TSX VENTURE COMPANIES

AEROQUEST INTERNATIONAL LIMITED ("AQL")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: January 2, 2008

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation pertaining to

a Share Purchase Agreement (the "Agreement") dated December 31, 2007,

between Aeroquest International Limited (the "Company"), Geophex, Ltd.,

and Dr. I.J. Won - an arm's length party to the Company (the "Vendor"),

whereby the Company has agreed to acquire 100% of the issued and

outstanding shares of Geophex, Ltd. - a private North Carolina based

research company specializing in the design and construction of

geophysical instruments.

The proposed US$5,700,000 purchase price will be satisfied by making a

US$2,000,000 cash payment, issuing a US$2,000,000 promissory note, and

issuing 498,001 common shares to the Vendor. Pursuant to the Agreement,

an additional 87,882 common shares will be issued to Mr. Alex Oren - an

employee of Geophex, Ltd.

For further details, please refer to the Company's new releases dated

November 5, 2007 and December 31, 2007.

TSX-X

--------------------------------------------------------------------------

AXEA ENERGY INC. ("AXT.P")

BULLETIN TYPE: Halt

BULLETIN DATE: January 2, 2008

TSX Venture Tier 2 Company

Effective at the open, January 2, 2008, trading in the shares of the

Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Market Regulation

Services, the Market Regulator of the Exchange pursuant to the provisions

of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

--------------------------------------------------------------------------

BRIGADIER GOLD LIMITED ("BRG")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 2, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement:

Number of Shares: 5,000,000 flow-through shares

Purchase Price: $0.10 per flow-through share

Warrants: 2,500,000 share purchase warrants to purchase

2,500,000 non flow-through shares

Warrant Exercise Price: $0.15 for an eighteen month period

Number of Placees: 3 placees

Finder's Fee: 200,000 units and 500,000 compensation options

payable to First Canadian Securities Inc. Each

unit is exercisable into one common share and

one-half of one common share purchase warrant

at a price of $0.10 for a period of two years.

Each whole warrant is exercisable into one

share at a price of $0.15 for a period of

eighteen months. Each compensation option is

exercisable into one unit at the same terms as

described above.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

has issued a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). Note that in

certain circumstances the Exchange may later extend the expiry date of

the warrants, if they are less than the maximum permitted term.

TSX-X

--------------------------------------------------------------------------

BRIGADIER GOLD LIMITED ("BRG")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 2, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement:

Number of Shares: 2,795,000 flow-through shares

150,000 common shares

Purchase Price: $0.10 per flow-through and common share

Warrants: 1,397,500 flow-through share purchase warrants

to purchase 1,397,500 shares

150,000 share purchase warrants to purchase

150,000 shares

Warrant Exercise Price: $0.15 per flow-through share warrant until June

21, 2009

$0.13 per share warrant until June 21, 2009

Number of Placees: 16 placees

Finder's Fee: $22,360, plus 279,500 common shares payable to

Integral Wealth Securities Limited

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

has issued a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). Note that in

certain circumstances the Exchange may later extend the expiry date of

the warrants, if they are less than the maximum permitted term.

TSX-X

--------------------------------------------------------------------------

EDGEWATER EXPLORATION LTD. ("EDW.P")

BULLETIN TYPE: New Listing-CPC-Shares

BULLETIN DATE: January 2, 2008

TSX Venture Tier 2 Company

This Capital Pool Company's ('CPC') Prospectus dated November 30, 2007

has been filed with and accepted by TSX Venture Exchange and the British

Columbia and Alberta Securities Commission effective November 30, 2007,

pursuant to the provisions of the British Columbia and Alberta Securities

Act. The Common Shares of the Company will be listed on TSX Venture

Exchange on the effective date stated below.

The Company has completed its initial distribution of securities to the

public. The gross proceeds received by the Company for the Offering were

$200,000 (2,000,000 common shares at $0.10 per share).

Commence Date: At the opening January 3, 2008, the Common

shares will commence trading on TSX Venture

Exchange.

Corporate Jurisdiction: British Columbia

Capitalization: Unlimited common shares with no par value of

which 12,120,000 common shares are issued and

outstanding

Escrowed Shares: 4,670,000 common shares

Transfer Agent: Pacific Corporate Trust Company

Trading Symbol: EDW.P

CUSIP Number: 280290 10 7

Sponsoring Member: Woodstone Capital Inc.

Agent's Options: 100,000 non-transferable stock options. One

option to purchase one share at $0.10 per share

up to 24 months.

