Shippers Evergreen, Hapag-Lloyd Seeking Megaships Worth $2.2 Billion

June 20 2019 - 12:24PM

Dow Jones News

By Costas Paris

Shipping lines Evergreen Marine Corp. of Taiwan and Germany's

Hapag-Lloyd AG are asking Asian yards in separate requests to build

a total of about 15 mega-container ships that would have a combined

value of around $2.2 billion.

The proposals signal a lull in new orders in the sector is

ending as carriers seek ever-bigger vessels to carry goods, and

will widen a gap between capacity and demand on container

shipping's critical Asia-to-Europe trade lanes, where operators

have been mostly losing money over the past five years.

Hapag-Lloyd, the world's fifth largest container operator in

terms of capacity, is sounding out yards in Japan, South Korea and

China for up to six ships that could each move 23,000 containers,

people with knowledge of the matter said. Evergreen, the

seventh-biggest player, is considering adding eight to nine ships

and that deal may be signed by the end of the summer, these people

said.

"Evergreen's order will come faster and Hapag-Lloyd will be

later," a person involved in the matter said.

The carriers are members of competing alliances that share ships

and port calls to cut costs. A typical one-way trip from Asia to

Northern Europe involves at least 10 port calls in which the

megaships drop off and take on new cargo.

"Some of the vessels are to fulfill capacity commitments within

the alliances and others to renew older and less efficient ships,"

a second person said. "Yes, there is overcapacity and the trade

picture does not look good with the tariffs and the economic

slowdown, but these ships will run for the next 25 years and now is

a good time to buy."

Taiwan's Yang Ming Marine Transport Corp. and China's Cosco

Shipping Holdings Co., the third biggest boxship operator, are also

looking for new ships but no orders are imminent, the people

said.

The orders would be the first for big ships in the container

shipping sector since last fall, when South Korea's Hyundai

Merchant Marine last October signed contracts for 20 vessels,

including 12 of the biggest ships that carry up to 23,000 20-foot

containers.

Demand for shipping consumer goods, manufacturing parts and

other anchors of global trade is waning this year on the back of a

slowing global economy and the yearlong tensions between the U.S.

and China. Maritime data provider Alphaliner in late May cut its

container volume growth estimate for this year to 2.5% from

3.6%.

Chinese shipping executives say they have withdrawn capacity in

the trans-Pacific route since the first round of U.S. tariffs were

introduced last summer.

Operators say they have little choice but to invest in new ships

despite a gloomy outlook because of stricter environmental

regulations kicking in early next year. Starting in January, all

oceangoing vessels will have to sharply reduce their sulfur

emissions, and maritime operators expect to slash greenhouse gas

emissions from ships by half in 2050.

"This means a lot of older ships will be scrapped because the

cost of retrofitting them to meet clean air standards will be too

expensive," the first person said. "We actually expect supply of

new ships to match demand by 2021, which is just around the

corner."

Write to Costas Paris at costas.paris@wsj.com

(END) Dow Jones Newswires

June 20, 2019 12:09 ET (16:09 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

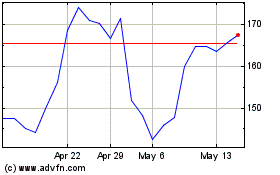

Hapag-Lloyd (TG:HLAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

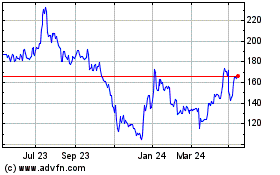

Hapag-Lloyd (TG:HLAG)

Historical Stock Chart

From Apr 2023 to Apr 2024