Uber Moves Closer to Profitability as Revenue Climbs -- 3rd Update

February 06 2020 - 7:34PM

Dow Jones News

By Preetika Rana

Uber Technologies Inc. said it would reach a measure of

profitability a year sooner than it previously expected, as growth

in ride hailing and food delivery boosted the company's top line in

the fourth quarter.

Chief Executive Dara Khosrowshahi said he now sees the company

profitable on an adjusted basis before interest, taxes,

depreciation and amortization by the end of this year. Previously,

he said the company hoped to reach that marker by the end of

2021.

"We plan to achieve this profitability target assuming only

modest improvements in the current competitive environment, and

without the assumption of any significant changes to our current

portfolio of businesses," Mr. Khosrowshahi said Thursday in a

conference call with analysts. He also said the new target assumes

the regulatory environment won't change very much.

On that front, Uber has some work ahead. Its core ride-sharing

business is under regulatory scrutiny in some of its most lucrative

markets. In California, which accounts for about 9% of Uber's gross

bookings, a so-called gig-economy law, known as AB5, may require

the company to reclassify its drivers as employees which would

raise costs significantly. In London, which contributes about 5% of

its ride bookings, the company was stripped of its license to

operate in November and is appealing the decision.

There have been some regulatory wins. This week, a Brazilian

court ruled that Uber drivers weren't the company's employees.

Brazil is Uber's biggest country by number of trips.

The company reported an adjusted Ebitda loss of $615 million in

the three months ended Dec. 31, narrower than the $817 million loss

it booked in the year-earlier quarter and better than the average

estimate of analysts polled by FactSet for a loss of $705 million.

The net loss for the period widened to $1.1 billion, bringing

losses for the full year to $8.5 billion. Still, the loss was

smaller than analysts' projected. Revenue climbed 37% to $4.07

billion, fueled by rapid growth in new business offerings and

premium rides to consumers. Gross bookings in the quarter surged

28% to $18.13 billion,

The company also spent a smaller percentage of revenue on

marketing and discounts than in the quarter a year earlier.

"We recognize that the era of growth at all costs is over,"

Chief Executive Dara Khosrowshahi said, adding that he wants Uber

to be a leader in food delivery, a heavy cash-burning business. He

has said Uber would exit markets where the company isn't the No. 1

or No. 2 food-delivery player.

Uber pulled out of food delivery in South Korea in September and

sold its struggling Indian food-delivery unit last month. Together,

those businesses accounted for more than a quarter of the adjusted

Ebitda losses for Uber Eats last year, according to J.P. Morgan,

and the exits are expected to lift the company's outlook this

year.

Uber's leaders "finally are showing that profitability and a

rationalized Eats business will be the focus in 2020 and beyond,"

Daniel Ives, a Wedbush Securities Inc. analyst, wrote in a research

note following Thursday's earnings. He said Wall Street expected

"another negative was going to come out of left field. Instead,

Uber finally delivered a quarter with minimal noise."

Uber's profitability might come at a higher cost to consumers.

Mr. Khosrowshahi said the company had already raised prices for

rides in California as it tweaked its business to respond to the

state's new gig-economy law, which went into effect Jan. 1.

The law requires companies to treat workers as employees --

eligible for sick days and other benefits -- rather than as

independent contractors if they are controlled by their employer

and contribute to its usual course of business. Uber has argued

that it is a technology platform that connects riders with drivers,

not a transportation company, so the drivers aren't part of its

usual course of business.

The company has unveiled a host of changes to show its drivers

are free of its control. Last month, it began testing a feature

that allows some drivers in California the ability to set fares as

high as five times Uber's price. It separately capped its

commissions on rides across the state and allowed drivers to see

where riders were going.

Mr. Khosrowshahi said the changes were "possibly a net positive

for drivers," but a "net negative for riders."

"Hopefully we can get to a win-win" situation, he added. Uber,

Lyft Inc., DoorDash Inc. and Postmates Inc. have raised more than

$110 million for a planned ballot initiative this year, asking that

voters exempt them from the law.

Uber's shares, up 38% over the past three months, climbed more

than 5% in after-hours trading. They closed the regular session

below their $45 initial-public-offering price at $37.09.

Write to Preetika Rana at preetika.rana@wsj.com

(END) Dow Jones Newswires

February 06, 2020 19:19 ET (00:19 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

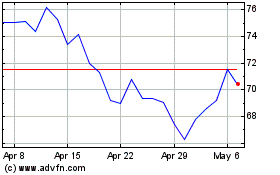

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Aug 2024 to Sep 2024

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Sep 2023 to Sep 2024