For further information, please refer to the Company's Prospectus dated

November 30, 2007.

Company Contact: Ed Farrauto

Company Address: 500 - 900 West Hastings Street

Vancouver, BC V6C 1E5

Company Phone Number: (604) 687-3992

Company Fax Number: (604) 687-3912

Company Email Address: efarrauto@baybridgecapital.com

TSX-X

--------------------------------------------------------------------------

KALIMANTAN GOLD CORPORATION LIMITED ("KLG")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: January 2, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing a Share Purchase Agreement

dated October 11, 2007 (the 'Agreement') between Kalimantan Gold

Corporation Limited (the 'Company') and Kalimantan Investment Corporation

('KIC'), pursuant to which the Company has agreed to acquire all of the

issued and outstanding share capital of PT Pancaran Cahaya Kahay ('PCK'),

a wholly owned subsidiary of KIC. PCK is the owner of 25% of the shares

of PT Kalimantan Surya Kencana ('KSK'), the holder of the KSK Contract of

Work. The Company, through its wholly owned subsidiary, Indokal Limited,

owns the other 75% of the shares of KSK.

The aggregate consideration payable by the Company to KIC for the shares

of PCK is 20,000,000 common shares.

Insider / Pro Group Participation: At the time the Agreement was entered

into KIC was an Insider via shareholdings of the Company amounting to

19.45% of the issued and outstanding capital of the Company. In addition,

three of the Company's officers and directors were also officers or

directors of KIC, namely VP Exploration Mansur Geiger, director and CEO

Rahman Connelly, and director Murray Clapham and all abstained from

voting on the Agreement.

For further details, please refer to the Company's press release dated

October 16, 2007 available on SEDAR.

TSX-X

--------------------------------------------------------------------------

LAKOTA RESOURCES INC. ("LAK")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 2, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement:

Number of Shares: 375,000 flow-through shares

Purchase Price: $0.20 per flow-through share

Number of Placees: 4 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

John Gibson P 250,000

Rob Furse P 50,000

Finder's Fee: $6,000 payable to Integral Wealth Securities

Ltd.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

has issued a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s).

TSX-X

--------------------------------------------------------------------------

MARUM RESOURCES INC. ("MMU")

BULLETIN TYPE: Private Placement-Non-Brokered, Amendment

BULLETIN DATE: January 2, 2008

TSX Venture Tier 2 Company

AMENDMENT:

Further to the TSX Venture Exchange Bulletin dated December 28, 2007, the

Exchange has accepted an amendment with respect to a Non-Brokered Private

Placement announced November 7, 2007:

Additional finders fee of $10,500 was paid to Roland Perkins.

Jeffrey Robinson is a subscriber who is also an insider. He subscribed

for 50,000 Units.

All other terms of the private placement remain the same.

TSX-X

--------------------------------------------------------------------------

NORTH AMERICAN GEM INC. ("NAG")

BULLETIN TYPE: Private Placement-Non-Brokered, Amendment

BULLETIN DATE: January 2, 2008

TSX Venture Tier 2 Company

Further to the TSX Venture Exchange Bulletin dated December 27, 2007, the

Company advises that the following finder's fees are amended:

Finder's Fees: $12,500 cash and 125,000 warrants (same terms

as above) payable to Kris Begic.

$12,500 cash and 125,000 warrants (same terms

as above) payable to Northern Precious Metals

Management Inc.

TSX-X

--------------------------------------------------------------------------

PENNANT ENERGY INC. ("PEN")

BULLETIN TYPE: Warrant Term Extension

BULLETIN DATE: January 2, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has consented to the extension in the expiry date of

the following warrants:

Private Placement:

# of Warrants: 349,000 (flow-through)

635,000 (non-flow-through)

Original Expiry Date

of Warrants: January 3, 2008

New Expiry Date

of Warrants: January 3, 2009

Exercise Price

of Warrants: $0.45

These warrants were issued pursuant to a private placement of 635,000

non-flow-through shares with 635,000 non-flow-through share purchase

warrants attached and 698,000 flow-through shares with 349,000 flow-

through share purchase warrants attached, which was accepted for filing

by the Exchange effective December 22, 2006.

TSX-X

--------------------------------------------------------------------------

PETROLYMPIC LTD. ("PCQ")

(formerly Pisces Capital Corp. ("PCP.P"))

BULLETIN TYPE: Resume Trading, Qualifying Transaction-Completed/New

Symbol, Prospectus-Unit Offering, Name Change

BULLETIN DATE: January 2, 2008

TSX Venture Tier 2 Company

The common shares of the Company have been halted since December 21,

2007, pending final review of its Qualifying Transaction. As a result of

the completed Qualifying Transaction, effective at the open, Thursday,

January 3, 2008, trading will resume in the securities of the Company.

