Ventas Boosts Outlook as Profit Soars

October 28 2016 - 9:18AM

Dow Jones News

By Imani Moise

Ventas Inc., one of the nation's biggest health-care real-estate

investment trusts, said profit surged in its third quarter as the

company benefited from its investments and lower transaction

costs.

The company also raised its current-year forecast to earnings of

between $1.51 and $1.63 a share. In July, the company forecast

earnings of $1.46 and $1.59 per share.

In all for the quarter, Ventas reported a profit of $149.5

million, or 42 cents a share, up from $22.9 million, or 7 cents, a

year earlier.

Funds from operations, a closely watched profitability measure

for real-estate investment trusts, came in at $1 a share for the

latest period, up from 78 cents. Excluding the impact of the

spinoff of some of its business, funds from operations rose to

$1.03 from 98 cents.

Revenue rose 4.8% to $867.1 million.

Analysts polled by Thomson Reuters had forecast FFO of $1.01 on

$843.2 million in revenue.

During the quarter, the company acquired the life science and

medical real estate assets of Wexford Science & Technology,

LLC. from affiliates of Blackstone Real Estate Partners L.P. for

$1.5 billion in cash.

Shares closed Thursday at $66.40 and were inactive premarket.

The stock has climbed 18% so far this year.

(END) Dow Jones Newswires

October 28, 2016 09:03 ET (13:03 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

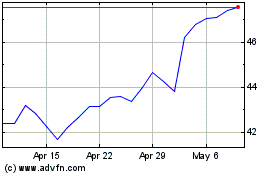

Ventas (NYSE:VTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

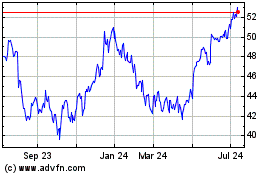

Ventas (NYSE:VTR)

Historical Stock Chart

From Apr 2023 to Apr 2024