorn’s President and CEO, commented, “Based on Acorn’s strong financial position and solid growth prospects,

our Board of Directors has approved a reverse split in an effort to make our common stock accessible to a larger base of investors. Acorn

shareholders have authorized the Board to pursue a reverse split each year, for the last several years. We believe this action should

also support our longer-term objective to up-list our shares to a major national exchange.

“Acorn’s

total revenue grew 22% in Q2’23 and 10% in the first half of 2023, net income was also positive in both periods, and we target

long-term net profit growth of approximately 20%. We are seeing encouraging trends for commercial and industrial demand for our remote

monitoring and control services in both new and existing markets. We also see additional revenue opportunities from demand response (DR)

programs that support electric grid operators with power provided by backup power generators during peak demand periods. We expect DR

programs to benefit grid operators, our company, our dealers, and their backup generator customers, based on Acorn’s unique monitoring

and control capabilities.

“Acorn

had $1.6M of consolidated cash at June 30, 2023 and no debt. Acorn was operating cash-flow-positive on a consolidated basis through the

first six months of 2023, and we expect to remain so moving forward, on a full-year basis, based on the achievement of our growth goals.

In light of the momentum in our business, we felt this was the right time to expand the potential investor base for our stock. A higher

stock price may also help facilitate accomplishing accretive acquisitions.”

Reverse

Stock Split Details

Acorn

expects its common stock to begin trading on a reverse-split-adjusted basis, under the temporary symbol “ACFND,” effective

with the opening of the OTCQB market on [Friday, September 8, 2023]. The fifth character “D” will remain appended to the

Company’s symbol for 20 trading days, at which point it will revert back to “ACFN.” The new CUSIP number for the Common

Stock following the reverse stock split will be 004848206.

No

fractional shares will be issued in connection with the reverse stock split. Each stockholder that would have been entitled to receive

a fractional share of Common Stock as a result of the reverse stock split will instead receive a cash payment in lieu of such fractional

share.

The

reverse stock split will reduce Acorn’s issued and outstanding Common Stock from 39.76 million shares to approximately 2.48 million

shares. The reverse split will affect neither the par value of the Common Stock nor the number of authorized shares.

The

Company’s transfer agent, Equiniti Trust Company, LLC will act as exchange agent and paying agent for the reverse stock split. Equiniti

will provide stockholders of record holding certificates representing pre-split shares of the Company’s Common Stock as of the effective

date a letter of transmittal providing instructions for the exchange of shares. Stockholders owning shares via a broker, bank, trust

or other nominee, as well as registered stockholders holding shares electronically in book-entry form, are not required to take any action

to receive post-split shares.

About

Acorn (www.acornenergy.com) and OmniMetrixTM

(www.omnimetrix.net)

Acorn

Energy, Inc. owns a 99% equity stake in OmniMetrix, a pioneer and leader in Internet of Things (IoT) wireless remote monitoring and control

solutions for stand-by power generators, gas pipelines, air compressors and other industrial equipment, serving tens of thousands of

customers including more than 25 Fortune/Global 500 companies. OmniMetrix’s proven, cost-effective solutions make critical systems

more reliable and also enable automated “demand response” electric grid support by enrolled back-up generators. OmniMetrix

solutions monitor critical equipment used by cell towers, manufacturing plants, medical facilities, data centers, retail stores, public

transportation systems, energy distribution and federal, state and municipal government facilities, in addition to residential back-up

generators.

Safe

Harbor Statement

This

press release includes forward-looking statements, which are subject to risks and uncertainties. There is no assurance that Acorn will

be successful in growing its business and revenues, remaining cash flow positive or maintaining profitability. A complete discussion

of the risks and uncertainties that may affect Acorn Energy’s business, including the business of its subsidiary, is included in

“Risk Factors” in the Company’s most recent Annual Report on Form 10-K as filed by the Company with the Securities

and Exchange Commission.

Follow

us

Twitter:

@Acorn_IR and @OmniMetrix

Investor

Relations Contacts

Catalyst

IR

William

Jones, 267-987-2082

David

Collins, 212-924-9800 acfn@catalyst-ir.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

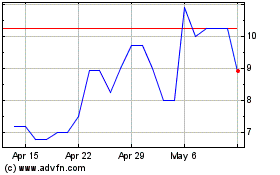

Acorn Energy (QB) (USOTC:ACFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

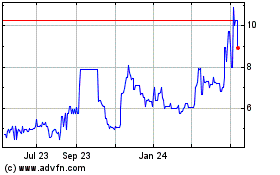

Acorn Energy (QB) (USOTC:ACFN)

Historical Stock Chart

From Apr 2023 to Apr 2024