TSX Venture Exchange has accepted for filing the Company's Qualifying

Transaction described in its Prospectus dated November 28, 2007. As a

result, at the opening on Thursday, January 3, 2008, the Company will no

longer be considered a Capital Pool Company. The Qualifying Transaction

includes the following:

Qualifying Transaction

Pursuant to an Amalgamation Agreement dated September 18, 2007, a wholly

owned subsidiary of the Company has amalgamated with Petrolympia Inc.

("Petrolympia"). Pursuant to the terms of the Amalgamation Agreement, the

Company issued common shares to the former holders of Petrolympia common

shares.

In aggregate, 48,147,111 common shares of the Company were issued to the

former shareholders of Petrolympia, a company which controls certain oil

and gas properties in the Appalachian Basin of Quebec. In addition, the

Company has issued 837,270 common shares to Foundation Markets Inc.

("Foundation") as consideration for advisory services provided by

Foundation to Petrolympia, and certain flow-through and non flow-through

common shares pursuant to a prospectus offering as described below.

For complete details of the Qualifying Transaction, the business of

Petrolympia and the related transactions, please refer to the Company's

Prospectus dated November 28, 2007 and available at www.sedar.com.

Prospectus-Unit Offering

Effective November 29, 2007, the Company's Prospectus dated November 28,

2007 was filed with and accepted by TSX Venture Exchange, and filed with

and receipted by the British Columbia, Alberta, Ontario and Quebec

Securities Commissions, pursuant to the provisions of the respective

Securities Acts.

TSX Venture Exchange has been advised that closing occurred on December

27, 2007, for gross proceeds of $3,051,500.

Agents: CTI Capital Securities Inc., Research Capital

Corporation

Offering: 3,803 A Units. Each A Unit consisting of 2,000

flow-through common shares ($0.20 per share),

556 non flow-through common shares ($0.18 per

share) and 1,556 common share purchase warrants.

Each warrant provides the right to purchase one

common share.

800 B Units. Each B Unit consisting of 2,500

flow-through common shares ($0.20 per share)

and 1,250 common share purchase warrants. Each

warrant provides the right to purchase one

common share.

1,500 C Units. Each C Unit consisting of 2,778

non flow-through common shares ($0.18 per share)

and 2,778 common share purchase warrants. Each

warrant provides the right to purchase one

common share.

Unit Price: $500 per A Unit

$500 per B Unit

$500 per C Unit

Warrant Exercise

Price/Term: $0.25 per common share for a period of two

years from closing.

Agents' Warrants: 239,227 non-transferable warrants exercisable

to purchase one share at $0.18 per share and

960,600 non-transferable warrants exercisable

to purchase one share at $0.20 per share, for a

period of two years from closing.

Name Change

Pursuant to a resolution passed by shareholders of the Company on August

22, 2007 at the annual and special meeting, the Company has changed its

name as follows. There is no consolidation of capital.

Effective at the opening on Thursday, January 3, 2008, the common shares

of Petrolympic Ltd. will commence trading on TSX Venture Exchange, and

the common shares of Pisces Capital Corp. will be delisted.

The Exchange has been advised that the above transactions have been

completed.

Capitalization: Unlimited common shares with no par value of

which 70,754,849 common shares are issued and

outstanding

Escrow: 46,444,445 common shares are to be released in

stages over a 36 month period from the date of

this bulletin.

Transfer Agent: Equity Transfer & Trust Company

Trading Symbol: PCQ (new)

CUSIP Number: 716725 10 6 (new)

The Company is classified as an 'Oil and Gas Exploration' company.

Company Contact: Enrique Lopez de Mesa

Company Address: c/o Fogler, Rubinoff LLP

95 Wellington Street West, Suite 1200

Toronto-Dominion Centre

Toronto, Ontario M5J 2Z9

Company Phone Number: (416) 817-6202

Company Fax Number: (416) 941-8852

E-mail: enriqueldem@yahoo.com

TSX-X

--------------------------------------------------------------------------

POTASH ONE INC. ("KCL")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 2, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced December 19, 2007:

Number of Shares: 4,150,000 shares

Purchase Price: $2.65 per share

Warrants: 2,075,000 share purchase warrants to purchase

2,075,000 shares

Warrant Exercise Price: $3.75 for a fifteen month period. However, if

four months and one day after closing, the

shares of the company close at $4.00 or more

for ten consecutive trading days, then the

company may, upon written notice to the warrant

holder shorten the exercise period to 30 days.

