Baytex Energy Corp. (“Baytex”) (TSX: BTE) announces that its Board

of Directors have approved a 2022 capital budget of $400 to $450

million, which is designed to generate average annual production of

80,000 to 83,000 boe/d.

“I am excited with the momentum we are building

in our business. We expect to generate record free cash flow in

2021 and our priorities for 2022 remain much the same. Our 2022

capital program is designed to generate meaningful free cash flow

with modest annual production growth driven by exploration success

and scaled up development in the Clearwater. In a US$65/bbl WTI

pricing environment, we expect to generate approximately $2.1

billion of cumulative free cash flow through our 2021-2025

five-year outlook,” commented Ed LaFehr, President and Chief

Executive Officer.

Highlights of the 2022

Budget

- Funding of Capital Program. Our

capital program is expected to be fully funded from adjusted funds

flow at a WTI price of US$45/bbl. Based on the forward strip(1) our

capital program represents approximately 55% of our adjusted funds

flow.

- Free Cash Flow. Based on the

forward strip(1) we expect to generate approximately $340 million

of free cash flow in 2022. For every US$1/bbl change in WTI, our

adjusted funds flow changes by approximately $24 million on an

unhedged basis ($15 million including 2022 hedges).

- Capital Efficiency. Our capital

program is expected to generate strong capital efficiencies of

approximately $15,000 per boe/d across the portfolio.

- Capital Allocation. We will direct

approximately 60% of our capital program to our high netback light

oil assets in the Viking and Eagle Ford, 25% to our heavy oil

assets at Peace River and Lloydminster and 10% to the

Clearwater.

- Risk Management. Approximately 42%

of our net crude oil exposure has been hedged for 2022 utilizing a

combination of a 3-way option structure that provides price

protection at US$58/bbl with upside participation to US$68/bbl and

swaptions at US$53.50/bbl.

The 2022 capital program is expected to be

equally weighted to the first and second half of the year. Based on

the mid-point of our production guidance of 81,500 boe/d,

approximately 65% of our production is in Canada with the remaining

35% in the Eagle Ford. Our production mix is forecast to be 83%

liquids (43% light oil and condensate, 32% heavy oil and 8% natural

gas liquids) and 17% natural gas, based on a 6:1 natural gas-to-oil

equivalency.

Note:

(1) 2022 pricing assumptions:

WTI - US$66/bbl; WCS differential - US$16/bbl; MSW differential –

US$5/bbl, NYMEX Gas - US$4.10/mcf; AECO Gas - $3.50/mcf and

Exchange Rate (CAD/USD) - 1.28.

2022 Free Cash Flow

In 2021 we made a commitment to maintain capital

discipline, maximize free cash flow and reduce our net debt. We

expect to generate record free cashflow in 2021 of approximately

$420 million, which is accelerating our debt reduction efforts. As

a result, we expect to exit 2021 with net debt of approximately

$1.4 billion, which represents a 25% reduction from year-end 2020.

Over the past three years, we will have reduced our net debt by

approximately $900 million.

Based on the forward strip for 2022, we expect

to generate approximately $340 million of free cash flow. We remain

committed to further strengthening our balance sheet and providing

an enhanced return to our shareholders.

Our priorities for the allocation of free cash

flow in 2022 are as follows:

- We will allocate 100% of our free

cash flow to reducing net debt until we hit our initial $1.2

billion net debt target. We expect this to occur by mid-2022. This

debt target represents a net debt to EBITDA ratio of approximately

1.4x at a US$65 WTI price.

- Upon reaching a net debt level of

$1.2 billion, we anticipate announcing a plan for enhanced

shareholder returns, which could include share buybacks and/or a

dividend, while we continue to reduce our net debt to further

strengthen the business.

Five-Year Outlook

Our five-year outlook (2021 to 2025) highlights

our financial and operational sustainability and ability to

generate meaningful free cash flow. Through this plan period, we

are committed to a disciplined, returns based capital allocation

philosophy, targeting capital expenditures at approximately 50% of

our adjusted funds flow, while optimizing production in the 85,000

to 90,000 boe/d range. This generates annual production growth of

2% to 4% with annual capital spending of $400 to $475 million from

2022 to 2025.