Number of Placees: 7 placees

Finder's Fees: 175,000 units (comprised of one share and one

half of one warrant) payable to Peninsula

Merchant Syndications Corp. (Sam Magid).

31,500 units (comprised of one share and one

half of one warrant) payable to Powerone

Capital Markets Limited.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

--------------------------------------------------------------------------

RAYMOR INDUSTRIES INC. ("RAR")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: January 2, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange (the "Exchange") has accepted for filing

documentation pursuant to a arm's length share purchase agreement entered

into on September 18, 2007 (the "Agreement"), whereby Raymor Industries

Inc. (the "Company") will acquire 100% of the issued and outstanding

shares of SE Techno Plus Inc. In consideration, the company will pay

between $2,700,000 and $3,300,000 over the next 3 years based on

performance.

TSX-X

--------------------------------------------------------------------------

TESLIN RIVER RESOURCES CORP. ("TLR")

(formerly Wind River Resources Ltd. ("WRR"))

BULLETIN TYPE: Name Change and Consolidation

BULLETIN DATE: January 2, 2008

TSX Venture Tier 2 Company

Pursuant to a resolution passed by shareholders on November 16, 2007, the

Company has consolidated its capital on a five old for one new basis. The

name of the Company has also been changed as follows.

Effective at the opening January 3, 2008, the common shares of Teslin

River Resources Corp. will commence trading on TSX Venture Exchange, and

the common shares of Wind River Resources Ltd. will be delisted. The

Company is classified as a 'Mineral Exploration/Development' company.

Post - Consolidation

Capitalization: Unlimited shares with no par value of which

4,379,453 shares are issued and outstanding

Escrow: Nil

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: TLR (new)

CUSIP Number: 881604 10 2 (new)

TSX-X

--------------------------------------------------------------------------

TITAN TRADING ANALYTICS INC. ("TTA")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 2, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced November 1, 2007:

Number of Shares: 3,036,234 common shares

Purchase Price: CDN$0.40 or US$0.42 per share

Warrants: 1,518,117 share purchase warrants to purchase

1,518,117 shares

Warrant Exercise Price: CDN$0.60 or US$0.62 for a two year period

Number of Placees: 51 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Harold Elke Y 15,000

Robert f Roddick Professional Corp.

(Robert Roddick) Y 15,000

Kenneth Powell Y 850,000

David Terk Y 28,571

Finder's Fee: $10,350.84 payable to Rhonda Lawrence and Roy

Shatzko

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s).

TSX-X

--------------------------------------------------------------------------

TOM EXPLORATION INC. ("TUM")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: January 2, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation with

respect to a Brokered Private Placement announced on July 13, 2007:

Number of Shares: 8,000,000 common shares

Purchase Price: $0.10 per common share

Warrants: 8,000,000 warrants to purchase 8,000,000 common

shares

Warrant Exercise Price: $0.15 for a 24-month period

Number of Placees: 23 placees

Agent: Anchor Securities Limited

Agent's Fee: A total of $50,000 in cash and an option to

purchase 800,000 units of the Private Placement

at $0.15 per share for a period of 24 months.

Each unit is comprised of one common share and

one common share purchase warrant carrying the

same terms as those of the Private Placement.

Pursuant to the Exchange's Corporate Finance Policy 4.1 section 1.11 (d),

the Company must issue a press release announcing the closing of the

Private Placement and setting out the expiry dates of the hold period(s).

The Company must also issue a press release if the Private Placement does

not close promptly.

EXPLORATION TOM INC. ("TUM")

TYPE DE BULLETIN : Placement prive par l'entremise d'un courtier

DATE DU BULLETIN : Le 2 janvier 2008

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive par l'entremise d'un courtier, tel qu'annonce le 13

juillet 2007 :

Nombre d'actions : 8 000 000 actions ordinaires

Prix : 0,10 $ par action ordinaire

Bons de souscription : 8 000 000 bons de souscription permettant de

souscrire a 8 000 000 actions ordinaires

Prix d'exercice des bons : 0,15 $ pour une periode de 24 mois

Nombre de souscripteurs : 23 souscripteurs

Agent : Anchor Securities Limited

Commission des agents : Un total de 50 000 $ au comptant et l'option

d'acquerir 800 000 unites du placement prive au

prix de 0,15 $ l'unite pour une periode de 24

mois. Chaque unite est comprise d'une action

ordinaire et d'un bon de souscription. Chaque

bon de souscription comporte les memes termes

que ceux du placement prive.