We have updated our five-year outlook to include

expected inflationary cost increases along with increased drilling

on our Clearwater lands. Our base plan assumes development of 20

sections (of our 80-section land base) which have been delineated

to-date and includes the drilling of approximately 80 net wells.

With this initial phase of drilling, we expect Clearwater

production to increase from zero at the beginning of 2021 to

approximately 6,000 bbl/d while generating over $100 million of

cumulative free cash flow. With continued success, we believe the

play ultimately holds the potential for over 200 drilling locations

that could support production increasing to over 10,000 bbl/d.

We have grounded our updated five-year outlook

on a constant US$65/bbl WTI price and expect to generate

approximately $2.1 billion of cumulative free cash flow. Under a

constant US$75/bbl pricing scenario, our expected cumulative free

cash flow increases to approximately $2.8 billion.

Risk Management

To manage commodity price movements, we utilize

various financial derivative contracts and crude-by-rail to reduce

the volatility of our adjusted funds flow.

For 2022, we have entered into hedges on

approximately 42% of our net crude oil exposure utilizing a

combination of a 3-way option structure that provides price

protection at US$58/bbl with upside participation to US$68/bbl and

swaptions at US$53.50/bbl. We also have WTI-WCS differential hedges

on approximately 70% of our expected net heavy oil exposure at

US$12.28/bbl and MSW differential hedges on approximately 25% of

our expected net Canadian light oil exposure at a WTI-MSW

differential of approximately US$4.43/bbl.

2022 Budget Details

In 2022, we expect to benefit from our

diversified oil weighted portfolio and our commitment to allocate

capital effectively. Our capital program is designed to generate

stable production from our light and heavy assets in Canada and the

Eagle Ford in the United States, while scaling up development in

the Clearwater.

Eagle Ford and Viking Light Oil

Approximately 60% of our capital program will be

directed to our high netback light oil assets in the Viking and

Eagle Ford, where we forecast stable production and strong asset

level free cash flow. We expect to bring approximately 145 net

wells onstream in the Viking and 14 net wells onstream in the Eagle

Ford.

Heavy Oil

Approximately 25% of our capital program will be

directed to our heavy oil assets at Peace River and Lloydminster.

Our 2022 activity reflects a capital efficient drilling program

complemented by long life and high value polymer flood projects. In

total, we will see approximately 47 net wells drilled at

Lloydminster and 9 net Bluesky wells drilled at Peace River.

Clearwater

We will allocate approximately 10% of our 2022

capital budget to the Peace River Clearwater as successful

exploration results in 2021 lead to scaling up our development. We

expect to bring approximately 18 Clearwater wells onstream in

2022.

We are currently executing our Q4/2021 drilling

program and preparing for increased activity in 2022 with our three

Q4/2021 Peavine wells scheduled to be onstream in December. In

addition, we have drilled our first Clearwater exploration well in

the core of our Seal legacy land base and have a follow-up

appraisal well planned for H2/2022. During the first quarter of

2022, we anticipate running a two-rig program that will see eight

wells drilled on our Peavine lands.

At current commodity prices, the Clearwater

generates among the strongest economics within our portfolio with

payouts of less than six months and the ability to grow organically

while enhancing our free cash flow profile.

Pembina Area Duvernay Light Oil

During the third quarter, we drilled two 100%

working interest wells with very encouraging results. The first

well (7-8) was brought on-stream October 18 and established a

30-day initial production rate of 944 boe/d (712 bbl/d light oil,

148 bbl/d NGLs and 0.5 mmcf/d of natural gas). The second well

(6-8) was brought on-stream October 30 and established a 30-day

initial production rate of 1,230 boe/d (814 bbl/d light oil, 265

bbl/d NGLs and 0.9 mmcf/d of natural gas).

We expect to drill three net wells in the

Duvernay during 2022 as we follow-up on our successful 2021

program.

Environmental Stewardship

As part of our commitment to enhancing our

culture of sustainability, we are investing $30 million to progress

our plans to decarbonize and shrink the environmental footprint of

our operations. We will invest approximately $10 million as part of

our GHG mitigation program and expect to reduce our GHG emissions

intensity by 10% over 2021 levels. In addition, we will embark on

an active abandonment and reclamation program with approximately

$20 million being directed to pipeline, wellbore and facility

decommissioning along with well site reclamations.

2022 Guidance

The following table summarizes our 2022 annual

guidance.

|

|

Exploration and development capital ($ millions) |

$400 - $450 |

|

|

|

Production (boe/d) |

80,000 - 83,000 |

|

| |

|

|

|

|

|

Expenses: |

|

|

|

|

Royalty rate (%) |

18.5 – 19.0% |

|

|

|

Operating ($/boe) |

$12.25 - $13.00 |

|

|

|

Transportation ($/boe) |

$1.20 - $1.30 |

|

|

|

General and administrative ($ millions) |

$43 ($1.45/boe) |

|

|

|

Interest ($ millions) |

$80 ($2.70/boe) |

|

| |

|

|

|

|

|

Leasing expenditures ($

millions) |

$3 |

|

|

|

Asset

retirement obligations ($ millions) |

$20 |

|

|

|

|

|

|

2022 Adjusted Funds Flow Sensitivities

|

|

|

Excluding Hedges($ millions) |

Including Hedges($ millions) |

|

| |

Change of US$1.00/bbl WTI

crude oil |

$24.1 |

$15.1 |

|

| |

Change of US$1.00/bbl WCS

heavy oil differential |

$8.4 |

$3.3 |

|

| |

Change of US$1.00/bbl MSW

light oil differential |

$7.0 |

$5.3 |

|

| |

Change of US$0.25/mcf NYMEX

natural gas |

$7.6 |

$4.8 |

|

|

|

Change

of $0.01 in the C$/US$ exchange rate |

$11.5 |

$11.5 |

|

| |

|

|

|

|

2022 Capital Budget and Wells On-Stream by Operating

Area

|

|

Operating Area |

Amount (1)($ millions) |

Wells On-stream(net) |

|

| |

Canada |

$335 |

216 |

|

| |

United States (2) |

$90 |

14 |

|

|

|

Total |

$425 |

230 |

|

(1) Reflects mid-point of capital budget

guidance range.(2) Based on a Canadian-U.S.

exchange rate of 1.27 CAD/USD.

2022 Capital Budget Breakdown

|

|

Classification |

Amount (1)($

millions) |

|

| |

|

|

|

| |

Drill, complete and equip |

$385 |

|

| |

Facilities |

$20 |

|

| |

Land and seismic |

$10 |

|

|

|

GHG

Mitigation |

$10 |

|

|

|

Total |

$425 |

|

(1) Reflects mid-point

of capital budget guidance range.

Advisory Regarding Forward-Looking

Statements

In the interest of providing Baytex's

shareholders and potential investors with information regarding

Baytex, including management's assessment of Baytex's future plans

and operations, certain statements in this press release are

"forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

"forward-looking information" within the meaning of applicable

Canadian securities legislation (collectively, "forward-looking

statements"). In some cases, forward-looking statements can

be identified by terminology such as "anticipate", "believe",

"continue", "could", "estimate", "expect", "forecast", "intend",

"may", "objective", "ongoing", "outlook", "potential", "project",

"plan", "should", "target", "would", "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement.