En vertu de la section 1.11 (d) de la Politique de financement des

societes 4.1 de la Bourse, la societe doit emettre un communique de

presse annoncant la cloture du placement prive, incluant les dates

d'echeance des periodes de detention obligatoires des titres emis en

vertu du placement prive. La societe doit aussi emettre un communique de

presse si le placement prive ne cloture pas dans les delais.

TSX-X

--------------------------------------------------------------------------

TRANSGAMING INC. ("TNG")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: January 2, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation with

respect to a Brokered Private Placement, announced on November 6, 2007:

Number of Shares: 4,002,183 common shares

Purchase Price: $0.55 per common share

Warrants: 4,002,183 warrants to purchase 4,002,183

common shares

Warrant Exercise Price: $0.85 per share for a maximum period of five

years following the closing of the Private

Placement, subject to adjustment where the

issue price of future equity securities is less

than $0.55 per security. However, in no event

shall the warrants' exercise price be lower

than $0.55 as a result of adjustments resulting

from the above-mentioned future equity issues.

Number of Placees: 39 placees

Insider/Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

John Nemanic Y 220,000

Hugh Cooper P 50,000

HFCA Holdings P 50,000

Ian Black P 45,500

William Black P 36,000

CTI Capital Inc. P 27,273

Denis Piche P 50,000

Louis Plourde P 138,055

Timothy Price P 25,000

Agents' Fee: $112,335.58 in cash and 167,418 brokers'

warrants were paid to CTI Capital Inc. Each

warrant can be exercised at $0.55 per share for

a period of 24 months following the closing of

the Private Placement.

The Company has announced the closing of the above-mentioned Private

Placement by way of a press release dated December 11, 2007.

TRANSGAMING INC. ("TNG")

TYPE DE BULLETIN : Placement prive par l'entremise d'un courtier

DATE DU BULLETIN : Le 2 janvier 2008

Societe du groupe 2 TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive par l'entremise d'un courtier, tel qu'annonce le 6

novembre 2007 :

Nombre d'actions : 4 002 183 actions ordinaires

Prix : 0,55 $ par action ordinaire

Bons de souscription : 4 002 183 bons de souscription permettant de

souscrire a 4 002 183 actions ordinaires

Prix d'exercice des bons : 0,85 $ par action pour une periode maximale

de cinq ans suivant la cloture du placement

prive, assujetti a un ajustement dans le cas ou

le prix d'emission des titres d'actions futures

est inferieur a 0,55 $ par titre d'action.

Cependant, le prix d'exercice des bons ne

pourra en aucun cas etre inferieur a 0,55 $

suite a des ajustements resultant de l'emission

des titres d'actions futures precites.

Nombre de souscripteurs : 39 souscripteurs

Participation initie / Groupe Pro :

Initie egals Y /

Nom Groupe Pro egals P Nombre d'actions

John Nemanic Y 220 000

Hugh Cooper P 50 000

HFCA Holdings P 50 000

Ian Black P 45 500

William Black P 36 000

CTI Capital Inc. P 27 273

Denis Piche P 50 000

Louis Plourde P 138 055

Timothy Price P 25 000

Commission des agents : 112 335,58 $ au comptant et 167 418 bons de

souscription ont ete payes a CTI Capital inc.

Chaque bon de souscription permet de souscrire

a une action au prix de 0,55 $ l'action pendant

une periode de 24 mois suivant la cloture du

placement prive.

La societe a annonce la cloture de ce placement prive par voie d'un

communique de presse date du 11 decembre 2007.

TSX-X

--------------------------------------------------------------------------

NEX COMPANIES

TRI-RIVER VENTURES INC. ("TVR.H")

BULLETIN TYPE: Halt

BULLETIN DATE: January 2, 2008

NEX Company

Effective at 7:49 a.m. PST, January 2, 2008, trading in the shares of the

Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Market Regulation

Services, the Market Regulator of the Exchange pursuant to the provisions

of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

--------------------------------------------------------------------------

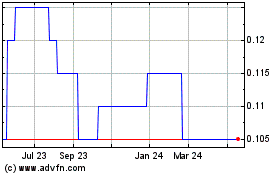

Pender Street Capital (TSXV:PCP.P)

Historical Stock Chart

From Apr 2024 to May 2024

Pender Street Capital (TSXV:PCP.P)

Historical Stock Chart

From May 2023 to May 2024