Specifically, this press release contains

forward-looking statements relating to but not limited to: our 2022

capital budget of $400-$450 million, that the budget is designed to

generate average annual production of 80,000 to 83,000; we expect

to generate record free cash flow in 2021; our 2022 budget is

designed to generate meaningful free cash flow with modest annual

production growth; in a US$65 WTI environment we expect to generate

$2.1 billion of cumulative free cash flow through our 2021-2025

five-year outlook; our capital program is fully funded from

adjusted funds flow at US$45/bbl WTI; based on the forward strip

our capital program represents ~55% of adjusted funds flow and

generates ~$340 million of free cash flow; the amount our adjusted

funds flow changes based on a US$1/bbl change in WTI unhedged and

hedged; our capital program is expected to generate capital

efficiencies of $15,000 per boe/d across the portfolio; the

percentage of our net crude exposure that is hedged for 2022; the

allocation as between certain assets and timing of our capital

spending; the geographic breakdown and product type breakdown for

2022 production; our expected 2021 year-end net debt and resulting

one year and three year debt reduction; we are committed to further

strengthening our balance sheet and providing enhanced return to

our shareholders; we will allocated 100% of free cash flow to debt

reduction until we hit our initial net debt target of $1.2 billion;

our expected net debt to EBITDA ratios at certain WTI prices when

we hit our initial debt target; upon reaching our net debt target

we anticipate announcing a plan for enhanced shareholder returns,

which could include share buybacks and/or a dividend while we

continue to reduce our net debt; regarding our five-year outlook:

it highlights our financial and operational sustainability and

ability to generate meaningful free cash flow, during the

plan period we are committed to a disciplined, returns based

capital allocation philosophy, our targeted capital expenditures as

a percentage of adjusted funds flow, expected production growth and

capital spending; for the Clearwater during our five-year outlook:

development assumption, expected production rate and cumulative

free cash flow, number of potential drilling locations and that the

pay could support production increasing to over 10,000 bbl/d; the

expected cumulative free cash flow from during the five-year

outlook at US$65 WTI and US$75 WTI; the percentage of our net

crude, WTI-WCS differential and WTI-MSW differential exposure that

is hedged for 2022; we expect to benefit from our diversified oil

weighted portfolio and our commitment to allocate capital

effectively; our 2022 plan is designed to generate stable

production from our light and heavy assets in Canada and the United

States while scaling up development in the Clearwater; the

percentage capital allocation and expected wells drilled and

onstream by asset; we forecast stable production and strong asset

level free cash flow in the Eagle Ford and Viking; the expected

on-stream date of our three Q4/2021 Peavine wells; that we will run

a two rig program in Q1/2022 in Peavine; at current commodity

prices, the Clearwater generates among the strongest economics

within our portfolio with payouts of less than six months and has

the ability to grow organically while enhancing our free cash flow

profile; our GHG emissions reduction and abandonment and

reclamation plans and spending commitments; our expected

exploration and development capital spending, production, royalty

rate and operating, transportation, general and administrative,

interest costs, leasing expenditures and asset retirement

obligations for 2022; the sensitivity of our 2022 adjusted funds

flow to changes in WTI, WCS, MSW and NYMEX prices and the C$/US$

exchange rate (with and without hedges); the expected capital

budget and wells on-stream by operating area in 2022 and capital

budget by spending type for 2022.

In addition, information and statements relating

to reserves are deemed to be forward-looking statements, as they

involve implied assessment, based on certain estimates and

assumptions, that the reserves described exist in quantities

predicted or estimated, and that the reserves can be profitably

produced in the future. Although Baytex believes that the

expectations and assumptions upon which the forward-looking

statements are based are reasonable, undue reliance should not be

placed on the forward-looking statements because Baytex can give no

assurance that they will prove to be correct.

These forward-looking statements are based on

certain key assumptions regarding, among other things: petroleum

and natural gas prices and differentials between light, medium and

heavy oil prices; well production rates and reserve volumes; our

ability to add production and reserves through our exploration and

development activities; capital expenditure levels; our ability to

borrow under our credit agreements; the receipt, in a timely

manner, of regulatory and other required approvals for our

operating activities; the availability and cost of labour and other

industry services; interest and foreign exchange rates; the

continuance of existing and, in certain circumstances, proposed tax

and royalty regimes; our ability to develop our crude oil and

natural gas properties in the manner currently contemplated; and

current industry conditions, laws and regulations continuing in

effect (or, where changes are proposed, such changes being adopted

as anticipated). Readers are cautioned that such assumptions,

although considered reasonable by Baytex at the time of

preparation, may prove to be incorrect.

Actual results achieved will vary from the

information provided herein as a result of numerous known and

unknown risks and uncertainties and other factors. Such factors

include, but are not limited to: the volatility of oil and natural

gas prices and price differentials (including the impacts of

Covid-19); the availability and cost of capital or borrowing; risks

associated with our ability to exploit our properties and add

reserves; availability and cost of gathering, processing and

pipeline systems; that our credit facilities may not provide

sufficient liquidity or may not be renewed; failure to comply with

the covenants in our debt agreements; risks associated with a

third-party operating our Eagle Ford properties; public perception

and its influence on the regulatory regime; restrictions or costs

imposed by climate change initiatives and the physical risks of

climate change; new regulations on hydraulic fracturing;

restrictions on or access to water or other fluids; changes in

government regulations that affect the oil and gas industry;

regulations regarding the disposal of fluids; changes in

environmental, health and safety regulations; costs to develop and

operate our properties; variations in interest rates and foreign

exchange rates; risks associated with our hedging activities;

retaining or replacing our leadership and key personnel; changes in

income tax or other laws or government incentive programs;

uncertainties associated with estimating oil and natural gas

reserves; our inability to fully insure against all risks; risks of

counterparty default; risks related to our thermal heavy oil

projects; alternatives to and changing demand for petroleum

products; risks associated with our use of information technology

systems; results of litigation; risks associated with large

projects; risks associated with the ownership of our securities,

including changes in market-based factors; risks for United States

and other non-resident shareholders, including the ability to

enforce civil remedies, differing practices for reporting reserves

and production, additional taxation applicable to non-residents and

foreign exchange risk; and other factors, many of which are beyond

our control.

These and additional risk factors are discussed

in our Annual Information Form, Annual Report on Form 40-F and

Management's Discussion and Analysis for the year ended December

31, 2020, as filed with Canadian securities regulatory authorities

and the U.S. Securities and Exchange Commission.

The above summary of assumptions and risks

related to forward-looking statements has been provided in order to

provide shareholders and potential investors with a more complete

perspective on Baytex’s current and future operations and such

information may not be appropriate for other purposes.

There is no representation by Baytex that actual

results achieved will be the same in whole or in part as those

referenced in the forward-looking statements and Baytex does not

undertake any obligation to update publicly or to revise any of the

included forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

by applicable securities law.

All amounts in this press release are stated in

Canadian dollars unless otherwise specified.

Non-GAAP Financial and Capital Management

Measures

In this news release, we refer to certain

financial measures (such as adjusted funds flow, capital

efficienty, exploration and development expenditures, free cash

flow and net debt) which do not have any standardized meaning

prescribed by Canadian GAAP (“non-GAAP measures”) and are

considered non-GAAP measures. While these terms are commonly used

in the oil and gas industry, our determination of these measures

may not be comparable with calculations of similar measures for

other issuers.

Adjusted funds flow is not a measurement based

on generally accepted accounting principles ("GAAP") in Canada, but

is a financial term commonly used in the oil and gas industry. We

define adjusted funds flow as cash flow from operating activities

adjusted for changes in non-cash operating working capital and

asset retirement obligations settled. Our determination of adjusted

funds flow may not be comparable to other issuers. We consider

adjusted funds flow a key measure that provides a more complete

understanding of operating performance and our ability to generate

funds for exploration and development expenditures, debt repayment,

settlement of our abandonment obligations and potential future

dividends.

In addition, we use a ratio of net debt to

adjusted funds flow to manage our capital structure. We eliminate

settlements of abandonment obligations from cash flow from

operations as the amounts can be discretionary and may vary from

period to period depending on our capital programs and the maturity

of our operating areas. The settlement of abandonment obligations

are managed with our capital budgeting process which considers

available adjusted funds flow. Changes in non-cash working capital

are eliminated in the determination of adjusted funds flow as the

timing of collection, payment and incurrence is variable and by

excluding them from the calculation we are able to provide a more

meaningful measure of our cash flow on a continuing basis. For a

reconciliation of adjusted funds flow to cash flow from operating

activities, see Management's Discussion and Analysis of the

operating and financial results for the three and nine months ended

September 30, 2021.

Capital efficiency is not a measurement based on

GAAP in Canada. We define capital efficiency as exploration and

development expenditures divided by the expected aggregate IP365

rate (boe/d) for all wells coming on production in the year,

normalized to a January 1 start-date.

Exploration and development expenditures is not

a measurement based on GAAP in Canada. We define exploration and

development expenditures as additions to exploration and evaluation

assets combined with additions to oil and gas properties. We use

exploration and development expenditures to measure and evaluate

the performance of our capital programs. The total amount of

exploration and development expenditures is managed as part of our

budgeting process and can vary from period to period depending on

the availability of adjusted funds flow and other sources of

liquidity.

Free cash flow is not a measurement based on

GAAP in Canada. We define free cash flow as adjusted funds flow

less exploration and development expenditures (both non-GAAP

measures discussed above), payments on lease obligations, and asset

retirement obligations settled. Our determination of free cash flow

may not be comparable to other issuers. We use free cash flow to

evaluate funds available for debt repayment, common share

repurchases, potential future dividends and acquisition and

disposition opportunities.

Net debt is not a measurement based on GAAP in

Canada. We define net debt to be the sum of cash, trade and other

accounts receivable, trade and other accounts payable, and the

principal amount of both the long-term notes and the credit

facilities. Our definition of net debt may not be comparable to

other issuers. We believe that this measure assists in providing a

more complete understanding of our cash liabilities and provides a

key measure to assess our liquidity. We use the principal amounts

of the credit facilities and long-term notes outstanding in the

calculation of net debt as these amounts represent our ultimate

repayment obligation at maturity. The carrying amount of debt issue

costs associated with the credit facilities and long-term notes is

excluded on the basis that these amounts have already been paid by

Baytex at inception of the contract and do not represent an

additional source of capital or repayment obligation.

Advisory Regarding Oil and Gas Information

Where applicable, oil equivalent amounts have

been calculated using a conversion rate of six thousand cubic feet

of natural gas to one barrel of oil. The use of boe amounts

may be misleading, particularly if used in isolation. A boe

conversion ratio of six thousand cubic feet of natural gas to one

barrel of oil is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead.

References herein to average 30-day initial

production rates and other short-term production rates are useful

in confirming the presence of hydrocarbons, however, such rates are

not determinative of the rates at which such wells will commence

production and decline thereafter and are not indicative of

long-term performance or of ultimate recovery. While encouraging,

readers are cautioned not to place reliance on such rates in

calculating aggregate production for us or the assets for which

such rates are provided. A pressure transient analysis or well-test

interpretation has not been carried out in respect of all wells.

Accordingly, we caution that the test results should be considered

to be preliminary.

Baytex Energy Corp.

Baytex Energy Corp. is an oil and gas

corporation based in Calgary, Alberta. The company is engaged in

the acquisition, development and production of crude oil and

natural gas in the Western Canadian Sedimentary Basin and in the

Eagle Ford in the United States. Approximately 81% of Baytex’s

production is weighted toward crude oil and natural gas liquids.

Baytex’s common shares trade on the Toronto Stock Exchange under

the symbol BTE and the New York Stock Exchange under the symbol

BTE.BC.

For further information about Baytex, please

visit our website at www.baytexenergy.com or contact:

Brian Ector, Vice President, Capital

Markets

Toll Free Number: 1-800-524-5521Email:

investor@baytexenergy.com

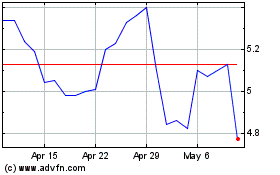

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Apr 2023 to Apr 2024